Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 03, 2025

By Dylan Thomas and Annie Sabater

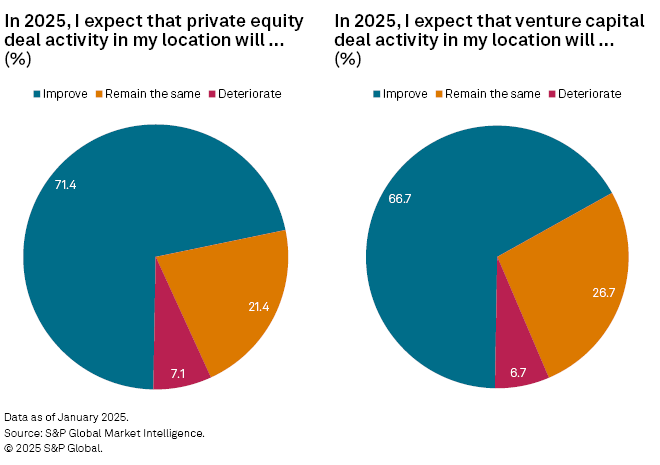

The outlook for private equity (PE) and venture capital (VC) deal activity and fundraising is improving, but private markets participants are cautious about the macroeconomic environment.

These are the takeaways from the 2025 S&P Global Market Intelligence Private Equity and Venture Capital Outlook. The annual report summarizes findings from a survey of global private equity, venture capital and limited partner professionals on the issues facing private markets fund managers and investors.

This year's survey captures insights shared by dozens of respondents between November 2024 and January 2025. The findings are a barometer of private market sentiment on topics including current deal dynamics to the role of AI in future investment decisions.

Read the 2025 Private Equity and Venture Capital Outlook report

Selected top findings

– General partners (GPs) are more optimistic about the deal environment than they were a year ago.

– Fundraising outlooks have improved, with more private equity and venture capital GPs optimistic about conditions than last year.

– Retail investors are gaining access, and most GPs offer or plan to offer opportunities to non-institutional investors.

– The macroeconomic environment will be the primary influence on private markets deal activity in 2025, according to GPs.

– Small and mid-tier firms struggle to compete against the private equity and venture capital giants.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.