Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Sep, 2023

By Ruilin Wang

In the monthly Commodity Briefing Service (CBS) report, S&P Global Commodity Insights discusses the copper market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

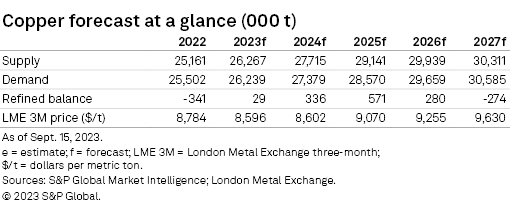

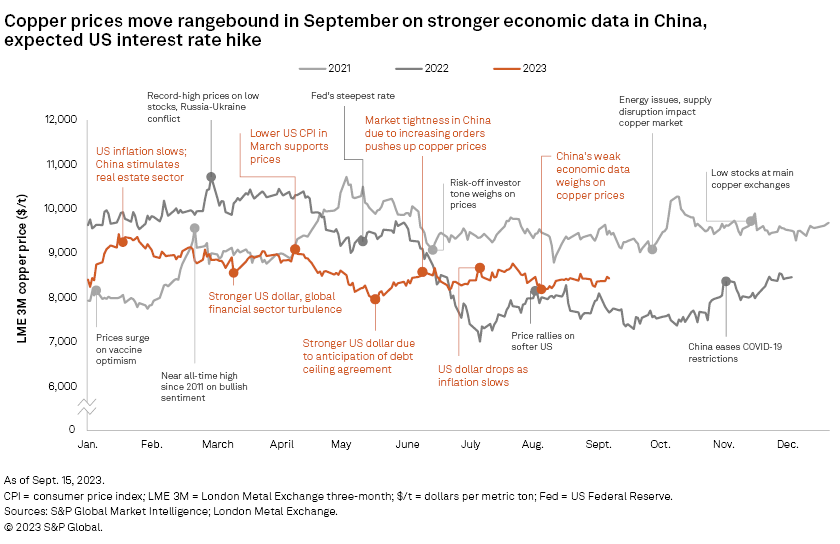

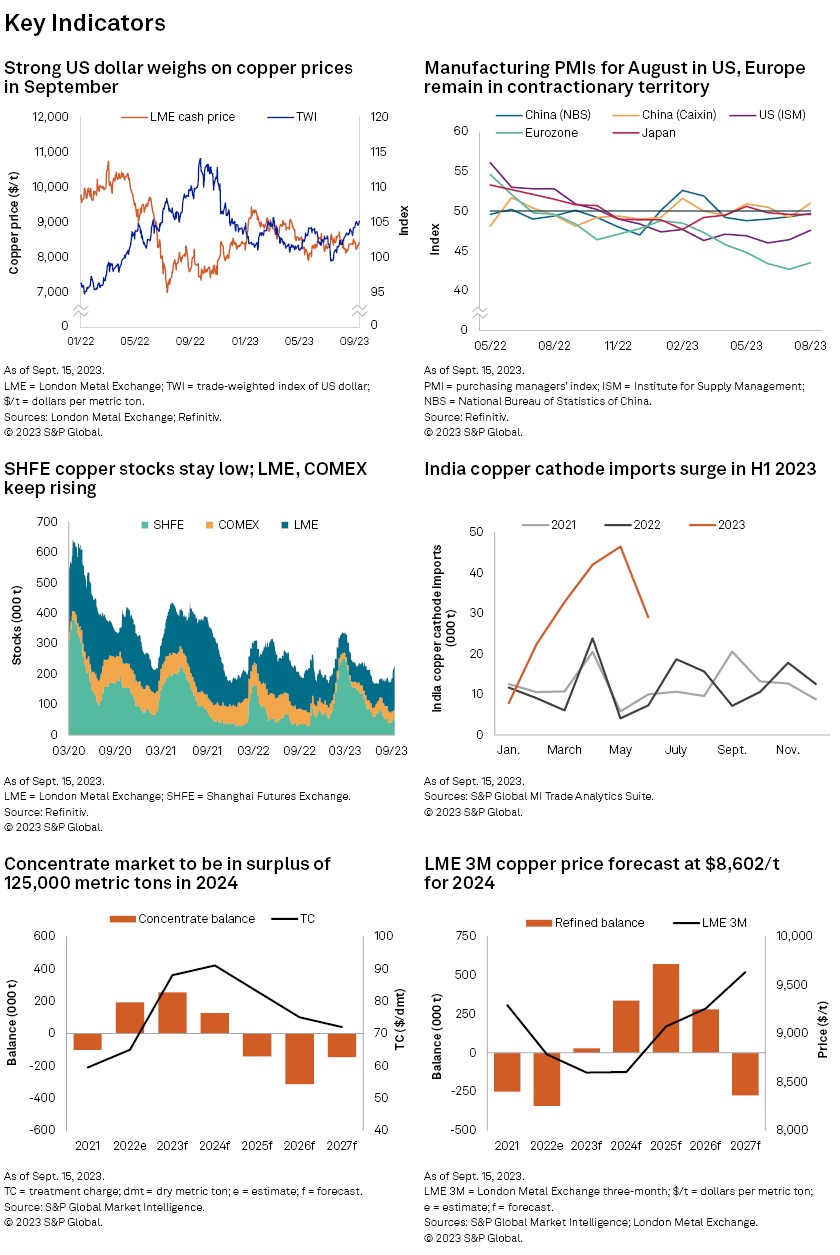

➤ Copper prices have moved rangebound in September. After stimulus measures aiming to boost housing purchases in China lifted the London Metal Exchange three-month (LME 3M) copper price to $8,535 per metric ton on Sept. 1, a rapid increase in copper stocks at LME warehouses and a stronger US dollar pushed the price down to $8,242/t on Sept. 8. Prices then rallied to $8,465/t on Sept. 14 after the release of better-than-expected August economic data in China.

➤ Our estimated China apparent refined copper consumption was the second strongest year to date in August, a month when demand would typically weaken due to hot weather. Price movements in 2023 seem to have more influence on demand than seasonality, with heavy restocking in August tailing off in September under higher prices.

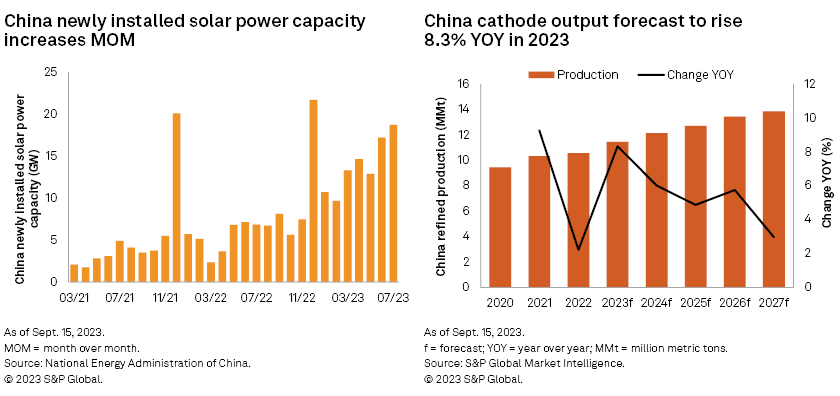

➤ Strong China refined copper production in August was reflected in a 36.6% increase month over month in China's copper concentrate imports. We have upgraded our forecast Chinese cathode output to a year-over-year increase of 8.3% in 2023.

➤ Limited growth in refined copper imports also helped to keep stocks low in China. In contrast, inventory accumulation accelerated at LME warehouses, up by nearly 40,000 metric tons in the first half of September.

➤ Copper consumption saw sustained contractions in the US and Europe in August. In comparison, demand is robust in several Asian countries, with India as the standout performer. India's copper cathode imports in the first half of 2023 nearly tripled year over year.

➤ We expect the average annual LME 3M copper price to be $8,596/t in 2023. We have downgraded our price forecast for 2024 to a similar level as 2023 since it will be another year with sufficient supply of copper concentrate and cathode. Our forecast global refined copper surplus in 2024 now sits at 336,000 metric tons.

Analyst comment

The LME 3M copper price rebounded on a flurry of orders from copper end users following the price drop to $8,182/t on Aug. 15. Prices gained additional upward momentum from the China central bank's guidance on relaxing residential housing loan rules, which was followed by China's first-tier cities, including Guangzhou, Shenzhen, Shanghai and Beijing, allowing home buyers to enjoy preferential loans for first-home purchases regardless of their previous credit record. These stimulus measures aiming to boost housing purchases lifted the LME 3M copper price to $8,535/t on Sept. 1 before it pulled back to $8,242/t on Sept. 8 due to a rapid increase in copper stocks at LME warehouses and strong US service sector data fueling a hawkish tone on the near-term outlook for US interest rates. The copper price then increased to $8,465/t on Sept. 14 with the release of stronger-than-expected August economic data in China.

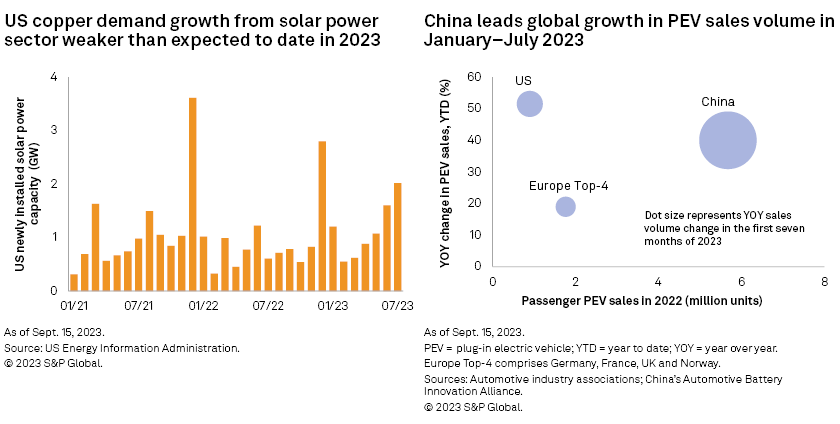

The LME 3M copper price has mostly traded in a narrow range between $8,200/t and $8,600/t in the past three months. Underlying the relative price stability was a persistently low level of SHFE copper stocks and firm demand in China. A key demand driver is strong growth in China's newly installed solar power capacity, which jumped 157.5% year over year in the first seven months of 2023. Estimated consumption from this sector could be about 200,000 metric tons higher year over year in 2023. The electric vehicle sector has also seen robust year-to-date growth, with production up 36.9% and sales volume increasing 39.2%. Copper demand would typically weaken in August due to hot weather; however, our estimated apparent refined copper consumption for the month was stronger than most of the previous seven months of 2023. In 2023, price movements seem to have more influence on demand than seasonality; following heavy restocking in August, procurement weakened when prices increased in September, a typical peak demand month.

China's strong refined copper production in August was reflected in a 36.6% jump month over month in copper concentrate imports, and we also expect firm output to continue in September. Nanguo smelter could possibly start its Phase 2 smelter project earlier than expected, from October or November, when its Phase 1 smelter needs to undergo a maintenance outage, as indicated by several market participants. The Phase 1 smelter will likely remain halted until sometime in 2024 after the Phase 2 project achieves steady production and the privately-owned Guangxi Nanguo Copper Industry Co. Ltd. is in a better financial condition to allow the two smelters to operate together. As the two phases have the same smelter capacity of 300,000 metric tons per year, our projected Nanguo production estimate has not changed much. We have upgraded our forecast for China's total cathode output from a year-over-year increase of 8.1% to 8.3% in 2023, with adjustments mainly to the Shandong Jinsheng refinery.

Limited increases in refined copper imports helped to keep stocks low in the Chinese market. In contrast, inventory accumulation accelerated at LME warehouses, up by nearly 40,000 metric tons in the first half of September. This could be related to continuous cathode exports from the Democratic Republic of the Congo to Europe and the Middle East. In addition, cathode production increased at Zijin Mining Group Co. Ltd.'s Bor refinery in Serbia, which produced only 14,684 metric tons of cathode in the first half of 2023 after a smelter upgrade was completed in March. We also learned that anode from Boliden AB (publ)'s Ronnskar smelter was transported to another refinery to produce cathode.

Copper consumption, however, continued to slow in the US and Europe in August. In the US, 5.9 GW of solar power capacity came online in the first half of 2023, 4.6 GW less than planned, as supply chain constraints forced some new capacity additions to be rescheduled to the second half. New installations in July already increased 26.1% month over month. According to Argonne National Laboratory, the plug-in electric vehicle sector remains robust as expected in the US, with sales increasing 51.5% year over year during January and July. The growth rate was much higher than the 19.0% observed across the top four European markets, which comprise Germany, France, the UK and Norway. S&P Global's survey indicated that firms in Europe experienced the quickest fall in new copper orders in August since May 2020, which could depress their operating conditions this month.

In comparison, copper demand is robust in several Asian countries, with India being the standout performer. S&P Global's Manufacturing Purchasing Managers' Index for India rose to 58.6 in August from 57.7 in July, with new orders and output increasing at the quickest rate in nearly three years. India's copper cathode imports in the first half of 2023 nearly tripled year over year to 180,400 metric tons.

Outlook

We forecast high cathode supply in China to persist in the December quarter. The restart of the Daye smelter and the startup of the Houma and Baiyin smelter projects could offset production loss due to maintenance outages at several smelters. Demand is expected to follow the adage that "it is not that strong in the peak period, but not so weak in the slack period." Relatively stable market fundamentals are likely to dampen volatility in the copper price. Meanwhile, price-sensitive buying activity in China could continue to limit the upside for prices. We have downgraded our average annual LME 3M copper price forecast to $8,596/t in 2023.

We have also lowered our price forecast for 2024 to a similar level to 2023, as it will be another year with sufficient supply of copper concentrate and cathode. We expect a global refined copper surplus of 336,000 metric tons, lower than our previous estimate in August. Production in Myanmar was cut to zero because it is unlikely Wanbao Minerals Co. Ltd. will recover SX-EW operations at Letpadaung Mountain and Monywa assets as social unrest continues. Other downward supply adjustments were mainly focused on the bankrupted Camacari refinery in Brazil.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.