Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Aug, 2022

Highlights

Barrick has moved from a net debt burden of $4 billion at the time of its merger announcement with Randgold in September 2018 to a net cash position, while returning $2.5 billion of cash to shareholders, including a record distribution of $1.4 billion in 2021.

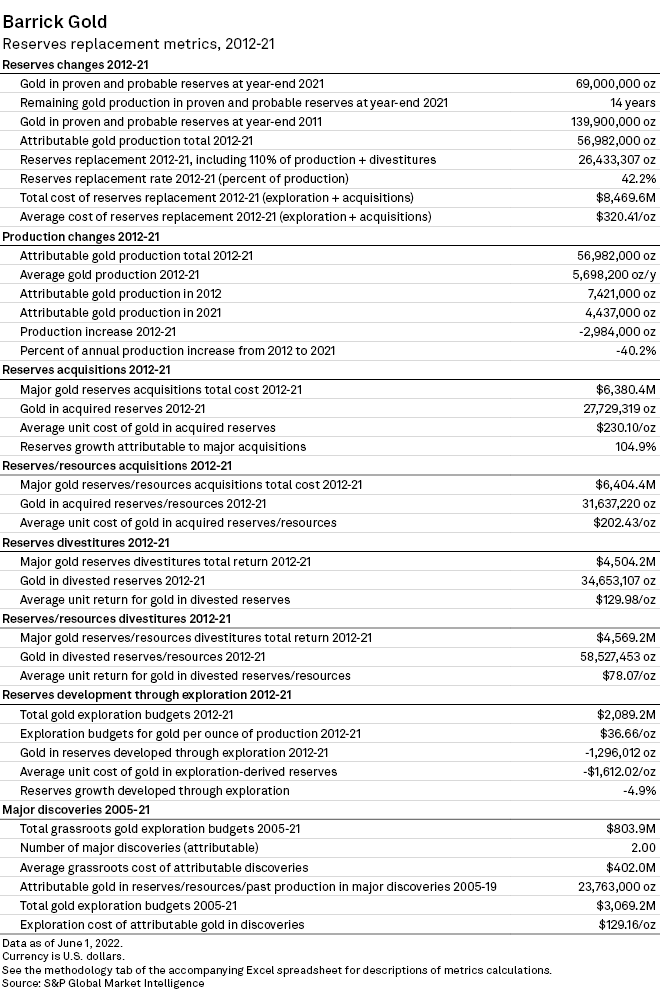

During the 2012-21 period, Barrick replaced 26.4 million ounces of gold reserves, entirely from M&A.

Barrick remains focused on high-margin, long-life operations and projects clustered in the world's most prospective gold districts, and supporting these with a robust copper business.

Following almost a decade of retrenchment, Barrick Gold Corp. has regained its footing after a series of transformative deals in the past several years, including the successful merger with Randgold Resources, the consolidation of its Nevada mines with those of rival and partner Newmont Corp., the amicable resolution of a long-running dispute between subsidiary Acacia Mining PLC and the government of Tanzania, and the subsequent integration of Acacia’s assets into Barrick’s growing portfolio of low-cost, long-life mines.

While ceding the title of the world's top gold miner to Newmont, Barrick has moved from a net debt burden of $4 billion at the time of its merger announcement with Randgold in September 2018 to a net cash position, while returning $2.5 billion of cash to shareholders, including a record distribution of $1.4 billion in 2021.

Our analysis of Barrick's strategies is based on a detailed compilation of its activities over the 2012-21 period, part of the Strategies for Gold Reserves Replacement study, which includes analysis of the world's top five gold producers in 2021. These compilations show the relationships between each company's production, reserves, costs, exploration budgets, acquisitions, divestitures and gold discoveries during the period.

S&P Capital IQ Pro Metals & Mining users can access the Barrick Gold RRS databook here.

During the 2012-21 period, Barrick replaced 26.4 million ounces of gold reserves, entirely from M&A. Although the company replaced less than half of the gold it produced during the period, the 57 Moz it churned out was more than 4 Moz more than that produced by Newmont, its nearest competitor, which had 52.7 Moz of output.

Following $13 billion of write-downs in 2013, Barrick placed 12 mines under review, representing about 25% of the company's output at the time. Operations with all-in sustaining costs of more than $1,000 per ounce were put on the block to improve free cash flow.

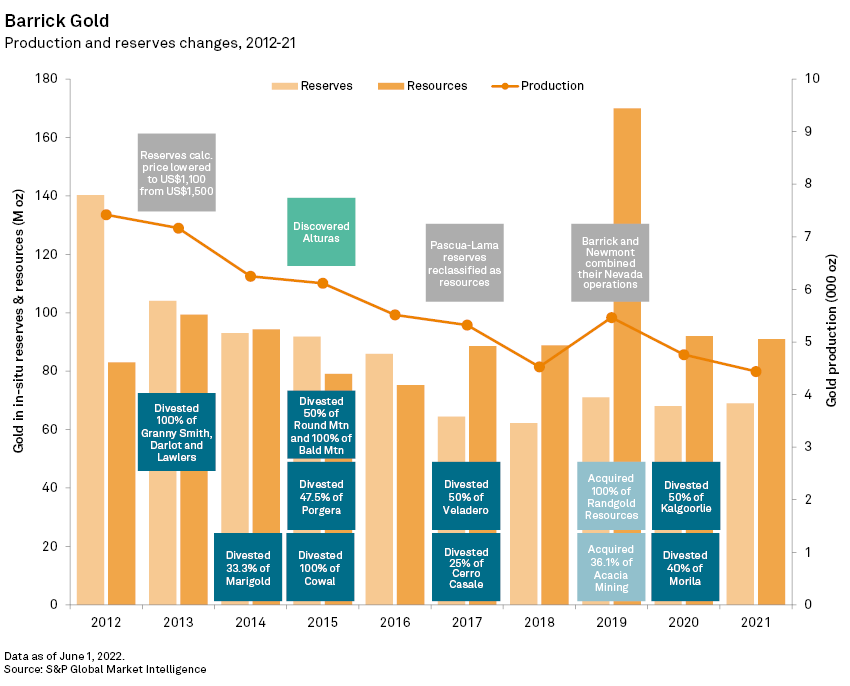

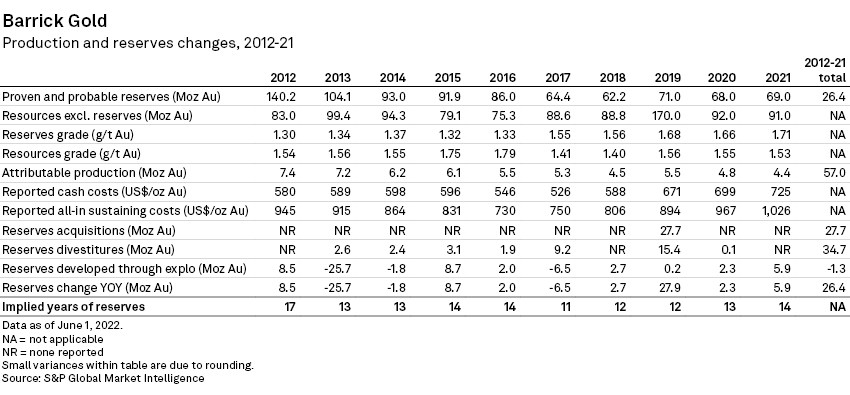

Barrick's production dropped from almost 7.4 Moz in 2012 to 4.4 Moz in 2021, a decrease of 3 Moz. Despite the significant decline in production, Barrick's implied remaining reserves life dropped from 17 years in 2012 to 14 years in 2021.

During the 2012-21 period, Barrick's proven and probable reserves were halved, to 69 Moz from 140 Moz, due to a number of different factors. Reserves dropped by over 36 Moz in 2013 when Barrick lowered the price used to calculate reserves to $1,100/oz from $1,500/oz. In 2017, more than 14 Moz of reserves were reclassified as resources at the struggling Pascua Lama project on the border between Argentina and Peru. In 2019, reserves at the Lagunas Norte operation in Peru and the phase six pit pushback at Hemlo in Canada were reclassified as resources. Finally, the divestiture of numerous noncore assets over the past 10 years has removed more than 25 Moz of reserves from the company's books. As a result, Barrick posted negative 1.3 Moz of reserves growth attributed to exploration during the 2012-21 period. The company can nevertheless boast 69 Moz of gold in proven and probable reserves at the end of 2021, the world's third-largest reserves position, behind Polyus Gold and Newmont.

Period of transformation

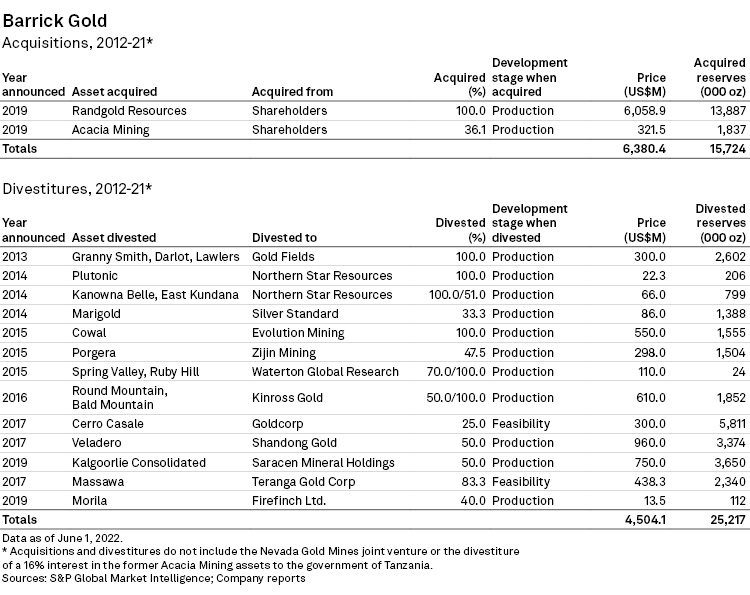

Announced in September 2018, Barrick's $6.06 billion all-share acquisition of Africa-focused Randgold Resources brought it four significant mines — Kibali, Loulo-Gounkoto, Morila and Tongon — producing a total of 1.1 Moz of attributable gold and hosting about 14 Moz of proven and probable gold reserves. Arguably, Randgold's most valuable asset, however, was its CEO, Mark Bristow, who has proceeded to transform Barrick through a series of successful deals.

One month after Bristow officially took the reins, Barrick announced a $17.8 billion hostile takeover bid for Newmont. Colorado-based Newmont rejected the attempt, opting instead for its previously announced plan to acquire Goldcorp. In March 2019, Barrick withdrew its offer and announced an unexpected agreement, years in the making, between the two companies to combine their Nevada operations. With Barrick holding a 61.5% interest as operator and Newmont taking the remaining 38.5% stake, the Nevada Gold Mines joint venture is the world's largest gold-mining complex and at least twice the size of the next-largest operation. Barrick contributed its Goldstrike, Cortez, Turquoise Ridge, Goldrush and South Arturo properties to the joint venture, while Newmont brought its Carlin, Twin Creeks, Phoenix, Long Canyon and Lone Tree projects.

In September 2019, Barrick regained full control of its troublesome, 63.9%-held subsidiary Acacia Mining, acquiring the remaining 36.1% of shares it did not already own. In short order, Bristow proceeded to settle Acacia's longstanding dispute with the government of Tanzania. Terms of the agreement included a $300 million payment to settle all outstanding tax and other disputes, lifting of a concentrate export ban, sharing of future economic benefits from the mines on a 50/50 basis and establishing an Africa-focused international dispute resolution framework. In conjunction with the agreement, a new operating company called Twiga Minerals Corp. was formed to manage the Bulyanhulu, North Mara and Buzwagi mines.

Continuing with its policy of selling noncore assets, Barrick banked $750 million from the sale of its 50% stake in the Kalgoorlie super pit at the end of November 2019 and then sold its 83.3% interest in the Massawa project in Senegal in March 2020 for proceeds of up to $430 million.

Bristow is also trying to resolve a dispute in Papua New Guinea whereby the government is seeking increased benefits from Barrick's 47.5%-owned Porgera gold mine, in which Zijin Mining Group Co. Ltd. also owns 47.5%. As of April, Barrick has planning to open Porgera in 2022 through the execution of framework and starting agreements with the Papua New Guinea government.

In March 2022, Barrick agreed to sell its entire 12.9% stake in Skeena Resources Ltd. to an unnamed Canadian investment dealer for $105.5 million. Skeena owns the Eskay Creek gold project and has a 40% interest in the Snip gold project, with Hochschild Mining PLC owning the remaining 60%, both in British Columbia.

Growth driven by drill bit

Barrick's exploration department, still led by long-time industry veteran Rob Krcmarov, executive vice president for exploration and growth, can claim credit for just over 10%, or 3.9 Moz, of the company's reserves growth during the 2012-21 period. With gold exploration budgets totaling $2.09 billion, the average unit cost of gold in exploration-defined reserves was an expensive $549.27/oz. In a number of recent presentations, Bristow has mentioned returning to a "fresh geology-focused approach" to exploration.

Barrick's exploration focuses on highly endowed gold districts where it controls large land positions, principally the Goldstrike and Cortez districts in Nevada, the El Indio district in Chile and Argentina, and the Lake Victoria goldfields of Tanzania. It also continues to explore earlier-stage projects and evaluate opportunities in emerging districts worldwide.

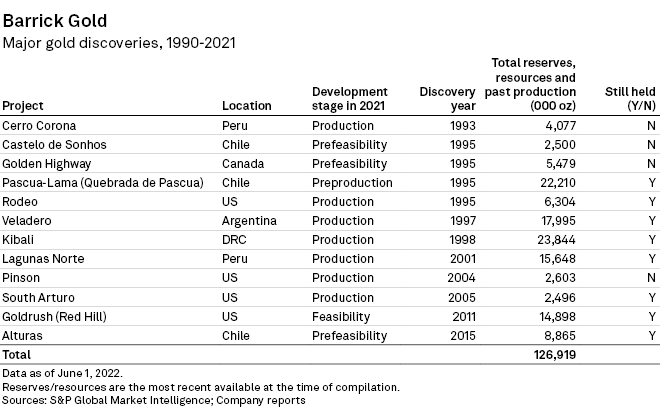

Barrick has shown considerable success in finding new orebodies, particularly in Latin America and Nevada. With grassroots exploration budgets totaling $803.9 million from 2007 to 2021, the company is credited with two major gold discoveries, both of which it still holds, containing 23.8 Moz of gold in attributable reserves, resources and past production. When we include discoveries back to 1990, Barrick is credited with a total of 12 major discoveries hosting almost 127 Moz of gold.

For S&P Capital IQ Pro Metals & Mining users only – For a detailed look at all the major gold finds over the past 10 years, please see Gold RRS 2022 — Surge in recent discoveries.

Growing from stable base

Barrick remains focused on high-margin, long-life operations and projects clustered in the world's most prospective gold districts, and supporting these with a robust copper business. The company now holds six tier-one gold operations, which it defines as mines with annual production of more than 500,000 ounces, a mine life of at least 10 years and total cash costs in the bottom half of the industry range. The operations all have rolling 10-year plans, providing a stable and sustainable production profile.

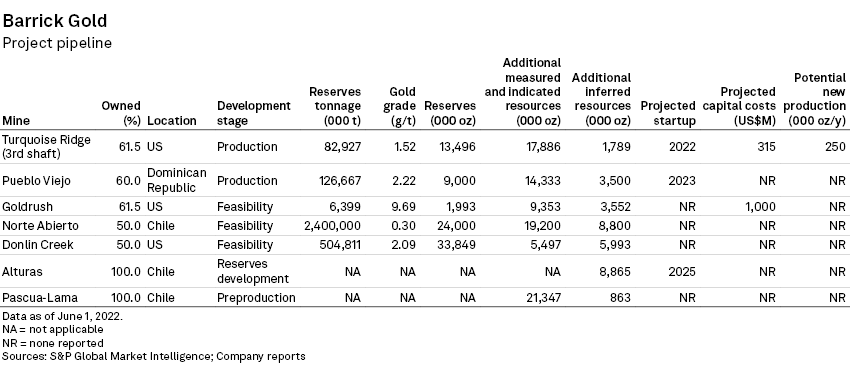

In the near term, Barrick has a pipeline of low-risk, organic brownfields growth projects, including the Turquoise Ridge underground expansion and the Goldrush project, both in Nevada.

In Nevada, the recently updated Goldrush feasibility study delivered a project that meets Barrick's investment criteria; together with the Fourmile project, it will eventually be included in the Cortez complex, securing Cortez's future as a tier one asset.

Also in Nevada, the $300 million-$330 million Turquoise Ridge expansion will nearly double output to more than 500,000 oz/y. A third shaft will enable access to new areas of the deposit and is expected to reduce operating costs, increase mining productivity and increase the total life of the mine. Initial production from the new infrastructure is expected in 2022, with sustained production to start in 2023.

At its 60%-owned Pueblo Viejo joint venture with Newmont, which owns 40%, in the Dominican Republic, a plant expansion and new tailings facility will increase throughput to 14 million tonnes per year and maintain average gold production of about 800,000 oz/y well into the future. The plant expansion is due for completion by the end of 2022; once permitting of a new tailings facility is completed, more than 11 Moz of gold will be unlocked, extending production from 2028 to the mid-2040s.

Barrick maintains long-term greenfields optionality from a number of significant projects — including Donlin, Pascua-Lama, Norte Abierto and Alturas — which together host almost 80 Moz of attributable gold.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Blog

Research