Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 8 Aug, 2024

A steady stream of ratings downgrades and foreboding media reports regarding the health of the collateral underlying commercial mortgage-backed securities (CMBS) structures threaten to overstate the breadth and depth of the associated risks to the US life insurance industry, which is actively invested in the asset class.

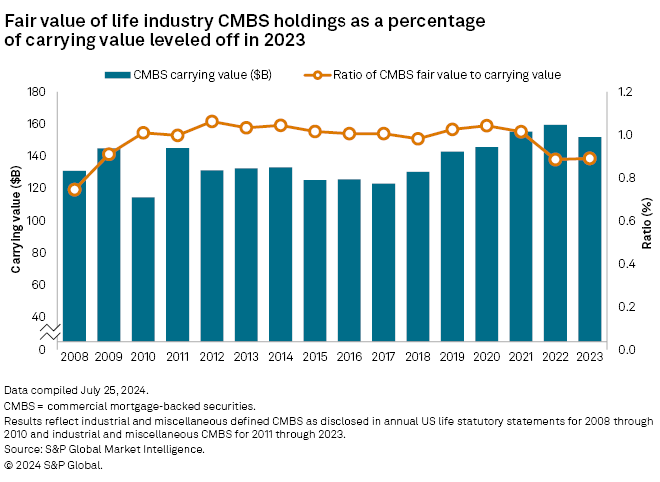

➤ S&P Global Market Intelligence's industry aggregations show that at year-end 2023, US life insurers held $151.86 billion of CMBS issued by industrial and miscellaneous nongovernmental entities, representing only about 2.8% of the industry's total net admitted cash and invested assets. The CMBS position constitutes part of the industry's demonstrably higher exposure to a range of real estate debt, which totaled 14.7% when incorporating assets such as direct holdings of uninsured commercial mortgages, investments in funds with characteristics of mortgage loans, and residual tranches of structured securities collateralized by mortgages.

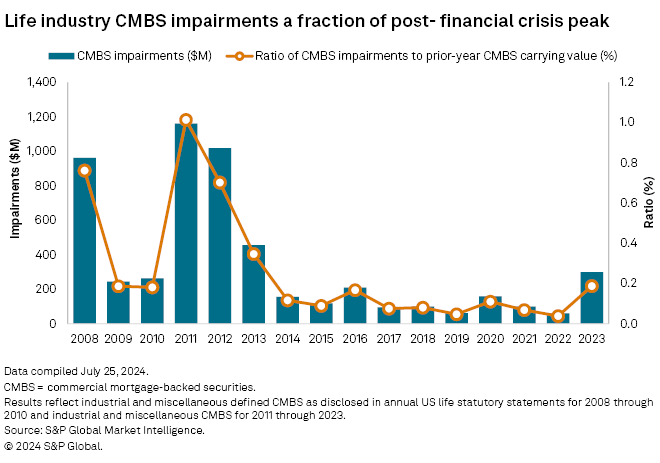

➤ Life insurers' CMBS impairments in 2023 rose to the highest level, both on an absolute basis and as a percentage of prior-year-end aggregate carrying value, in a decade amid stress on transactions backed by office and retail properties. Continued rating downgrades to date in 2024 by S&P Global Ratings and other agencies create the potential for further stress, but other market developments may serve as a partial mitigant.

➤ Rising interest rates, concerns about asset quality and mounting refinancing risk led to an especially wide gap between the aggregate fair value and carrying value of life insurers' CMBS holdings. The ratio stood at a 14-year low of 88.5% at year-end 2022, down from 101.5% as of the same point in 2021 and increased only marginally in 2023. However, our analysis of Markit CMBS pricing data newly available on S&P Capital IQ Pro suggests that current valuations in many cases, despite the ratings downgrades and omnipresent headline risk, are higher than the insurers' reported year-end 2023 marks.

➤ The vast majority of the industry's exposure benefits from significant structural support. At year-end 2023, 76.2% of life insurers' industrial and miscellaneous CMBS holdings had a designation of NAIC-1A, equivalent to AAA (sf) in S&P Global Ratings' scale, as compared with 81.9% two years prior. Nearly 90.4% had a designation of NAIC-1, which is intended to be indicative of an A-category rating, down from 91.4% at the end of 2021. Both percentages may decline further in 2024 amid the various year-to-date downgrades and warnings about more such actions to come, but they still should constitute the substantial majority of the industry's CMBS positions.

The Wall Street Journal, in a July 16 report, warned of rising CMBS defaults amid what it has referenced on multiple occasions as a "real estate meltdown" triggered by deterioration in office and shopping mall valuations. The article highlighted risks associated with single-asset, single-borrower bonds, focusing in particular on BWAY 2015-1740 Mortgage Trust. In that transaction, holders of the originally AAA (sf)-rated A tranche took losses on the default of the underlying loan on the office building at 1740 Broadway in Manhattan, NY, best known among insurance industry veterans as the ex-headquarters of the former MONY Group Inc.

MetLife Inc. and Farmers Insurance Group of Cos. were among the investors that lost "at least 25%" of the value of their positions in the bonds, the report said. A review of S&P Global Market Intelligence's insurance investment holdings data finds that life insurers recorded $33.2 million in impairments on the BWAY 2015-1740 bonds in 2023, with subsidiaries of Global Atlantic Financial Group Ltd., Aegon Ltd. and Western & Southern Mutual Holding Co. effectively writing off their positions in more junior pieces of the structure. The US life subsidiaries of MetLife accounted for only $1.5 million of the impairments, and they continued to hold $8.6 million of the class A tranche of the deal as of year-end 2023. A hypothetical 25% decline from that level based on year-to-date 2024 developments would imply a loss of approximately $2.2 million.

All told, life insurers' CMBS impairments surged fivefold in 2023 to $299.7 million, the highest annual sum attributable to the asset class since 2013. CMBS impairments peaked in 2011 amid fallout from the global financial crisis at $1.16 billion, unadjusted for inflation. The 2023 impairments constituted 0.19% of year-end 2022 CMBS carrying values; the same ratio was 0.35% in 2013, and it peaked in 2011 at 1.01%.

Our analysis of 2023 life insurer CMBS impairments at the CUSIP level finds that BWAY 2015-1740's class B, D and A notes each ranked among the tranches with the 25-largest impairments. A $59.3 million impairment taken by Pacific Life Insurance Co. on its investment in the class C notes of Dbjpm 2016-Sfc ranked as the largest such action recorded by a life insurer on an industrial or miscellaneous CMBS transaction. The notes were backed by a loan on the troubled former Westfield San Francisco Centre retail and office complex in San Francisco's Union Square. Additionally, the US subsidiaries of Athene Holding Ltd. recorded an impairment of $30.4 million of their investment in the class E tranche of BB-UBS Trust 2012-TFT, a structure supported by loans on two regional shopping malls.

All of the aforementioned securities had endured multiple downgrades in recent years by S&P Global Ratings, which said in a July 8 report that it had issued downgrades to 344 CMBS classes during a 12-month period ended in June. The rating agency cautioned that further actions through the balance of 2024 would likely continue to be heavily biased toward downgrades.

Our analysis of CUSIP-level downgrades finds that US life insurers had exposure of nearly $1.22 billion to CMBS classes downgraded by S&P Global Ratings between Jan. 1 and July 24. That analysis was based on downgrades listed on S&P Global Ratings' RatingsDirect on Capital IQ Pro and S&P Global Market Intelligence's CUSIP-level insurance investments holdings data.

Loans on offices and retail properties do not represent the entirety of the asset class nor US life insurers' investment therein, though, similar to their direct investment in commercial mortgage loans, most of the recent focus has centered on those beleaguered categories.

For those securities where S&P Global Ratings has assigned specific collateral type codings in RatingsDirect, which amounted to $21.89 billion of the life industry's CMBS holdings at year-end 2023, those labeled as office, retail or shopping mall accounted for 15.4% of the total. Mixed-use properties, which could include office and/or retail properties, accounted for just over two-thirds of the associated life industry investments. Both the Journal article and the S&P Global Ratings report flagged single-asset, single-borrower transactions backed by office properties as a particular area for concern.

Yet amid these headwinds, a review of Markit evaluated pricing data for the largest distinct CMBS classes held by life insurers suggests some reason for optimism, particularly as it pertains to the divergence between the securities' fair values and carrying values.

Markit has pricing data for 42 of the top 50 CMBS CUSIPs owned by life insurers at year-end 2023 and, as of July 24, showed appreciation (generally in modest amounts) in average fair values per unit since year-end 2023. That included the single-largest CMBS tranche held by the industry, the class A notes of Hamlet Securitization Trust 2020-Cre1. US life insurers, and more specifically the US life units of Athene, held $1.06 billion of the notes as of year-end 2023. Another CMBS tranche with significant aggregate life industry ownership and a broader base of investors, the class A notes of BAMLL Commercial Mortgage Securities Trust 2014-520M, showed a higher Markit evaluated price as of July 24 than at year-end 2023. Holders of that class included subsidiaries of Corebridge Financial Inc., Brighthouse Financial Inc., Allianz SE, Knights of Columbus, MetLife, Brookfield Reinsurance Ltd. and United Services Automobile Association.

The Markit evaluated bond prices available on S&P Capital IQ Pro for CMBS, other structured finance products and various fixed-income instruments are based on a proprietary methodology. IHS Markit is part of S&P Global. Year-end 2023 fair value per unit statistics reflect averages of the measures reported by all applicable holders of a given CUSIP, and they may reflect a combination of our evaluated bond prices and/or other inputs from different vendors.

The life industry's five-largest investors in industrial and miscellaneous CMBS based on year-end 2023 carrying values at the group level were New York Life Insurance Co., Corebridge, Teachers Insurance & Annuity Association of America (TIAA), Global Atlantic and The Northwestern Mutual Life Insurance Co. Relative to net admitted cash and invested assets and subject to a minimum position of $500 million, the largest investors were American Life & Security Corp., Bluejacket GP LLC (Prosperity Life), CNO Financial Group Inc., the Fidelity & Guaranty Life business of Fidelity National Financial Inc. and Western & Southern.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.