Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

The global energy system is experiencing profound transformation. To understand how your sustainability strategy is shaped by the decisions you make today, S&P Global offers the insights, research, connected financial and market data as well as innovative tools and benchmarks to guide your journey to sustainability and a thriving future.

Our world-class energy presence, combined with expertise in price reporting, technology, finance, automotive, chemicals, maritime, climate, geopolitics, macroeconomics, and trade equip investors, organizations and governments with the tools necessary to navigate toward a low-carbon energy future with confidence.

Standardized data and analytics on greenhouse gas emissions across the global energy value chain and industrial sectors, combined with price assessments for low carbon oil, gas, and power markets.

Comprehensive coverage of clean energy technologies – batteries & storage, hydrogen & green gas, wind, solar, & carbon sequestration – to support the future energy system.

Integrated, long-term scenarios projecting energy use and emissions by fuel type, country, and sector. Risk assessment and portfolio strategies.

Market first price assessments provide increased transparency, rigor, and integrity to the pricing of voluntary carbon market assets, supporting market growth and development.

Get a clearer view of physical and transition climate risk exposure with actionable financial impact analysis across asset locations, investment portfolios, and supply chains.

Keep pace with the global patchwork of sustainability reporting frameworks with in-depth data intelligence, specialist analyst support, and integrated workflow tools.

The world needs a secure, affordable and sustainable energy system. And you need the clarity to chart your path through it.

Hedge risk in new markets with Platts forward curves. Model prices, forecast trends, and calculate key risk metrics with confidence. Gain greater clarity and save time with historical and reference data all on one screen.

Climate transition is more than net zero targets. Our Climate Transition Assessment, featuring Shades of Green, will help you demonstrate where you are in your current transition plans, and where you’re expected to head in the foreseeable future.

Understand today with market news and price reporting. Make informed trading decisions, understand your current position, and stay informed as the market evolves with Platts market data in Carbon and new fuel markets.

Benchmark portfolios using standardized emissions data and analytics on corporate greenhouse gas emissions across global energy value chain and industrial sectors.

Track clean energy technology, capacity and investment. Insight and analysis covering solar, wind, batteries, storage, hydrogen and renewable gases.

Reference integrated views of future energy demand. Coverage across all major sectors, regions, fuel types, dating back to 1990 and forecasting through 2050.

Analyze decarbonization pathways in new fuel markets. Access to our annual guidebook, reference case outlooks, quarterly tracking reports and alternative fuel analytics.

Understand the implications of new policy decisions. Assess the business environment today for oil, gas and emerging fuel markets in the context of Energy Transition.

S&P Capital IQ Pro offers unparalleled intelligence on the global energy sector, covering over 4,260+ publicly listed and 167,630+ private energy companies worldwide. Integrating comprehensive power plant asset data, global mining sector data, deep company financials, and unique energy insights, S&P Capital IQ Pro can help you uncover opportunities and challenges in the Energy Transition as the sector evolves. Additionally, users can access over 100 asset-level metrics for 12,960+ data center facilities globally, including capacity, utilization, and new construction activity sourced through primary research.

Comprehensive data coverage and hyper-local insight on weather related risks and trends across asset locations, investment portfolios, and supply chains.

A multi-sector, multi-asset class approach to climate portfolio analysis.

Designed to address climate change and the transition to a low-carbon economy, these indices focus on different carbon reduction objectives—including carbon-efficient and fossil-fuel-free-strategies. The indices use both current and forward-looking approaches, as well as those that align with the Task Force for Climate-Related Financial Disclosures (TCFD).

Transportation plays a key role in the energy transition as it is responsible for almost 25% of global energy-related emissions. Data and insights from our global mobility experts on current trends in sustainability including the electrification of vehicles and the future changes in the automotive sector helps OEMs, suppliers and investors understand the trajectory to net zero across the industry by identifying opportunities, evaluating impacts, and navigating risk.

S&P Global Mobility provides near real-time updates of electrified (BEV and hybrid) light vehicle sales volumes for 150+ countries by brand, model, and fuel type, as well as invaluable data on the global charging ecosystem.

Provides insight, analysis, and data in understanding how regulations, technology, new business models, and consumers are impacting oil, energy demand, and the automotive industry plus its supply chain.

Our vehicle level energy consumption & GHG emissions products, and forecasts support a range of decision making from competitive benchmarking of future energy consumption and EV ranges, to sourcing opportunity targeting, through to cost of compliance with regional emissions regulation.

In-depth analysis of battery technology developments and the evolving supply chain landscape.

S&P Global Sustainable1 matches customers with the sustainability products, insights and solutions from across S&P Global’s divisions to help meet their unique needs. Our comprehensive coverage across global markets combined with in-depth sustainability intelligence provides financial institutions, corporations and governments with expansive insight on business risk, opportunity, and impact as we work towards a sustainable future.

Our unparalleled data and insight is tried-and-tested throughout the global value chain, helping companies, banks, investment managers and asset owners to accelerate their net zero journeys, from quantifying net zero baselines and setting targets to reporting progress and financing ambition.

Get actionable sustainability insights built on the world’s most granular ESG Raw Data, and the S&P Global ESG Score.

Access curated and comprehensive nature and biodiversity risk data intelligence to efficiently assess company operations & investment portfolios. Gain the knowledge, capacity, data, and deep analytics to understand, manage and disclose the nature-related risks you face.

The S&P Global CSA enables you to directly report key sustainability metrics and benchmark your company's performance on a wide range of industry-specific economic, environmental and social criteria.

Navigate the sustainability reporting landscape with in-depth sustainability data, specialist analyst support, and streamlined workflow tools.

INTERACTIVE REPORT

S&P Global Ratings

S&P Global Ratings

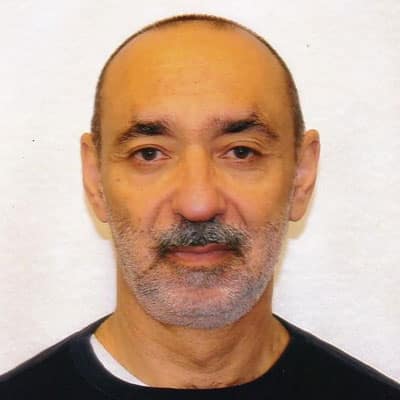

Head of Climate Economics & European Economist

Marion Amiot is Head of Climate Economics & European Economist at S&P Global Ratings, based in London. In this position, she develops the Eurozone economic forecasts, provides insight into the economic outlook and conducts in-depth research on key macroeconomic developments and policies.

S&P Global Energy

Senior Director, Gas, Power, and Energy Futures

Coralie specializes in regulation and strategy in European power markets and renewable energy investments. Her work centers on how policy is shaping the energy transition. In particular, she focuses on the European carbon price, the emissions trading scheme (ETS), renewable support frameworks and PPAs, and developing capacity markets.

Before joining S&P Global, Coralie developed onshore wind and biomass projects in the United Kingdom with EFRG. Prior to that, she led the regulatory analysis efforts of boutique investment bank Climate Change Capital, focusing on the ETS in London, and was a part of EDF's commodity market analysis team in Paris. She holds a Master in Management from HEC Paris, France.

Coralie speaks French and English.

S&P Global Energy

S&P Global Energy

Head of Energy Transition Narratives & Policy

S&P Global Energy

Look Forward Council, Co-Chair

Senior Vice President and Chief Energy Strategist

His areas of expertise include business strategy, commercial analysis, oil markets, energy technologies, climate change and renewables. He has previously led Energy Insight, Research and Analysis and Energy Research teams at S&P Global (Now a part of S&P Global). Dr. Atul previously worked for BP for over 20 years in a number of operational, business, technical and strategic positions around the world. His career includes international leadership experience in a diverse array of energy fields spanning strategy development, business planning, field operations and technology commercialization. His experience includes leadership in solar energy development as well as oil and gas. Dr. Atul has previously served on boards of several companies and institutions and is member of the World Economic Forum's Global Future Council on Advanced Energy Technologies and is 25+ year member of the Society of Petroleum Engineers. He is a sought-after speaker and moderator at public conferences, company boards and industry events and a member of the CERAWeek leadership team.

He holds B.S., M.S. and Ph. D. degrees in engineering.

S&P Global Energy

S&P Global Energy

Research Director, North America Power & Renewables Research

Steve Piper is Director of Energy Research with S&P Global Energy. He has been with the company since 2009. Steve specializes in market price forecasting, economic feasibility assessment, demand forecasting and environmental analysis. Steve manages strategic research and forecasting for SNL Energy’s clients in the utilities, natural gas and coal industries.

Prior to his role at S&P Market Intelligence, Steve held positions at Platts, RDI and RCG/HaglerBailly.

Steve earned a Bachelor of Arts from Grinnell College and an Master in Project Management from the School of Public Affairs at University of Maryland-College Park.

S&P Global Energy

S&P Global Market Intelligence

Research Director, Energy

Ms. Federico has been following the U.S. power and gas utility sector for more than 30 years, with an emphasis on state regulatory policy.

She joined Regulatory Research Associates, or RRA, immediately upon her graduation from Drew University where she earned a Bachelor's degree in Psychology, with a minor in Business. She was awarded an MBA in Financial Management from Pace University in 1992.

RRA was acquired by SNL Financial in 2005. Ms. Federico took over as RRA President in 2011. Following the acquisition of SNL by McGraw Hill Financial, now S&P Global, she became a Research Director in the Energy Research team of S&P Global Market Intelligence.

In her current role she spearheads the team's analysis of emerging trends in energy regulation and has primary responsibility for the team's coverage of six regulatory jurisdictions.

S&P Global Energy

S&P Global Energy

Director, Metals & Mining Research

Mark Ferguson is the Research Director for the Metals & Mining Research group at S&P Global Energy. Having worked for previous iterations of the division since 2004, he has extensive experience in producing exploration and supply-side studies and topical research for the mining sector.

Increasingly focused on energy transition-related needs pertinent to the metals & mining sector, the Research team tracks the industry’s upstream efforts while assessing demand and price expectations for key industrial and battery metals.

Mark holds a Bachelor of Science in Geology/Geography from Saint Mary’s University, and an MSc in Earth Sciences from Dalhousie University.

S&P Global Market Intelligence

Executive Director, Economic Consulting

Mohsen is Executive Director of consulting in S&P Global Market Intelligence, working on macroeconomic and industry economics since 1986. He brings more than 30 years of experience in macroeconomic, regional, and industry consulting with a strong focus on scenario analysis, economic impact assessments, and applications of market planning. Mohsen has been responsible for development of a detailed regional application (Business Market Insights) and global information and communication technology capability. He has expertise in regional economic impact assessment and is fluent in relevant modeling tools to a wide array of issues and policies.

Mohsen worked as a partner with Cisco's Global Market Intelligence group to build a model to estimate total addressable market for network technologies and services. The model has become on the forefront of strategic marketing initiative for Cisco via their global market view model and database.

Mohsen was the project manager for series of large scale energy related projects including Crude Oil Export Decision - the Fact-based study and analysis played an important role in lifting the ban, Americas New Energy Future - studies had an extraordinary impact at a time of debate over future of shale and was cited in Presidential State of the Union Address, and Restarting the Engine in US Gulf of Mexico - client used the research to have BOEMER accelerate licensing process in the Gulf of Mexico.

Mohsen holds an M.A. in Economics and a B.S. in Economics and Computer Science from Temple University.

S&P Global Market Intelligence

Associate Director, Global Intelligence & Analytics

Frank Hoffman has 15 years of experience in economic modeling and analysis with a strong focus on commodities, cost and price forecasting, and market planning. He brings these skillsets to a variety of consulting engagements and helps clients make more informed data-driven decisions. He has also been involved in several pieces of thought leadership around metals and the energy transition, such as S&P Global’s Future of Copper study and Impact of the IRA on North American Minerals Markets study.

Mr. Hoffman has also worked as a Senior Economist with S&P Global’s Pricing & Purchasing Service, where he covered nonferrous metals, building materials, healthcare, and services. Before returning to S&P Global, he worked as a senior operations manager at Uber Technologies. His areas of focus included incentives strategy and investment allocation for the US and Canada rides business. Mr. Hoffman has also worked as a federal consultant on analytics and data science-related engagements. He has been featured in media outlets such as American Metal Market, Bloomberg Television, the Financial Times, Forbes, Metal Bulletin, and Mining Technology.

He has a Master's degree in International & Development Economics from the University of San Francisco and a Bachelor's degree in Economics from the University of Illinois.

S&P Global Market Intelligence

S&P Global Market Intelligence

Head of Latin America Country Risk

Carla Selman is the Head of Latin American country risk. She joined the company in 2014, having previously worked in political risk in London, in Chile's diplomatic missions in France, and as a journalist in Santiago, Chile. Carla holds an MSc in Global Politics from the London School of Economics, a master's degree in Geopolitics and International Relations from Sciences-Po Toulouse, France, and a degree in journalism from Universidad Católica de Chile. Originally from Chile, she is currently based in London.

S&P Global Market Intelligence

Associate Director of Economics in the Pricing and Purchasing Service

NEWSLETTER