Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Jul, 2024

Concerns about the office real estate sector remain high, particularly for older buildings where few employees have returned to the office. High interest rates, low valuations and increased scrutiny of the sector will prove worrisome for the coming quarters, as landlords find it challenging to refinance their loans in the current environment.

➤ The gap between premier office properties and lower-quality office buildings continues to grow, with tenants leasing space now increasingly considering the landlord's balance sheet and willingness to spend capital on building improvements.

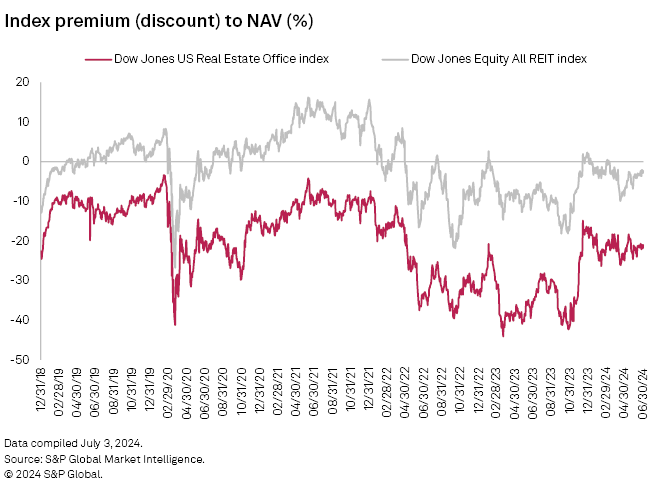

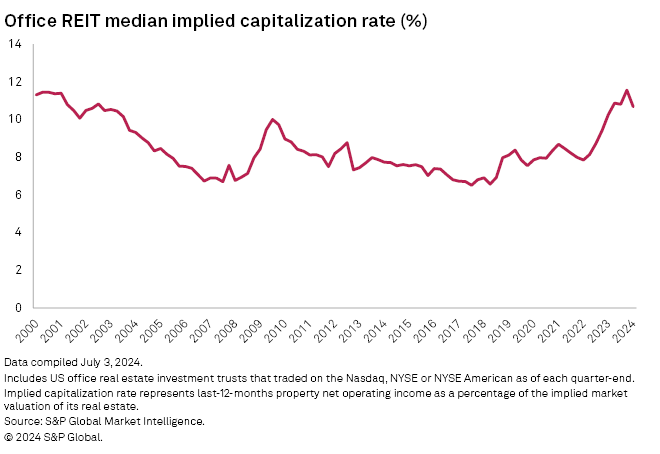

➤ Office real estate investment trusts continue to trade at vast discounts to their estimated net asset value (NAV), with the discount growing throughout 2024. The median implied capitalization rate for the office REIT sector remains high; however, it dipped slightly in the first quarter of 2024 to 10.7%.

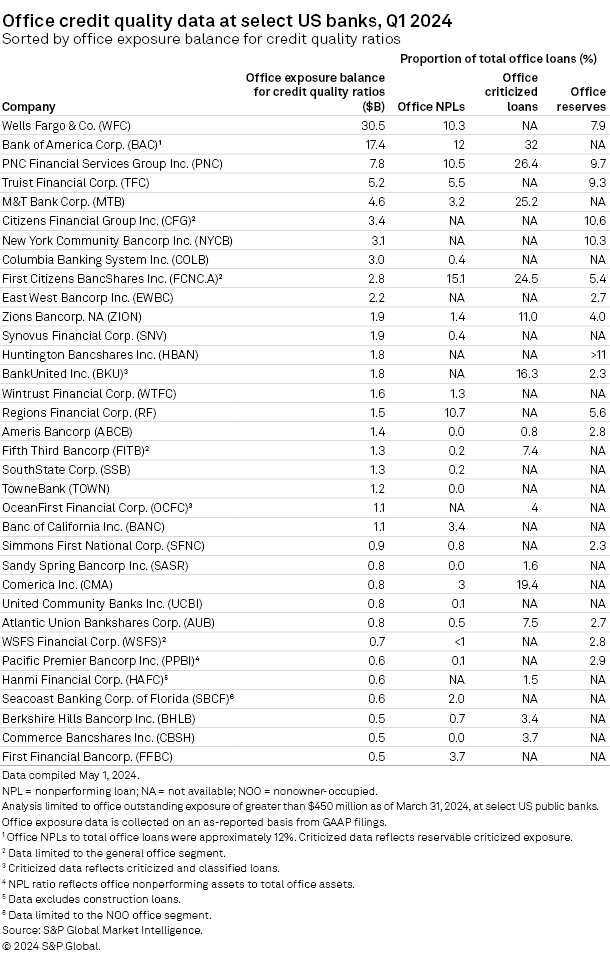

➤ Stress remains in bank office loan portfolios, with the proportion of criticized and nonperforming office loans growing for several of the top lenders. Banks are, however, preparing for rough conditions and have increases to 8% or more of their office loans.

Office tenants look toward landlords with strong balance sheets and adequate cash

Valuations within the office REIT sector remain low as investors continue to remain cautious of the office sector in general. As of July 2, the office REIT sector traded at a 29.4% median discount to NAV, 1.3 percentage points lower than the 28.1% median discount at year-end 2023. Similarly, the Dow Jones US Real Estate Office index ended July 2 with a market-cap-weighted 21% discount to NAV, compared to a 2.3% discount for the broader Dow Jones Equity All REIT index.

The median implied capitalization rate for the office REIT sector remains high, at 10.7% for the first quarter of 2024. The median figure, however, is down a bit from the sector's more than 20-year high of 11.6% in the quarter prior. While earnings remain relatively healthy overall within the office REIT sector, the high implied capitalization rates indicate investor concerns regarding future earnings potential for the sector. Landlords of antiquated buildings may find it challenging to re-lease their space and may require an investment of capital to make the property appealing to tenants.

Distress and concerns around the office market have driven lenders to be more stringent when making their office loans, preferring to work more with landlords that have strong balance sheets. Similarly, tenants are evaluating landlords and looking toward landlords with stronger balance sheets and adequate liquidity due to their ability to further invest in their properties. Many tenants in the leasing market are looking for attractive office spaces to bring their employees back to the office and are increasingly considering the landlord's balance sheet and willingness to spend capital on building improvements.

The gap between premier office assets and lower-quality office buildings continued to grow in recent months. While many lower-quality office buildings have struggled to bring employees back into the office and re-lease their space, office landlords of premier buildings have largely reported an increase in leasing demand. Premier office buildings are also proving more appealing to tenants looking to consolidate nearby office buildings into a single location.

While expected rate cuts by the Federal Reserve should help spur more transactions, property transactions for commercial real estate overall remain low, including office properties. Uncertainty around the future of interest rates has largely kept buyers and sellers on the sideline, choosing to delay asset sales for now.

Elevated stress in office loan portfolios

The credit quality of office loans continued to deteriorate in the first quarter, with several of the top lenders reporting an increase in criticized office loans — meaning they are higher risk.

Interest rate hikes over the last two years have made refinancing increasingly difficult for office property owners who originated loans at much lower rates and are now struggling with higher vacancy rates and persistent remote work trends.

In anticipation of rough waters ahead, banks are holding loan-loss reserves at high single digits for loans tied to office properties. Banks also tout that they have low loan-to-values on their office credits, giving them significant equity cushions. That being said, price discovery remains challenging given the lack of transactions in the marketplace, and price declines might have been severe enough to wipe out those cushions.

Additionally, a number of banks with the largest exposure to the sector are paring back their office loan portfolios and reducing their exposure.

Future outlook for office sector

Some pressure around commercial real estate should be alleviated once interest rates eventually start to decrease; however, interest rates could remain higher for longer than originally anticipated. Once interest rates eventually come down, real estate landlords should find easier access to debt and more potential refinancing opportunities, but older antiquated office properties with little tenant demand may still find their debt nonfinanceable.

Banks will likely continue to express caution toward the asset class and will likely extend new credit with less favorable terms and pricing to borrowers. Many traditional lenders view commercial real estate loans, including certain smaller office loans, as part of their core competency and should continue to service existing customers.

Additional clarity on the future of interest rates should also spur property transactions within the commercial real estate market, with potentially strong buying opportunities for investors with capital ready to deploy.

There could also be an increase in office-to-residential conversion projects beginning soon, particularly in New York City. Given the cost of such projects and the regulations for apartment buildings, however, not all office properties will be good candidates for conversions.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.