Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 12, 2025

By Anna Duquiatan

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

Access the databook.

See Commodity Insights' most recent market outlooks for aluminum, copper, gold, iron ore, lithium and cobalt, nickel and zinc.

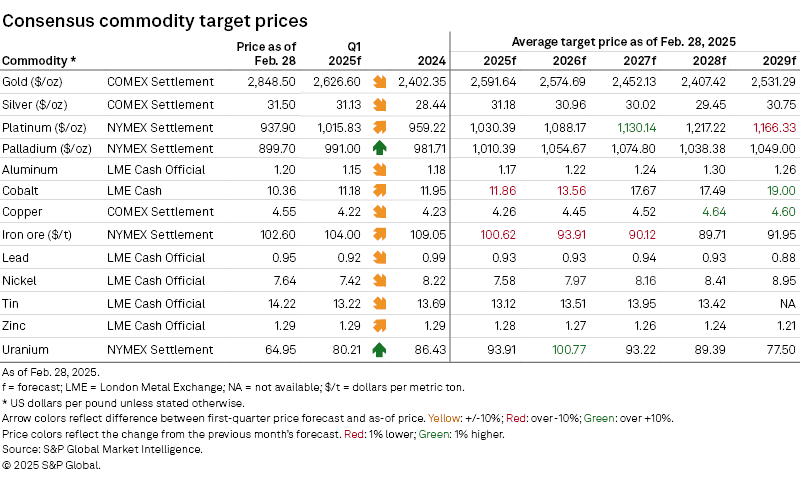

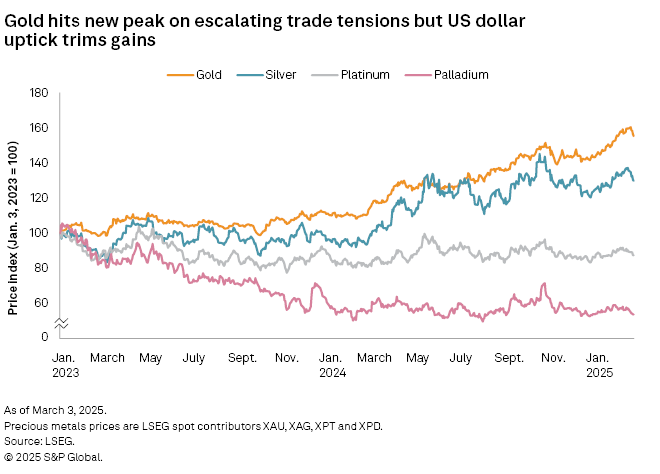

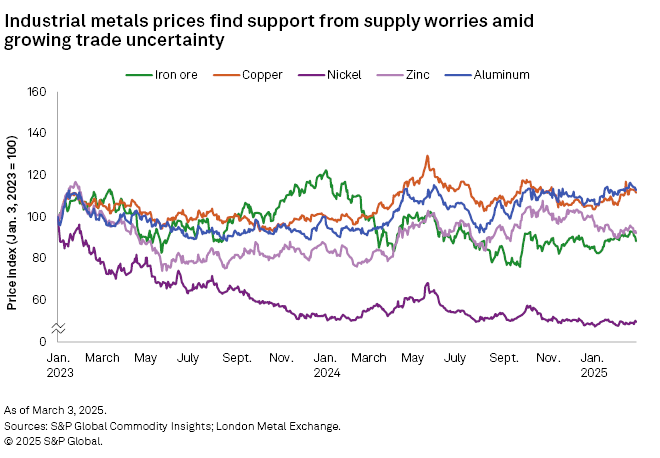

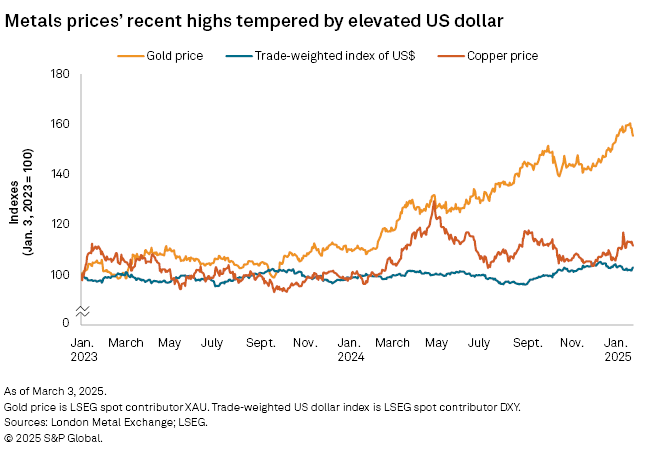

Newly announced tariffs and retaliatory policies presented growing challenges to global trade in February, swaying metals prices. Gold prices broke through resistance levels and reached an all-time high as investors sought refuge amid heightening risks to global economic growth. For industrial metals, worries over tight supplies drove bullish sentiments, but the adverse implications of the tariffs to consumer and industrial activity weighed on prices. Consensus price forecasts for gold held firm but were adjusted lower for most industrial metals.

Trade tensions continued to impact sentiment in February, as a series of tariff announcements from US President Donald Trump and prospects of reciprocal actions from other countries triggered concerns over the future of global economic growth, demand, trade and investment. Tariff hikes on US imports from Canada and Mexico and retaliatory measures from the two countries were to take effect in early February, but they were temporarily put on hold following negotiations. As of March 4, the US import duties and retaliatory Canadian tariffs are in effect. Mexico has also announced its intention to respond with tariffs on US imports, though details have yet to be made public as of this writing. Further, a 10% duty on US imports from China introduced in February has been doubled. This was likewise met with retaliatory trade tariffs and export controls. In addition, the US introduced 25% tariffs on all steel and aluminum imports, effective March 12. Concerns over the restrictions on trade flows encouraged safe-haven demand for precious metals, while the anticipated detrimental impacts on economic activity dragged on industrial metals prices in late February.

Economic indicators drove some of the volatility in metals prices. US data for January showed lower-than-expected job additions, but a decline in the unemployment rate to 4% and an inflation uptick to 3% supported the likelihood of a slower pace of Fed rate cuts this year. Higher-for-longer rates will likely keep the US dollar elevated, further weighing on metals prices. Meanwhile, the US manufacturing purchasing managers' index (PMI) in January indicated growing business confidence under the Trump administration, entering expansionary territory for the first time since October 2022 before softening in February. January PMI readings in China were lackluster amid concerns around the negative impact of tariffs on exports.

The London Bullion Market Association gold price reached a new peak at $2,953.05 per ounce Feb. 20. Worries over US President Donald Trump's trade agenda have sustained the upside bias, with the price breaking the $2,800/oz resistance level following the announcement of tariffs on US imports from major trade partners Canada and Mexico, and breaching $2,900/oz after news of a 25% levy on steel and aluminum imports. The prospect of blanket tariffs on commodities also boosted bullion movements to New York from London, reducing liquidity at the Bank of England and providing support to prices. Escalating trade disputes alongside geopolitical instability, amid ongoing conflicts in the Middle East and Ukraine, have fueled safe-haven demand. Physical demand has also been supportive, with central bank purchasing led by the People's Bank of China in December 2024 and physically backed gold exchange-traded funds starting the new year at a net positive position on the back of European fund inflows. Curbing the upside, the US dollar remains elevated, with further strengthening anticipated as trade tensions feed inflationary pressures and the pace of US interest rate cuts slows. Consensus price expectations for gold for the 2025–29 period were unchanged versus the prior month.

The price of silver fluctuated in February, reaching a four-month high of $32.92/oz Feb. 20 but slipping below $32/oz toward the end of the month. Like gold, investors' flight to safety amid a shifting global trade landscape and ongoing geopolitical risks bolstered silver prices. As the Trump administration unveiled its tariff plans, COMEX silver inventories rose sharply. The metal's industrial applications, however, make it susceptible to headwinds to global economic growth, such as higher-for-longer interest rates in the US, a strong US dollar and dampened industrial activity due to inflationary pressures from rising import duties. Silver consensus price forecasts in February for the five-year horizon were unchanged versus January.

Platinum and palladium prices trended together below $1,000/oz throughout much of February, with a drop-off toward month end. Platinum was at $947.65/oz Feb. 28, at a premium to palladium's $919.13/oz. Outlooks for the metals also diverged, with consensus price forecasts for platinum adjusted 0.1% lower on average for 2025–26 but 0.5% higher for 2027–29, while projections for palladium have been downgraded about 0.1% for 2025–27. Market fundamentals lend more support to platinum, which has a challenging supply pipeline alongside diverse demand drivers that include the automotive sector and emerging hydrogen technologies. Platinum is expected to remain undersupplied through 2028, while palladium is forecast to shift into a market surplus starting in 2025. Palladium prospects are dampened by an anticipated growth in recycled supply and continued platinum-for-palladium substitution.

The London Metal Exchange three-month (LME 3M) copper price reached its highest level since November 2024 at $9,665 per metric ton Feb. 14, bolstered by a tightening concentrate market, with spot treatment charges falling to record lows. The concentrate squeeze could jeopardize refined production by negatively impacting smelters' margins, encouraging operational curtailments. Triggered by concerns that US tariffs could include copper, COMEX prices surged Feb. 13 to their highest level since May 2024 following the announcement of new tariffs on US imports of steel and aluminum, while the COMEX futures price over LME cash price arbitrage widened to over $1,000/t in February. Nevertheless, punitive trade actions continue to feed bearish demand sentiments, alongside expectations for a resilient US dollar and a slower pace of US rate cuts. Copper consensus price forecasts have been adjusted 1.0% lower for 2025 and 1.2% higher on average for 2026–29, as supply worries and longer-term green economy demand keep upside risks intact.

After ending January at a four-month low of $2,742/t, the LME 3M zinc price rallied throughout much of February to reach a monthly peak at $2,928/t Feb. 21, helped by supply tightness. On Feb. 4, inventories at LME and the Shanghai Futures Exchange reached their lowest level since November 2023. By contrast, both domestic and imported spot treatment charges in China were higher in January, continuing a recovery from record lows and reflecting a loosening concentrates market. On the demand side, tariff worries have dragged on China manufacturing PMIs, which declined month over month in January, although they were surprisingly robust in February. While supply concerns have driven bullish sentiment, the upside is capped by the anticipated impacts of the Trump tariffs on global trade flows and a further strengthening of the US dollar. Zinc consensus target prices have been upgraded an average of 0.5% for 2025–27.

In the nickel market, worries over evolving tariff policies prevailed over supply concerns, with the LME 3M closing price rangebound below $16,000/t in February. As the flurry of tariff announcements from the Trump administration dampened demand sentiment, the potential inflationary pressures suggest reduced consumer activity, which makes up roughly a third of global primary nickel end-use demand. Increased import duties on China also threaten to pressure Chinese manufacturing activity, while the tariffs' potential impacts on the US supply chain could impede the development of the domestic electric vehicle battery sector. Weakening demand would exacerbate the ongoing market oversupply. Reports of the Philippines' exploring a potential ban on nickel ore exports drove upside support for nickel prices, albeit short-lived. Aimed at boosting domestic processing capabilities, the proposed ban has raised concerns about possible mine closures in the world's second-largest mined nickel producer. Nickel consensus price outlooks have been adjusted 0.4% lower on average for the 2025–26 period and 0.1% higher for 2027–29.

The LME 3M aluminum price cleared $2,700/t Feb. 20 but was largely rangebound between $2,600/t and $2,700/t throughout the month. A new European Union sanctions package against Russia to mark the third year of the Ukraine invasion drove the brief upside, but bearish sentiment prevailed amid risks to global demand growth posed by trade tariffs. While LME aluminum price activity has been subdued, the Platts-assessed US Midwest premium reached a record high of 40.85 cents per pound Feb. 21, reflecting heightened concerns over new tariffs imposed by the Trump administration. Platts is part of S&P Global Commodity Insights. Canada — a target of the US tariff hikes — was the largest exporter of aluminum to the US in 2024. With demand prospects lackluster, consensus target prices for aluminum have been downgraded 0.7% for 2025 and unchanged for the rest of the forecast horizon. Curbing the downside pressure, aluminum supply is expected to tighten as China approaches its smelter capacity limit.

The Platts-assessed European cobalt metal price remained suppressed by abundant supplies and subdued demand in February, reaching a monthly low at $10.25/lb, its lowest level since January 2016. Top cobalt producer Democratic Republic of Congo (DRC) began halting cobalt exports Feb. 22 to address surplus supplies and falling prices. The export curb has had limited impact on the market, however, with observers noting a possible continuation of production that will be stockpiled until the ban is lifted. DRC cobalt production growth is expected to slow in 2025 from a large base the prior year, while Indonesia is poised to take a larger role in cobalt supply, helped by expansions partly financed by China-origin investments. The cobalt supply overhang is expected to persist into the early 2030s, as demand prospects are weighed down by slowing EV sales growth, the waning popularity of cobalt-intensive battery chemistries and potential impacts of the Trump presidency on the US green energy transition. Consensus price expectations for cobalt have been downgraded 2.0% on average for 2025–27 but upgraded 0.9% for 2028–29.

Weather-related supply disruptions buoyed the Platts IODEX 62% Fe iron ore price, which had an upward momentum through much of February to test $110/dmt Feb. 20. Tropical cyclones in Australia in late January into February have prompted major iron ore producers Rio Tinto Group, BHP Group Ltd. and Fortescue Ltd. to temporarily suspend mining and port operations in the country, impacting shipments. Meanwhile, China steel mill utilization rates climbed coming off the Lunar New Year holiday, but margins were suppressed by elevated iron ore prices. Bearish prospects triggered by intensifying trade tensions continue to weigh on sentiment, however. A 20% tariff on US imports from China is expected to drag on China's manufacturing sector, which was a bright spot in the domestic economy in 2024, albeit cooling of late. While the 25% US import duties on steel and aluminum are anticipated to have a limited direct impact on China due to its low level of steel shipments into the US, escalating trade actions threaten to reorganize trade flows and hamper global growth. With softening demand expected to coincide with the startup of the Simandou iron ore project in Guinea later this year, the global seaborne iron ore trade balance is expected to be in surplus starting in 2025. Consensus price expectations for iron ore have been downgraded an average of 1.6% for 2025–27.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.