Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Oct 03, 2023

By Matt Chessum

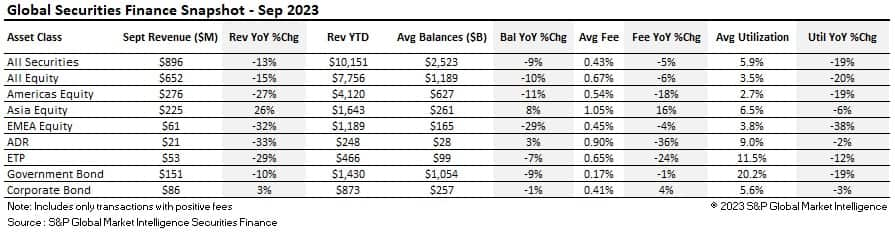

Securities lending activity generated $896M in revenues during the month of September. This is the lowest revenue generating month of the year so far and the first time during 2023 that revenues have fallen below the $1B per month mark. September's revenues were also the lowest seen since October 2022. As can be seen from the table above, most asset classes experienced YoY declines in revenues, balances, fees, and utilization during the month. In the equity markets, the only region to see any revenue growth was the APAC region. EMEA equity revenues continued to decline, and Americas equities returns fell following a substantial decline in specials revenues.

Across the fixed income markets, despite a 3% YoY increase in corporate bond revenues ($86M), monthly returns were lower than those seen during previous months. Many market participants may have become accustomed to seeing double digit increases and monthly returns that are closer to the $100M mark across the asset class since the beginning of the year. Government bonds experienced a 10% decline in revenues YoY along with a fall in average fees, utilization, and balances.

The third quarter of the year was slightly disappointing for securities lending markets when compared on a YoY basis. During Q3, $3.13B in revenues were generated for securities lending participants which is a 7.5% decline when compared with Q3 2022. Average fees across all equities fell to 49bps (-1% YoY) which is lower than during both Q1 (53bps) and Q2 (56bps). Average balances for the Q3 period also declined YoY (-9%) as did utilization (-17%). Lendable increased by 8% over Q3 2022, however. Despite the decline in revenues and general borrowing activity during the quarter, given the strong start to the year, on a YTD basis, annual revenues are still trending 7% higher than at the same point during 2022.

September bucked the trend for financial markets in the US with the major stock markets seeing their first declines in many months. During September the S&P500 fell by 4.85%, the Nasdaq was down 5.36%, the Dow Jones fell by 3.97% and the TSX 60 in Canada declined by 3.53%. During the month US treasury yields reached highs not experienced since pre-financial crisis as the Federal reserved repeated their calls for higher interest rates for longer. As a result, a sell off was seen in the US equity markets as investors preferred the comfort of higher yielding Treasuries over many of the growth stocks that have been experiencing the recent stock price increases.

September was by far the worst month of the year so far for US equity markets with autoworkers on strike, a looming government shutdown and rising energy prices, all providing new pressure points across the US economy and potentially challenging the idea of a soft landing following the US Federal reserve's war on inflation. It appears that the Fed's restrictive monetary policy is finally starting to bite in the US and consumers are starting to feel the pinch.

Over the third quarter, the S&P 500 posted a 3.7% decline, its first negative quarter in a year. Meanwhile, the Nasdaq Composite ended the quarter down 4.1%, its biggest quarterly decline since Q2 of last year.

During the month of September, Americas equities generated $276m in securities lending revenues. This was the lowest monthly revenue number YTD and the lowest seen since January 2022. Daily revenues dipped below the $10m a day mark throughout the month as a sharp decline in average fees was experienced from the end of August onwards. Average fees hit their lowest monthly level of the year so far, standing at 54bps, which represents a decline of 18% YoY and 42% MoM. Average fees were also the lowest seen since January 2022. A fall in balances was experienced throughout the month, also reaching their lowest level of 2023 so far and hitting a multiyear low (lowest since May 2021) ($627B) with an 11% decline YoY and a 3% decline MoM. Utilization fell to 2.73% over the month, falling 19% YoY and 2% MoM, remaining significantly under the 3.2% average seen during 2022.

Over the quarter, securities lending revenues of $1.295B were generated by Americas equities which is 13% lower YoY (Q3 2022 $1.492B). Despite the decline YoY, revenues for Q3 still remain significantly higher than those seen during previous years (Q3 2021 $890M, Q3 2020 $880M). Revenues were lower during every month of Q3 when compared with 2022, with September experiencing the largest decline (July -15%, August -1% and September -27%). A reduction in balances took place throughout the quarter but lendable values increased. Q3 lendable values were 9% higher YoY, increasing by $900M between Q2 and Q3. As a result, average utilization dipped to its lowest quarterly average of 2023 (2.77%).

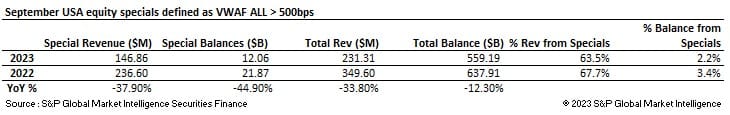

Specials activity for US equities experienced its lowest revenue generating month since April 2021 ($117M) during September. Following the completion of the AMC / APE share conversion and the JNJ / KNVU spin off, specials revenues declined by 61% MoM (Aug $376M) and 38% YoY. The significant decline in specials revenues appears to be the principal driver behind the sharp decline in monthly revenues across the region depicting how important these opportunities have been in supporting revenues across Americas equities over the year. In the US, the percentage of revenue being generated from specials activity fell to 63.5% during September from 79% during August. The proportion of balances linked to specials activity also declined both YoY and MoM (August 3.2%).

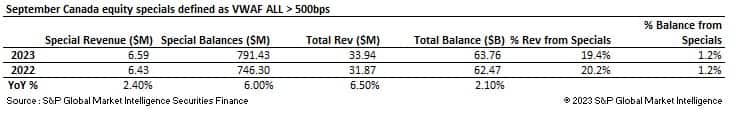

Across Canada, specials activity increased YoY (+2.4%) but declined MoM (-4%). The percentage of revenues derived from specials activity decreased from 23% during August to 19.4% during September. YTD specials revenues are 18% higher than at the same point during 2022 ($67.86M).

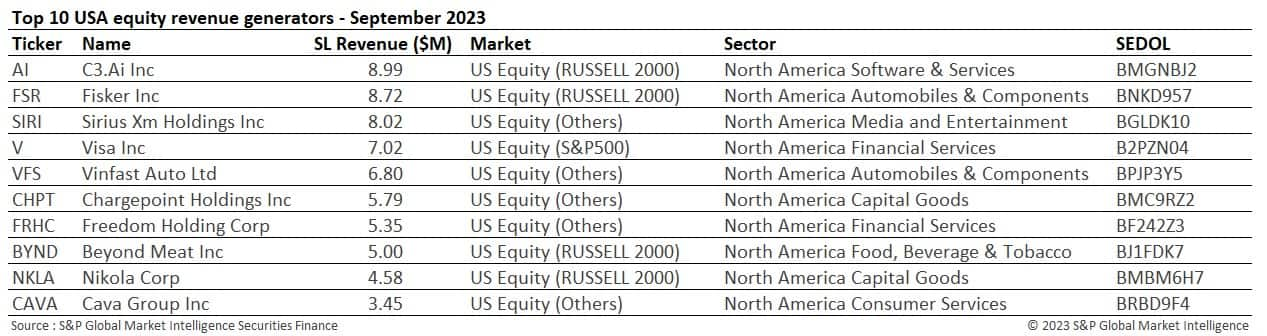

As discussed, the decline in specials activity can be seen in the revenue numbers shown in the US top ten revenue generator list. For the first time this year, no one stock has generated double digit revenues during the month. Many of the names in the list are reoccurring stocks. Vinfast Auto Ltd (VFS) is a SPAC that was for a short period, one of the world's hottest stocks, as its market valuation soared. The rapid increase in price led to an increase in stock on loan as investors remained cautious of the company's valuation.

Cava Group Inc (CAVA), the Mediterranean-themed restaurant chain, is the only new addition to the table throughout the month. This company recently completed its initial public offering in June and was the first restaurant chain to go public since Sweetgreen Inc (SG), another well-known short from 2022, issued shares during late 2021. The company remains loss making but is showing impressive growth rates leading some investors to believe that the company may soon run out of cash.

Across Canada, the energy and banking sector remained in focus with the arrival of third quarter dividends. Canopy Growth Corp (WEED), a producer, distributor and seller of cannabis entered the top ten revenue generator table. Liquidity in this stock within the securities lending market remains tight with active utilization in the stock showing 100%, which continues to push average fees higher.

Stock markets across the Asia Pacific region followed those in the US lower during the month with the ASX 200 down 3.15%, the Heng Seng down 3.65% and the CSI 300 down 2.65%. The Nikkei 225, which has increased by over 22% so far this year, also lost some of the previous month's gains with a decline of 2.61% over the month. Yen weakness, Chinese economic data and possible contagion from the struggles being played out in the Chinese property sector continued to dominate the headlines in the region. In South Korea, the emergence of some meme stocks continued to keep the regulators interested in the securities lending markets and a diplomatic row between Canada and India kept geopolitical risk at the forefront of investors' minds.

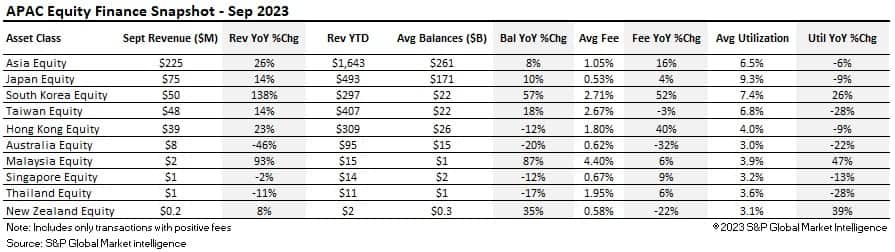

In the securities lending markets, the Asia Pacific region was the best performing region globally during the month, posting increases in revenues (+26%), balances (+8%) and average fees (+16%) when compared YoY. Revenues of $225M were generated during the month, making September the highest revenue generating month of the year so far. Strong increases were seen in both South Korea (+138%) and Malaysia (+93%) YoY, with only Australia and Thailand seeing decreases in revenues during the month. In Hong Kong, revenues also experienced strong increases (+23% YoY and 10% MoM). Average fees have continued to grow in Hong Kong over the year with September posting their highest-level YTD (180bps). The growth in average fees is responsible for the increase seen in revenues throughout the year as balances continue to decline and utilization remains 9% lower YoY (3.96%).

South Korea was the standout market during the month as strong growth in both revenues and average fees pushed the market to second place after Japan (in terms of revenue generation). Interest in the market has grown significantly over the year with balances increasing by over 60% since January. Utilization now also exceeds 7% having started the year just below 5%. This is one of the only markets globally to see an increase in utilization since the beginning of the year.

During the quarter, APAC equities generated $605.4M, making Q3 the best performing quarter of 2023 so far (Q1 $512.97M, Q2 $524.9M). Average fees increased by 11% YoY to 106bps, but utilization declined 5% YoY to 5.22%. Taiwan ($148.3M), South Korea ($141M) and Malaysia ($5.9m) all experienced their strongest quarter of 2023 so far in relation to revenue generation.

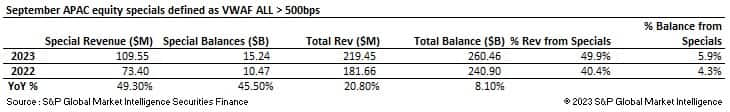

APAC specials revenues increased by 49% YoY to $109.5M, making September the highest revenue generating month for specials activity since March 2019 ($109.78M). Specials revenues YTD of $780.7M currently places 2023 as the best performing year for specials revenues YTD since at least 2008 (+10% YoY). The proportion of overall revenues that were generated by specials activity was 49%. These revenues were generated from a decreasing proportion of the on-loan balance (5.9% Sep vs 6.7% Aug).

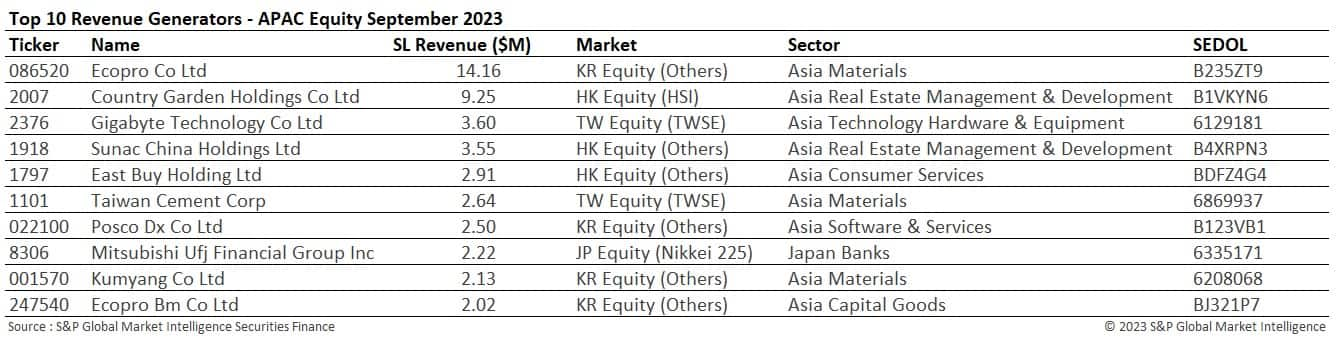

The top ten revenue generators accounted for 20% of the regions revenues during the month. South Korea dominated the table with four out of the top ten stocks listed in the country. Concerns in the Chinese property sector increased borrowing in Country Garden Holdings Co Ltd (2007) and Sunac China Holdings Ltd (1918) during the month. Sunac recently sought chapter 15 protection in a New York bankruptcy court as it looks to restructure $9B of debts. As mentioned in previous snapshots Gigabyte Technology Co Ltd (2376) continued to see the percentage of its shares outstanding on loan increase during the month with utilization surpassing 80% towards the end of the month as its share price remains volatile as the company's profit margins continue to decline.

Eurozone inflation reached its lowest point in nearly two years during the month of September, offering optimism that the recent surge in consumer prices is abating and potentially paving the way for the European Central Bank to halt interest rate hikes. Stagflation concerns remain high across Europe and continue to weigh heavily on investors minds. Across Europe the global sell off in equity markets continued with the CAC 40 falling 3.2%, the DAX down 3.4% and the Eurostoxx 600 declining 3.51%. The UK's FTSE100 was one of the only world stock markets to increase throughout the month as oil traded close to $100 a barrel for the first time since early May benefiting the large cap petroleum companies listed in the country's benchmark index.

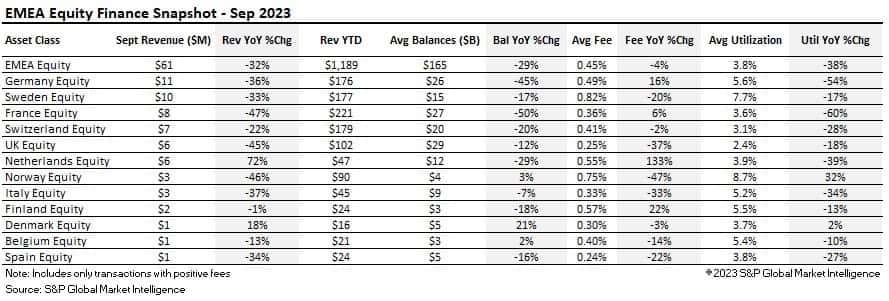

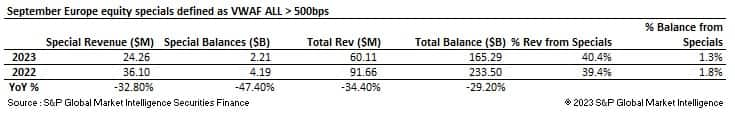

During the month revenues generated by European equities continued to decline. $61.4M was generated during the month making September one of the lowest revenue generating months for EMEA equities for many years. Revenues declined by 32% YoY and 13% MoM. Average fees declined 4% YoY to 45bps marking the lowest average fee since February 2022 (42bps). Balances continued to decline, again, marking their lowest level for many years (-29% YoY, -4% MoM) whilst lendable values increased by 14% YoY. This combination pushed average utilization to 3.84%, another multi-year low.

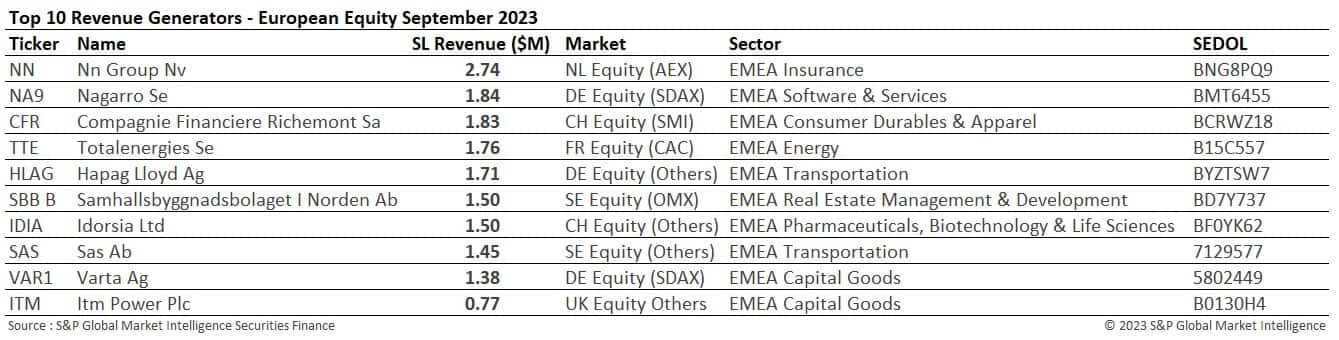

All markets performed relatively poorly over the month, all experiencing double digit declines except for the relatively low revenue generating markets of Denmark (+18%) and the Netherlands (+72%). The Netherlands was the standout market over the month with YoY revenue increases of 72%. Just under 50% of these revenues were originated from one stock, NN Group NV (NN). Average fees increased across German equities over the month (+16%) to 49bps. This represents their lowest level since January however (43bps). A similar picture was seen in the UK where average fees declined to 25bps (-37% YoY, -14% MoM). Revenues in the UK also hit multi-year lows despite continual increases in lendable inventories.

Over the quarter, EMEA equities generated $223.3M. This was 25% lower than during Q3 2022. YTD revenues for EMEA equities are 20% lower when compared with 2022 despite a Q3 average fee of 50bps (+2% YoY). A sharp decline in balances (-27% YoY) coupled with a 12% YoY increase in lendable supply has pushed Q3 utilization to a multiyear quarterly low of 3.95%.

In the specials market, revenues declined to $24.26M accounting for 40% of the total revenues for the region. The specials revenues are generated from a declining specials balance of 1.3% (January specials balances equated to 2.2%). YTD $372.56M has been generated through specials activity which is 9% higher than during the same point in time in 2022.

NN Group NV (NN) was the highest revenue generating European equity during September. During the month the company's share price fell 11% after an unfavourable court ruling regarding the provision of information in relation to the costs of investment linked insurance products that it sold during the 1990s and 2000s.

Nagarro SE (NA9), the second highest revenue generating stock, continues to see a share price that has fallen circa 65% since its all-time highs seen towards the end of 2021. The company was accused of fraud in the Wirtschafts Woche magazine which has affected investor confidence and kept its share price depressed ever since.

Outside of Compagnie Financiere Richemont SA (CFR), which is a luxury goods holding company, many of the other names continue to appear regularly in the table. The luxury goods sector continues to be affected by the slowdown in consumer spending in both China and the US and recently posted slower sales than the market expected in their latest quarterly report.

ADR's generated $20.87M in securities lending revenues during the month which represents a 34% decline YoY but an 11% increase MoM. Average fees for the month, 90bps, also followed the same trend showing a decline of 36% YoY but an increase of 9% MoM. Utilization increased over the period to 8.98% (8.62% during August), marking its highest level since March.

During the quarter, ADR's generated $58.9M in securities lending revenues which is considerably lower (-43%) than during Q3 2022 ($103.2M). Average fees were significantly higher during Q3 2022 (146bps vs 85bps Q3 2023) which helped to drive revenues higher. Balances remained 2% lower during the quarter YoY and utilization declined by 3% to 874bps (vs 901bps during Q3 2022).

During September, Posco Holdings (PKX) was the highest revenue generating stock. The local line of this stock also remained a popular borrow in the APAC equity table. The company has seen a rapid increase in its share price valuation over the last three months (+50%) as retail investors have been buying up the stock. Questions are being asked in relation to whether the company is overvalued and whether the company's growth potential is commensurate with the recent increase in valuation.

ARM Holdings (ARM), one of the largest IPO's of the year so far, also appears in the top five highest revenue generating stocks. Shares in the company started to trade below their initial offering price in the last week of the month raising concerns over whether an IPO revival is still possible.

The news of a revival in the launch of actively managed ETFs and the takeover of Rize ETFs by Cathie Wood's ARK investments were the two biggest ETF related stories of the month. BlackRock also released their August ETF flow data during the month pointing towards a slowdown in investment in ETF vehicles as Global exchange traded funds received $65B of inflows, down from $90B during July.

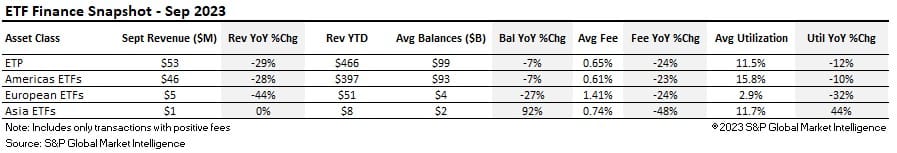

During September, exchange traded funds generated $52.7M in revenues. This represents a decline of 29% YoY and 3% MoM. Average fees continued to decline across all ETP's, with Asian ETPs seeing the largest declined YoY.

During the quarter, exchange traded funds generated $150.2M in revenues which represents a decline of 26% YoY and the lowest revenue generating quarter YTD (Q1 $161.4M, Q2 $154.7M). Average fees for the quarter were 64bps which remained in line with Q2. Balances declined 12% YoY ($93.4B) and utilization fell to 10.48% which was -14% YoY but the highest quarterly figure of the year so far (Q1 10.42%, Q2 10.29%).

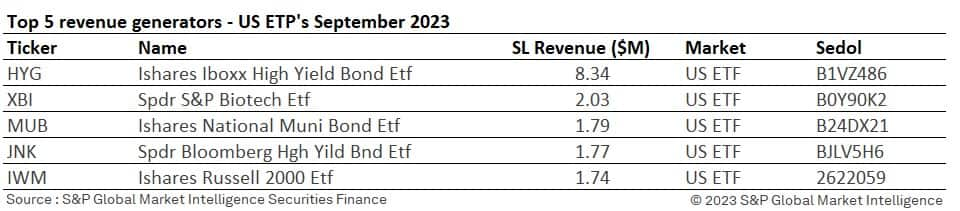

Despite a MoM decline seen in revenues generated by HYG ETF during the month ($8.34M vs $12.04M during August), JNK, the SPDR Bloomberg High Yield Bond ETF re-emerged into the top five highest revenues generating ETFs for September. Recent press reports pertaining to an increase in default rates and an increase in issuance are likely to be fuelling the demand to borrow these types of assets.

As Treasury yields continue to increase because of the selloff being seen across government bonds following the Federal Reserve's "higher for longer mantra", MUB, the iShares National Municipal Bond ETF also reappeared in the table. Prices of Municipal bonds declined across the board during the month, pushing the yields on some 10-year issues to the highest levels seen since November. Continued price weakness is affecting the market, providing opportunities for directional trading strategies.

Across the highest revenue generating European ETF's, VXX continues to generate the highest revenues. This ETF is often used by traders looking to short the VIX which continues to gain traction. Other ETFs offering exposure to markets with onshore lending only capabilities such as India and China remained popular borrows.

Inflation proved to be far stickier in Europe than in the US during the month, with analysts and investors growing concerned over how policymaking and economic conditions will start to differ on each side of the Atlantic. Concerns regarding the speed in the decline in core inflation in the US compared to Europe and the sluggishness seen in the decline in wage growth across Europe are causing a growing number of investors to show a degree of apprehension.

The Federal Reserve once again did as was expected, and voted to hold rates steady during the month, leaving its benchmark interest rate unchanged, while signalling borrowing costs are likely to stay higher for longer after one more hike this year. US treasury yields moved higher as a result with 10 year yields the hitting the highest levels seen since 2007.

The Bank of England followed in the footsteps of the Federal Reserve, halting interest rate increases during the month, as core inflation figures finally started to move lower. The hawkish pause pushed Sterling lower during the month as the Andrew Bailey hinted to markets that he believed that interest rates were close to the top of their cycle but would stay higher for longer than markets were currently priced in.

The European Central Bank decided to raise interest rates by 25bps to 4% during the month however taking the ECB deposit rate above the previous record high recorded in 2001 when rate setters raised borrowing to boost the value of the newly launched Euro. ECB president, Christine Lagarde, refused to confirm whether rates had reached their peak in the ensuing press conference. The Euro slumped to touch its lowest level since May and bonds rallied. Traders now see around a 20% chance of another hike, reflecting growing concern over the region's growth outlook.

In Asia, China's central bank cut the amount of cash lenders must hold in reserve for the second time this year, by 25bps. This represents a move that will help banks support government spending to stimulate growth in the economy. The Bank of Japan kept its negative interest rate and the parameters of its yield control program intact during the month and the Reserve Bank of Australia decided to keep interest rates on hold.

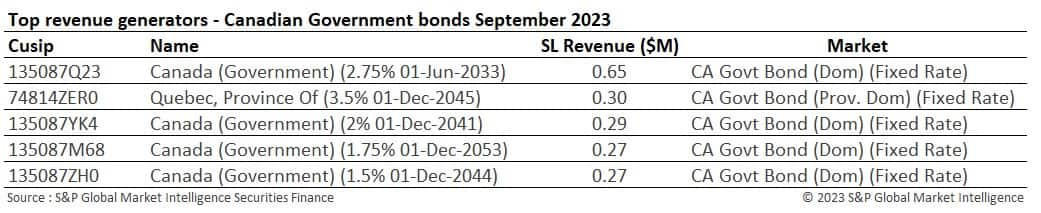

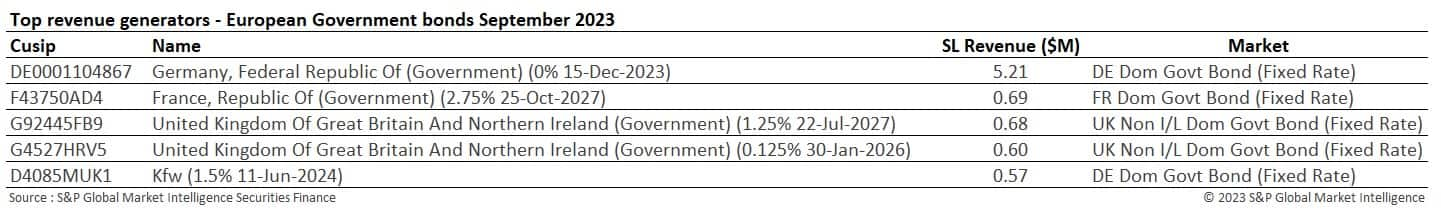

In the securities lending markets, government bond lending revenues dropped during the month with revenues of $150.5M, representing a decline of 10% YoY and 6% MoM. Average fees declined slightly MoM from 18bps to 17bps but the continued decline in balances affected both the headline revenue figures and the level of utilization (-20% YoY).

During the quarter, $464.3M in revenue was generated. Q3 was the lowest revenue generating quarter of the year so far (Q1 $482.4M, Q2 $483.8M). Despite revenues declining during the quarter, when looking YTD, thanks to a very strong Q1 and Q2, government bond lending revenues remain higher than at the same point during 2022 ($1.43B 2023 vs $1.34B). Average fees during the quarter were 17bps, down from 18bps during Q1 and Q2 but utilization declined 19% (20% Q3 2023 vs 24.7% Q3 2022).

Shorter dated issues continued to drive the majority of the specials activity but the emergence of longer dated bonds into the highest revenue generating issues is starting to take place. As central banks appear to be reaching the peak of their hiking cycles those bonds with higher duration risk become more sensitive to the impact of higher rates for longer. As yields have been increasing aggressively in these issues, prices have been falling, which has given rise to an increase in directional opportunities in longer dated issues.

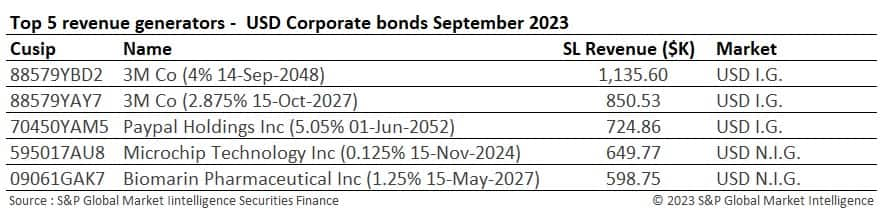

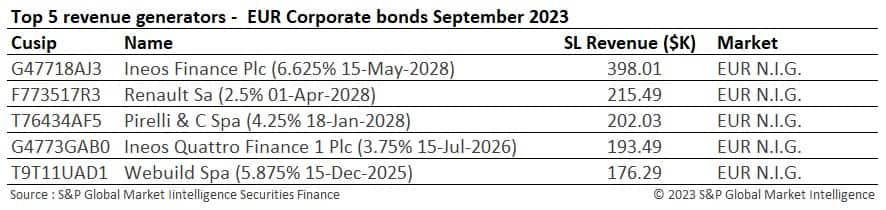

As interest rates have risen aggressively over the last eighteen months, investor interest in corporate bonds has grown. Despite an initial assumption that the rise in rates would put global economies into recession, market data has remained resilient which has amplified investor confidence in an asset class that is offering increasingly higher yields against a buoyant market backdrop. When looking at investment performance, the S&P high yield corporate bond index has increased 6.95% over the past year whilst the S&P Global Developed investment grade corporate bond index has increased by 3.38%.

Corporate bonds have been issued at a record pace throughout the year and September has seen some of the busiest days on record. Not only has September recorded the busiest day since March 2020 for issuance but the total issuance for the week ending September 15th exceeded $50 billion. One trend that has been apparent throughout the recent spate of issuance has been the focus on the short end of the curve. As 30-year Treasury yields have been trading at their highest levels in more than a decade many issuers have been reluctant to lock in the higher funding costs. Shorter duration debt has therefore been the preference in the hope that interest rates fall next year, and refinancing can take place to lock in lower rates. A focus on shorter dated debt has also been a theme within the securities lending markets. Eight out of the top ten highest revenue generating corporate bonds of the year so far from a securities lending perspective have all had maturities of under five years.

In the securities lending markets, the buoyancy of this asset class continues to be reflected in the revenue numbers. Despite posting one of the lowest monthly revenue figures of 2023 so far, September revenues still increased 3% YoY, making corporate bonds the only other asset class, along with APAC equities, that experienced an increase in revenues. Average fees followed suit falling MoM to their lowest level of 2023 so far, 41bps, but posting an increase of 4% YoY.

When looking over the quarter, Q3 revenues performed well. Corporate bonds generated $279.1M over Q3 which represents an increase of 11% YoY. As with many other asset classes, when comparing the revenues YTD, they remain significantly higher than at the same point during 2022 (YTD 2023 $872.9M vs YTD 2022 $687.2M) given the strong start to the year. Average fees trended lower over the quarter (42bps) (Q1 46bps, Q2 45bps), with September seeing the biggest dip of any month during Q3. Utilization declined to 5.61% during the quarter, down from 5.79% during Q2 as lendable increased by 2% and balances declined by 2%.

When looking at the highest revenue generating corporate bonds over the month many of the names remain familiar. 3M Co bonds in the US remain under pressure given the impending fines, water utility companies remain popular borrows in the UK following recent funding issues, and the automobile sector remains popular across Europe as the transition to electric production lines and supply chains increase costs for manufacturers.

Over the past month, data from S&P Global Market Intelligence Repo Data Analytics showed that global volumes in both repo and reverse repo markets decreased whilst haircuts and average terms increased.

Repo volumes: Volume -12.3%, Weighted Average Haircuts +0.02%, Average term increase of 8 days (87.19 days current average).

Reverse repo: Volume -3.3%, Weighted Average Haircuts +0.06%, Average term increase of 6 days (134.39 days current average).

Across the EMEA region, government bond repo volumes decreased by 11% and reverse repo volumes declined by 4.8% over the month. These moves were led lower by a sharp decrease in activity across both Spanish (-20%) and Italian government bond (-15%) repo activity.

A 36% decrease was also seen across French investment grade corporate bond repo volumes over the period despite spreads widening over the month.

Activity across US treasuries was mixed over the month as repo volumes declined by 18% whilst reverse repo volumes increased by 3.5%. Specials activity in the treasury market remained focused on the short end of the curve with the 2023, 2024 and 2026 issues becoming more expensive. Treasuries in the 5 years+ issues cheapened over the month.

Across the corporate bond markets, repo activity across the USD denominated high yield and investment grade bonds generally cheapened over the month with rates declining by 6%. Volumes in both USD denominated investment grade and high yield corporate bonds remained unchanged over the period.

APAC

Government bond markets experienced an increase in volumes during the month of September. Reverse repo volumes increased by 4.3% and repo volumes increased by 2%.

Japanese government bond repo volumes increased by 5% over September whilst reverse repo volumes increased by 8%.

Across the corporate bond markets, the most notable market moves were seen across USD denominated China high yield corporate bond repo activity (+20%), and USD denominated Korea high yield reverse repo (+36%).

September securities lending performance was reflective of a growing uncertainty starting to grip financial markets. A realisation by market participants that higher interest rates are likely to be a reality for some time to come have made investors re-evaluate their current strategies. The sell off during September appears to have impacted securities lending markets, as the reversal taking place in the ongoing trends of increases in market valuations and the hawkish nature of monetary policy starts to unwind.

As we head into Q4, it's possible that securities lending revenues will continue to fall further until either a soft landing in the US can be confirmed or economic data starts to provide clearer signals, offering a greater level of comfort to investors. Despite the decline experienced during September and Q3 however, an exceptionally strong start to the year is likely to help market participants experience a strong 2023.

If you would like to receive further details regarding Q3 performance, please download a copy of our Q3 Securities lending snapshot and ensure that you register for our Q3 webinar that will be taking place on the October 31st at 3pm UK time.

If you are based in New York, please also be sure to register for our upcoming Securities Finance Forum at 1345 6th Avenue. New York, NY 10105 on November 9th, 2023, between 1:00pm - 7:00pm where we have numerous market leaders scheduled to discuss the past, present, and future of the securities lending markets.

To register for the forum and to see the agenda please clickHERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.