Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 11, 2025

By Dan Lowrey

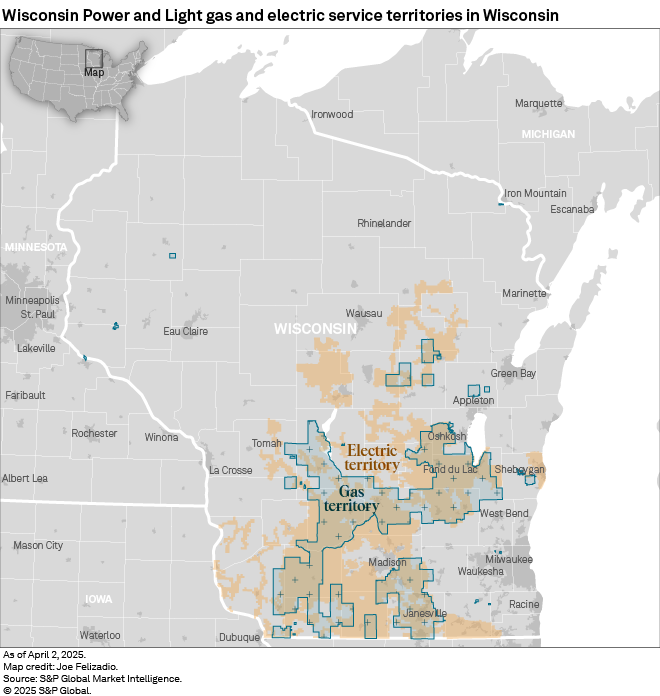

Alliant Energy Corp. subsidiary Wisconsin Power and Light Co. is requesting the Public Service Commission of Wisconsin authorize it an increase in electric rates of $201.9 million and an increase in gas rates of $13.8 million over 2026 and 2027. The company indicates higher rates are needed to fund investments in distribution and generation infrastructure, rising operations and maintenance expenses, higher transmission costs, changes in regulatory asset amortizations since the last rate case, and adjustments in capital structure and cost of capital for financial stability.

A procedural schedule has not been established in the case (Docket 6680-UR-125 (Elec)) and (Docket 6680-UR-125 (Gas)). The commission is expected to render a decision prior to the requested date of new rates, Jan. 1, 2026.

➤ After its last rate case was concluded in a fully litigated setting in late 2023, Wisconsin Power and Light (WPL) is requesting another increase in base rates for electric and gas service to fund investments in distribution infrastructure, plant upgrades and conversions, new solar and proposed changes to capital structure and cost of capital.

➤ The company has requested a 10-basis-point bump up in its authorized return on equity to 9.90% and an increase in equity ratio in financial capital structure to 54% from 52.5%. The requested ROE is slightly above national averages tracked by Regulatory Research Associates. The company indicated the change is needed to support cash flow needs of construction plans, given persistent inflation and rising geopolitical tensions since its last rate proceeding.

➤ Typical of the constructive regulatory climate in Wisconsin, the filings rely on forward-looking test years. State statutes support the use of settlements between parties in rate cases in order to expedite the conclusion of such proceedings, and several major rate cases have been resolved via settlements in the last couple of years. However, the past two rate cases for WEC Energy have been fully litigated. For more on Wisconsin's regulatory environment, refer to the commission profile.

The company's request for higher electric rates is based upon a 9.90% return on equity (55.27% of regulatory capital structure) and a 7.86% overall return on an electric rate base of $6.69 billion for a test year ending Dec. 31, 2027. WPL's request for higher gas rates is based upon a 9.90% return on equity (55.27% of regulatory capital structure) and a 7.82% overall return on gas rate base of $583.6 million and test year ending Dec. 31, 2027.

The requested 9.90% return on equity exceeds national averages. According to calculations by Regulatory Research Associates, the average ROE authorized for electric utilities in rate cases decided in 2024 was 9.74%, notably above the 9.60% average observed in 2023. There were 55 electric ROE authorizations in 2024 versus 63 in 2023.

The average ROE authorized for gas utilities in cases decided in 2024 was 9.72%, above the 9.64% average observed in 2023. There were 44 gas ROE authorizations in 2024 versus 43 in 2023.

Investments on behalf of customers encompass additional distribution system enhancements in the test years aimed at bolstering the safety and reliability of WPL's infrastructure. This includes the full costs of 12 new solar generation projects that have come online over the past three years and previously approved battery energy storage systems. WPL's proposed revenue requirement accounts for the recovery of deferred returns on investment for these solar projects, as well as the initiation of cost recovery for these deferred expenses.

Additionally, the electric revenue requirement reflects planned capacity and efficiency improvements at WPL's Neenah and Sheboygan Falls plants, refurbishments at two existing wind generating stations, and WPL's interest in a new carbon dioxide-based energy storage system at the Columbia Energy Center.

Increased transmission expenses also contribute to WPL's current revenue requirement deficiency. The rise in renewable energy resources and projected load increases necessitate significant investments in transmission infrastructure to ensure safe and reliable energy delivery. By the 2027 test year, WPL anticipates transmission expenses will rise by $44 million, accounting for approximately 21% of the company's total proposed revenue requirement increase in this case.

The major drivers for WPL's requested natural gas revenue requirement increase include increased rate base additions that were not addressed in its last rate case, changes in regulatory asset and liability amortizations since then, inflationary pressures leading to increased O&M expenses, and the impacts of proposed changes in its capital structure and cost of capital.

WPL is also proposing changes to its capital structure by increasing its financial equity ratio from 52.5% to 54% and its authorized return on equity from 9.8% to 9.9%.

Given inflation, high long-term treasury yields, ongoing geopolitical tensions and shifts in Federal Reserve policy, the company testified that a return on equity above 10% seems justified. However, the utility indicated it is conscious of customer cost impacts and advocates for a modest 10-basis-point increase to 9.9%. This approach will enhance cash flows, support the company's credit ratings, and facilitate equity investment under current market conditions while ensuring financial stability, according to WPL. Additionally, it indicated the increased common equity ratio will position WPL to have the cash flow needed to avoid further credit rating downgrades and raise capital on competitive terms in a variety of macroeconomic circumstances.

In connection with its plan to convert the Edgewater coal plant to gas, WPL proposes to amortize deferrals for Edgewater 5 in the 2027 test year and to continue deferring the revenue requirement impact of retiring Columbia Units 1 and 2 in the 2026 and 2027 test years. "This provides the Company with flexibility to retire the units earlier if necessary while providing significant cost savings to customers," WPL said.

With respect to rate design, WPL proposes to modify tariffs and introduce programs aimed at supporting low-to-moderate income (LMI) customers and enhancing energy management. These initiatives include expanding eligibility for the arrears management program, reducing reconnection fees, and switching LMI customers to time-of-use rates that could lower their bills by at least $100. Additionally, WPL will launch electric vehicle pilot programs, update time-of-use rates, and promote a behavioral demand response program to help customers reduce energy usage during peak periods.

Previous rate case

WPL's previous rate case was decided by final order from the PSC on Dec. 20, 2023, authorizing the company a $49.4 million increase in electric rates 2024 and an incremental $59.7 million increase in 2025, for a combined increase of $109.1 million, premised upon a 9.80% return on equity (53.70% of regulatory capital structure) and a 7.54% return on an electric rate base of $5.77 billion for a test year ending. Dec. 31, 2025.

The commission's final order also authorized WPL a $12.8 million increase in gas base rates in 2024 and ordered the company to reduce base rates by $629,000 in 2025, for a net increase in gas base rates of $12.7 million. This rate change was premised upon a 9.80% return on equity (53.70% of regulatory capital structure) and a 7.42% return on gas rate base of $532.2 million for a test year ending Dec. 31, 2025.

WPL filed the application with the PSC April 28, 2023, seeking an increase in electric rates of $181.8 million and an increase in gas rates of $16.5 million over the 2024 and 2025 time frame.

WPL requested a 10.00% return on equity and a 7.65% return on rate bases valued at $5.915 billion for Wisconsin jurisdictional electric operations (Docket 6680-UR-124 (Elec)) and $532.0 million for its natural gas utility (Docket 6680-UR-124 (Gas)).

Drivers of the case included providing WPL an authorized return on 12 solar generation projects the PSC has approved, including the impacts of utility ownership of the projects rather than tax equity ownership, which was assumed in WPL's last rate proceeding. In addition, the proposed revenue requirements included the impacts of construction projects that were pending before the PSC as well as major construction projects that the utility expected to seek commission approval for soon. The revenue requirement request included $78 million associated with electric rate base additions and $9 million of gas rate base additions over the two-year rate period.

Wis. energy regulatory environment

RRA considers Wisconsin regulation to be constructive from an investor perspective. Energy utilities are regulated under a traditional framework, and the most recently authorized equity returns have been above the prevailing national averages when established. The use of forecast test periods and other constructive financial practices, such as the reliance on comparatively equity-rich capital structures for rate-setting purposes and authorization of a cash return on 50% of construction work in progress, have provided the state's investor-owned utilities a reasonable opportunity to maintain solid credit quality metrics and to earn their authorized equity returns.

To expedite the resolution of rate cases, legislation was enacted in 2018 authorizing the PSC to approve settlements between parties. Prior to 2018, rate cases were rarely settled. Since enactment of the legislation, settlements in rate case have been frequent.

The PSC also allows periodic adjustments to reflect expected changes in electric fuel costs that are outside a variance range. The commission has taken an active role in integrated resource planning; thus, before constructing a generating facility, a utility must obtain a determination of need from the PSC, which includes an estimate of the facility's costs. While certain impediments to the construction of new nuclear facilities have been removed, none of the state's electric utilities have plans to develop nuclear generation.

Recent mergers involving the state's major energy utilities have been approved without onerous conditions being imposed. In the gas industry, gas-cost recovery mechanisms are currently in place for local distribution companies, and gas retail choice is effectively available for large-volume customers only. State statutes support the use of settlements between parties in rate cases to expedite the conclusion of such proceedings.

RRA accords Wisconsin energy regulation an Above Average/3 ranking, indicating it is constructive from an investor standpoint. For more information, visit the Wisconsin commission profile page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Theme

Location

Products & Offerings

Segment