S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 31 Mar, 2021

This is the final blog in a four-part series on ESG and Credit Risk Analysis

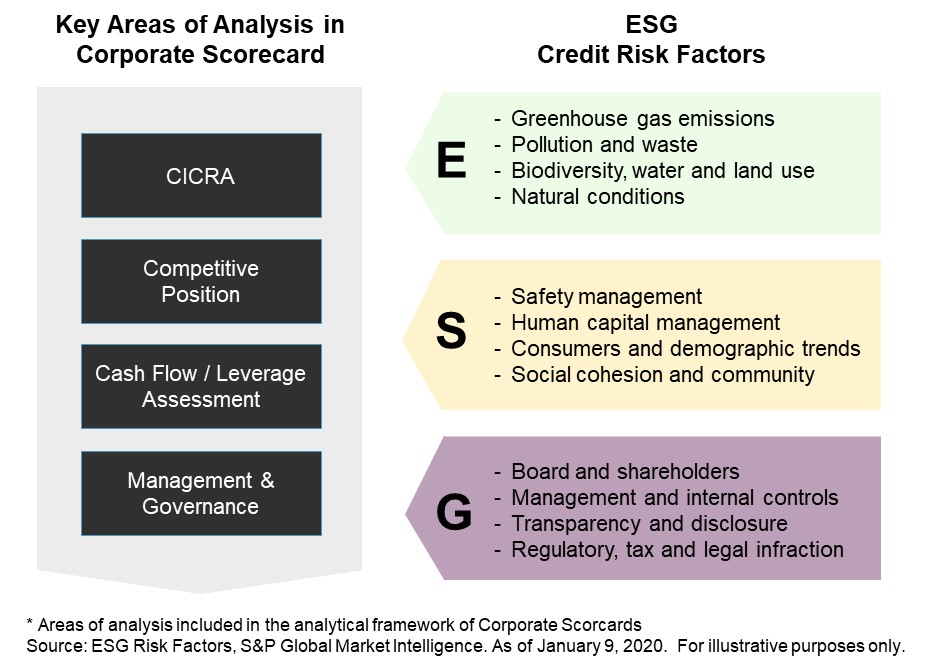

In the first blog, we discussed how environmental, social, and governance (ESG) factors are becoming important considerations when assessing the credit risk of different industries and companies around the world. We followed this with a second and third blog that looked at the governance and environmental components, and how S&P Global Market Intelligence incorporates these elements in its proprietary Credit Assessment Scorecards (“Scorecards”). We now turn to the ‘S’ in ESG.

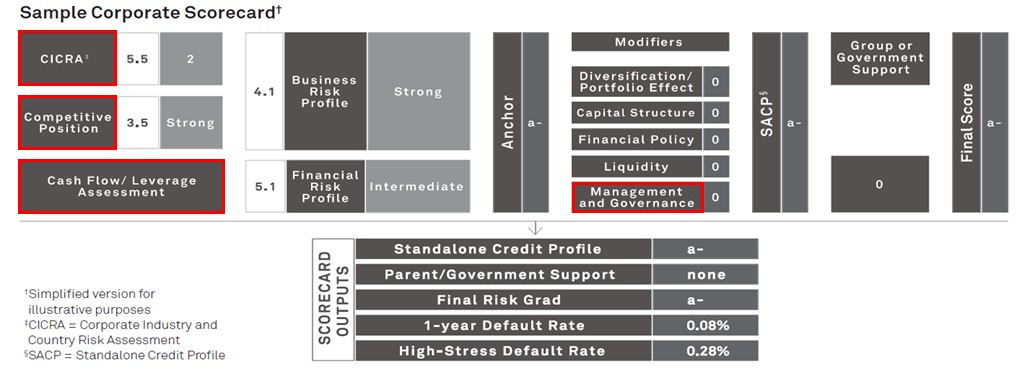

The Scorecards provide a structured framework for assessing credit risk, generating credit scores that are designed to broadly align with credit ratings from S&P Global Ratings.[1]

Figure 1: ESG in Scorecards

The analysis of ‘S’ addresses how a company manages relationships with its stakeholders, including its workforce, the communities in which it operates, and its consumers. On one hand, it involves an assessment of the potential impact changing social dynamics or consumer preferences may have on a business activity. On the other, it entails the review of potential labor and human rights violations, community exploitation, and corruption, and how these factors may ultimately impact an entity’s reputational, legal, and regulatory risks and costs.

Over the past 12 months, ‘S’ has been further pushed into the spotlight by the COVID-19 pandemic, which has highlighted a range of problematic social issues, including safety in the workplace and other business premises, as well as financial protection and work flexibility for workers more directly impacted by lockdowns.

Defining Social Credit Risk Factors

Identifying the social risks and opportunities linked to the complex and dynamic interactions among a company, its stakeholders, and broader society is an integral part of the credit analysis process.

Similar to environmental factors, we have reviewed the impact of social risks and opportunities on a series of corporate credit ratings, leveraging S&P Global Ratings’ research and approach. We have grouped the most common examples of social developments that can impact credit risk in four major factors, divided in two groups:

Internal social factors

External social factors

‘S’ issues are harder to quantify than ‘E’ and ‘G’ and integrate in a structured way into credit analysis. Default observations linked to social issues are still limited, and there are a lot of nuances with data, such human rights and labor standards. According to the United Nations Principles for Responsible Investment (PRI), “the social element of ESG issues can be the most difficult for investors to assess. Unlike environmental and governance issues, which are more easily defined, have an established track record of market data, and are often accompanied by robust regulation, social issues are less tangible, with less mature data to show how they can impact a company’s performance.”[2]

Assessing the Materiality of Social Credit Risk Factors

While governance is a material factor for all companies, social risks, similar to environmental risks, are more material for some borrowers versus others, depending on the sector in which they operate, plus their location and level of diversification. Therefore, we have developed an ESG sector materiality map. This provides a ranking system of economic activities based on their social sustainability. This classification has been integrated with the key credit risk factors and main sustainability issues and developments to which each sector is exposed.

Capturing Social Factors in the Scorecards

Incorporating material social risk factors into credit analyses strives to evaluate how these factors can potentially impact the credit risk of the counterparty being reviewed. The impact of social factors will depend on how prepared the entity is to manage potentially disruptive trends. The existence of buffers in the form of provisions and reserves, and the potential to recover and prosper in the long term, will also directly impact a company’s ESG shock-absorbing capacity.

Material social risk factors are reviewed alongside traditional credit risk factors. These are reflected in different areas of our Scorecards, depending on the specific development stage of the risk and the aspect of the business which is being, or potentially could be, impacted. More specifically, they are captured in:

Figure 2: Capturing Social Factors in Scorecards

For more information about our Corporate Scorecard with ESG Factors, please click here.

[1] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[2]“ESG INTEGRATION: HOW ARE SOCIAL ISSUES INFLUENCING INVESTMENT DECISIONS?”, PRI, MAY, 16 2017.www.unpri.org/download?ac=6529.

Blog

Blog