Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 12, 2025

By Tim Zawacki

High levels of retained losses from the Southern California wildfires will put at least a temporary stop to the significant momentum that the group led by State Farm Mutual Automobile Insurance Co. mostly generated in its core personal lines businesses during the final months of 2024.

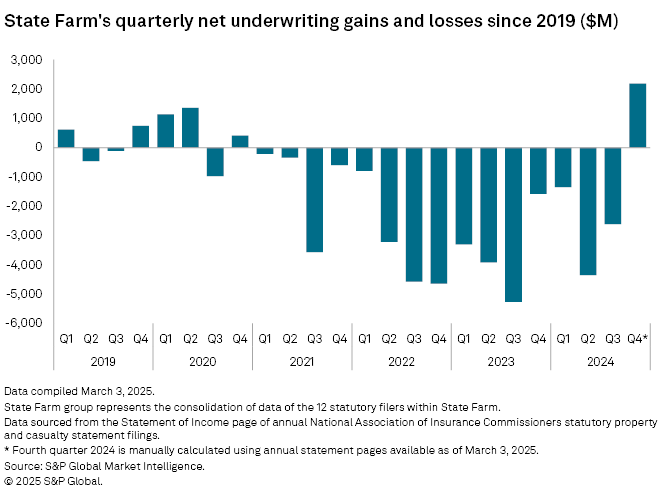

State Farm on Feb. 28 reported that its property and casualty (P&C) business generated a net underwriting loss of $6.1 billion in 2024, which compared favorably to a loss of $14.1 billion in 2023. Our analysis of the disclosures in the annual statements for State Farm Mutual Auto and 11 P&C subsidiaries and affiliates finds that a historically large net underwriting gain in the fourth quarter of 2024 accounted for a meaningful portion of the improvement. The 2024 annual filings for the State Farm group members and thousands of other US insurers are available on S&P Capital IQ Pro.

We calculate that the State Farm US P&C group posted a $2.18 billion net underwriting gain in the fourth quarter of 2024, a swing of $3.76 billion from a loss in the year-earlier period to its first such profit in 16 quarters. In nominal terms, the fourth-quarter 2024 result ranks as the largest net underwriting profit for the State Farm P&C group in any quarter since the start of 2001, easily surpassing the previous high of $1.36 billion in the depths of the COVID-19 pandemic in the second quarter of 2020. Our calculated combined ratio of 91.7% prior to policyholder dividends was the seventh-best result for the group since the start of 2001, a span of 96 quarters.

Disclosures in several of State Farm group's annual statements indicate that the good times will prove short-lived, however. With two entities poised to absorb a majority of the $7.9 billion in wildfire losses and loss adjustment expenses (LAE) incurred by State Farm General Insurance Co. and the top-tier mutual from the wildfires in the first quarter, we estimate that the State Farm group may be poised to post one of its largest net underwriting loss on a nominal basis in any quarter in at least 24 years even as underlying conditions in key business lines have markedly improved. The group posted a net underwriting loss of $5.27 billion in the third quarter of 2023; its predividend combined ratio peaked at 130.0% in the fourth quarter of 2001.

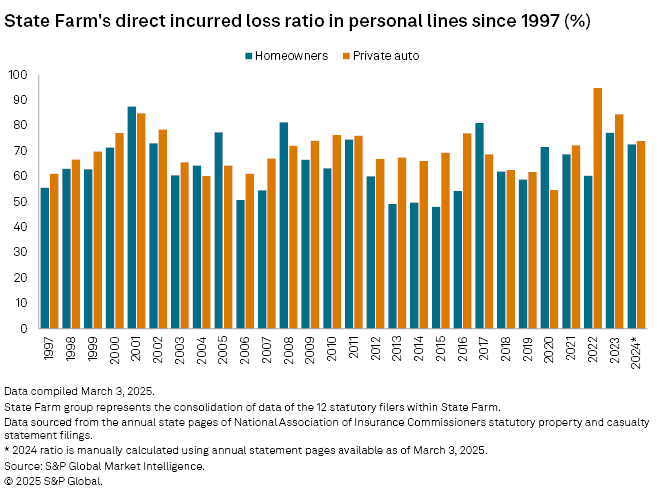

State Farm said in its Feb. 28 release that its auto underwriting loss in 2024 narrowed by a staggering $7 billion to $2.7 billion. The direct incurred loss ratio in the group's private auto business lines narrowed by 10.4 percentage points to 73.9% in 2024 from 84.3% in 2023, according to individual company statements, as growth in direct premiums earned of 20.1% vastly exceeded the 5.3% increase in direct incurred losses. While results in the private auto liability coverages improved, the private auto physical damage line was largely responsible for the dramatic decline. The direct incurred loss ratio in that line plunged by 23.6 percentage points to 63.0%.

In the fourth quarter of 2024, the private auto direct incurred loss ratio improved on a year-over-year basis by double-digit percentage points for the fifth time in the past six quarters. At less than 69.5%, the group's private auto direct incurred loss ratio was 12.7 percentage points lower than the fourth quarter of 2023 to its best level since the first quarter of 2021. The ratio peaked during the current cycle at a high of 102.9% in the fourth quarter of 2022.

State Farm and the rest of the US P&C industry posted historically favorable results in the private auto business from the second quarter of 2020 through the first quarter of 2021 as COVID-19 restrictions led to a dramatic decline in the amount of miles driven by Americans and, in turn, the frequency of claims. Those favorable results led auto insurers to provide rebates or other forms of relief to policyholders, but since State Farm largely accounted for its response as policyholder dividends, the direct incurred loss ratios for those periods were unaffected.

Since then, elevated claims severity due to the nature of vehicle crashes and inflationary pressures in the costs to repair and replace damaged vehicles led to historically poor private auto results for State Farm and its peers. But fortunes took a decided turn for the better in 2024 as the rates of increase in several of the key inflationary factors leveled off and carriers fully earned into their books of business the significant rate increases they had obtained across most geographies.

We expect State Farm and other leading private auto writers to continue to benefit from the same tailwinds in 2025, aside from some amount of comprehensive claims related to the California wildfires and risks presented by potential tariffs. The homeowners line faces a more challenging outlook, unscored by the likely significant financial impact from the wildfires and the potential for longer-term fallout for State Farm, specifically, and the P&C industry as a whole.

For 2024, a year highlighted by hurricanes Helene and Milton along with particularly active severe convective storm activity, we calculate that State Farm's homeowners direct incurred loss ratio improved to 72.6% from 77.1% in 2023. An especially favorable fourth quarter helped partially mitigate the impact of elevated catastrophe losses in the first three quarters of the year. At 47.9%, State Farm's fourth-quarter 2024 homeowners direct incurred loss ratio was its lowest such result in any quarter since the opening three months of 2020 and it marked improvement of 9.4 percentage points from the year-earlier period.

We would expect the homeowners business to serve as a material drag on State Farm's results for the first quarter of 2025, given the severity of the expected losses from the wildfires.

State Farm General, California's largest homeowners insurer, disclosed in the notes to its 2024 annual statement that it faces $7.9 billion of direct losses and LAE related to the wildfires. While those losses will be spread across various lines of business, State Farm General previously provided to California regulators loss estimates across various homeowners coverages that exceeded $6.85 billion. For context, the entire State Farm group reported direct incurred losses in the homeowners line of $4.43 billion in the first quarter of 2024.

Assuming that State Farm's homeowners direct premiums earned grow in the first quarter of 2025 at the same rate as its homeowners direct premiums written in full year 2024 and that homeowners losses aside from the wildfires were at their first quarter 2020 low, this would imply a direct incurred loss ratio in that business line of more than 130% across the entire group. That would be more than double the group's homeowners direct incurred loss ratio of 64.7% in the first quarter of 2024 and would rival the highest such results in any quarter since at least the start of 2001 — ratios of more than 131% in each of the third quarters of 2004 and 2005.

Net of reinsurance, the group is likely to see similarly historic results as the top-tier mutual and Oglesby Reinsurance Co. are poised to assume and retain the majority of State Farm General's losses. State Farm General put its expected retained losses and LAE at $221 million. State Farm Mutual Auto, which has sustained both direct and assumed losses from the wildfires, estimated gross and net pretax losses and LAE of $6.7 billion and $5.4 billion, respectively. Oglesby Re put its assumed losses and LAE at $1.3 billion. Notably, State Farm's wildfires estimates do not incorporate subrogation recoveries from public utilities or any other parties that may be deemed to hold responsibility in connection with one or more of the January events.

Executives at State Farm General indicated in a Feb. 25 letter to California Insurance Commissioner Ricardo Lara that the top-tier mutual is on the hook for "billions of dollars of reinsurance recoveries." This does not include the $165 million in initial California Fair Plan Association assessments that State Farm General has already received nor the estimated $400 million in assessments that the company cautioned it expects to ultimately pay.

State Farm's largest net underwriting loss in a first quarter since at least 2001 was $3.31 billion in 2023, a level that it would surpass even if the rest of its business replicates the historical fourth-quarter 2024 profit in that period. Its largest net underwriting loss in any quarter during that span was $5.27 billion in the third quarter of 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.