Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 2 Aug, 2023

S&P Global Commodity Insights reports on major copper acquisitions in 2022, defined as transactions with a deal value of at least $10 million involving reserves and resources of at least 200,000 metric tons of contained copper. This analysis does not include terminated, nonequity deals like royalty and streaming and "earn-in" transactions, and deal status is as of the time the data was compiled.

Copper M&A activity rebounded significantly in 2022, reaching a 10-year high in deal value and matching the amount of metal in reserves and resources that changed hands in 2018 — the fourth-highest since our study began in 2011. With a market price that remains above historical averages, the price paid per pound of acquired metal was healthy. Taken together, these metrics further emphasize the healthy pace of M&A activity for the red metal, especially compared with a lackluster year for gold. The top project-focused transactions involve two high-potential copper mines, including Rio Tinto's ownership consolidation of the Oyu Tolgoi mine and the sale of Antofagasta's share in the feasibility-stage Reko Diq project, which had been previously stalled for years due to challenges for the now Barrick-led consortium in securing a mining license. BHP's purchase of Oz Minerals in the second half of 2022 expanded the major's copper portfolio in the largest corporate takeover of the year. The rise in activity suggests the copper sector is looking to capitalize on market deficits anticipated to emerge over the next three to five years.

Copper M&A powered by green energy

Most M&A metrics were up year over year in 2022, starting with a more than doubling of the total deal value of the acquisitions considered to $14.2 billion — a 10-year high that also eclipsed the amount spent on gold. This trend aligns with the overall picture painted in our overview of the mining M&A landscape , where, in a reversal of a four-year trend, more money was spent on base metals, led by copper, than on gold. The amount of copper acquired in reserves and resources also increased significantly, going back to 2018 levels after steady year-over-year declines. The price paid for each pound of metal acquired was slightly lower than in 2021, however, following the market price trend. The 16 cents/lb paid in 2021 was a 10-year high and twice the amount spent in 2018-2020, while the 19.7 million metric tons of copper in reserves and resources changing hands was the lowest since this study began in 2011.

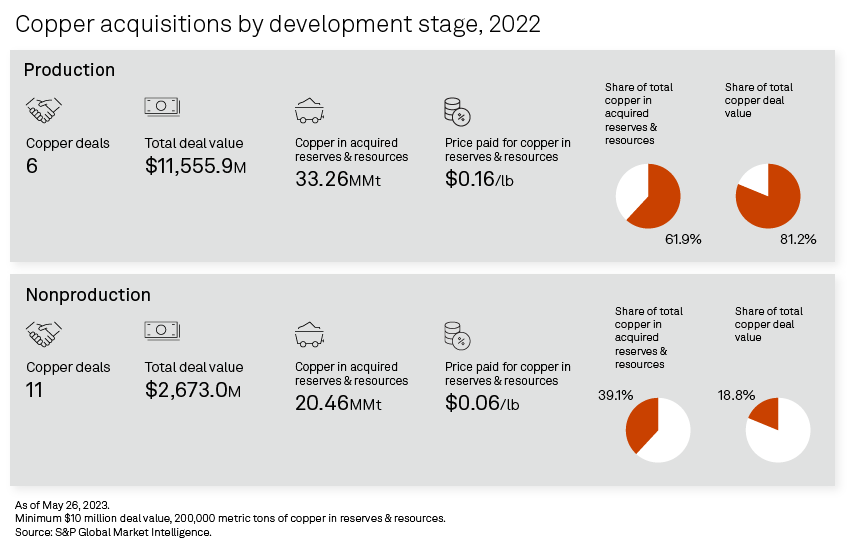

This renewed interest in acquiring copper assets comes as markets forecast a concentrate deficit as early as 2025, compounded by a dearth of new significant discoveries despite healthy exploration budgets. Nonproducing assets were favored over producing ones in 2022, accounting for 65% of the transactions — the highest proportion since 2011 and just above the 64% in 2017. This preference has alternated quite regularly over the past decade, likely indicative of the availability of assets for sale in a given year. In all other 2022 metrics, however, producing assets were largely ahead: deal value, copper acquired and price paid for the metal. The two somewhat diverging trends reflect the two main strategies companies adopt when engaging in copper M&A: pay a premium for short-term returns or play the long-term game and invest in assets they can develop.

Mining companies are also going in roundabout ways to increase their exposure to copper, engaging in M&A ventures that seemingly target other commodities. An example is Newmont Corp. 's gold-focused takeover of Newcrest Mining Ltd. , announced in February 2023; analysis from the Mine Economics team shows that the acquisition of Newcrest's copper reserves and resources would result in an average fourfold increase in Newmont's copper production until 2027.

Demand for the red metal is expected to grow steadily, fueled by the global energy transition. Copper is at the core of all renewable energy technologies — solar, onshore and offshore wind, and traction batteries — as well as in the general storage and transmission sector, with most of its application in cabling. With renewable capacity deployment backed by country- or region-level policies across the major economies (US, China, Europe), copper will remain a fixture of the M&A landscape.

Major-major takeovers top copper M&A; renewed interest in projects

The number of deals involving projects in 2022 was similar to the number involving companies at nine and eight, respectively, compared with the significant gap between the 10 companies and two projects purchased in 2021. Most projects were in the reserves development stage, but the single producing project commanded the highest price per pound of copper in reserves and resources. In its acquisition of the Cobar (aka CSA) project located in New South Wales, Australia, from Glencore PLC , Metals Acquisition Ltd. paid 89 cents/lb for just 612,000 metric tons of copper — a high premium on the annual average of 15 cents/lb and over twice the second-highest price paid by Agnico Eagle Mines Ltd. for a 50% stake in the San Nicolas project in Mexico. This project purchase is also the third highest-value deal of 2022 at $1.2 billion.

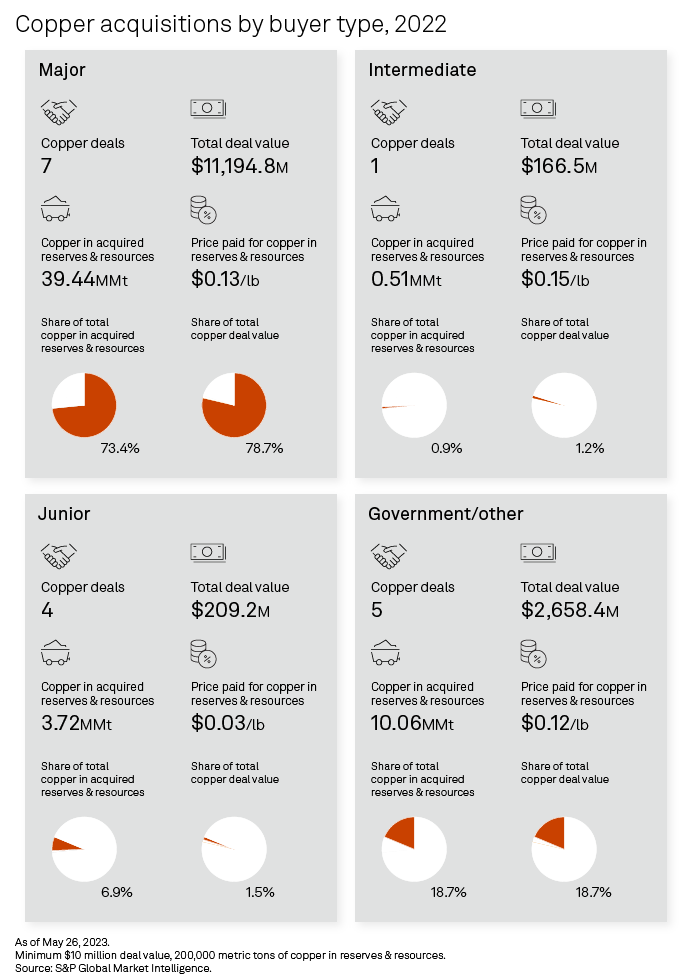

The top two deals were major-major takeovers, with a combined deal value amounting to 65% of the year's total. The most significant transaction of 2022, valued at $5.94 billion for 11.1 MMt of copper in reserves and resources, was BHP Lonsdale Pty. Ltd. 's (an operating subsidiary of BHP Group) acquisition of OZ Minerals Ltd. After having its initial offer promptly rejected in August 2022, BHP counteroffered in November, and Oz Minerals and its shareholders and the Federal Court of Australia approved over the following months. The takeover has strengthened BHP's copper and nickel portfolio and consolidated the company's capabilities to meet the demands from the green energy transition in what was a strategic initiative, according to BHP CEO Mike Henry. Among the assets acquired are the producing Carrapateena and Prominent Hill mines and their respective 5.6 MMt and 1.6 MMt of copper in reserves and resources. The mines produced around 55,000 metric tons of copper each in 2022 and are both undergoing expansions.

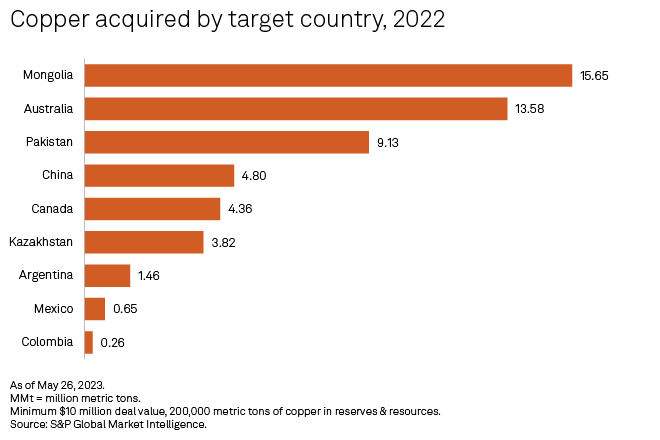

Rio Tinto International Holdings Ltd. 's (an operating subsidiary of Rio Tinto Group) acquisition of Turquoise Hill Resources Ltd. is a similar and somewhat competition-based strategic positioning in the copper market after BHP further cemented its foothold. For $3.25 billion, Rio Tinto bought 15.7 million metric tons of copper in reserves and resources — the largest amount of metal changing hands in 2022; the deal included the expansion-stage Oyu Tolgoi open pit operation in Mongolia that has the potential to become the world's fourth-largest copper mine with an expected annual output of 500,000 metric tons as of 2028 and an estimated reserves life of 30 years. Underground production at the mine started in March.

The third-largest transaction in terms of copper in reserves and resources, and the fifth-largest in deal value, comprised Antofagasta PLC 's divestiture of its 37.5% share in the feasibility-stage Reko Diq project in Pakistan. The sale increased Barrick Gold Corp. 's stake to 50%, with the remaining 25% passed to Pakistani federal government entities. The 9.1 MMt of copper acquired for $945.0 million makes for one of the lowest prices per pound of metal at just 5 cents/lb, compared with the 24 cents/lb paid by BHP and even the 9 cents/lb paid by Rio. Barrick is currently updating the project's feasibility study and is targeting first production in 2028. The transaction further cemented the ownership structure of the mine and emphasized Barrick's commitment to partnering with the local government in developing a social infrastructure around the mine — jobs, healthcare and education. The company recently received the green light from the Pakistan government to restart the project, which had been stalled for over a decade because of geopolitical and licensing issues. Over its expected minelife of 40 years, Reko Diq is poised to expand Barrick's copper portfolio and accelerate the company's world-class copper mining business.

Mongolia, Australia and Pakistan have thus emerged as the top target countries in 2022, hosting 71% of the metal acquired. Further, in light of these top transactions, the majors were also unsurprisingly the biggest spenders and acquirers, with 79% and of the total deal value and 73% of total copper in acquired reserves and resources.

The ratio of copper acquired in reserves to that of total acquired reserves and resources is among the lowest since the beginning of our study in 2011. At just 20%, it compares with 21% and 22% in 2016-17 and is the next-lowest after the 12% low of 2015. Further, nonproducing assets host roughly one-third of the reserves and resources acquired in 2022; buyers spent $2.7 million for 20.5 MMt of copper, or just 6 cents/lb. While this is promising and indicates a willingness to invest in the red metal, it also implies that much work needs to be carried out by the miners to capitalize on the investment and address the looming supply deficit.

Copper M&A in 2023

Copper M&A activity year-to-date seems healthy, with some industry giants further consolidating their positions. Canada's Lundin Mining Corp. agreed to acquire from ENEOS Holdings Inc. 51% of the operating Caserones mine in Chile and its 2.2 MMt of copper in resources and reserves for $950 million. The mine would increase Lundin Mining's annual copper production by 50%. Still in Canada, Hudbay Minerals Inc. will acquire Copper Mountain Mining Corp. in an all-share deal valued at $758.6 million. The transaction will create the third-largest copper company in Canada, with an estimated annual production of 150,000 metric tons of copper and reserves and resources amounting to 3.2 MMt.

Although unsuccessful and now terminated, Glencore PLC 's pursuit of diversified miner Teck Resources Ltd. for $23.00 billion aimed to secure significant copper operations, including the large-scale Quebrada Blanca Phase 2 expansion and its known resources of nearly 105 MMt of contained copper. With Glencore having spent less on exploration than other miners in the past years, the company must rely more on M&A to replenish its reserve and resource base. According to a study from the Mine Economics team, had Glencore succeeded in its attempted merger, the company would have been the second-largest global producer behind Codelco.

Brazilian giant Vale SA is spinning off its base metal division — one of the world's largest producers of copper and nickel, worth about $25 billion — and putting a minority stake of up to 10% for sale. Vale is rationalizing the spinoff in light of the energy transition and expects the new business to grow as demand rises for these critical minerals. The spinoff and sale of the minority stake are expected to be completed by the middle of the year.

From a macroeconomic perspective, the copper market remains robust, with prices still above historical norms. Even though major economies are recovering at different paces, they all have a green energy agenda with near- and medium-term decarbonization targets that ensure future sustained copper demand. While investments in and commitments to exploration will certainly be required, market placement through company synergies and takeovers will be part of the strategy.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.