Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 19 Aug, 2022

By Shunyu Yao

Highlights

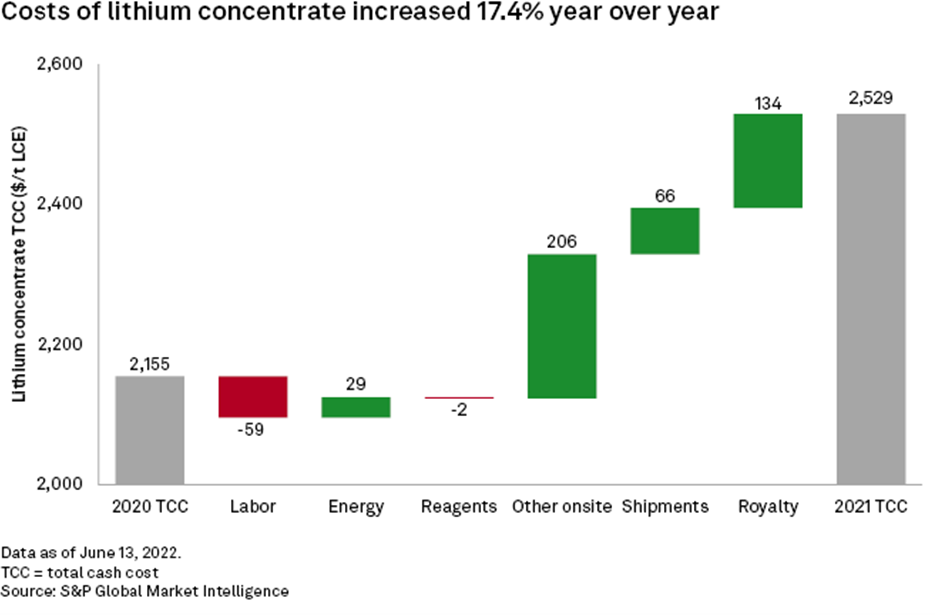

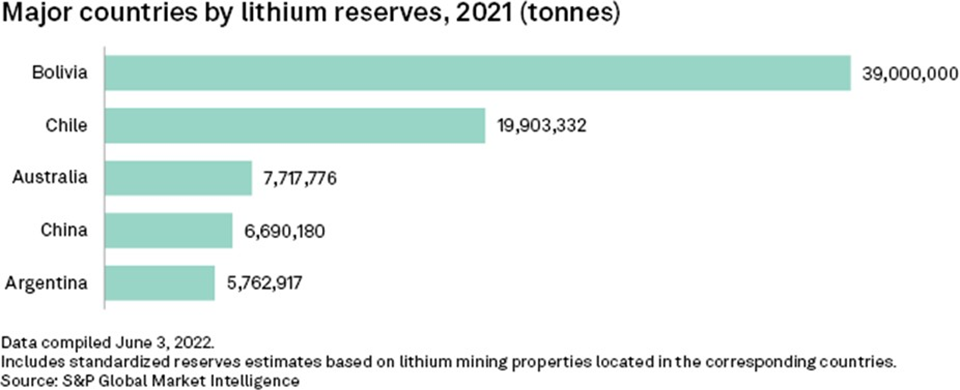

Total cash costs of lithium concentrate operations increased 17.4% year over year to $2,529/t lithium carbonate equivalent, or LCE.

China's high cost of lithium production poses challenges to cut reliance on foreign imports of lithium resources.

The global supplies of raw lithium will increase by about 143% from 2021 to 2026, but that still may not be enough to meet rising demand.

Read our snapshot below or download pdf >.

Lithium costs up in 2021, continuing to surge in 2022

Lithium prices skyrocketed in the December 2021 quarter after gently ramping up earlier in the year. The Battery- grade Lithium Carbonate EXW China price closed at $41,925 per tonne at year-end, an increase of 485.8% year over year. Against a backdrop of soaring prices, costs of lithium extraction from hard-rock ores and brines also rose. According to S&P Global Market Intelligence data, total cash costs of lithium concentrate operations increased 17.4% year over year to $2,529/t lithium carbonate equivalent, or LCE.

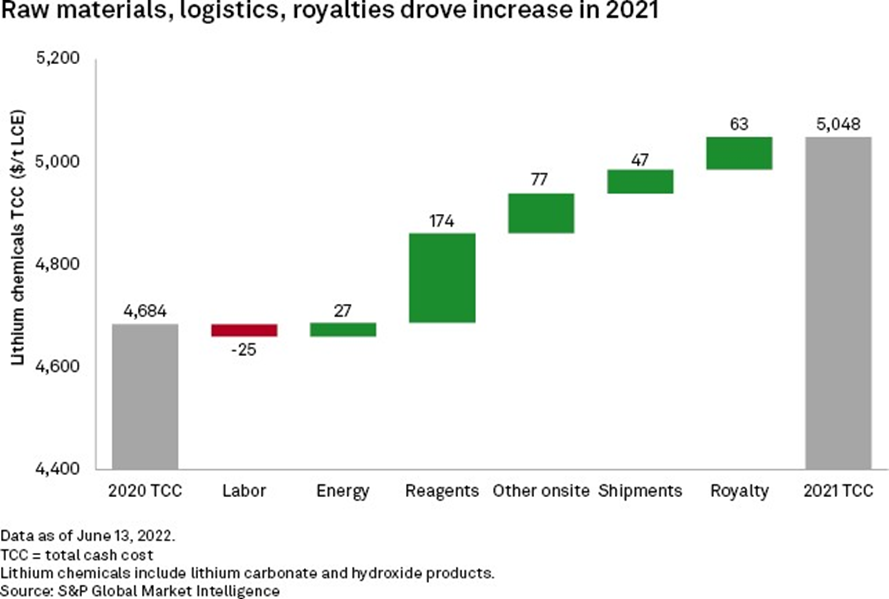

Raw materials and logistics were the key drivers of cost increases in 2021

Total cash costs of lithium chemicals — lithium carbonate and lithium hydroxide products — increased from $4,684/t LCE in 2020 to $5,048/t LCE in 2021. Looking at each component of total cash costs, we found that raw materials and logistics were the main drivers of cost increases. Labor costs of lithium concentrates declined by $59/t LCE and labor costs of chemical products declined $25/t LCE in 2021. Lithium total cash costs are expected to continue rising in 2022, and royalty costs will be a major contributor. S&P Global Commodity Insights forecast the lithium carbonate CIF Asia price to average $41,708/t in 2022, more than triple that of 2021. Surging prices will increase lithium concentrate producers' royalty costs at the same rate.

High battery metal costs add to electric vehicle sale slowdown

Rising battery metal costs have contributed to a slump in electric vehicle sales, slowing the transition to a low-carbon economy. The average cost of making lithium-ion batteries used for EVs is increasing for the first time in roughly a decade, largely due to the inflated cost of key metals including lithium, cobalt and nickel. The trend has been toward lower costs for years as manufacturers scaled up production. But recent inflationary pressures on these raw materials have forced EV producers to increase the prices of their cars, together with pandemic related lockdowns in China and supply chain challenges in the opening weeks of the second quarter. Sales of EVs plunged 35.6% in April in China, the U.S. and Europe's top four markets.

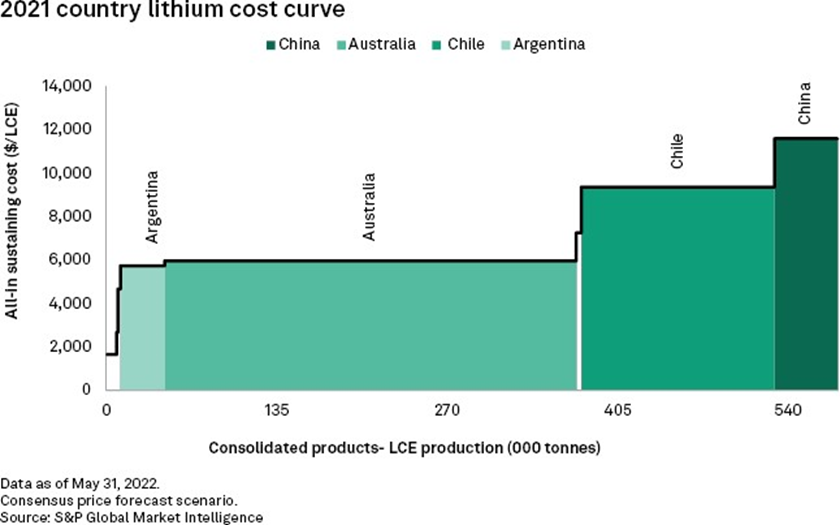

China's high cost of production poses challenges to cut reliance on foreign imports of lithium resources

The transaction value of Chinese domestic lithium deals reached 16 billion Chinese yuan in the first five months of 2022, more than double the annual record set in 2021, according to S&P Global Market

Intelligence and data collected from company announcements on a best-efforts basis. Despite

domestic costs for acquisitions and operations being far higher than overseas, Chinese companies are now rushing to acquire lithium at home to reduce geopolitical risk. Chinese production has its own cost struggles, as many domestic projects are located in remote locations amid rugged terrain, and the chemistry of its brine makes processing more expensive than brine from certain other places.

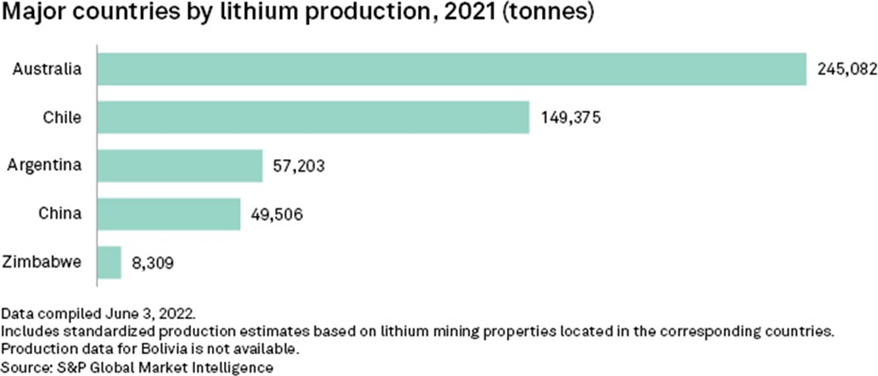

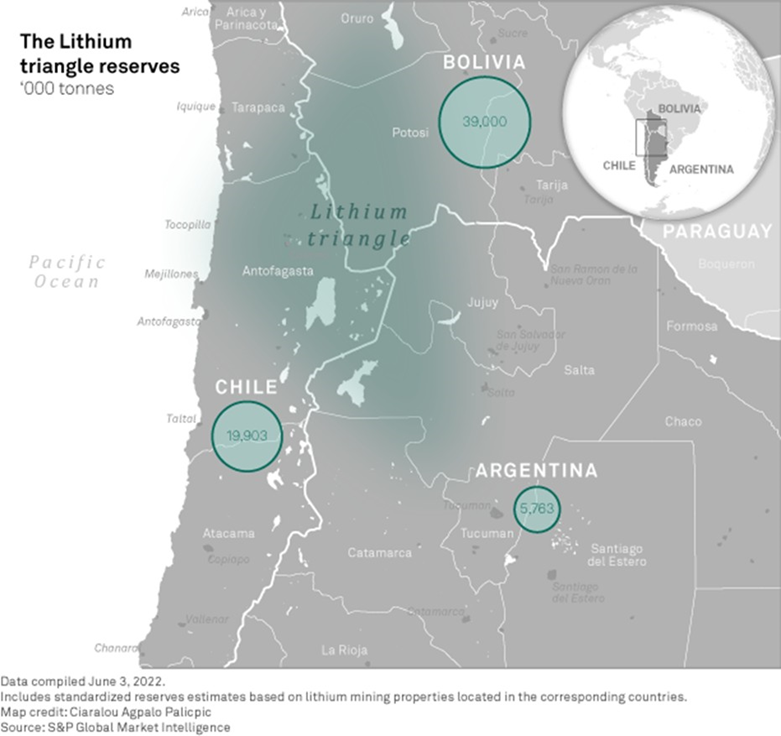

Chile at risk of missing lithium boom amid political, policy instability

According to S&P Global Commodity Insights, the global supplies of raw lithium will increase by about 143% from 2021 to 2026, but that still may not be enough to meet rising demand. With lithium prices soaring through most of 2021 and 2022, major miners have been eyeing Chile as a potential new source of the white metal. But Chile has been failing for half a decade to create a legal framework to sell concessions to developers to extract its 19.9 million tonnes of lithium reserves, according to S&P Global Market Intelligence data, and the country has only issued a handful of permits. The country's inability to capitalize on its reserves allowed Australia to surpass it in 2017 and become the top global lithium supplier, according to United States Geological Survey data.

Bolivia is eyeing to become a major lithium producing country by 2030

In the lithium rush unfolding in South America, Bolivia has lagged Argentina and Chile, its neighbors in the Lithium Triangle. Now, President Luis Arce is trying to change that. Bolivia's vast salt flats harbor an estimated 39 million tonnes of lithium reserves, according to S&P Global Market Intelligence, enough to make the country a significant supplier in a market that is expected to explode over the next decade.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro

Blog