Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 27 Aug, 2022

Highlights

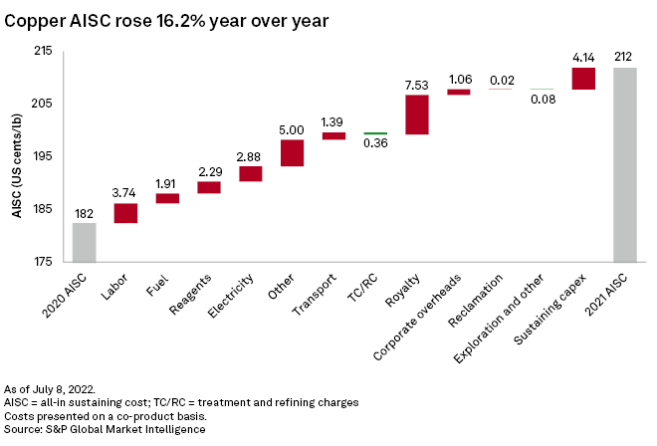

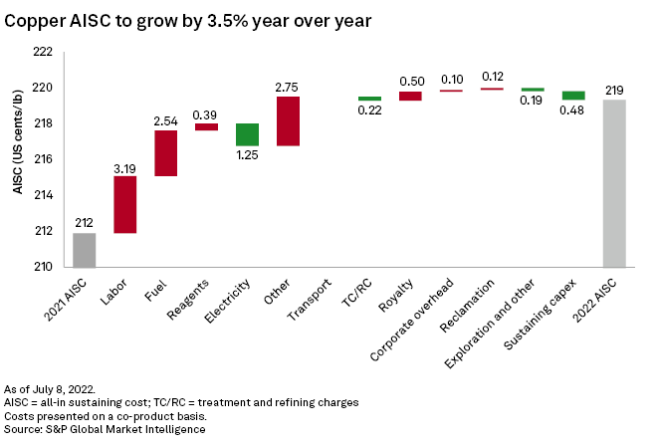

In 2021, the average AISC of copper production rose 16.2% year over year to US$2.12 per pound.

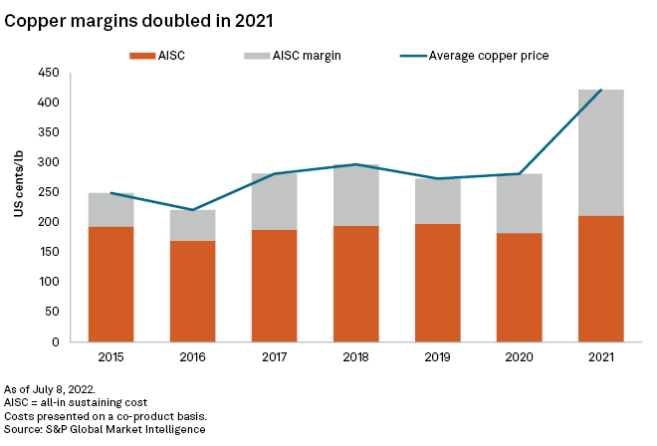

AISC margins grew 112.4% in the same period, following the 50% rise in the copper price.

In 2022, the AISC is expected to increase 3.5% year over year to US$2.19/lb.

In 2021, the average all-in sustaining cost, or AISC, of copper production increased 16.2% year over year to US$2.12 per pound on the back of rising minesite and royalty costs, combined with relaxed capital spending. In the same period, AISC margins more than doubled by 112.4% year over year, following a 50% rise in the copper price.

In 2021, the average AISC of copper production rose 16.2% year over year to US$2.12 per pound. AISC margins grew 112.4% in the same period, following the 50% rise in the copper price. Relaxed sustaining capital expenditure and higher minesite and royalty costs were the main sources of upward pressure on AISC. In 2022, the AISC is expected to increase 3.5% year over year to US$2.19/lb.

Sustaining capex, minesite, royalty costs drive AISC upward

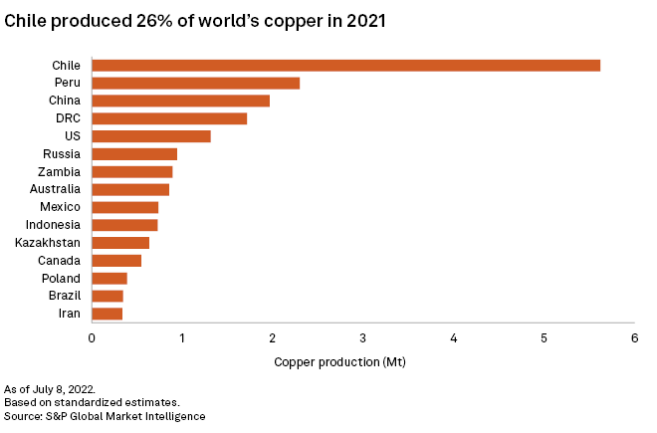

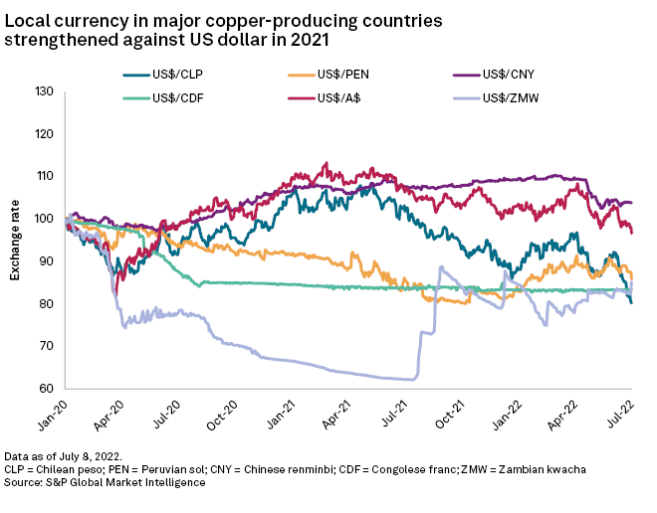

Local currencies in major copper-producing countries strengthened against the U.S. dollar in 2021, putting upward pressure on labor and other minesite costs, which account for 36.3%, or 77 U.S. cents/lb, of the total AISC. Local currencies in Australia, China and Chile strengthened the most, by 8.7%, 6.9% and 4.3% year over year, respectively. Rising wages in local currency terms in these major copper-producing countries further exacerbated rising minesite cost, resulting in higher labor cost when expressed in U.S. dollars.

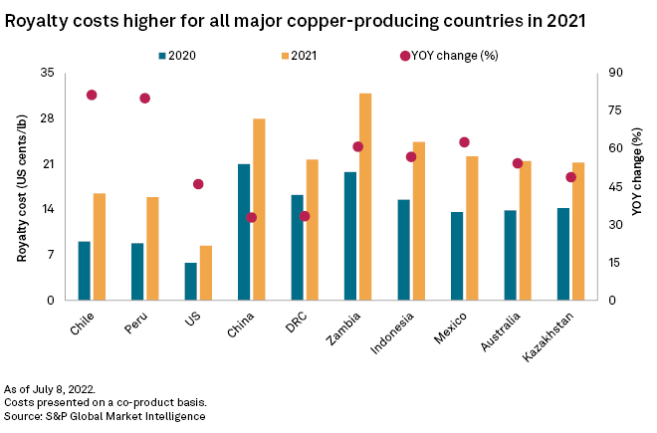

Royalties and production taxes in some major copper-producing countries are typically calculated as a percentage of revenue or profit, translating to higher royalty costs when prices increase and vice versa. With molybdenum, silver and gold metal prices rising 83.7%, 22.3% and 1.6% year over year, respectively, royalty costs rose 64.4% in the same period, to 19 cents/lb of the total AISC.

Sustaining capex grew 14.9% year over year in 2021, following tight capital spending in 2020. This is in line with higher reported sustaining capex among major copper-producing companies, including Southern Copper Corp., with 38.3% growth to $335 million; Glencore PLC, with 41.5% growth to $1.75 billion; First Quantum Mineral Ltd., with 38.9% growth to $443 million; and Antofagasta PLC, with 20% growth to $839 million. Overall, the sustaining capex accounted for 15.1%, or 32 cents/lb, of the total AISC.

Inflation, diesel price to drive AISC 3.5% higher in 2022

Using macroeconomic consensus forecasts, we estimate the AISC will increase to $2.19/lb in 2022, up 3.5% year over year. Minesite costs will increase to $1.34/lb of the total AISC, up 6% year over year — mainly attributable to rising local inflation despite a weak foreign exchange environment affecting labor and other minesite costs. Year-to-date average exchange rates in some major copper-producing countries show weakness against the U.S. dollar — most notably in Chile, the Democratic Republic of Congo and Australia. However, this weakness will not offset the rising input costs in local currency terms. In Chile alone, we estimate the labor cost will rise 7% year over year in U.S. dollar terms.

Brent oil's 2022 year-to-date average price is up 51.4% compared with full year 2021, due to tightness in the oil market. With 88% of copper production coming from open pit mines, we expect the fuel cost component to increase 27.9% year over year to 11 cents/lb of the total AISC.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign

Research

Blog

Location

Products & Offerings