Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 20, 2025

S&P Global Commodity Insights reports on M&A activity in the global metals and mining industry in 2024 with a minimum deal value of $10 million and 1 million ounces of gold or 100,000 metric tons of base metal in acquired reserves and resources (R&R). This report categorizes acquisition assets by primary metal — gold, copper, nickel and zinc — and the acquisition cost for projects that contain more than one metal is not split. Terminated, nonequity deals — such as royalty and streaming — and "earn-in" transactions are not included in the analysis, and deal status is as of the time the data was compiled.

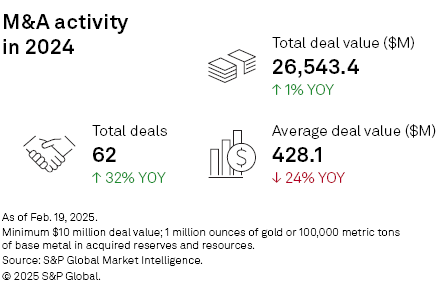

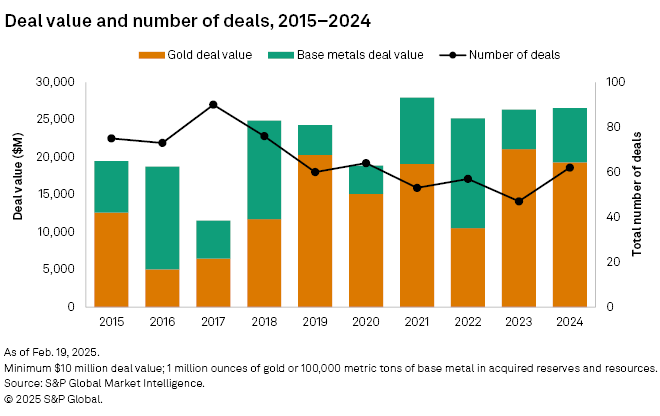

M&A activity in the metals and mining space strongly favored gold over base metals in 2024, but there was not any megamerger, like in 2023. With a total deal value reaching $26.54 billion across 62 deals that fit our criteria for this study, the transactions resulted in the turnover of 192.5 million ounces of gold and a combined 29.8 million metric tons of copper, nickel and zinc in reserves and resources. Geopolitical uncertainties will likely drive M&A activity in 2025, with gold and copper anticipated to remain strong focal points amid rising metal prices.

Mining M&A activity in 2024 for select commodities continued 2023's increasingly strong focus on gold; its robust streak was supported by elevated prices that peaked toward 2024-end. At $26.54 billion, the total deal value in 2024 was 1% higher than in 2023, which had been greatly skewed by the sale of Newcrest Mining Ltd. to Newmont Corp. for $16.49 billion. The total number of deals with primary metal in reserves and resources increased 32% year over year to 62, with company takeovers making up more than half of the total transactions that met our criteria. The average deal price for 2024 was $428.1 million, down 24% from 2023 and the lowest since 2020 in the absence of megamergers. Although the year-over-year increase in deal value was minuscule, the increased number of deals resulted in the growth of smaller acquisitions in 2024, alongside the eight announced deals valued above $1 billion.

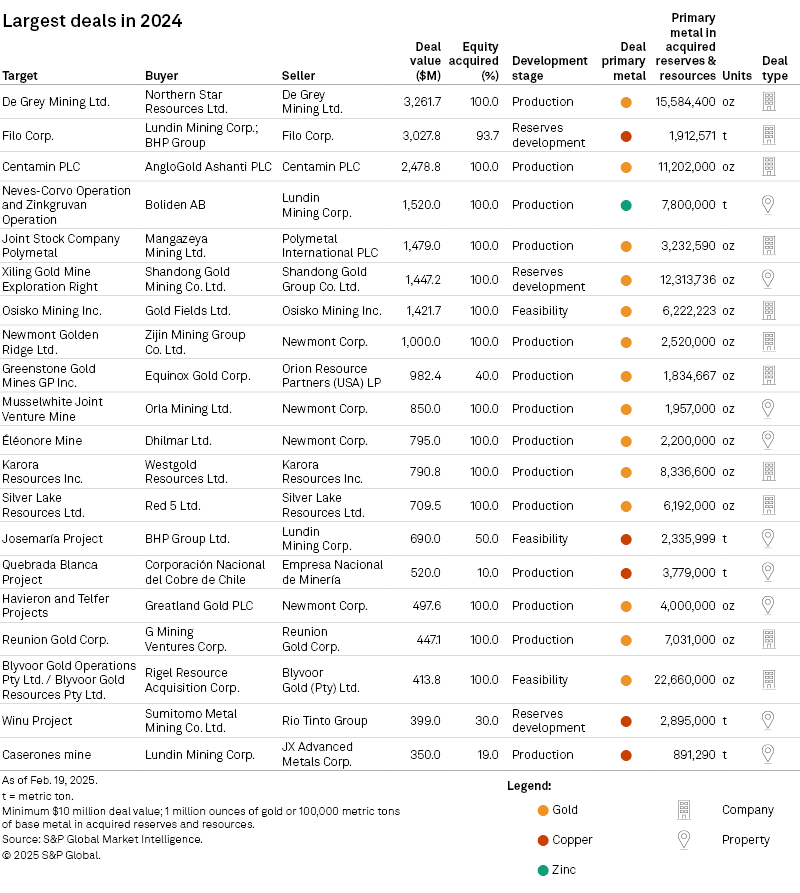

The three largest deals by deal value were company-level transactions, with a divided focus between gold and copper. The first was the announced acquisition of De Grey Mining Ltd. by Northern Star Resources Ltd. in December 2024 for $3.26 billion, closely followed by Lundin Mining Corp. and BHP Group's buyout of Filo Corp. for $3.03 billion in a copper-focused deal. The gold-focused transaction between AngloGold Ashanti PLC and Centamin PLC priced at $2.48 billion, was the third-largest deal of 2024. The largest property acquisition was made by Boliden AB, targeting two copper-zinc mines in Europe for $1.52 billion.

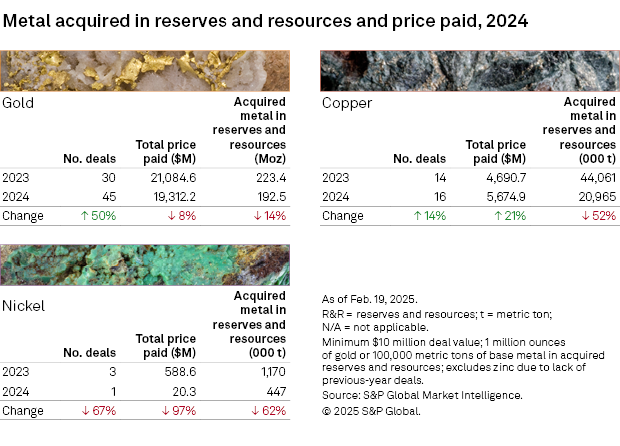

There were 43 gold deals with a total deal value of $19.31 billion in 2024, which would have been the highest in five years in the absence of the Newcrest sale. Copper slightly increased with regard to the number of deals but only accounted for 26% of the announced 62 transactions. The acquired copper R&R fell 52% year over year to 21 MMt, losing momentum as more miners found new opportunities in the gold market. Nickel attracted less interest in 2024, with only one deal fitting our criteria. After an absence in 2023, zinc entered the picture again in 2024, with two deals and a total acquired R&R of 8.4 MMt.

This study excluded two notable deals with significant R&R due to undisclosed deal values. The first involved Broken Hill Mines Ltd. acquiring the lead-zinc Rasp mine in Australia from Japan-based Toho Zinc Co. Ltd. through its subsidiary CBH Resources Ltd., turning over 1.1 MMt of contained zinc metal. The producing mine previously faced uncertainty, following Toho's decision to leave the business and shut down its operations. Along with Rasp, Broken Hill Mines also optioned Pinnacles — another lead-zinc-silver mine in the same region. The second deal involved PJSC Polyus' sale of its Degdekan gold deposit in Russia to PJSC ALROSA. Had the deal been considered, it would have represented the largest amount of gold R&R acquired in 2024 — since Degdekan contains 30 Moz of gold — putting the year's total a little closer to 2023's 223.4 Moz. Other deals excluded from the analysis were the merger between First Majestic Silver Corp. and Gatos Silver Inc., and BHP Group's rejected takeover of Anglo American PLC with a multicommodity focus.

Gold retains its luster

Gold continued outperforming base metals in both deal value and number of deals in 2024, with more miners and investors coming into the fold. Even in the absence of deals valued above $10 billion, transactions involving gold remained consistently high through all four quarters, with at least one high-priced deal announced for the commodity. Gold prices reached multiple record highs in 2024, boosted by safe-haven demand amid geopolitical risks stemming from the Russia-Ukraine war, Middle East conflicts, US-China trade tensions and a gold rush driven by central bank purchases. There were 27 gold-focused company acquisitions and 16 transactions targeting specific mining assets.

The gold deals, totaling $19.31 billion, predominantly involved production-stage mining properties in Australia and Canada. These countries — two of the most geographically significant sources of gold — maintained their reputation as stable jurisdictions to investors and producers, eager to capitalize on the yellow metal's upward price trajectory.

Australia welcomed more investment from junior and intermediate buyers, with the average price paid per ounce of gold averaging at $122, with 46 Moz of contained gold R&R handed over. The De Grey-Northern Star deal stood out as one of only two major-led deals in Australia and the largest for gold and for 2024, accounting for a substantial 33% of the total R&R acquired. This was closely followed by Westgold Resources Ltd.'s takeover of Karora Resources Inc. for $790.8 million. Meanwhile, Newmont turned over around 4 Moz of gold R&R to Greatland Gold PLC by selling the nonproducing Havieron and Telfer gold mines in Western Australia for $497.6 million. The stream of acquisitions in Western Australia hinted at strategic consolidation efforts, as the promise of profitability from nonproducing assets — such as Hemi in the Pilbara region — rekindled confidence among players looking to bolster their portfolios and cash in on the soaring prices.

Canada drew the most attention from majors, led by Gold Fields Ltd.'s acquisition of Osisko Mining Inc. for $1.42 billion. The deal was merely one of the many mergers announced that signaled a pronounced focus on footprint expansion, as producing mines became more appealing to buyers than startups, which demand intensive capital for development.

Throughout 2024, gold acquired in R&R was modestly priced at an average of $100/oz, with the total primary gold R&R acquired at 192.5 Moz, down 14% from 2023.

Volatile prices, current events influence base metals deals

Copper M&A activity in 2024 was off to a sluggish start, with only two deals out of the 16 total announced in the first half, but it picked up in the second half. Copper transactions for 2024 were valued at a total of $5.7 billion. This coincided with the rise in London Metal Exchange copper prices, which ultimately peaked in May 2024 — propelled by a short squeeze on COMEX futures in the same month — before settling into a chiefly bullish, albeit rangebound, movement through the rest of the year. The largest deal announced in the copper landscape was the joint acquisition of Filo Corp. by majors Lundin Mining Corp. and BHP Group for $3.03 billion in July 2024. In addition, BHP and Lundin formed a 50-50 joint venture company called Vicuña Corp. to operate the Josemaria copper project, which had previously been solely under Lundin's stewardship. BHP paid $690 million for the deal, securing 2.3 MMt of copper R&R.

Over two-thirds of the 16 announced copper deals were company acquisitions, with most targets evenly split between Canada and Chile. Except for the Filo deal, M&A activity in Canada remained largely subdued, as no other high-value transactions emerged after Minister of Innovation François-Philippe Champagne imposed stricter M&A regulations by Canada's in July 2024. Aimed at fortifying national oversight over critical minerals, the new guidelines subject foreign investments targeting large Canada-headquartered players to net benefit reviews.

Majors were the most prominent buyer type for copper, along with companies classified as "Other." Without the deals valued above $1 billion, 2024's total deal value would have decreased 6% year over year. Much of the money spent by majors went to assets in the preproduction stage — a surprising turn, given 2023's pronounced focus on producing mines. Although copper exploration budgets increased annually in 2024, miners still hesitated to rely heavily on exploration. Instead, they found better incentives to acquire operating mines at the expense of a potential future supply deficit, given the current state of the metal's global reserves in conjunction with steady demand from the energy transition. The total acquired copper R&R for 2024 was down to 21 MMt, a hefty 52% year-over-year decrease, with an average price of $3.92/lb.

After a lack of activity in 2023, there were two zinc-focused deals announced in 2024. Essentially, the M&A story for zinc echoed the copper one, led by Boliden AB's acquisition of the Neves-Corvo copper-zinc mine in Portugal and the primary zinc mine Zinkgruvan in Sweden for $1.52 billion. The transaction is the largest primary zinc deal in more than five years in deal value, atypical for the commodity, and the two properties collectively host a total of 7.8 MMt of zinc. Boliden said the transaction will allow the company to strengthen the production of zinc and copper concentrate.

Only one nickel-focused deal was announced in 2024, two less than in 2023, with a steep 97% drop in deal value. Horizon Minerals Ltd. acquired Poseidon Nickel Ltd. for $20.3 million, along with Poseidon's producing nickel assets in Australia — Windarra, Black Swan and Lake Johnston. Amid an ongoing low-price environment, the announcement of more trade tariffs could further weigh down on investor sentiment and impede significant progress in the commodity's M&A activity.

Geopolitical uncertainties could drive M&A in 2025

Based on the deals announced in the first quarter of 2025, it is likely that gold will continue to gain traction throughout the year and that overall M&A activity will be stronger, following new developments in the global mining sector. As the critical minerals race grapples with concerns surrounding the Ukraine-Russia war and with trade tensions triggered by US tariff announcements coming to a head, metal prices are expected to fluctuate, especially for gold and copper. This is already seen in Equinox Gold Corp.'s February announcement of its strategic move to fully acquire the Toronto Stock Exchange-listed Calibre Mining Corp. for $1.87 billion. As geopolitical turbulence continues to sway the markets, we forecast an uptick in slightly more opportunistic acquisitions and supply chain consolidation efforts from players big and small.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.