Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 19 Feb, 2021

This is the third blog in a four-part series on ESG and Credit Risk Analysis

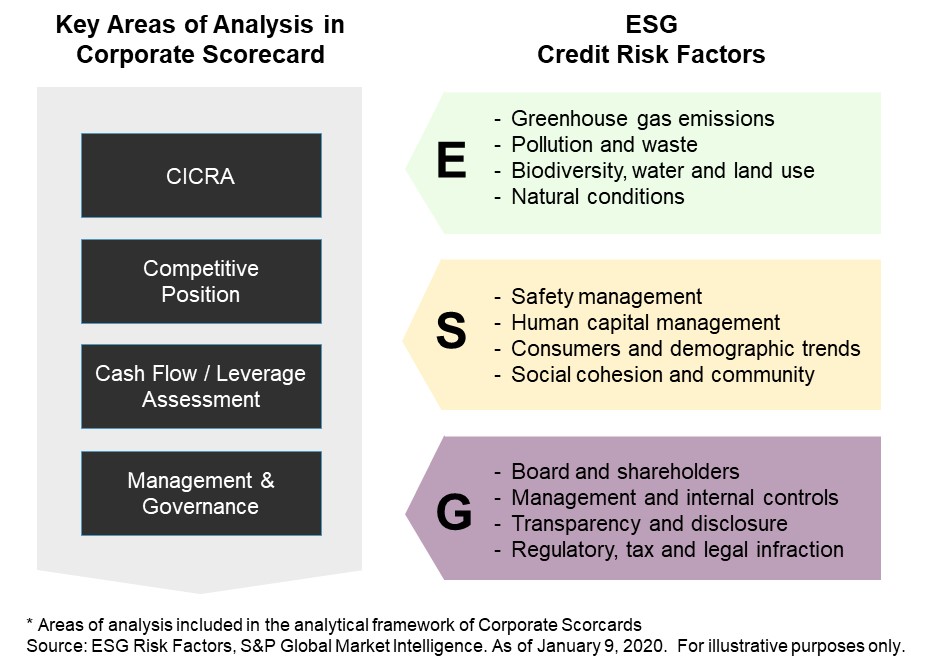

In the first blog, we discussed how environmental, social, and governance (ESG) factors are becoming important considerations when assessing the credit risk of different industries and companies around the world. We followed this with a second blog that took a closer look at the governance component, and how S&P Global Market Intelligence incorporates this in its proprietary Credit Assessment Scorecards (“Scorecards”). We now turn to the environmental, or ‘E’, component and how this element is captured in the analysis of credit risk when using the Scorecards.

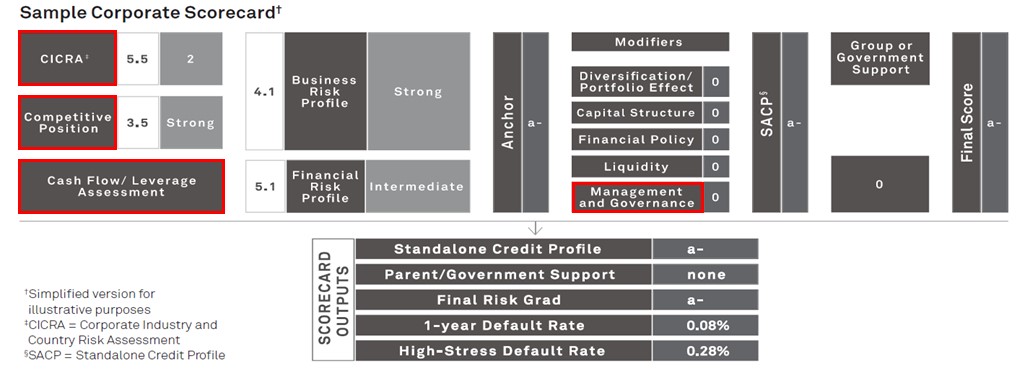

The Scorecards provide a structured framework for assessing credit risk, generating credit scores that are designed to broadly align with credit ratings from S&P Global Ratings.[1]

Figure 1: ESG in Scorecards

`

`

The analysis of ‘E’ addresses how the natural environment in which an entity operates can influence its credit profile. On one hand, it involves a review of the potential impact natural events and conditions may have on a business activity. On the other, it entails an assessment of the natural resources used by an entity, the waste and polluting gases produced, and how these factors may ultimately impact an entity’s reputational, legal, and regulatory risks and costs.

Adverse weather and extreme events — such as storms, earthquakes, tsunamis, floods, and wildfires — have hindered the progress of construction, disrupted distribution chains, and deferred production, all negatively impacting operational and financial performance, along with levels of capital and liquidity. CO2 emissions from fossil fuels, the loss of biodiversity from land use choices, water leakages, pollution, and use of non-recycling packaging related to business activities are some of the issues under increasing scrutiny by legislators, communities, and consumers. Poor management of these issues can increase exposure to regulatory fines and result in reputational costs and potential losses of competitive advantage. This can hinder a counterparty’s broader financial stability.

Defining Environmental Credit Risk Factors

Environmental-related risks are increasingly affecting credit risk and corporate failures, and one of the main challenges for businesses today is to transform environmental factors from risks and costs into opportunities and benefits.

From a credit point of view, default observations linked to environmental issues are still limited, making ‘E’ more difficult to capture, measure, and integrate in a structured way into credit analysis than other credit factors, such as corporate governance.

We have reviewed the impact of environmental risks and opportunities on a series of corporate credit ratings, leveraging S&P Global Ratings’ research and approach. We have grouped the most common examples of environmental factors that can impact credit risk in the following categories:

Assessing the Materiality of Environmental Credit Risk Factors

The materiality and kind of environmental issues an entity is exposed to are closely linked to the type, location, and diversification of its business activities. We have, accordingly, developed an ESG sector materiality map, which is a ranking system of economic activities based on their environmental and social sustainability. This classification has been integrated with the key credit risk factors and main sustainability issues and developments to which each sector is exposed.

Capturing Environmental Factors in the Scorecards

Incorporating material environmental risk factors into credit analyses strives to evaluate how these factors can potentially impact the credit risk of the counterparty being reviewed. In doing so, it is important to recognize that many environmental risks are only likely to crystallize and affect an entity’s creditworthiness over a longer timeframe than the one to five years typically used in credit assessments.

The impact of environmental factors will depend on how prepared the entity is to manage potentially disruptive trends, such as fines or changes in consumer preferences, technologies, products, and regulations. The existence of buffers in the form of provisions and reserves, and the potential to recover and prosper in the long term, will also directly impact a company’s ESG shock-absorbing capacity.

As more evidence on the credit implications of environmental-related events is uncovered, we reflect environmental factors in our Scorecards by adopting a holistic approach. Material environmental risk factors are systematically scrutinized and reviewed alongside traditional credit risk factors. We reflect them in different areas of our Scorecards, depending on the specific development stage of the risk and the aspect of the business which is being, or potentially could be, impacted. More specifically, they are captured in:

Figure 2: Capturing Environmental Factors in Scorecards

Source: S&P Global Market Intelligence. For illustrative purposes only.

Blog

Blog