Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 14 Jun, 2023

S&P Global Commodity Insights discusses consensus price forecasts for industrial and precious metals, including platinum group metals, amid broader market trends.

See S&P Global Commodity Insights' most recent market outlooks for copper, gold, iron ore, lithium and cobalt, nickel, and zinc.

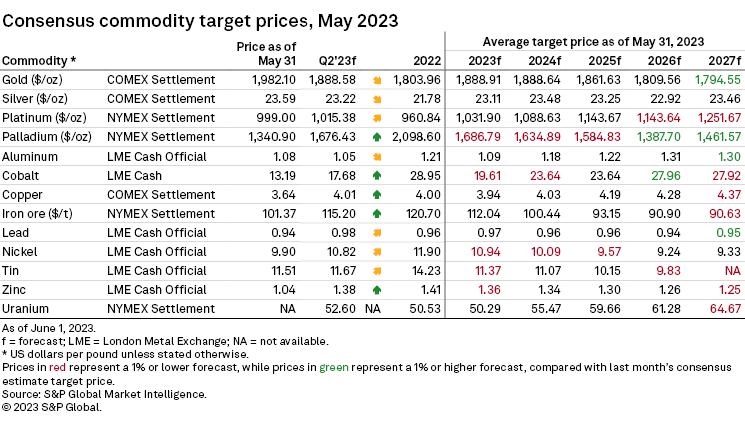

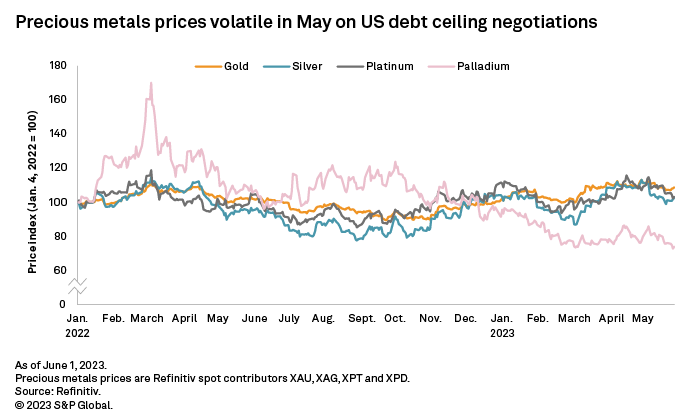

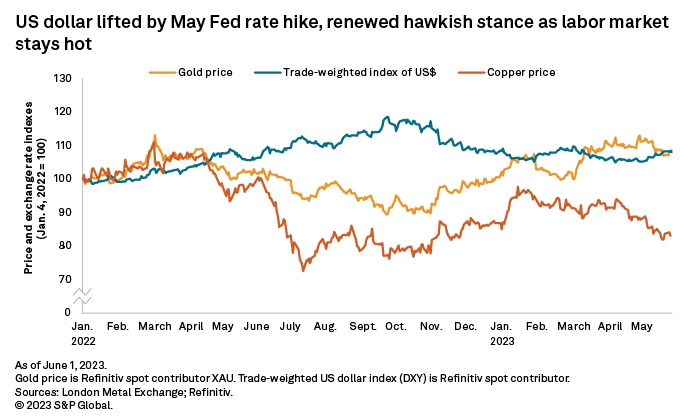

A new set of macroeconomic events shook markets in May, as the US economy faced the possibility of defaulting on its debt payments at the start of June. This triggered a price rally in the precious metals markets until even a positive outcome of debt ceiling discussions was countered by a renewed hawkish stance by the US Federal Reserve due to a still strong labor market. Sentiment in the industrial metals markets was bearish as a slow recovery by China's economy weighed on demand, with prices generally trending downward throughout the month. Consensus price forecasts were only modestly changed in May, likely factoring in the ongoing uncertainty and volatility in the macroeconomic environment.

May began bleakly with an increase in oil prices as the announced production cuts by OPEC+ came into effect. This was quickly overshadowed by the US Federal Reserve's latest interest rate hike — a trend that is unlikely to end soon in many economies, with labor markets remaining robust despite inflation slowing month over month and the latest crisis in the US economy as the country faced the possibility of defaulting on its debt payments come June 5. The debt ceiling negotiations injected volatility into global commodities markets, with precious metals prices initially rising on the potential for disruptions to financial markets before retreating, as talks ended in a deal between President Joe Biden and Speaker Kevin McCarthy. The House passed the debt ceiling bill on May 31, and a Senate decision is expected before the June 5 deadline.

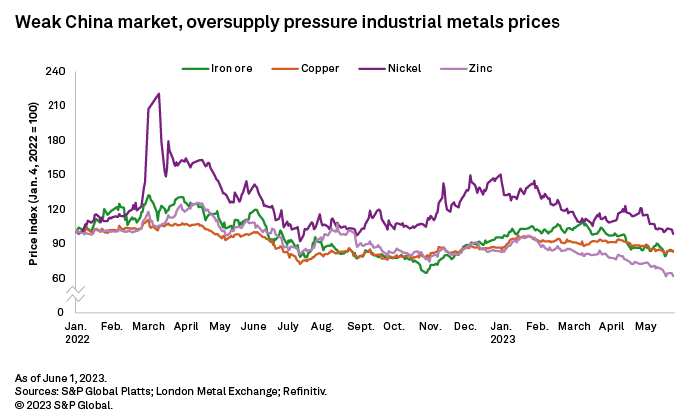

China's economic recovery is still proving slow and arduous despite a boost from the retail and services sectors. Commodities demand remains muted by slow manufacturing activity, a weaker-than-expected seasonal uptick in the construction sector and a subdued passenger plug-in electric vehicle (PEV) market due to subsidy expiry or cuts. For many commodities, supply is also loosening not only on strong shipments but also on a buildup of inventories of downstream materials, such as steel for iron ore. Consensus price forecasts were generally conservative due to the ongoing volatility, although some prices were reviewed significantly to the downside.

The London Bullion Market Association (LBMA) gold price was on a roller coaster in May, reacting to market events in the US. The latest Fed rate hike early in the month boosted the US dollar and the 10-year Treasury yield to two-month highs, which pressured the gold price. While inflation is still slowing, a resilient labor market supports the Fed's hawkish stance and hints at further rate hikes in the year. As the month progressed, the approaching deadline of the US debt default initially lifted the gold price, but the price settled below $1,950 per ounce as the debt ceiling talks progressed. Changes to the consensus price forecasts were generally positive across the forecast horizon, setting the gold price firmly above $1,800/oz through to 2026.

The LBMA silver price was equally volatile, peaking early in the month before tumbling as the US dollar strength overtook safe haven status. Amid these uncertain times, from both the safe haven and industrial application perspectives, changes to the silver consensus price forecasts were the most conservative for 2023 and across the forecast period.

Platinum and palladium prices followed a similar trajectory during the month, closing 8% and 11% lower, respectively, than at end-April. The platinum price is expected to remain robust over the near term, however, sustained by demand from traditional and the electric automotive sectors. On the other hand, palladium is being phased out of combustion engine vehicles, also in favor of the cheaper platinum, while rising availability from recycling is causing oversupply. Consensus price forecasts for both metals were downgraded across 2023–27 in May at annual averages of 1.7% for platinum and 1.2% for palladium.

Bearish market sentiment weighed on the London Metal Exchange (LME) copper price in May, as the US grappled with the possibility of a default on its debt payments and China struggled with a laboring economy. Stalled property sectors are further compounding the lackluster demand in both markets: Peak construction season in China failed to firm demand, while high mortgage rates cooled property sales in the US, where privately owned housing unit starts were down nearly 20% year over year in the March quarter. The green energy transition is nevertheless expected to support demand in the medium term, with consensus copper price forecasts upgraded to an annual average of 0.4% across 2023–25. Despite small downgrades in 2026–27, copper price is expected to increase year over year through to 2027.

The LME nickel price fell to a 10-month low in May on disappointing China trade data. Quarterly imports of battery-grade nickel were at a three-year low, emphasizing the ongoing weakness in China's passenger PEV market. The demand slowdown is also being felt in Indonesia, where stainless steel production is slowing and exports to China are dwindling in a feedback loop. In the longer-term perspective, Indonesia is also planning to lower its nickel pig iron production in favor of a battery-grade nickel compound, which will likely affect global market fundamentals. Consensus nickel price forecasts have been downgraded throughout the forecast period, slipping steadily every year to 2026.

Declining LME zinc prices reached a near three-year low at end-May, as historically low refined inventories are increasingly unable to counter weak downstream demand. Manufacturing activity in China was moderate during the month, with the National Bureau of Statistics purchasing managers' index indicating contraction. Investors are turning bearish, with short positions overtaking long positions on the LME in April. This ties in with a slight upgrade to near-term consensus price forecasts for the June quarter, followed by downgrades to each annual price through to 2027 by an average of 1.4%.

Following a few months of stability, the LME cobalt cash price resumed its decline at end-May, dropping below $30,000 per metric ton on lackluster demand and rising exports from the Democratic Republic of the Congo. Prices in China have been on a similar downtrend, especially as the economy has been slow to recover. Softer demand from the PEV market is being further exacerbated by a technological divergence from cobalt-containing batteries, which are typically more expensive than other chemistries. Demand from the consumer electronics sector has also been muted, although a seasonal uptick in sales is expected in the coming weeks. The 4.7% downgrade to the consensus cobalt price forecast is the second largest for 2023 — with the annual price expected to be 32% below 2022 levels — but higher than current prices and likely to pick up thereafter.

Weakness in the China market in May has unsurprisingly affected iron ore prices, with the S&P Global Platts IODEX 62% Fe iron ore price falling to a six-month low on a depressed steel market. Oversupply of steel has led to price and production cuts, which have recently slowed iron ore imports into China. Seaborne exports have been steady, however, despite a seasonal downturn in Brazil shipments in the first quarter and expectations that exports from Brazil and Australia will increase in the second half. These two factors are behind the 0.6% downgrade in consensus iron ore price forecasts for 2023.

Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.