S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — March 25, 2025

By Robert Clark

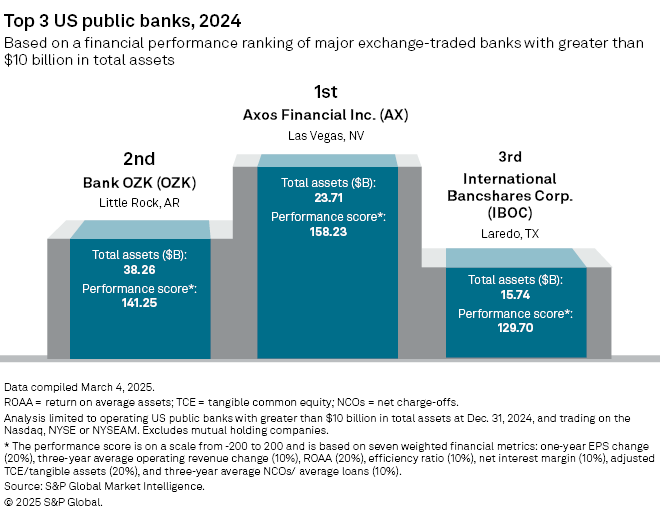

Axos Financial Inc. was the top bank with greater than $10 billion in total assets at year-end in the 2024 S&P Global Market Intelligence financial performance ranking of major exchange-traded US banks.

With no brick-and-mortar retail branches, Axos Financial is an outlier among the 98 banks in the analysis.

The company, formerly known as BofI Holding Inc., was the only bank in the analysis to achieve a score in the top 20 for all seven ranking metrics. It was the lone bank with scores in the top 10 for five of the metrics, and the only bank with earnings-per-share growth greater than 15% and a return on average assets (ROAA) higher than 1.50%.

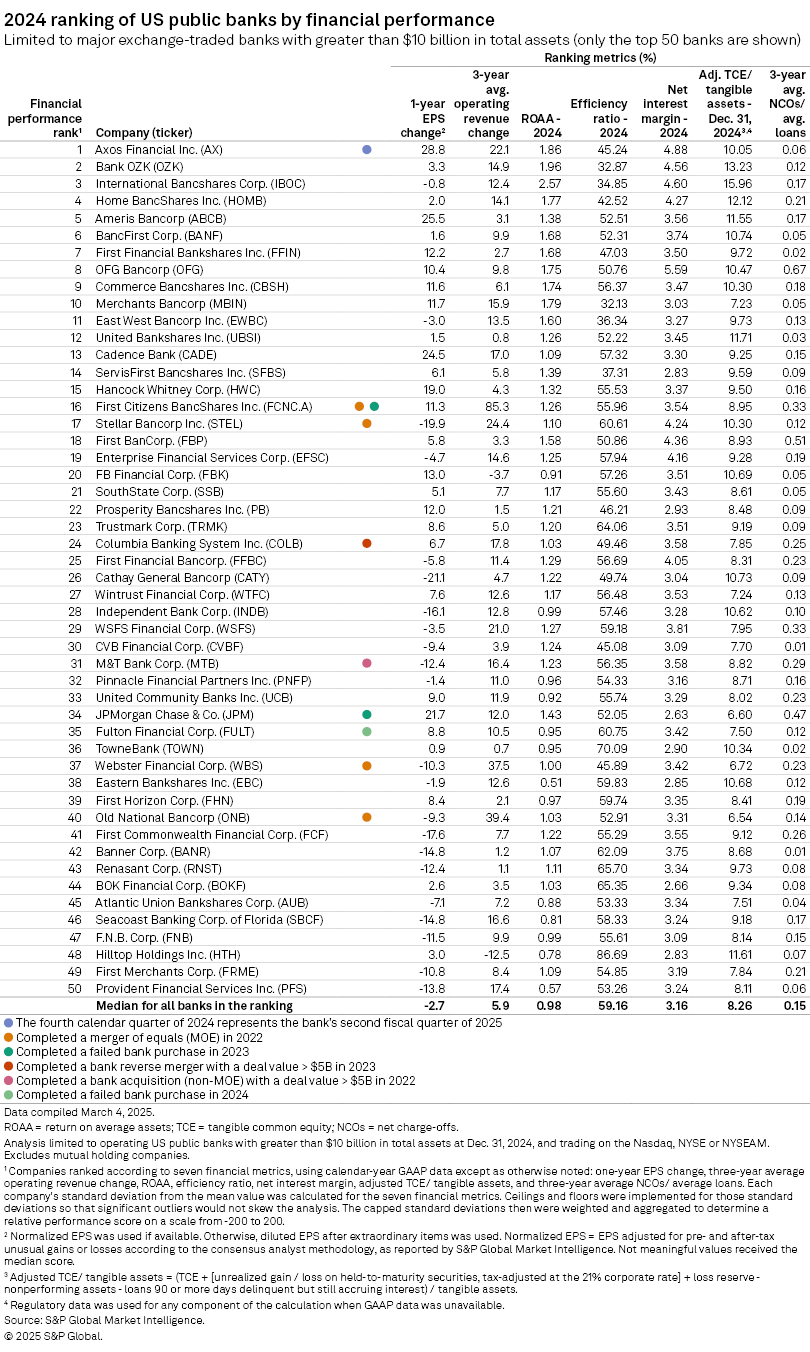

S&P Global Market Intelligence ranked the 2024 financial performance of US public banks with total assets exceeding $10 billion as of Dec. 31, 2024, and that are trading on the Nasdaq, NYSE or NYSE American as of March 4, 2025. Mutual holding companies were excluded. Industries were classified according to the Global Industry Classification Standard of S&P Global Market Intelligence. Companies were ranked based on three major categories, using calendar-year data as well as generally accepted accounting principles data unless otherwise noted: growth, weighted at 30%; profitability, weighted at 40%; and safety and soundness, weighted at 30%.

The two growth metrics were one-year EPS change, weighted at 20%, and three-year average operating revenue change, weighted at 10%. If available, normalized EPS was used for EPS change. For International Bancshares Corp., diluted EPS was used.

The three profitability metrics were 2024 ROAA, weighted at 20%; 2024 efficiency ratio, weighted at 10%; and 2024 net interest margin, weighted at 10%.

The two safety and soundness metrics were adjusted tangible common equity (TCE) as a percentage of tangible assets at Dec. 31, 2024, weighted at 20%; and three-year average net charge-offs (NCOs) to average loans, weighted at 10%. For the capital ratio, GAAP data for each component was used when available; otherwise, regulatory data was used. Adjusted TCE is standard TCE plus loss reserves plus unrealized held-to-maturity (HTM) securities gains or losses, tax-adjusted at the 21% corporate rate, less nonperforming assets and loans at least 90 days delinquent but still accruing interest.

S&P Global Market Intelligence measured each company's standard deviation from the mean value for the seven financial metrics. Ceilings and floors were implemented for those standard deviations so that significant outliers would not fundamentally alter the analysis. Then the capped standard deviations were weighted according to the above percentages and aggregated to determine a relative performance score on a scale from negative 200 to 200.

Axos Bank, the banking unit for Axos Financial, launched as a digital bank called Bank of Internet USA on July 4, 2000, when it offered a basic checking account. Axos Financial completed an IPO in March 2005 and brought in Greg Garrabrants as president and CEO in October 2007. At that time, it had a below-average ROAA and net interest margin (NIM), with just above $1 billion in assets a heavy multifamily loan concentration primarily funded through certificates of deposit (CDs) and borrowings. Over the last 17 years, Axos Financial has experienced exceptional growth and evolved into a highly profitable diversified bank.

Less than two years after Garrabrants joined the bank, Axos Financial achieved an ROAA over 1% and a NIM over 3.50%. The bank's profitability since then risen. Over the last five calendar years, the bank has topped the hurdles of a 1.50% ROAA and a 4% NIM while maintaining an efficiency in the low to mid-40s.

The balance sheet has also changed dramatically during Garrabrants' tenure. On the asset side, Axos Financial disclosed in public company filings that multifamily mortgages have declined to less than 11% of total gross loans from close to 60% at Sept. 30, 2007. The big-ticket categories in the loan portfolio now are non-real estate commercial and industrial at 29%, commercial real estate (CRE) specialty at over 26% and jumbo single-family mortgage at 18%. On the liability side, CDs as a proportion of total deposits have plunged to 4% from 88%, and total borrowings account for less than 2% of assets.

Balance sheet growth has been another key element in the company's transformation. Axos Financial topped the $10 billion asset barrier in 2019 and vaulted to $23.71 billion in assets as of Dec. 31, 2024. It has grown organically and through acquisitions, which include two loan portfolios from the Federal Deposit Insurance Corp. in 2023 and $2.4 billion in deposits from Nationwide Trust Co. FSB in 2018.

Going forward, one loan growth lever could be technology and life sciences. Axos Financial announced the launch of a new banking division in that niche in November 2024.

As of 2024-end, Axos Financial was awash in liquidity, with cash and cash equivalents representing about 12% of assets, and was highly capitalized, with an adjusted TCE ratio, basic TCE ratio and leverage ratio all slightly above 10%. That war chest could become even more robust as the company announced an at-the-market common stock shelf offering Jan. 28 for up to $150.0 million.

On an earnings call the same day, Garrabrants said the company is "seeing a meaningful increase in the number of inorganic asset and business acquisition opportunities" and the announcement of the shelf offering "is a proactive step to put us in a favorable position to capitalize on potentially accretive and strategic opportunities that may require additional capital."

Garrabrants said "organic loan growth and opportunistic share repurchases" remain the company's preferred use of capital and added that the company will not utilize the offering without "a clear line of sight into an acquisition that would require additional capital given the significant excess capital we have today."

Runners-up

The other top banks in the category — Little Rock, Arkansas-based Bank OZK and Laredo, Texas-based International Bancshares Corp. — have a lot in common. Both have leadership continuity at the chairman position since 1979, own deposit franchises in high-growth metropolitan statistical areas and have built loan portfolios with a majority weighting in CRE, including construction and development, an area scrutinized intensely by regulators and investors. Both banks also placed in the top four in the three profitability metrics as well as adjusted TCE ratio.

One key difference is that International Bancshares could have more balance sheet flexibility, with a loans-to-deposits ratio of 73% versus Bank OZK's 97%. International Bancshares also has a more diverse earnings stream, with 21% of its operating revenue coming from noninterest income in 2024, compared to just 7% for Bank OZK.

On the other hand, credit quality may be holding up better at Bank OZK, despite a large land loan moving to nonaccrual status in the 2024 third quarter and speculation about the risk of two high-profile CRE credits. Its ratio of nonperforming assets to total assets at year-end 2024 was 74 basis points lower than that of International Bancshares, and its NCO ratio for full year 2024 was 19 bps lower.

Bank OZK has more aggressively grown its balance sheet, with assets up 12% year over year in 2024 and 62% over the last five years. It may have a greater appetite for M&A as well, particularly for failed banks, or if it opts to accelerate its loan diversification plans. Bank OZK submitted a nonwinning bid for at least a portion of Republic First Bank, which was shut down in April 2024.

In the 2023 financial performance ranking, Bank OZK finished fifth, while International Bancshares was the runaway winner.

Other notable banks

Hicksville, New York-based Flagstar Financial Inc. was the only newcomer to the analysis in 2024. It was ineligible for the 2023 ranking, when it was known as New York Community Bancorp Inc., because of unavailable audited financials following data revisions. Flagstar finished at the back of the pack in the 2024 ranking but represents a turnaround story, with a capital infusion and new leadership announced last March.

Gulfport, Mississippi-based Hancock Whitney Corp., which announced its planned acquisition of asset manager Sabal Trust Co. on Jan. 21, improved the most in the ranking, moving up to No. 15 from No. 72. Live Oak Bancshares Inc., which is based in Wilmington, North Carolina, was the biggest mover to the downside, falling 39 spots to No. 88.

JPMorgan Chase & Co. was the clear winner among the Big Four US banks, at No. 34. It excelled in EPS growth, ROAA and efficiency ratio.

Category winners included KeyCorp for EPS growth of 31.8% on a normalized basis; First Citizens BancShares Inc. for operating revenue growth of 85.3%, aided by its merger of equals with CIT Group Inc. in 2022 and its failed-bank acquisition of Silicon Valley Bridge Bank NA in 2023; and International Bancshares for ROAA of 2.57% and adjusted TCE ratio of 15.96%.

Carmel, Indiana-based Merchants Bancorp led the efficiency ratio category with a ratio of 32.13%, and Puerto Rico-based OFG Bancorp led with NIM of 5.59%. There was a three-way tie for best NCO ratio, at 0.01%, between Ontario, California-based CVB Financial Corp.; Walla Walla, Washington-based Banner Corp.; and Olney, Maryland-based Sandy Spring Bancorp Inc., which announced a sale to Glen Allen, Virginia-based Atlantic Union Bankshares Corp. on Oct. 21, 2024.

Two banks in the analysis — No. 60 Berkshire Hills Bancorp Inc. and No. 79 Brookline Bancorp Inc., both based in Boston — are combining in a merger of equals.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Download a refreshable template containing the underlying data used in the rankings and a complete list of the 98 banks in the analysis.

Content Type

Theme

Segment