Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 22, 2025

Chih-Chieh Chang and Sam Huntington

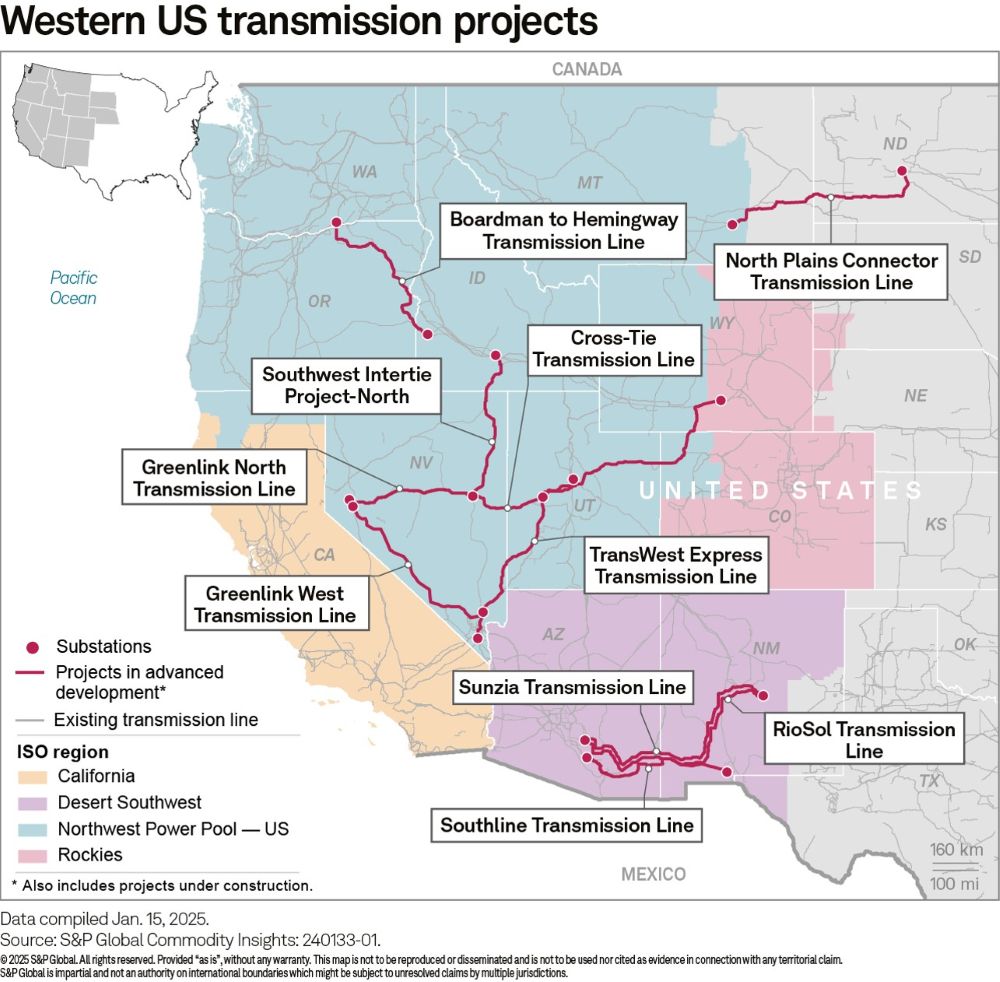

Transmission expansion is a critical issue in the US Western Electricity Coordinating Council (WECC) to meet states' clean energy goals and enhance grid reliability amidst growing load. However, several factors challenge the pace of transmission expansion, including the lack of centralized authority in non-California ISO WECC, the long distance between resources and loads, and prolonged permitting processes. Among the many scheduled upgrades, 10 major lines are planned over the next decade.

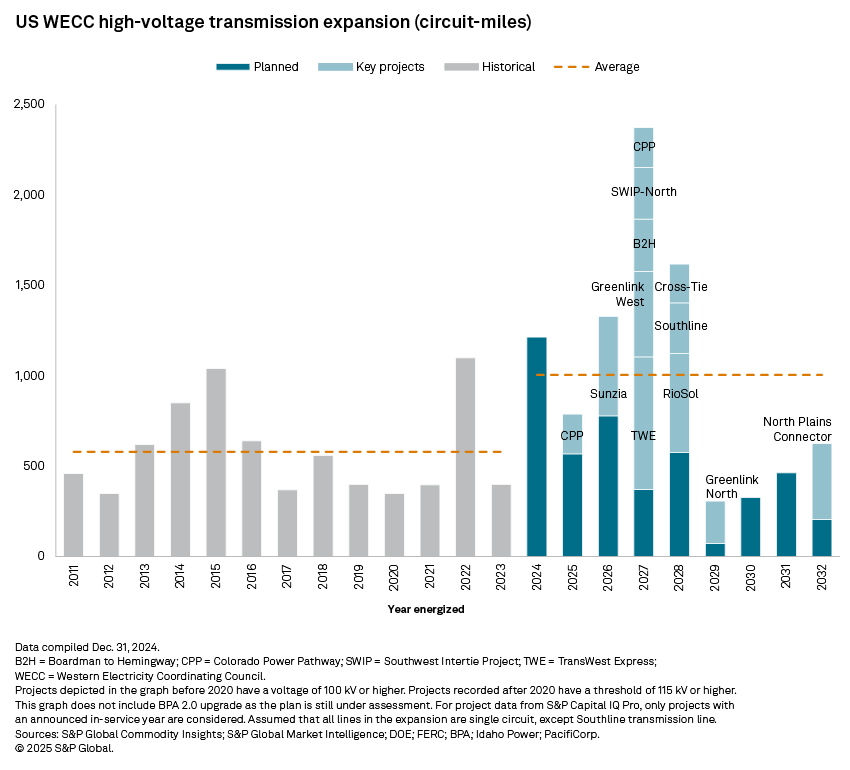

If these major lines stay on schedule, high-voltage transmission expansion will accelerate to roughly 1,000 circuit miles per year through 2032 — a 70% increase from the pace of expansion during 2011–2023. Over half of the planned expansion is associated with long-distance high-voltage transmission lines, with greater than or equal to 200 miles and a capacity greater than or equal to 345 kV. Most of these lines have experienced cost escalation since their original proposal, with a 15%-135% increase from their original proposals. Factors such as design modifications, route changes, rising labor costs and project delays often contribute to these increased costs.

Download the US WECC Transmission Landscape report.

Most of these long-distance high-voltage transmission lines under development in WECC are situated within a single planning region, with the TransWest Express Transmission Line and the North Plains Connector Transmission Line the notable exceptions. The project type and utility influence the method of cost allocation and recovery, with rate-based and subscriber methods as dominant approaches.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Theme

Location

Products & Offerings

Segment