Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 17, 2025

By Heike Doerr

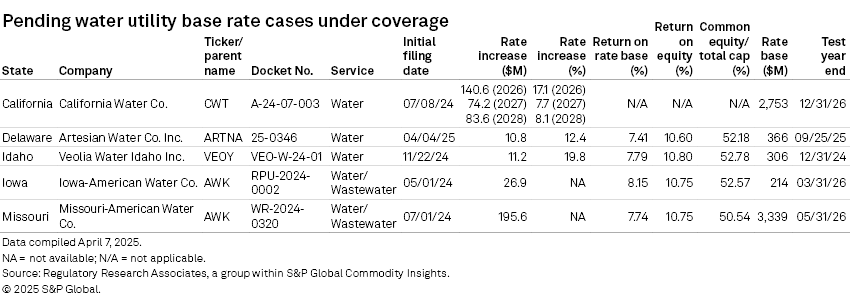

Regulatory Research Associates is currently tracking five base rate proceedings. A settlement is expected to be approved in Missouri shortly, while a case in Iowa proceeds on a litigated track. Rate proceedings in Delaware and Idaho have just begun and settlement discussions started this week in California.

➤ While regulatory activity has been notably quiet at the start of 2025, RRA anticipates that as many as 11 rate requests could be filed in 2025. RRA has observed that spring is usually the busiest time for rate case filings.

➤ Additionally, there has been activity in Connecticut, New Jersey and Texas related to smaller infrastructure surcharge mechanisms, which allow for increased rates in between base rate case filings.

➤ Legislation that was recently approved by both chambers of the Missouri General Assembly will align the regulation of sewer utilities with the existing regulatory framework for water utilities with respect to infrastructure surcharges and the asset valuation of acquisitions.

RRA evaluates water utility regulation in more than 20 state jurisdictions and monitors rate proceedings involving rate change requests of at least $1.0 million for the 10 largest investor-owned and privately held water utilities.

For additional details regarding water utility rate cases from Jan. 1, 2010, through Dec. 30, 2024, refer to this Excel companion.

Recent regulatory activity

California – Settlement discussions commenced April 7 in California Water Service Co.'s general rate case. A motion for evidentiary hearings is due April 29, and if necessary, would be held between May 13 and May 22.

On July 8, 2024, Cal Water filed to increase water rates by $140.6 million (17.1%) in 2026, by $74.2 million (7.7%) in 2027 and by $83.6 million (8.1%) in 2028. Rate of return is not an issue in this case because it is determined in a separate cost of capital proceeding. The general rate case reflects the current return on equity (ROE) of 10.27% and 53.4% capitalization, which took effect Jan. 1.

Delaware – Most recently, on April 4, Artesian Water Co. Inc. (AWC) filed for rate relief in Delaware. The $10.8 million (12.4%) rate request is based on a 10.6% equity (52.18% capitalization) and 7.41% overall rate of return on rate base of $366 million for a Sept. 30, 2025, test year.

In explaining the need for increased rates, AWC stated that the company will have invested over $58.5 million in used and utility plant and equipment since its last general base rate, through the end of the test period. Additionally, AWC notes that the "operating and economic environment has markedly shifted," citing inflationary pressures and new regulations surrounding contaminants also contributing to the requested increase.

Recent guidelines from the US Environmental Protection Agency for per-and polyflouoroalkyl substances (PFAS) will significantly increase AWC's expenses, "due to the number of new sites requiring treatment that necessitate periodic replacement of filter media and experienced increase in frequency of media change-out, as a national effort is undertaken to eradicate this contaminant from potable water." Artesian has 55 wells impacted by one or more PFAS chemicals and of these sources, over 95% exceed one of the PFAS regulatory limits set by the EPA.

The company’s last rate increase was completed in June 2024, with a $11.2 million rate increase, based on a 9.5 % ROE for a 2022 test year. The settlement was silent in regard to equity capitalization and rate case.

AWC, the largest subsidiary of Artesian Resources Corp., serves approximately 97,500 water connections throughout Delaware.

Idaho – On Nov. 22, 2024, Veolia Water Idaho Inc. filed an $11.2 million (19.8%) rate increase based on a 10.8% equity (52.78% capitalization) and 7.79% overall rate of return on rate base of $306 million for a Dec. 31, 2024, test year. The company proposes a two-phase rate plan, with 70% of the requested increase to be effective Dec. 23, 2024, and the remaining 30% to be effective a year later.

Staff and intervenor testimony are anticipated April 14 and rebuttal testimony is due May 9.

Veolia Water Idaho services approximately 108,000 customers connections and is a subsidiary of Veolia Utility Resources LLC.

Iowa – Hearing was held Jan. 21, 2025, and post-hearing briefs filed Feb. 7 as Iowa-American Water Co. Inc. (IAWC) approaches the conclusion of its rate proceeding. Key contested issues include cost of capital parameters, revisions to the company’s infrastructure surcharge, consolidation of rate tariffs, rate design, the inclusion of an acquisition's purchase price in the rate base, and IAWC's proposed revenue decoupling mechanism.

The company initially filed for a $26.9 million rate increase May 1, 2024, based on a 10.75% equity (52.57% capitalization) and an 8.15% overall rate of return on a rate base of $214 million for the test year ending March 31, 2026.

The Iowa Utilities Commission is expected to issue an order by May 27.

IAWC provides water service to nearly 69,000 customers in and wastewater service to 832 customers. It is a subsidiary of American Water.

Missouri – On March 17, Missouri American Water Corp. (MAWC), the public service commission staff and the Office of the Public Counsel signed a settlement calling for the company to increase rates by $63.1 million. If approved, new rates are expected to be effective by May 31. The settlement is silent in regard to cost of capital parameters and rate base.

MAWC initially requested a $195.6 million aggregate rate increase July 1, 2024. The request reflects a 10.75% return on equity (50.54% of capital) and a 7.74% return on an average rate base valued at $3.339 billion for a test year ending May 31, 2026. The rate request includes a $190.3 million water increase based on a rate base of $3.221 billion and a $5.2 million wastewater rate increase based on a rate base of $117.6 million.

MAWC, a subsidiary of American Water, is the largest investor-owned water utility in Missouri and serves approximately 484,000 water customers and 24,000 wastewater customers across the state. MAWC accounts for approximately 15% of American Water's regulated customer base.

Other regulatory activity

Connecticut – On March 26, the Connecticut Public Utilities Regulatory Authority (PURA) authorized a Water Infrastructure and Conservation Adjustment (WICA) surcharge of $1.6 million (1.35%) for Connecticut Water Inc. effective April 1, 2025, as a result of the company completing 13 WICA-eligible projects with a total cost of $15.7 million. The company’s cumulative WICA surcharge effective April 1, 2025, is $6.0 million, or 4.90%.

New Jersey – In February, the New Jersey Board of Public Utilities approved Middlesex Water Co.'s request to increase rates by $0.5 million and reset its purchased water adjustment clause to recover additional annual costs related to the purchase of treated water from New Jersey-American Water Co. Inc., which recently implemented a rate increase. The new PWAC rate will be effective March 1, 2025.

Texas – On March 13, the Public Utility Commission of Texas rejected the administrative law judge's proposal to approve The Texas Water Co.'s application to amend its water and sewer system improvement charge (SIC) riders. On Sept. 12, 2024, the company had requested to recover $5.5 million annually from its water SIC rider and $0.2 million from its sewer rider related to various system improvements made during the period from Jan. 1, 2020, through June 30, 2024.

The commission remanded the proceeding instructing the company to file additional information pertaining to the projects completed.

Anticipated regulatory filings

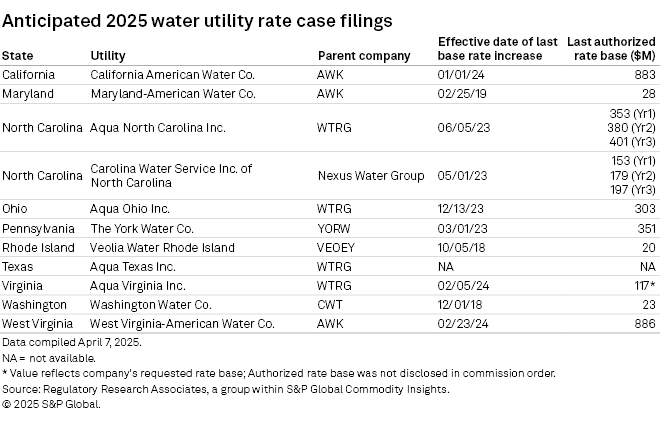

Although the first quarter is generally quiet, regulatory activity is anticipated to increase in the coming months. RRA has noted that spring is typically the busiest period for rate case filings. Based on comments from utilities and RRA's insights into the rate case cycles of various companies, the following 11 companies are expected to file a base rate case in 2025.

In California and North Carolina, water utilities are currently on a three-year rate cycle. In Maryland, Rhode Island and Washington, water utilities have not implemented rate increases since 2018.

Of note, Aqua Texas Inc.'s upcoming base rate case filing will be the first for a major water utility with the PUC since the sector's regulation was transferred from the Texas Commission on Environmental Quality in 2013. With authorized ROEs exceeding 11.0%, population trends driving customer growth, and infrastructure surcharges enabling investment to be reflected in the rate base, the larger investor-owned water utilities have successfully avoided full-scale base rate cases until now.

Relevant legislative actions

Missouri – Senate Bill 4, which was delivered to the governor for signing on March 25, includes provisions pertaining to rate case test years, construction work in progress, advanced meter opt-out procedures and several other important matters that would affect the state's electric and gas utilities. The bill would also align the regulation of sewer utilities with the existing regulatory framework for water utilities with respect to infrastructure surcharges and the asset valuation of acquisitions.

The bill would extend the Water and Sewer Infrastructure Replacement Adjustment (WSIRA) to sewer utilities with over 8,000 connections, enabling them to recover infrastructure improvement costs between base rate proceedings. Previously, WSIRA was limited to large water utilities. The new legislation would also extend appraisal and valuation guidelines currently applicable to water utility acquisitions to sewer transactions. The bill would require appraisals by at least two certified general appraisers: one appointed by the small utility being acquired and another by the acquiring large utility. If needed, a third appraiser may be appointed by the PSC.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Theme

Location

Products & Offerings

Segment