Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 20, 2025

By Tim Zawacki

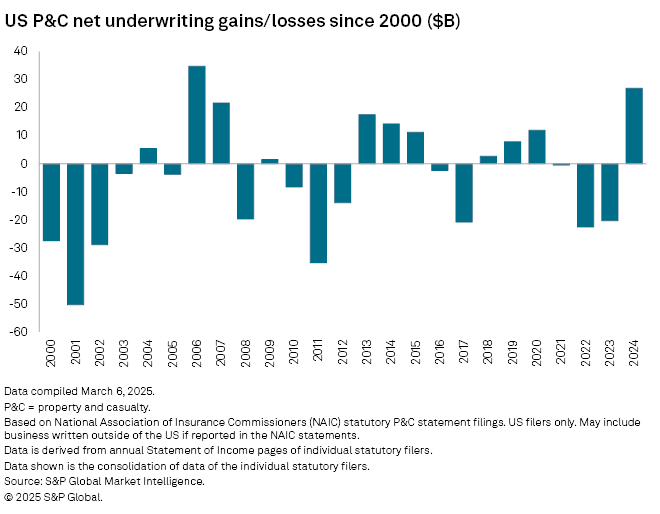

Dramatically improved personal lines results in 2024 drove historically favorable underwriting profitability for the US property and casualty industry, an analysis of newly available statutory financial data reveals.

An approximate year-over-year swing of $47 billion from the industry's second-consecutive net underwriting loss in excess of $20 billion to an underwriting profit of nearly $27 billion, according to our initial review of statutory results now available on S&P Capital IQ Pro, has few historical precedents. And the combination of the sharply improved underwriting results with the positive effects of higher interest rates on investment income means the industry is likely to post net income in excess of $100 billion for the first time in a calendar year, up from $85.10 billion in the year-earlier period.

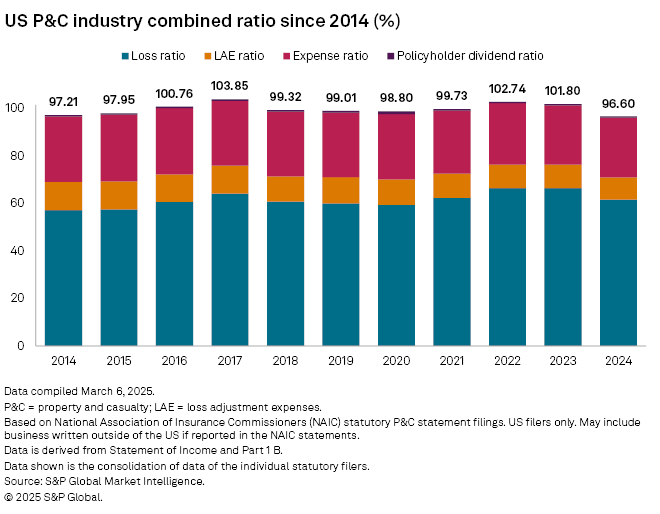

We calculate that the property and casualty (P&C) industry's statutory combined ratio improved to 96.6% in 2024 from 101.8% in 2023, marking the most significant year-over-year reduction since 2013.

While 2024 was a heavy year for natural catastrophes, particularly in the form of severe convective storms during the second and third quarters and hurricanes in the third and fourth quarters, significant portions of the associated losses flow to reinsurers that are based outside the US and are not incorporated in these results. Additionally, a material portion of losses from Hurricane Helene were caused by floods and were not covered under typical residential property insurance.

Momentum in the private auto business, which accounted for 28.5% of US P&C industry net premiums written in 2024, bodes well for another year of strong underwriting profitability in 2025 even with a temporary setback awaiting in the first quarter in property insurance lines due to January's southern California wildfires.

Significant loss ratio improvement

The industry's 2024 results mark the 10th net underwriting profit in the last 20 calendar years and the first since 2020. It has only once posted a higher net underwriting profit on a nominal basis: $34.75 billion in 2006, a year that benefited from tailwinds from the combination of significant upward price movement in property insurance lines following two consecutive adverse hurricane seasons and a dramatic decline in catastrophe losses. The 2006 underwriting profit marked a swing of $38.54 billion from 2005's underwriting loss, which ranked as the most significant such improvement on record prior to 2024.

Loss ratio improvement was most responsible for the 5.2-percentage-point reduction in the industry's combined ratio in 2024. A result of 61.6% marked improvement of 4.9 percentage points as high-single-digit growth in net premiums earned vastly exceeded a low-single-digit rise in incurred losses. This represented the first time since 2020 that earned premiums grew more quickly than losses, reflecting to a large extent outsized growth in the private auto and homeowners lines. Facing material loss-cost inflation in prior years, carriers have pursued significant rate increases in those businesses, leading to outsized growth.

We calculate a net loss ratio of 65.8% in the private auto business, down from 75.2% in 2023 to the best result in a calendar year from a COVID-19-depressed ratio of 55.9% in 2020. There remains further room for improvement as the private auto loss ratios at the end of previous pricing cycles fell to as low as 57.6% in 2006. The 2022 and 2023 private auto net loss ratios rank as the highest on record. In the homeowners business, meanwhile, the net loss ratio tumbled to 65.2% from 75.5%. Both business lines benefited from mid-teens growth in net premiums earned.

Commercial lines trends were mixed with the other liability lines posting an increase in their net loss ratio to nearly 67.0% from 60.2% in 2023. Everest Group Ltd.'s Everest Reinsurance Co. and Liberty Mutual Holding Co. Inc.'s Liberty Mutual Insurance Co. each posted net loss ratios well in excess of 100% in the other liability-occurrence line, reflecting significant adverse prior-year reserve development in the respective amounts of $1.23 billion and $918.7 million in that business. Results in the workers' compensation line remained at or near historically favorable levels and, in the commercial auto business, the net loss ratio fell to just under 70.0% from 71.9% in 2023 even with a full percentage point lift from New York livery insurer American Transit Insurance Co.'s previously announced change in reserving methodology.

The industry's expense ratio ticked higher by approximately 0.2 percentage points from 2024's historic low of just under 25.0%, but it remained well below longer-term averages. Private auto insurers with significant direct-to-consumer platforms such as The Progressive Corp. and Geico Corp. increased their advertising spending from historically low levels in 2023 as their appetite for taking on new business rose throughout 2024. Prior to the current private auto cycle, the industry's overall expense ratio averaged approximately 27.6% per year.

Private auto and reserve charges fuel outlier underwriting results

Lifted by the private auto recovery, several prominent personal lines-focused insurers showed dramatic year-over-year improvements in their underwriting results.

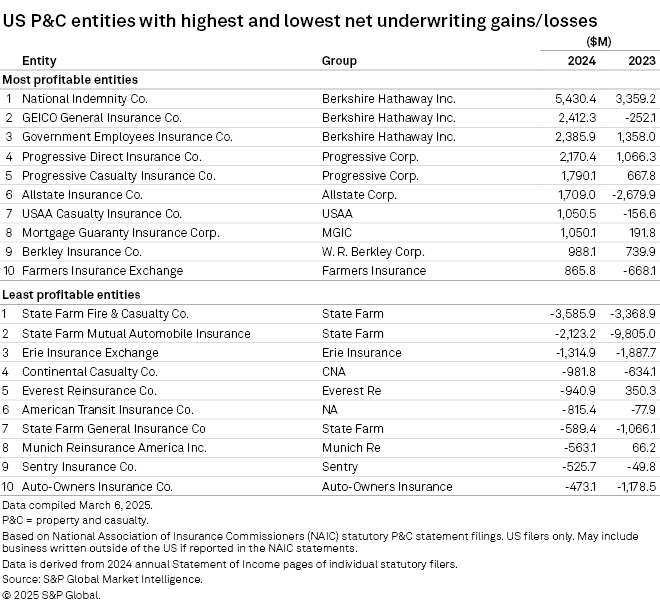

Three US P&C subsidiaries of Berkshire Hathaway Inc. led the industry on the basis of 2024 net underwriting gains as the overall P&C group boosted its result to $12.20 billion from an industry-leading $7.87 billion in 2023. National Indemnity Co. reprised its role as the industry's most profitable individual entity, aided by its role in reinsuring GEICO business. Its net underwriting gain of $5.43 billion included a $2.31 billion contribution from the auto insurance group. On a stand-alone basis, GEICO General Insurance Co. and Government Employees Insurance Co. produced net underwriting gains of $2.41 billion and $2.39 billion, respectively.

Progressive Direct Insurance Co. and Progressive Casualty Insurance Co. produced the fourth- and fifth-largest underwriting profits in the industry of $2.17 billion and $1.79 billion, respectively, as the overall Progressive P&C group's underwriting result spiked to $7.28 billion from $2.55 billion. The Allstate Corp.'s Allstate Insurance Co. placed sixth in terms of its overall underwriting gain with a result of $1.58 billion that ranked second only to State Farm Mutual Automobile Insurance Co. in terms of year-over-year improvement. The Allstate unit's result swung from a net underwriting loss of $2.95 billion in 2023. As previously reported, State Farm Mutual Auto's $7.68 billion year-over-year reduction in underwriting losses helped the overall State Farm P&C group more than halve its red ink from 2023.

Despite the group's progress, State Farm Fire and Casualty Co. and State Farm Mutual Auto posted the P&C industry's largest two net underwriting losses in 2024. The California-focused State Farm General Insurance Co. had the seventh-largest underwriting loss for the year.

The underwriting losses at Everest Reinsurance and American Transit of $940.9 million and $815.4 million, respectively, ranked among the industry's 10 largest. The two companies had the industry's largest amount of deterioration in their underwriting results with Everest Reinsurance swinging to its sizable loss from a $350.3 million 2023 underwriting profit.

Sentry Insurance Co. reported a $525.7 million net underwriting loss that largely reflected the accounting for two one-time items: revisions to the Sentry group's intercompany pooling arrangement at the start of 2024 and the entry of a 100% quota-share reinsurance agreement with the subsidiaries of PGC Holdings Corp. that conduct business as The General at the end of the year. Sentry acquired PGC Holdings for $1.61 billion, effective Dec. 31, 2024. We estimate that the consolidated net underwriting loss for all current Sentry P&C entities, which fully normalizes for the effects of the one-time items, was $106.8 million.

Methodology

The 2024 industry-level aggregates referenced in this article represent a compilation of individual company results filed with the National Association of Insurance Commissioners and obtained by S&P Global Market Intelligence as of March 7 unless otherwise noted. These results may change to some extent as we obtain additional information, including from Puerto Rico-domiciled entities with an April 1 reporting deadline, but we do not believe that the outstanding filers are individually or collectively significant enough to dramatically influence particular line items. Prior-year data from the available 2024 filings accounts for nearly 99.6% of the industry's 2023 net premiums earned.

S&P Global Market Intelligence tentatively expects to post industry aggregates for data points not subject to group-level adjustments on or around March 13. Historical results incorporate all available filers for the years referenced, and any calendar-year superlatives reflect annual data from 1996 through the present. Results referenced in this article for 2024 will differ slightly from industry aggregates posted on S&P Capital IQ Pro for a variety of reasons that include our incorporation of data from recently launched insurers.

Important considerations for our combined ratio calculations include the following: 1) the results include policyholder dividends unless otherwise noted and 2) we base expense ratios as the combination of other underwriting expenses and aggregate write-ins for underwriting deductions as a percentage of net premiums written. This can, on occasion, cause combined ratios to be slightly above or below 100% in years when the industry's net underwriting result is positive or negative, respectively.

Article amended at 11:30 a.m. ET to include clarification for Sentry Insurance's 2024 net underwriting loss.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.