Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 30 Apr, 2024

By Samantha Lipana and Marissa Ramos

Worldwide bank ranking series

Click to view stories in this series as they are published

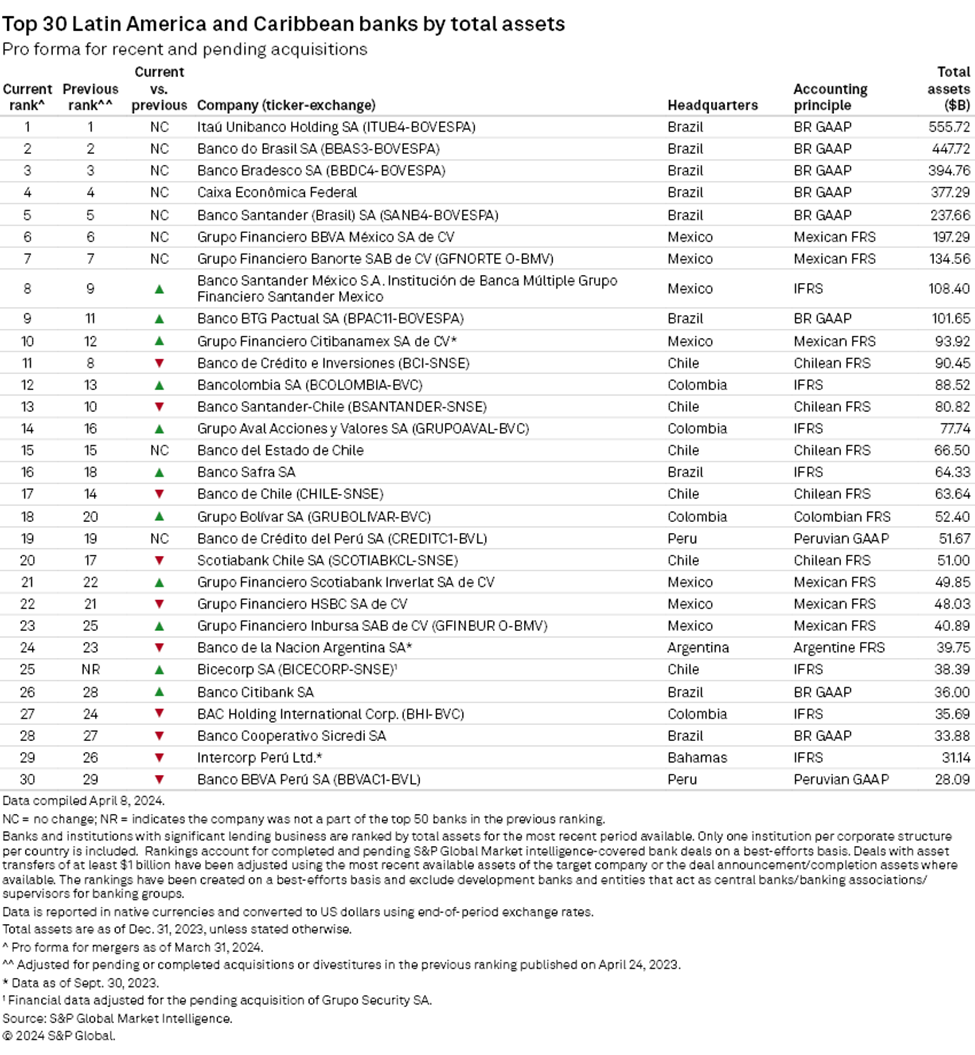

Brazilian and Mexican banks dominated S&P Global Market Intelligence's list of the biggest lenders in the Latin America and Caribbean region in 2023, filling every spot in the top 10.

Brazilian lenders occupied the first five slots, followed by two Mexican lenders, in what was an unchanged top seven from the year before, Market Intelligence data shows. Just behind them, Mexico City-based Banco Santander México SA moved up one spot to eighth, while domestic peer Grupo Financiero Citibanamex SA de CV moved into 10th spot from 12th. Brazilian lender Banco BTG Pactual SA also moved into the top 10, climbing two spots from 11th a year earlier.

Itaú Unibanco Holding SA remained the largest bank in the region, with about $555.72 billion in assets in 2023, up more than 26% from a year ago, while Banco do Brasil SA, Banco Bradesco SA, Caixa Econômica Federal and Banco Santander (Brasil) SA rounded out the top five. Mexican banks Grupo Financiero BBVA México SA de CV and Grupo Financiero Banorte SAB de CV held onto the sixth and seventh spots.

Brazil has the largest number of banks in the ranking, with the nine lenders on the list holding a combined $2.249 trillion in assets, according to Market Intelligence data. Mexico had seven banks on the list with aggregate assets of $672.94 billion.

The loan quality of Brazilian banks is expected to gradually improve as consumer delinquencies have been declining since late 2023, Moody's said in a March 7 banking system outlook report. However, the country's recently enforced 100% limit on interest and financial charges on revolving credit card debt and the continued reductions in the cap on payroll loan rates could have a negative, albeit limited, impact on banks' profitability, the rating agency said in a separate report.

For the latest ranking, company assets were adjusted on a best-efforts basis for pending mergers, acquisitions and divestures, as well as M&A deals that closed after the end of the period. To be eligible for inclusion in pro forma adjustments, the amount of assets being transferred had to be at least $1 billion, unless otherwise noted. Assets reported by non-US dollar filers were converted to dollars using period-end exchange rates. Total assets were taken on an "as-reported" basis, and no adjustments were made to account for differing accounting standards. The majority of banks were ranked by total assets as of Dec. 31, 2023. In the previous ranking, published April 24, 2023, most company assets were as of Dec. 31, 2022, and were adjusted for pending and completed M&A as of March 31, 2023.

Four Chilean banks fell three places in the ranking amid various headwinds. Banco de Crédito e Inversiones dropped to 11th, Banco Santander-Chile to 13th, Banco de Chile to 17th and Scotiabank Chile SA to 20th.

S&P Global Ratings in October 2023 revised Chile's outlook to negative as political disagreements regarding the redraft of its constitution hindered the approval of meaningful policies to boost economic growth and rebuild fiscal resilience. Political uncertainties are expected to persist through 2024 and may dampen new investments, although bank asset quality is expected to gradually improve due to increased real wages, monetary policy easing and a rebound in growth, Moody's said in a January report.

The only newcomer bank in the top 30 ranking is, however, Chile-based. Bicecorp SA is the 25th-largest bank in the region, with assets totaling $38.39 billion. Bicecorp in January agreed to acquire peer Grupo Security SA.

Chile had the third most banks on the list, with six lenders holding a combined $390.81 billion in total assets.