Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 17, 2025

By Paul Manalo

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

Access the databook.

See Commodity Insights' most recent market outlooks for aluminum, copper, gold, iron ore, lithium and cobalt, nickel and zinc.

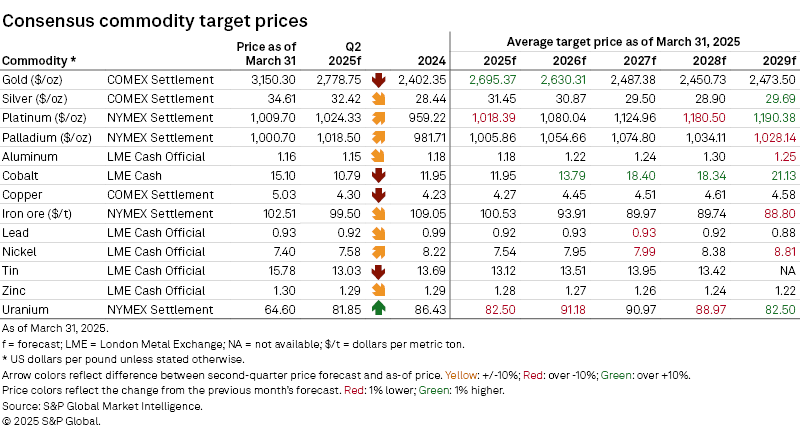

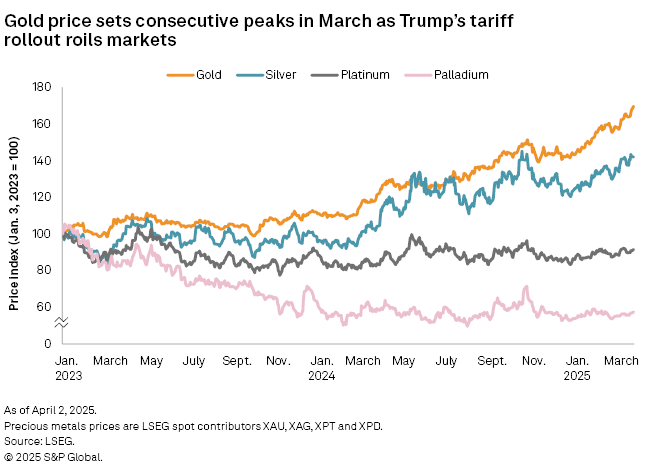

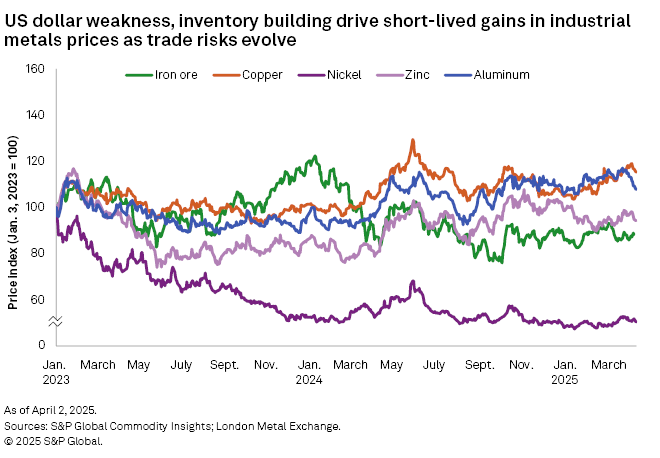

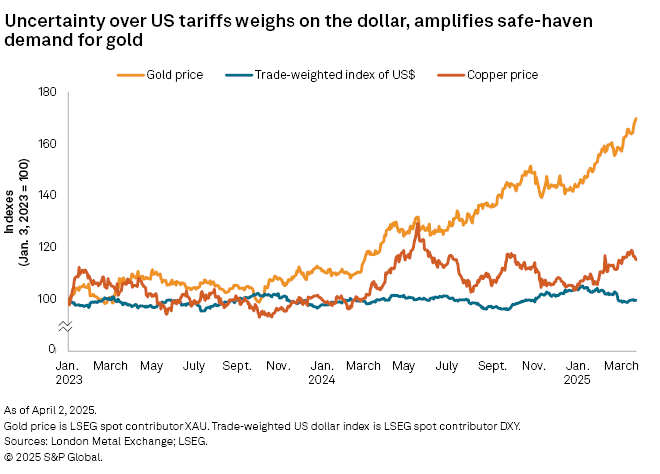

Mercurial developments in the global trade landscape, as the US' expanding tariff plans spark reciprocal measures, continued to take centerstage across metals markets in March. Gold reached multiple record highs as economic uncertainties increased interest in safe-haven assets. US recession fears, a weaker US dollar, pockets of supply tightness and inventory building amid worries of impending trade barriers bolstered industrial metals prices, but concerns for the impact of constrained trade flows on demand levels and a lingering supply overhang for some metals kept downside risks intact. Consensus gold price targets for the 2025–29 period have been upgraded, while expectations for industrial metals — except for cobalt and zinc — were adjusted lower.

Tariff announcements from the US and vows of retaliatory actions from other countries continued to agitate metals markets in March, supercharging safe-haven demand for gold as the uncertainty induced by escalating trade tensions threatens to curb global economic growth. Although major central banks have continued to trim policy rates, economic growth prospects are capped by the potential adverse implications of heightening trade restrictions, which have subsequently come to pass, following President Donald Trump's reciprocal tariff announcements on April 2. The US expanding tariffs on most of its trading partners have the potential to jeopardize even its own economic growth, feeding into recession fears and dragging down the US dollar. The trade-weighted index of the US dollar dropped to 102.07 on April 3, down 6.7% year to date. Reflecting market apprehension, the US manufacturing purchasing managers' index (PMI) returned to contractionary territory in March, following two consecutive months of expansion. In its Federal Open Market Committee meeting in March, the US Federal Reserve kept interest rates unchanged, even as it trimmed its US economic growth outlook for 2025 to 1.7% from 2.1% and raised its core inflation projection to 2.8% from 2.5%.

In China, manufacturing PMIs expanded at faster rates in March, suggesting resilience in the face of hiked US import duties. Other indicators echo this uptick in activity, as the January–February industrial production in China rose 5.9% year over year while fixed asset investment climbed 4.1% and retail sales increased 4.0%. Although China announced new incentives in mid-March to further spur economic activity, a lack of detail around the stimulus and, at the time, pending US tariff, capped market optimism.

After initially breaching $3,000 per ounce on March 18, the London Bullion Market Association gold price consecutively broke records toward the close of the month to settle at $3,115.10/oz on March 31. The unpredictability of Trump's tariff rollouts and possible retaliation from other countries have fueled concerns over inflationary pressures and fears of a possible US recession, driving investors' flight to safety. Unease over the US economy permeated the market, lifting COMEX gold inventories to a historic high of 43.8 million ounces as of March 31.

Trade tensions compound still-evolving geopolitical risks stemming from the Russia-Ukraine war and Middle East conflicts. Meanwhile, heightened activity in the physical market has also been a critical force driving the gold rally. Central bank buying picked up pace in January, and the total assets under management of physically backed gold exchange-traded funds (ETFs) reached an all-time high at above $300 billion. Given the sharp price increases of late, consensus price targets for gold are somewhat lagging current market values, despite being raised by an average of 1.1% for 2025–27; they are 0.5% lower for 2028–29 when profit-taking is expected to limit the upside.

Surging gold prices, safe-haven demand and market tightness combined to drive support for the silver price, which reached its highest level since October 2024 at $33.80/oz on March 13. As trade tensions escalate, silver has remained an attractive option as a hedge against uncertainty. Tight fundamentals add to the bullishness, as supply continues to lag demand that is largely driven by industrial applications, including uses in renewable energy and electrification. However, sensitivity to economic conditions could drive headwinds, as a slowdown in industrial activity could dampen silver demand going forward. The silver consensus price outlook has been upgraded 0.6% on average over the five-year forecast horizon.

Platinum and palladium prices were range-bound between $900/oz and $1,000/oz throughout March. Consensus price expectations for 2025–29 have been downgraded by 0.7% and 0.6% on average, respectively. Given the heavy exposure of platinum group metals (PGM) demand to the automotive sector, tariff concerns have likewise swayed PGMs, though the impact is likely to be more pronounced for platinum than palladium. The World Platinum Investment Council considers the US to be "almost self-sufficient" in palladium but short in platinum. Worries over the flurry of US tariff announcements have given rise to significant inflows of platinum into NYMEX warehouses, which could accelerate the tightening of supplies. Outlooks point to a continued supply deficit in 2025 for platinum but an emerging surplus for palladium in the same year. New US tariffs on imports of all automobiles that went into effect April 3 pose downside risk to demand, with the automotive sector being the single largest demand segment for both platinum and palladium, given their application in catalytic converters for exhausts of internal combustion engine vehicles. The uptake of electric vehicles that have no need for autocatalysts could also erode demand levels for PGMs over the medium to long term.

The London Metal Exchange three-month (LME 3M) copper price rose to a five-month high of $9,955 per metric ton on March 19 and remained supported above $9,800/t through month-end amid US dollar weakness and worries that the red metal could be the next target of US tariffs. An executive order issued in late February called for an investigation into US copper imports under Section 232 of the Trade Expansion Act — a likely forerunner to the imposition of US trade barriers — which grants the US president the authority to "adjust imports" of goods for national security reasons, such as supply chain vulnerabilities. As this unfolded, COMEX copper prices surged to an all-time high of $11,210/t on March 20, while the arbitrage between COMEX and LME cash prices reached $1,299/t. The COMEX premium could encourage metal flow into the US and prompt concerns over supply disruptions elsewhere. Copper concentrate spot treatment charges (TCs) reached a record low of negative $21.10/t in March, suggesting a persistent concentrate squeeze that could result in refined output cuts. Smelter capacity expansions in China, Indonesia, India and the Democratic Republic of Congo (DRC), alongside a new round of stimulus measures in China and signs of recovery in the domestic economy, exacerbated supply concerns. Nevertheless, the adverse implications of tariffs on demand and global trade remain a downside risk. Copper consensus price outlooks have been lowered 0.2% on average for 2025–29.

The weakening US dollar and news of refined production curtailments bolstered the LME 3M zinc price, which reached a monthly high of $2,972/t on March 25. Concerns over the latest US tariffs have prompted US consumers to build their zinc inventories. Although US imports of refined zinc fell 9.1% month over month in January, rising demand has propped up the US zinc premium to the LME in March. The Platts-assessed US Midwest delivered Special High Grade zinc premium rose to 21 cents per pound at the end of March. Platts is part of S&P Global Commodity Insights. While contractionary US manufacturing PMI for March reflects businesses' apprehension about the US economy, expansionary China PMIs suggested beneficial impacts of recent incentives, and additional stimulus packages aim to boost economic activity further. The concentrate market remains tight in terms of supply, as signaled by the annual contract agreement for TCs settled between Teck Resources Ltd. and China's Nandan Nanfang Non-Ferrous Metals Smelt Co. Ltd. at $60/t, which is 64% lower than the 2024 benchmark of $165/t. Citing the squeeze in raw materials, major zinc producer Nyrstar NV announced it will trim production by 25% at its Hobart smelter in Australia in April. The impact of reduced refined output, however, could be short-lived, considering a robust mine supply pipeline. Consensus price forecasts for zinc are 0.2% higher on average for 2025–29.

The LME 3M closing nickel price reached a near five-month high March 12 at $16,641/t but pared back gains to end the month at $15,918/t. US recession fears have weighed on the dollar and triggered a round of short-covering. On March 14, investment funds turned net long on LME nickel for the first time since October 2024. Profit-taking curbed the upside, while supply-side fundamentals continued to weigh on market sentiment. LME nickel inventories exceeded 200,000 metric tons on March 13 for the first time in over 3.5 years, helped largely by inflows of China-origin metal. China refined class 1 nickel production climbed 17.3% year over year in the January–February period. Indonesian production is expected to expand further in 2025, albeit at a slower pace due to tight ore availability and potential regulatory changes. An ongoing supply overhang is keeping the consensus price outlook biased lower, with price expectations downgraded 1.0% on average for 2025–29.

After trading range-bound between $2,600/t and $2,700/t for most of March, the LME 3M aluminum price fell past the lower boundary to end the month at $2,533/t. Cash prices traded at a premium to 3M prices, as a tight spot market helped to prop up market sentiment. Despite sanctions on Russian imports in key economies, the low India-origin metal at LME warehouses has resulted in increasing withdrawals of Russia-origin metal. The Platts-assessed benchmark US Midwest premium rose to a record-high of 41.75 cents/lb in late February, with the approaching implementation of US tariffs on steel and aluminum imports. While the premium has since corrected, renewed upside remains a possibility as tariff developments continue to unfold. Despite signs of tightening supply, broadening barriers to trade continue to dampen sentiment. Aluminum consensus price expectations are down 0.2% on average for the 2025–29 period.

Short-term supply disruptions drove the Platts-assessed European cobalt metal price to its highest level since August 2023 at $17.5/lb on March 13, but it has since pulled back to $16/lb on March 31. The export ban enforced by DRC in late February has triggered a shortage in the cobalt physical market, as participants opted to preserve inventories. Dwindling cobalt stocks at the LME prompted the exchange to temporarily suspend lending requirements on cobalt contracts on March 6 to encourage more inflows into its warehouses. The export ban — designed to address global oversupply — has an initial implementation period of four months and is subject to review for possible extension.

The imminent release of stockpiled inventories once the ban is lifted allay supply worries, however. Although there was an uptick in EV sales in February, battery manufacturers have also begun to shift away from cobalt-containing batteries in favor of the less costly lithium-iron-phosphate ones. Despite challenges in the US, the transition to a green economy remains a crucial demand driver for cobalt alongside other battery metals. Cobalt consensus price targets have been upgraded 4.5% on average for 2025–29.

After testing the $110 per dry metric ton threshold in late February, the Platts IODEX 62% Fe iron ore price slumped in March to average $102.43/dmt amid easing weather-related supply disruptions and a souring China demand outlook. Iron ore shipments from Australia have resumed in full, and major miners have maintained their annual production guidance for 2025 despite operational outages due to cyclones earlier in the year. Meanwhile, China iron ore imports declined 8.4% in January–February under pressure from a fall in steel production, with further cuts expected on weak domestic steel demand and external trade pressure. Antidumping measures imposed by Vietnam and South Korea on China's steel exports have been stifling demand prospects, in addition to newly imposed US duties on all steel and aluminum imports and tariff hikes on China-origin goods. Tepid demand will exacerbate the overcapacity in China's steel industry — China's National Development and Reform Commission has expressed an intention to reduce steel output to address this issue. While this intervention would improve mill margins, it would also soften iron ore demand and aggravate the market surplus. The iron ore consensus price outlook is downgraded 0.7% on average for the five-year forecast horizon.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.