Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Aug 29, 2023

By Matt Chessum

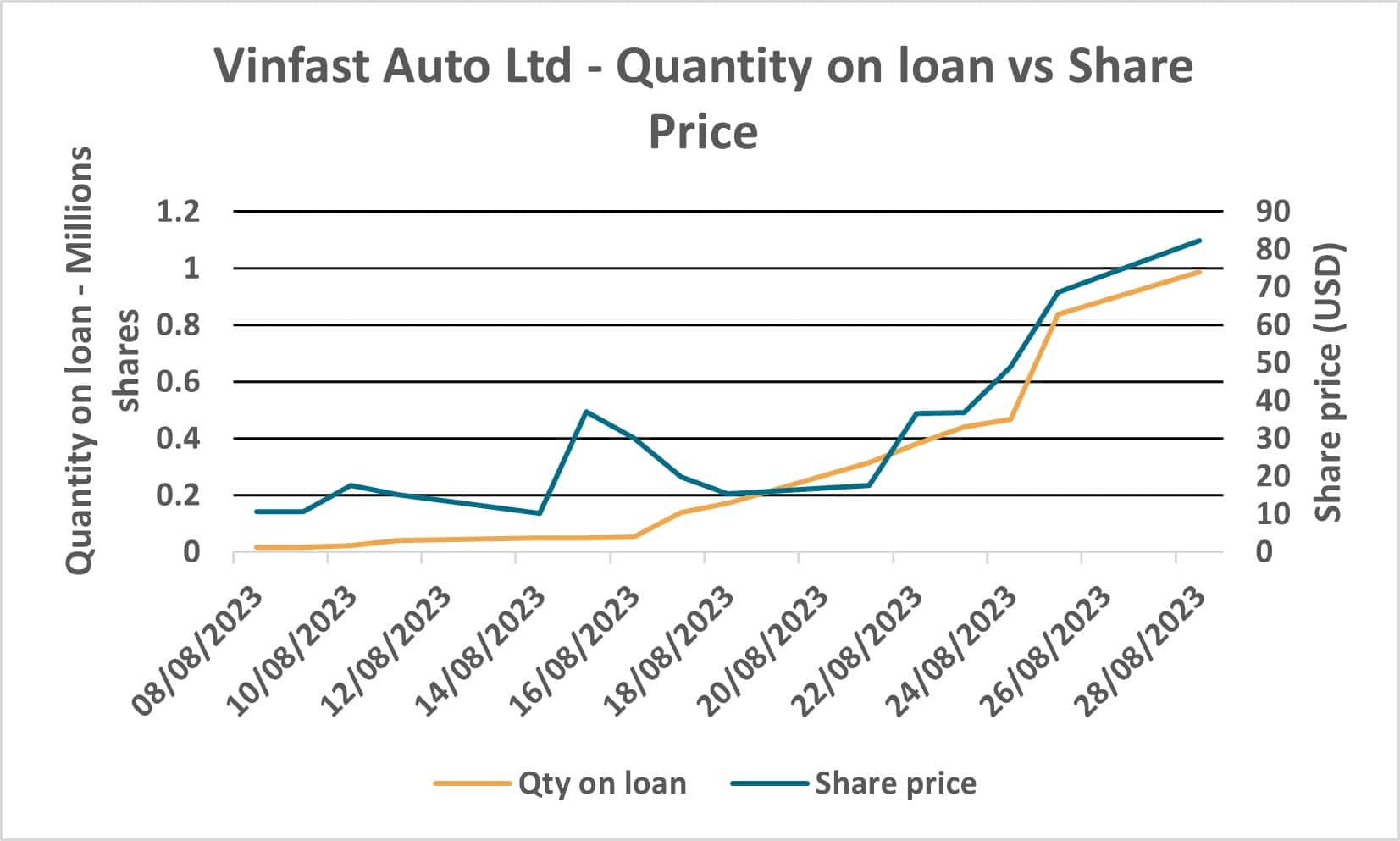

Following its recent SPAC listing on August 15th, Vinfast Auto Ltd (VFS UW) has experienced a rapid increase in its share price. The Vietnamese car maker's $190B market valuation means that it is now larger than at least half of the companies within the Dow Jones Industrial Average. The limited free float of the company and its appeal to momentum-focused retail investors have reportedly helped to push market valuations increasingly higher over the last few weeks despite its lack of revenue generation and general market liquidity.

As the share price has increased, so has the associated level of short interest. The quantity of stock on loan has continued to rise. Utilization has now exceeded 92%, pushing lending fees higher as a result.

The sudden movement in share price along with the limited free float has evoked similarities to AMTD which experienced similar market moves last year.

For more information on how to access this data set, please contact the sales team at: Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.