Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Oct, 2020

This is the first blog in a series on ESG and Credit Risk Analysis

The environmental, social, and governance (ESG) impact of firms across the globe is taking on an increasing level of importance as awareness continues to grow about the effect different business models can have on the well-being of society. Climate-related events can no longer be ignored as they become more frequent and intense, and issues such as biodiversity and sustainable infrastructure gain attention. In addition, company leaders are being encouraged to consider workforce inclusion and other human capital issues in their business strategies, and need to be cognizant of potential reputational risks that may arise if any ESG issue is not appropriately handled.

ESG best practices take hold

The inclusion of ESG in credit risk analysis became a recognized international best practice in 2016 when the Principles for Responsible Investment (PRI) launched the ESG in Credit Risk and Ratings Initiative with the aim of enhancing the transparent and systematic integration of ESG factors in these assessments.

Today there is increasing evidence that ESG factors can affect credit risk[1] and investment performance,[2] and ESG considerations are gaining prominence within investment and risk management groups. After all, mismanagement and poor governance can contribute to credit rating downgrades, and environmental and social issues can lead to reputational, legal, and regulatory risks that may result in negative financial consequences for companies.

Mandatory ESG disclosure is now gaining speed. The European Banking Authority (EBA) recently published prescriptive guidelines on loan origination and monitoring, addressing credit-granting practices by European banks. These guidelines will go into effect on June 30, 2021, requiring banks to take into account the risks associated with ESG factors on the financial conditions of borrowers, in particular the potential impact of environmental factors and climate change.

ESG in the S&P Global Market Intelligence Corporate Credit Assessment Scorecards

S&P Global Market Intelligence’s Credit Assessment Scorecards provide a structured framework for assessing credit risk, generating credit scores that are designed to broadly align with credit ratings from S&P Global Ratings.[3]

Our Scorecards enable ESG factors to be considered in credit risk analysis in a transparent and structured way, adopting a holistic approach while working through the regular credit assessment process.

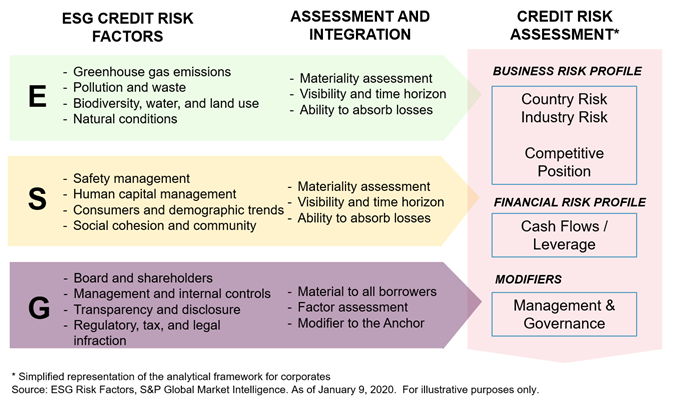

For each of the three ESG dimensions (environmental, social, and governance), we first define the ESG credit risk factors, which are the factors that influence the capacity and willingness of an obligor to meet its financial commitments and that can have negative or positive credit impacts. We then provide guidance on how to assess and integrate these factors into the credit assessment. This analytical process remains mostly evidence-based, qualitative and, accordingly, rules driven. ESG factors can be considered in several areas within the Corporate Scorecard framework, including management and governance, country and industry risk, competitive position, and cash flow/leverage, as shown in Figure 1.

Figure1: Integrating ESG factors more explicitly and structurally in Credit Assessment Scorecards

For more information about our Corporate Scorecard with ESG Factors, please click here.

1 “ESG Investing is Becoming Critical for Credit Risk and Portfolio Management Professionals”, S&P Global Market Intelligence, March 9, 2020.

Get Our Insights