Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 10, 2025

By Tim Zawacki

Warren Buffett used his annual Berkshire Hathaway Inc. shareholders' letter to laud Geico Corp.'s results. While past iterations of that messaging focused on the auto insurer's torrid top-line growth, Buffett's 2024 commentary emphasized its remarkable turnaround on the bottom line.

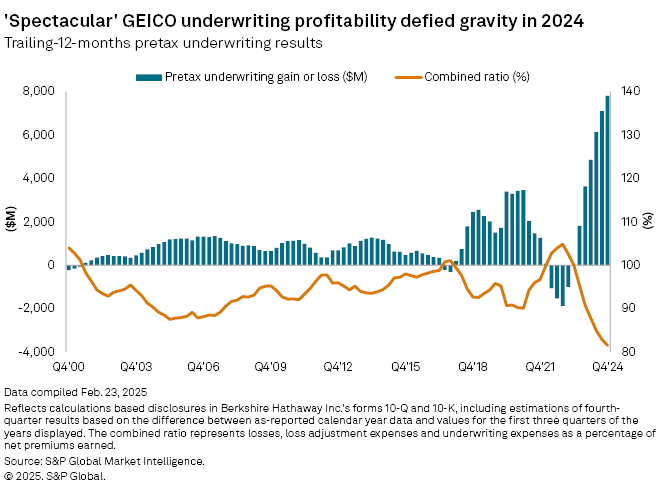

Geico's pretax underwriting profit of $7.81 billion marked an increase of 114.9% from 2023 levels, and it nearly matched the company's aggregate underwriting results for the previous five calendar years of $7.95 billion combined. The loss and loss-adjustment-expense (LAE) ratio of 71.8% represented the lowest such result for a trailing-12-month period in more than 17 years. The combined ratio of 81.5% was Geico's best result for any trailing-12-month period in the 21st century, reflecting an expense ratio of only 9.7%, more than 7 percentage points lower than what the company had been consistently generating during its previous stretch of sub-75% loss and LAE ratios in the mid-2000s.

Top-line growth, meanwhile, languished, with net premiums written and earned rising by 7.7% and 7.6%, respectively. This compares unfavorably to both our full-year 2024 projection for growth in US private auto direct premiums written of 14.2% and the outsized expansion achieved by Geico's primary rival, The Progressive Corp., in its personal auto business of 24.3%.

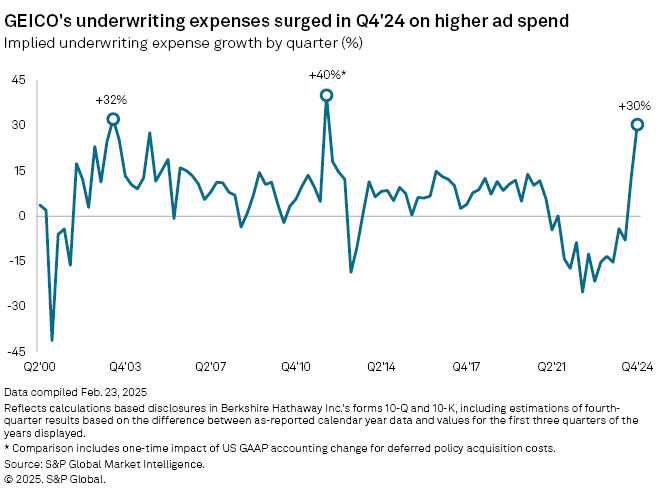

Progressive's pivot to growth mode appears to have long predated Geico's based on their respective disclosures related to underwriting expenses, and the 2024 results suggest the No. 3 US private auto insurer has a lot of catching up to do.

Buffett, the Berkshire chairman, praised Geico for leading a "major increase" in earnings for his company's insurance business. And he called out Geico President and CEO Todd Combs for successfully reshaping the auto insurer's business by boosting efficiency and modernizing underwriting practices.

"Geico was a long-held gem that needed major repolishing, and Todd has worked tirelessly in getting the job done," Buffett wrote. "Though not yet complete, the 2024 improvement was spectacular."

The fourth quarter of 2024 highlighted the dichotomy that has emerged on Geico's income statement. While the company achieved its highest on-record pretax underwriting gain on a nominal basis at $2.07 billion, edging out the previous high-water mark of $2.06 billion during the depths of the COVID-19 pandemic in the second quarter of 2020, its net premiums written growth slumped to a five-quarter low of only 5.8% during what we would consider to represent a generational hard market for private auto pricing.

Berkshire said that rate, rather than policy count, drove Geico's premium growth in 2024, with a 7.8% full-year rise in average premiums per policy offsetting a 0.5% decline in policies in force. In contrast, Progressive's agency and direct auto policies in force increased by a combined 21.8% in 2024.

These statistics make it all but certain that Geico's overall private auto market share will decline for a third consecutive year. Using our projected 2024 results for the full US property and casualty (P&C) industry, we estimate that Progressive's lead over Geico in the private auto market share rankings could widen to approximately 5 percentage points for the calendar year from less than 3 percentage points in 2023. This estimate assumes growth in statutory private auto direct premiums written at the same rates as Progressive's direct and agency auto net premiums written and Geico's overall volume across lines. Geico led Progressive by 0.6 percentage point in the 2021 private auto market share rankings.

Statutory data through the third quarter of 2024 shows that the diverging trends extend to the state level. Progressive's direct auto channel subsidiaries achieved double-digit year-to-date growth in total direct premiums written in all 48 states in which they reported volume, with expansion of at least 20% in 24 of their 25 largest states based on year-earlier results. Geico, meanwhile, showed year-over-year declines in 15 states, with double-digit growth in only five of its 25 largest states. We selected the Progressive Direct SNL subgroup as opposed to Progressive in its entirety in this exercise to eliminate noise from that group's market-leading commercial auto business and its residential property insurance business. Private auto accounted for more than 98.3% of the 2023 direct premiums written for both the GEICO SNL subgroup and the Progressive Direct SNL subgroup, so we can assume that total-filed results largely reflect their presence in that business.

Reclosing that widening gap may well represent the next step for Combs in his "repolishing" initiatives.

Underwriting expenses at Geico rose in the fourth quarter of 2024 to their highest point in two years but, at only 11.6%, remain well below the company's longer-term averages. Geico's expense ratio bottomed in the first quarter of 2024 at a paltry 8.7%, and we assume the increases in subsequent quarters largely reflect the company's reacceleration of its advertising spend. We estimate that Geico's full-year 2023 advertising spend of $838.2 million represented a 14-year low on an absolute basis and, as a percentage of direct premiums written, a 26-year low. The expense ratio for Progressive's direct auto channel bottomed in July 2023 at 11.0% and had more than doubled to 22.4% by August 2024, giving the company a significant head start in reigniting its new business acquisition efforts.

The timing of ad spend is not the sole driver of Geico's low expense ratio. The Berkshire annual report put the auto insurer's year-end 2024 headcount at 28,247 employees. That marks a decline of more than 10,000 people from the comparable figure in Berkshire's 2022 annual report. In discussing Geico's full-year expense ratio of 9.7%, which was unchanged from 2023's result, Berkshire said that improved operating efficiencies and increased operating leverage offset higher ad spend.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.