Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 25, 2025

In this study, S&P Global Commodity Insights looks at the past and present relationship between nominal government yields and the gold price. While we will look at different economies in this study, the focus will inherently be on the US for several reasons. The US is the world's biggest economy and has the largest and most sophisticated financial markets. At the same time, the US dollar is the most widely traded currency in the world, making for a level of liquidity that reinforces it as an advantageous reserve currency.

Safe-haven gold, government-backed securities: 2 contrasting assets

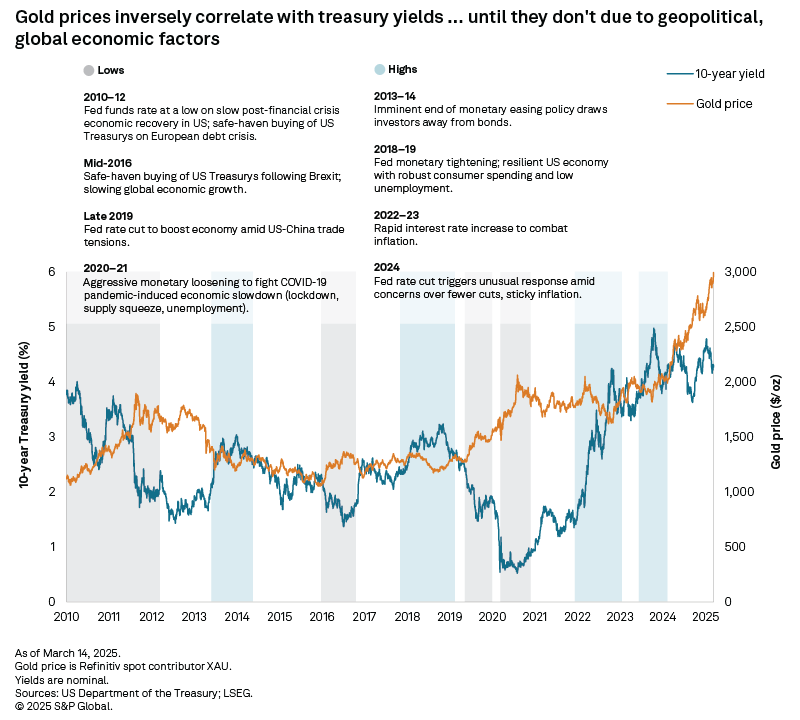

The gold price embarked on a near-uninterrupted upward trajectory in the March quarter of 2024, driven by geopolitical upheaval, a possibly related buying frenzy from central banks, and US recession fears — evidenced, as will be detailed below, by a particular trend in yields — that resulted in the gold price gaining $1,000 per ounce in less than a year to settle above $2,900/oz in February 2025. News and announcements, such as interest rate cut decisions in the second half of 2024, a steep dollar rally around the time of the US presidential election toward year-end, and periodic movements in stock markets have temporarily tempered the gold price.

However, the sustained and sporadically intensifying geopolitical turmoil in Europe and the Middle East, as well as escalating trade tensions between the US and several other economies lent further support to gold prices throughout 2024 and into 2025. The gold price breached $3,000/oz in trading on March 14 as tariffs were traded between the US and EU. Fears of recession in the US and ongoing geopolitical turmoil, especially in the Russia-Ukraine war, further fueling the safe-haven buying frenzy. Those same factors are also sustaining the benchmark 10-year Treasury yield at elevated levels, especially as markets do not anticipate the US Federal Reserve to cut borrowing rates at their March 18–19 meeting.

This gold price bull run occurred amid the high-interest-rate environment and, therefore, elevated-yield government bond market maintained by the Fed to combat widespread inflation. For several weeks in 2024, the US 10-year Treasury yield and the gold price rose concurrently, and some of this behavior has resumed recently. This lock-step correlation deviates from the typical inverse relationship between gold prices and T-yields, indicating unusual times during which geopolitical concerns have increasingly outweighed macroeconomic principles. Normally, an increase in the yield, reflecting changes in the domestic economic picture, would pressure the gold price. Conversely, the lower the yield, the lower the opportunity cost of holding bullion, which does not have a return, per se.

It is worth noting that there were extended periods when US yields and gold prices moved concurrently, breaking the inverse relationship and instead pointing at specific times with specific sets of economic and geopolitical drivers affecting the financial landscape. With gold a safe-haven asset against inflation and government bonds a "safe" investment amid stock market volatility, it is unsurprising that investors tend to pursue both in times of uncertainty.

US Treasury market 101

The US government began issuing Treasury securities in 1790 to help finance the Revolutionary War debt. These securities are debt instruments — in effect, a government-backed IOU, which therefore makes for a safe investment vehicle for institutions and individuals. However, they have fed the federal debt market in the country. Over the years, the types of Treasury securities issued have evolved to include options with different maturity durations to meet various financing needs and investor preferences: short-term T-bills, with less than one-year maturity, T-notes that mature in two to 10 years, and the long-term T-bonds with a maturity period of up to 30 years. The return on these securities at the end of the maturity period is the Treasury yield, which reflects the interest rate on that debt.

The T-yield varies daily and is influenced by many factors, but the most important is the benchmark interest rate set by the Fed. In the absence of any immediate change, this rate, or the trend in daily fluctuations, indicates a dovish or hawkish Fed monetary policy stance. Yields, especially the longer-term ones, indicate how market participants perceive the economy's evolution amid the broader picture — an important caveat as many of these expectations can be somewhat contradictory. Higher yields can imply economic growth, with higher rates destined to attract investment but also increased borrowing costs that can slow spending or inflationary pressures that might lead to increased interest rates.

How market expectations shape the yield curve, and vice versa

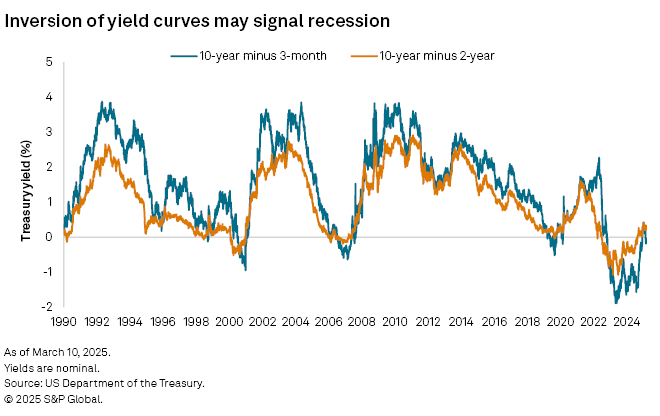

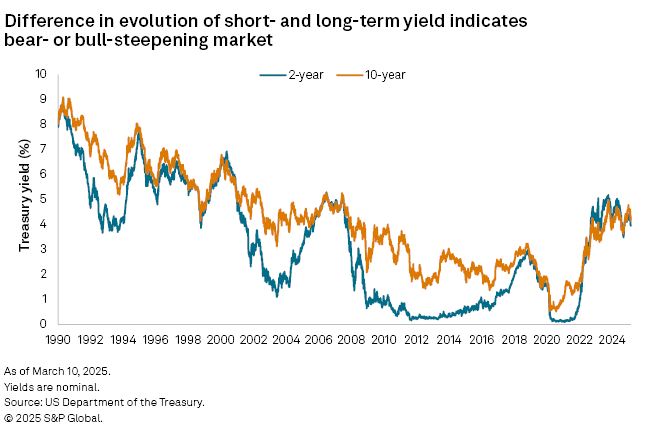

Looking at the yields for the various maturities and comparing the short-term and long-term rates further helps to see the bigger picture. Longer-maturity yields tend to be higher than shorter-maturity ones due to increased risk. When this principle breaks, it can indicate market perceptions of economic slowdown, with some near-term expectation of the monetary environment tightening. Specifically, the 10-year to 2-year yield differential is a key indicator of economic health; when that differential is negative, it is known as an "inverted yield curve" and tends to signal the possibility of a recession. Some will also look to the difference between the 10-year Treasury and 3-month note yield for similar clues.

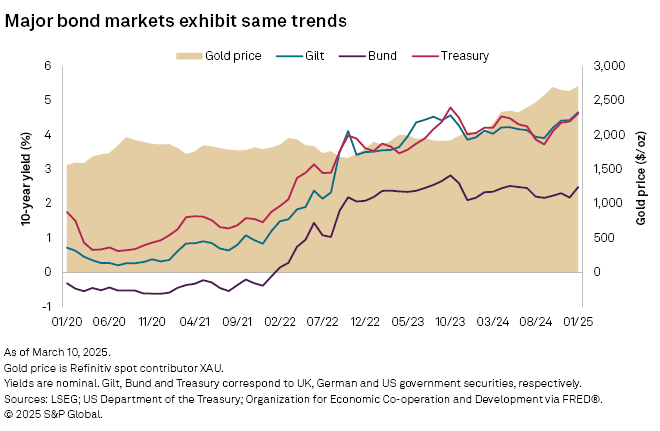

Trends in Treasury and other government yields have been extraordinary over the past few years, following seismic economic and geopolitical shocks. Since 2021, the US, like many other major economies such as Germany and the UK, has been grappling with inflationary pressures that peaked in 2022 amid the economic turmoil resulting from the COVID-19 pandemic, compounded by the start of a war in Europe that sent ripples in various commodity supply chains — food, energy, metals and chemicals. Central banks responded by aggressively raising benchmark interest rates in a monetary tightening move, maintaining rates at decade-highs for the better part of 2023 and 2024, even as another conflict broke out in the Middle East, adding to the global geopolitical instability. Government 10-year yields reached the highest in over 15 years in 2023, helped in the US by a strong currency.

An investor reading of the yield curve for the past few years can identify the following market indicators: throughout 2023–24, the inverted curve shows that recession threatened the US economy, though it eventually did not fully materialize. Amid this inversion, the long-term yields increased more than short-term ones in what is called a "bear steepening" move. This can be a reflection of expectations of either strong economic growth that calls for more capital or higher inflation, perhaps currently and more pressingly tied to the economic upheaval in the US since President Donald Trump came into office through the materializing threats of trade tariffs and retaliatory actions. Lastly, the simultaneous increase in Treasury yields and gold prices for several periods shows the preponderance of other factors over borrowing costs.

Thus, market participants would look to the rising or declining yields as indicators of economic growth trends and their implications, such as inflation or increasing debt, using the information to manage investment portfolios, including a turn to — or renewed interest in — bullion.

Bond markets, exchange-traded fund demand and economic outlooks

Other significant bond markets include Germany and the UK. These two economies have made headlines over the past few years amid their own sets of domestic political and economic events that influenced their benchmark yields. While the influence of these bond markets on the gold price is even less direct and immediate, any major development in fiscal or monetary policy indicative of spending — whether leading to debt or growth — will ultimately cascade into the gold market, just as it does stock markets.

Germany: When the solution is to spend

Germany has been grappling with an economy whose manufacturing sector has yet to fully recover, reflected by a purchasing managers' index in contractionary territory since mid-2022, dragged by the automotive sector, among others. Inflation is as sticky as it is elsewhere, with the country having the highest energy costs in the eurozone as of the first half of 2024, and the country is apparently in dire need of investment to support various infrastructures. Sentiment prevailed that the failures were due to the self-imposed "debt brake" that has limited Germany's borrowing power. However, this was lifted in a March 5 announcement, following both a snap election held Feb. 23 and the US urging NATO countries to increase their defense spending. Upon the extension of that debt brake and the unveiling of a €500 billion investment fund targeting defense and security that heralds a major increase in bond supply, Germany is back in the driver's seat of Europe. Following the latest European Central Bank interest rate cut, the EU is looking at a multibillion-euro package in defense spending for the bloc itself and to support Ukraine as the US pulled back military aid to the country. In response, the 10-year Bund soared by about 40 basis points on March 5, and the yield curve steepened following a massive, knee-jerk sell-off in the bond market. Yields are expected to remain high on these prospects, even as the ECB sounded more dovish in its comments following the rate cut.

The UK: When borrowing does not lead to stimulus

In the UK, the 10-year Gilt rose to 25-year highs in early 2025 due to a combination of factors. Along with concerns surrounding government fiscal policies — namely spending — announced in October 2024 and lingering inflationary pressures and some supply tightness, there was likely contagion from US yield trends.

Nevertheless, the (economic) struggle is real: The recently calculated budget deficit is more than £1.5 billion over what was expected, while economic growth has stagnated. Markets anticipate major spending cuts toward the end of March, a significant contrast to the €500 billion plans for defense by Germany and the European Union, which will likely shake up the Gilt market.

In its quarterly monetary policy meeting published in February, just after a 25-basis-point cut, the Bank of England upgraded its forecasts for interest rates in 2025. Markets are still pricing a 50-point cut through the rest of the year.

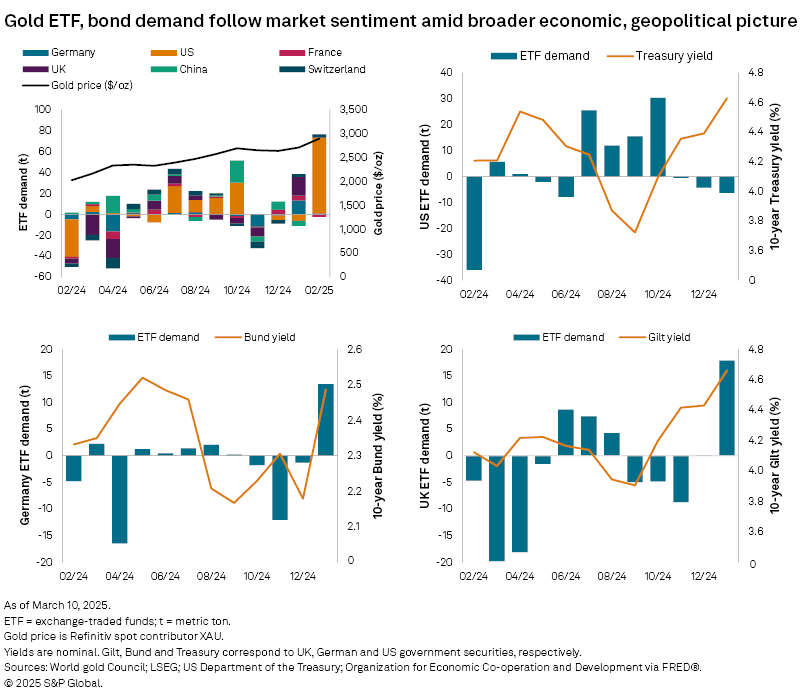

ETF demand in 2024 — mixed response to yields

Demand for physically backed gold exchange-traded funds (ETFs) soared in 2024, with the first annual inflow in four years on record prices and a flight to a safe haven, triggered by geopolitical concerns and changes in macroeconomic monetary policies. When the inverse relationship between bond yields and gold prices holds, ETF demand typically increases when yields rise (implying gold prices are down). However, flows were inconsistent across regions or even within a given economy, as markets also tracked local developments, indicating the unusual market dynamics. Overall, monthly inflows and outflows reflected interest rate decisions, stock market needs for liquidity and market-moving international events.

More volatility, unpredictability to come

We continue to expect volatility in both the gold and various government bond markets, with an unpredictable dynamic between the gold price and bond yield as many geopolitical and economic factors remain at play. Wars are still ongoing, with shifts in historical alliances and US military aid that are triggering localized defense spending; global trade is being disturbed, with the potential for supply squeezes and general price upticks that may restoke inflation, and some signs point to a possible correction to the US stock market. This creates a perfect storm that will support gold prices in the near to middle term, while markets are tuned to any development that would influence interest rates and bond yields..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.