Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 5, 2025

By Kristin Larson, PhD and Steve Piper

In a $572 million transaction announced in December 2024, Ørsted A/S sold 50% of two solar projects in the Electric Reliability Council of Texas Inc. (ERCOT) market and a solar and battery project in Arizona to Energy Capital Partners LLC (ECP), implying a $1.14 billion valuation for the three projects. ECP's purchase comes on the heels of the announced sale of the Calpine Corp. portfolio to Constellation Energy Corp. The S&P Global Market Intelligence Power Forecast values the Ørsted transaction similarly to this market result. The asset valuations are available in the Power Evaluator tool.

Ørsted plans to raise about $11 billion between 2024 and 2026 from equity stake sales or partnerships. The ECP sale price appears to be in line with the fundamental drivers of solar and storage value in each of these markets, reflecting strong solar revenue in ERCOT and the combination of solar revenue and battery arbitrage in Arizona.

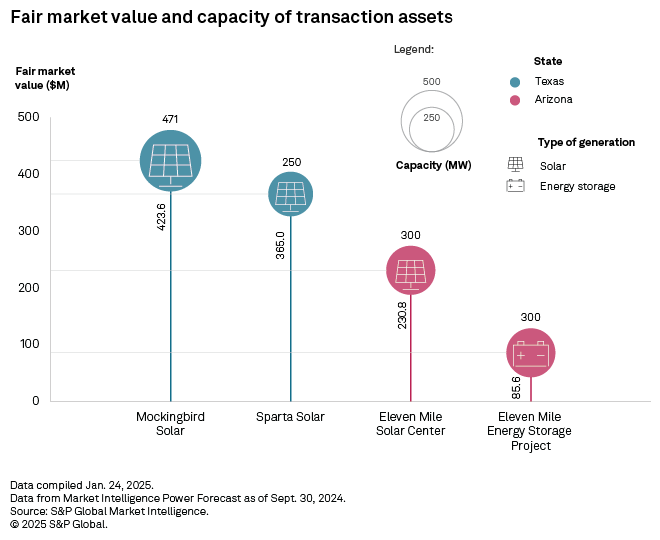

Due to anticipated increases in datacenter load, forecast prices continue to rise in ERCOT. Moderate solar penetration relative to load maintains robust solar capture prices in ERCOT. Assuming the projects utilize the production tax credit (PTC), we assess that returns are sufficient to repay all equity holders for the first 10 years of the project. After 10 years, the merchant forecast of project profits decrease, yet with a strong solar capacity factor, they still meet targeted equity returns. The 471-MW Baker Branch Solar Project (Mockingbird) in Lamar County, Texas, is valued at $423.6 million, and the 250-MW Sparta Solar Plant (Helena Energy Center) farther south in Bee County, Texas, is valued at $365.0 million. Project valuations are sensitive to the projected capacity factor of the project.

The value drivers for the hybrid solar and storage project in Arizona include the combination of solar energy revenue and battery arbitrage, along with 10 years of the PTC. Solar energy revenue contributes to net profits through 2029, as the solar capture ratio remains above 40%. Beginning in 2029, battery arbitrage revenue is forecast to become more significant, while the solar capture ratio and energy revenue decrease. We forecast that the net merchant profits for a hybrid solar and storage project in Arizona meet the debt threshold every year and exceed the threshold in years when the PTC is applied. The Eleven Mile Solar Center is valued at $230.8 million, and the Eleven Mile Energy Storage Project is valued at $85.6 million, both having a capacity of 300 MW. As solar energy revenue decreases, energy storage arbitrage revenue increases, providing stable project value into the future. Reduced operations and maintenance costs due to the colocation of the storage and solar project are not included in these estimates and may boost the project's value.

While we forecast merchant value, all three projects have power purchase agreements in place with corporate offtakers: Eleven Mile Solar with Meta Platforms Inc., Mockingbird with Bloomberg LP and DSM-Firmenich AG, and Sparta with Johnson & Johnson. These contracts likely produce a steady stream of revenue that further supports the transaction's valuation.

The valuation total from the Power Forecast is $1.105 billion, while the transaction price implies a value of $1.144 billion — 3% higher. Factors that may drive differences in valuation include PPA values, tax benefits and goodwill premiums. But the fundamental value drivers of this transaction include strong solar revenue in ERCOT and the combination of solar revenue and battery arbitrage in Arizona.

Cartography by Leigh Lunas. Data visualization by Allen Villanueva.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast. S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a complete, searchable listing of RRA's in-depth research and analysis, visit the S&P Capital IQ Pro Energy Research Library.

Theme

Location