Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jan, 2021

This is the second blog in a series on ESG and Credit Risk Analysis

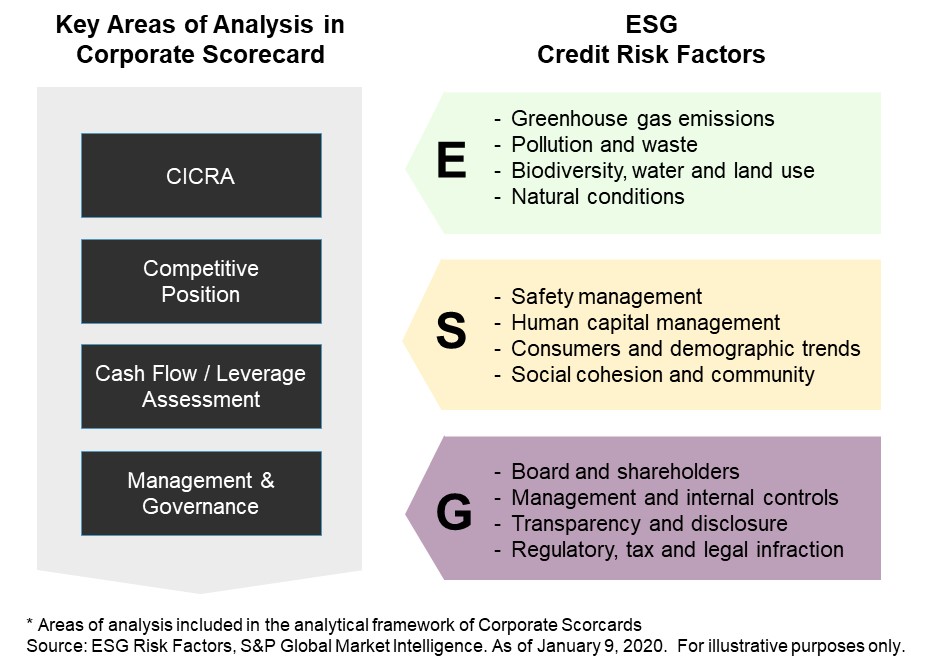

In the first blog of this series, we discussed how environmental, social, and governance (ESG) factors are gaining prominence within investment and risk management groups as more evidence shows that ESG factors can affect credit risk[1] and investment performance.[2] In this blog, we look specifically at the ‘G’ component, and describe how S&P Global Market Intelligence incorporates this in an analysis of credit risk, when using proprietary Credit Assessment Scorecards. The Scorecards provide a structured framework for assessing credit risk, generating credit scores that are designed to broadly align with credit ratings from S&P Global Ratings.[3]

Figure 1: ESG in Scorecards

Corporate Governance in Practice

The analysis of corporate governance addresses how the system of rules, practices, and processes by which a firm is directed and controlled can influence its credit profile. It involves reviewing how the interests of a company's many stakeholders, including investors, employees, customers, and communities, are effectively balanced to generate sustainable value.

Independent and diverse boards, together with effective control systems and transparent communication, can help drive operational success and mitigate risks, including those related to fraud and conflicts of interest.

Conversely, corporations can be penalized if controlling shareholders promote their own interests to the detriment of minority shareholders and other stakeholders. Accounting restatements, regulatory and legal infractions may also be signs of weak governance practices.

Defining Governance Credit Risk Factors

Leveraging a methodology published by S&P Global Ratings,[4] we have broken the governance dimension into four risk factors relating to how a company is managed, its relationship with shareholders and other stakeholders, and how its internal rules, practices, and processes either create or mitigate risks.

Assessing the Governance Dimension

All elements of governance are qualitative by nature. Our Scorecards User Handbook includes guidelines and metrics to assess governance, following a rules-based approach. Monitoring is particularly important as, from time-to-time, companies may change their strategic direction, risk appetite, senior management, and/or board membership.

Analysis of the sub-factors is evidence-based, meaning that a sub-factor may be regarded as neutral if there is insufficient evidence to assign either a more positive or a more negative score. We assign a negative score if a company fails to disclose key management and governance information.

Governance practises can be scored from 1.0 (Excellent) to 10.0 (Very Weak). We would score governance 1.0 if the company has an independent executive board composed of highly-qualified and experienced individuals, and management is responsive to stakeholder interests, appropriately balancing those interests.

We would assign a lower score to governance, or 10.0, if an enterprise has a history of regulatory, tax, or legal infractions.

Integrating Governance in Credit Assessment Scorecards

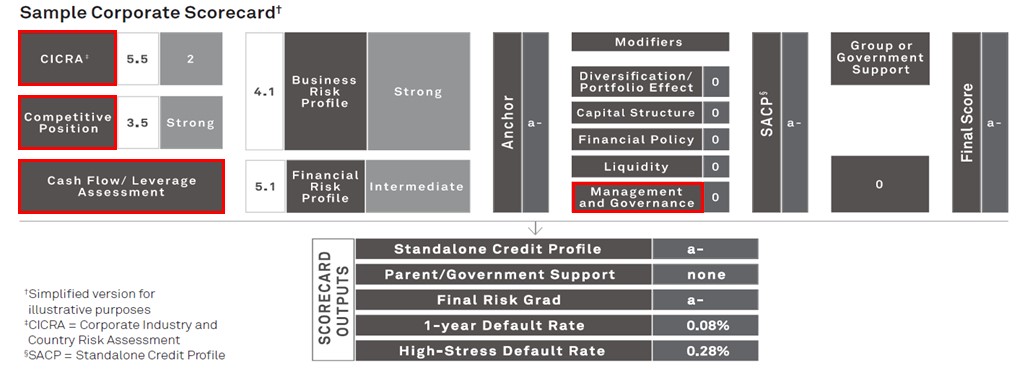

As shown in Figure 2, governance is included in the Scorecard framework as one of the four elements making up the wider management and governance (M&G) dimension. The assessment of M&G acts as a modifier to the anchor, just before the assessment of an entity stand-alone credit profile.

In the Scorecard framework, governance can either have a neutral or negative impact, but cannot enhance a credit assessment. This is because stronger M&G practises are expected to have already manifested themselves in stronger competitive positioning and more balanced financial risk profiles.

Conversely, poor planning and controls, lack of independence and preparation, and legal and regulatory infractions can be regarded as early-warning signals of a firm´s weakening business and financial conditions. A single governance deficiency does, accordingly, act as a modifier to the credit assessment.

Figure 2: M&G in Scorecards

Source: S&P Global Market Intelligence. For illustrative purposes only.

[1] Regular ESG Industry Report Cards published by S&P Global Ratings.

[2] “ESG funds outperform S&P 500 amid COVID-19, helped by tech stock boom”, S&P Global Market Intelligence, August 13, 2020.

[3] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[4] “Management and governance credit factors for corporate entities”, November 13, 2012.

Blog