Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 22, 2025

By Paul Manalo

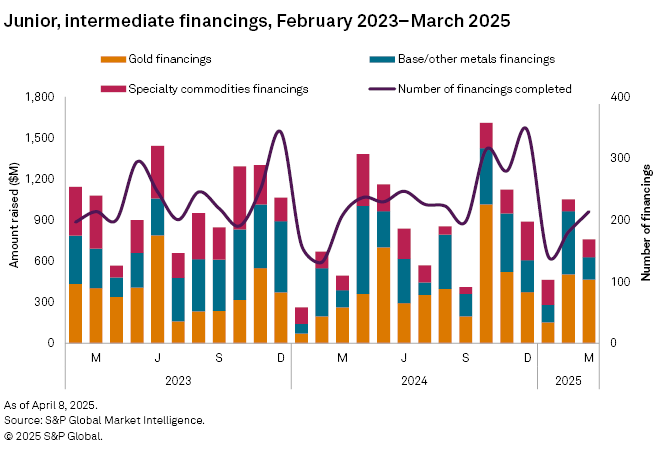

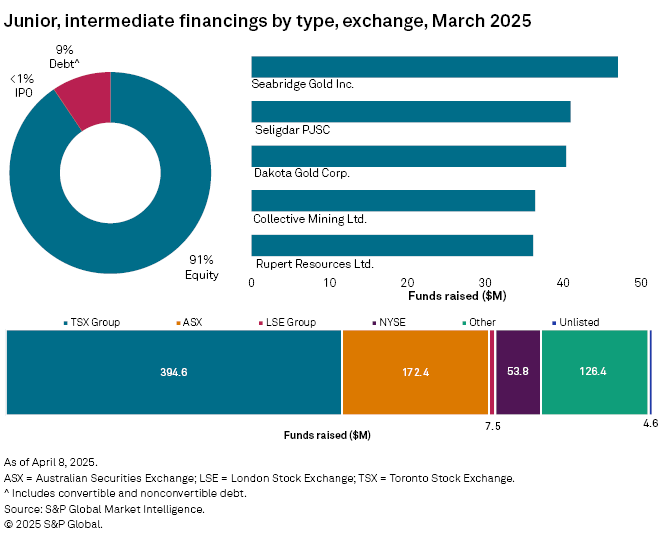

In March, funds raised by junior and intermediate companies fell 28%, totaling $759 million, compared to $1.05 billion in February. Despite the decline in funding, the number of transactions rose 18%, reaching 214 — the highest in three months. However, the absence of larger transactions negatively impacted the overall total for March. Notably, the number of significant financings — transactions valued at over $2 million — increased to 68 from 57 in February. Conversely, there were no transactions valued at over $50 million, a decrease from four in February.

The March 2025 financing data is available in the accompanying databook.

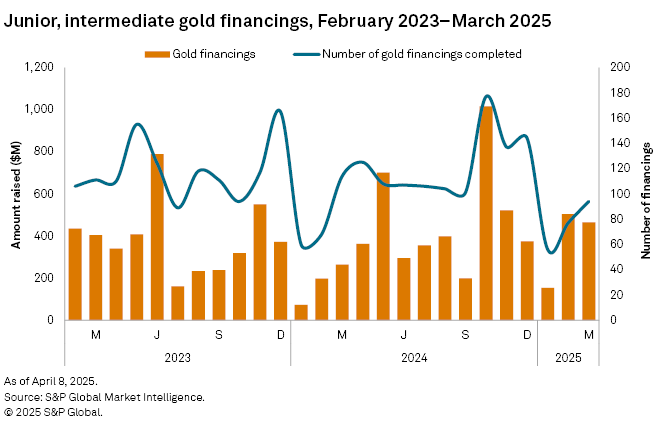

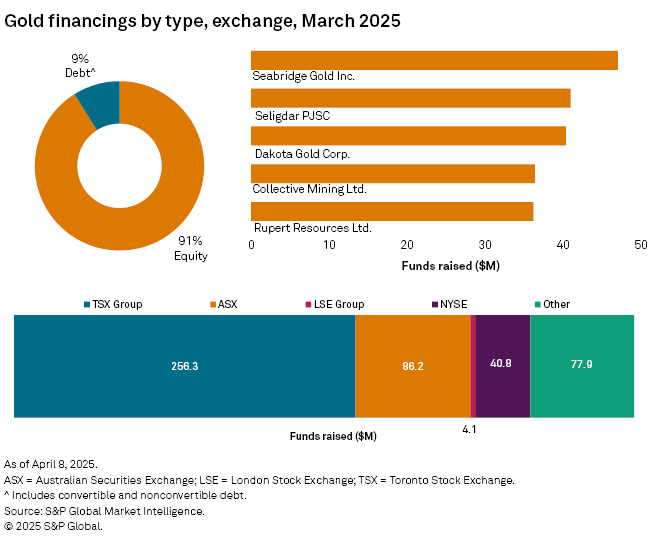

Gold financings retreat

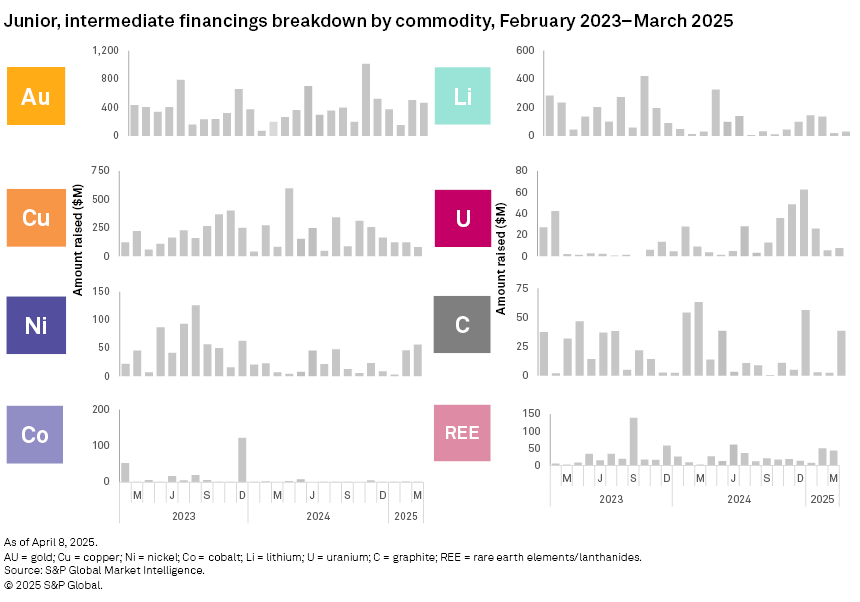

Gold financings decreased 8%, totaling $465 million, down from $504 million in February. Despite this decline in funding, the number of transactions rose to 94 from 77, and the number of significant financings increased by 6, reaching 33 transactions. Notably, there were no transactions valued at over $50 million, a decrease from two in February.

The largest gold financing and the largest overall was a $47 million private placement of common shares by Toronto-based Seabridge Gold Inc. Returning investor FCMI Parent Co. purchased these shares, increasing its ownership to 16.2% of Seabridge's outstanding common shares. Seabridge is involved in various precious metals projects in the US and Canada.

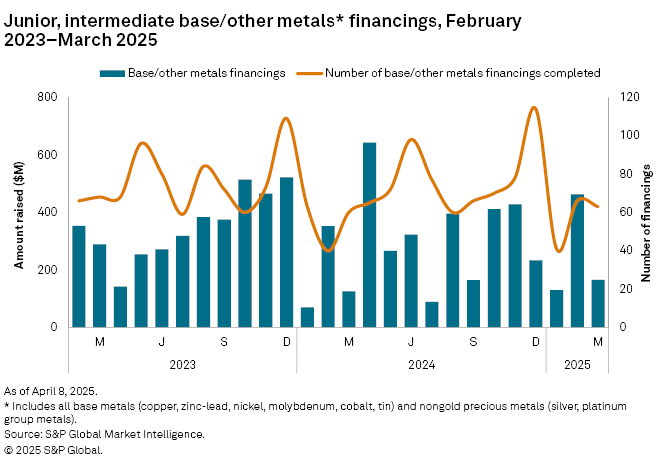

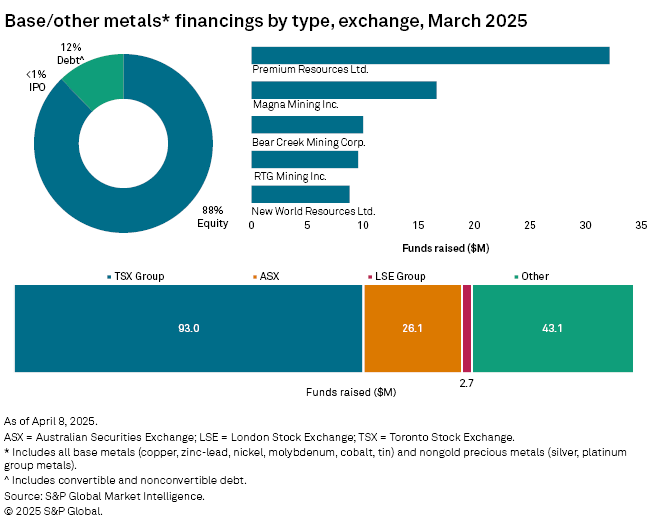

Silver, copper drag down base, other metals group

Funds raised for base and other metals group fell nearly two-thirds, totaling $165 million, following a significant increase of $463 million in February. Apart from nickel, which increased by $10 million, all major targets in this group declined, with silver and copper leading the downturn. The number of transactions in the base and other metals group decreased slightly to 63 from 66, while the number of significant transactions increased by one to 21. Similar to gold, there were no transactions valued at over $50 million, down from two in February.

The largest financing in this category and the seventh-largest overall was a C$46 million private placement of common shares by another Toronto-based junior company, Premium Resources Ltd. Proceeds from this financing are designated for the exploration and development of the company's base metals projects in Botswana.

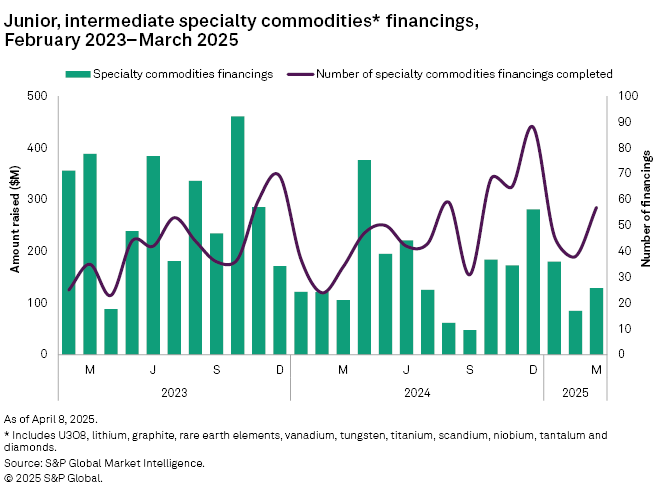

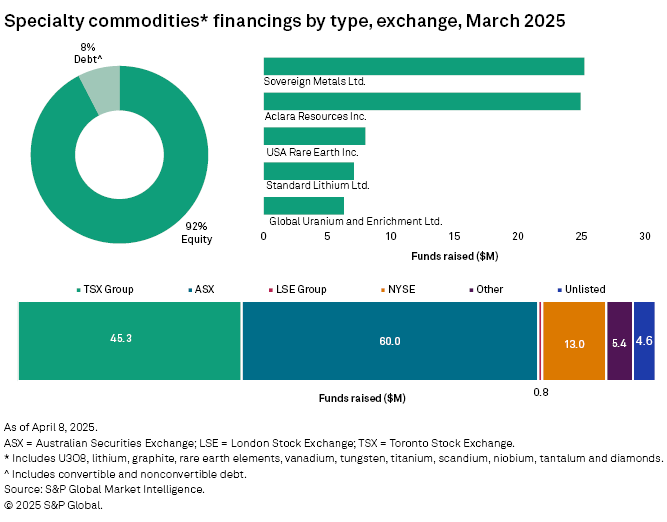

Specialty commodity group recovers

Funds raised for the specialty commodities group increased 52%, rising to $129 million from $85 million in February. Except for rare earth elements and vanadium, all targets within the group increased, with graphite and lithium leading the way. The number of transactions rose to 57 from 38 in February, while significant financings increased by four, totaling 14. No transactions were valued at more than $50 million in March, the same as in February.

The largest transaction in this category and the ninth-largest overall was a A$40 million private placement of common shares by Perth-based Sovereign Metals Ltd. Proceeds from this transaction are allocated for permitting and feasibility studies related to its Kasiya rutile-graphite project in Malawi. The definitive feasibility study is targeted for completion by the end of the December 2025 quarter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.