Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Sep 19, 2023

By Matt Chessum

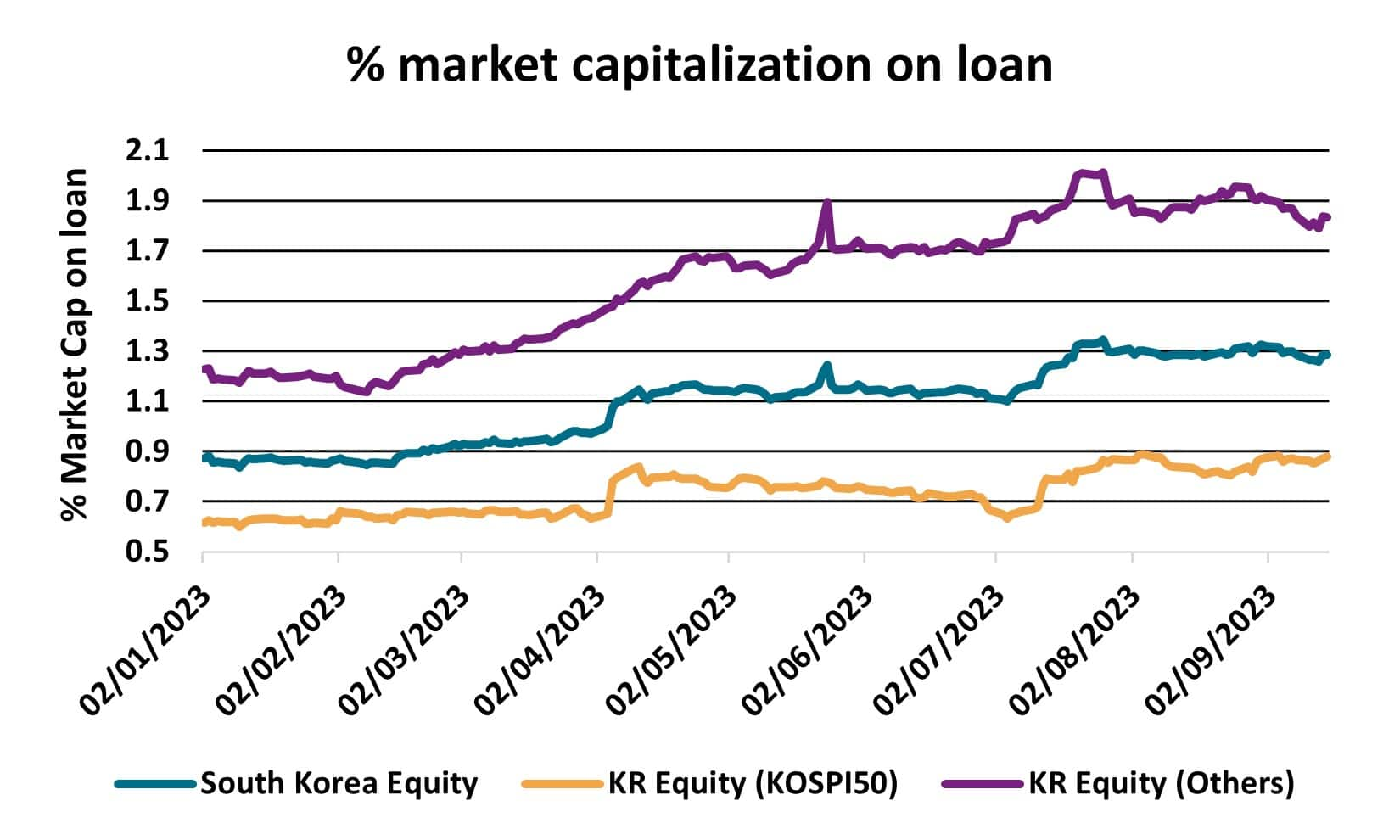

Since the beginning of 2023 the KOSPI index in South Korea has increased by circa 14%. Whilst this is an impressive rise in itself, it's small and mid-cap equivalent, the KOSDAQ has overshadowed this level of return by generating gains of almost 35%. As market valuations have increased, so has the amount of the securities lending activity taking place within the market. The percentage of market capitalization on loan in South Korea has been growing steadily since the beginning of the year reaching a peak of 1.32% across all South Korean equities during August.

Despite impressive growth seen in the valuations of some of South Korea's largest blue-chip equities (Samsung +28% and Hyundai +25%), younger investors are reportedly increasing their investments in "hot" stocks within the technology and science sectors in an attempt to match the performance seen across the KOSDAQ index. A movement towards short-term trading strategies is growing, leading to greater swings in asset prices, which is reminiscent of the characteristics of the meme stock phenomenon seen in the US.

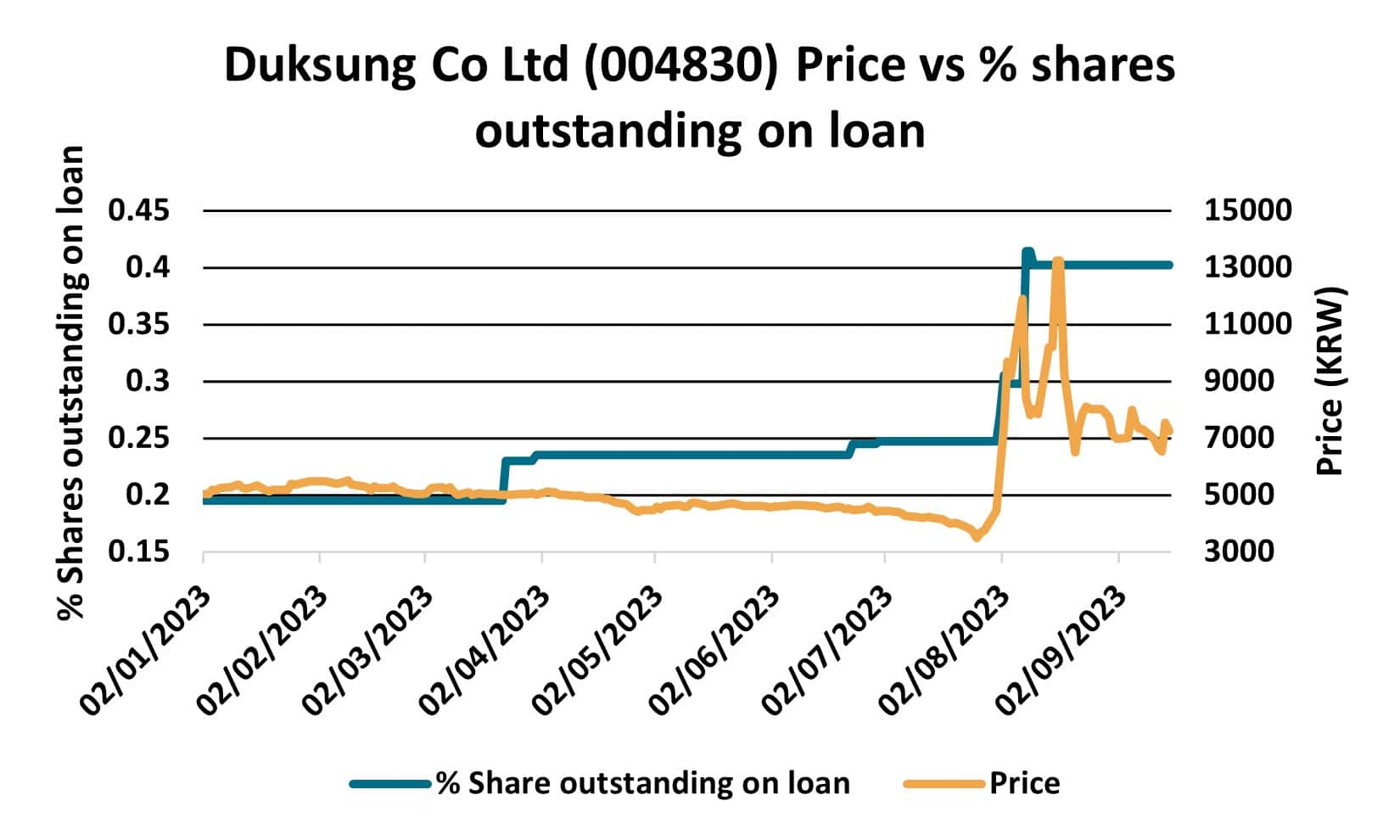

Duksong Co Ltd (004830), a textile company, saw its share price more than triple during August on rumors that it may benefit from the introduction of semi-conductor technology. After increasing so rapidly, the company soon lost over 50% of its gains within a very short period of time. As can be seen from the graph, as the share price increased, so did the percentage of shares on loan in the company, providing opportunities for securities lenders.

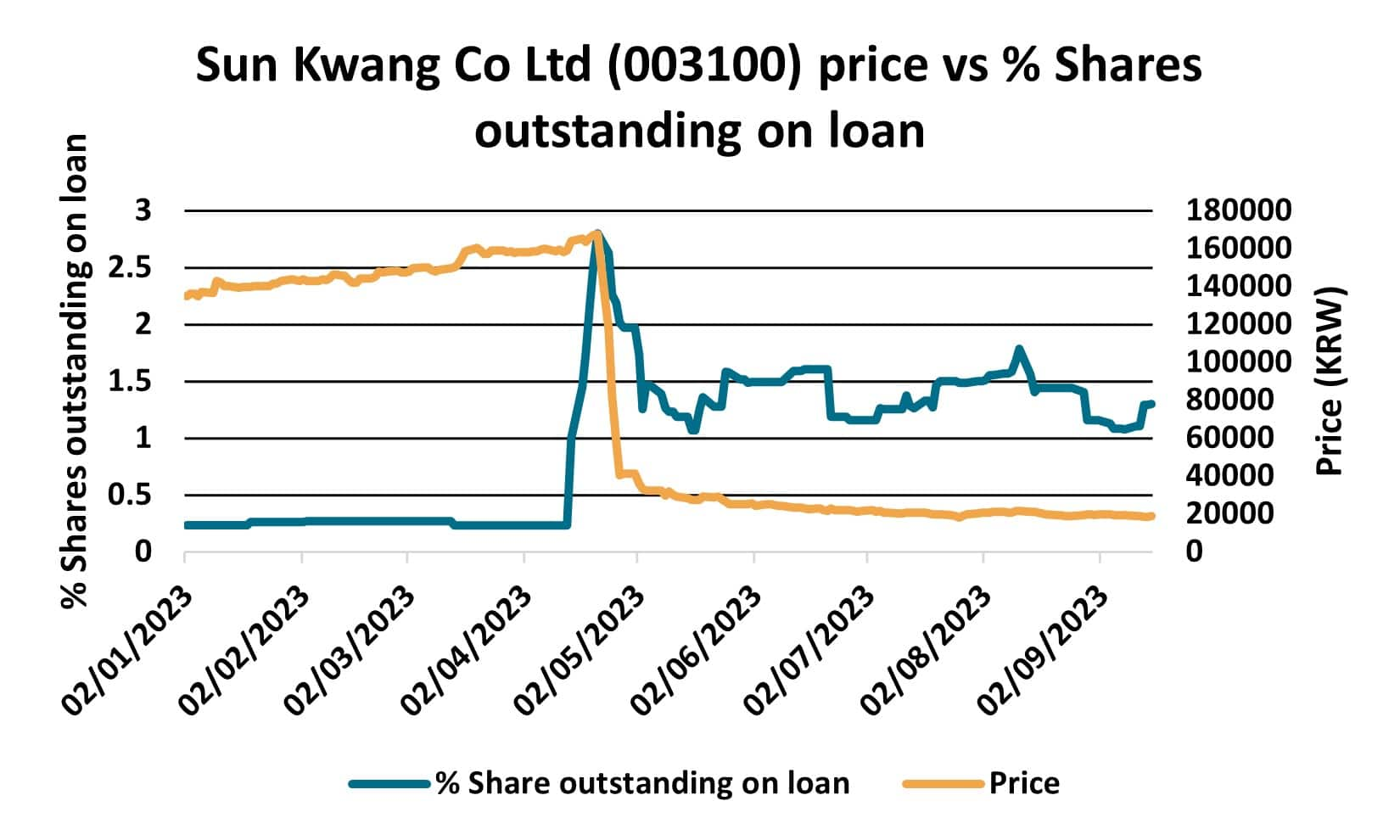

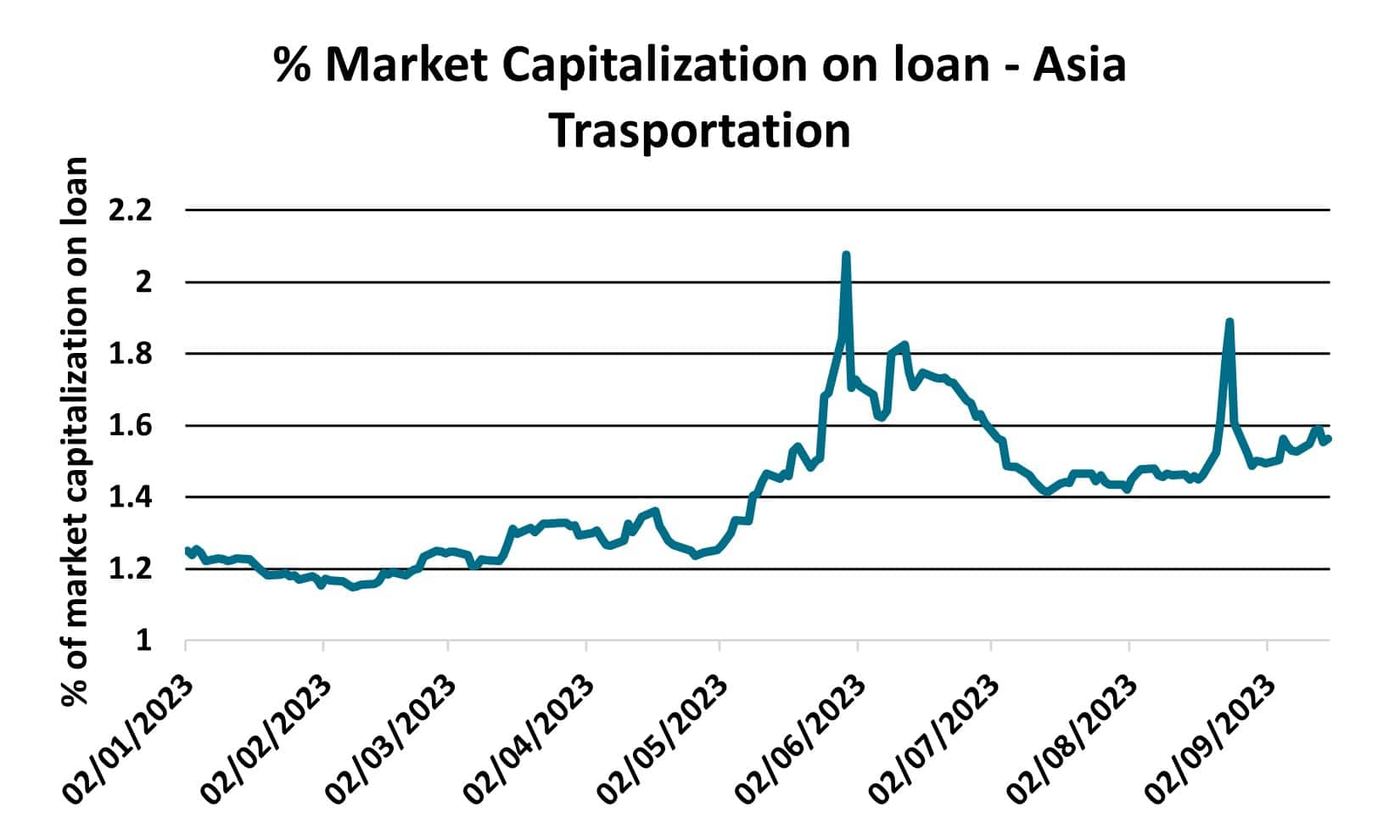

Sun Kwang Co Ltd (003100), a logistics company, also experienced a large movement in its share price earlier in the year, when a decline of 80% of the company's valuation took place within a very short period of time. Logistic companies across the region remain under pressure as the increased freight prices demanded during the pandemic start to normalize, consumption and production in China starts to slow and inflation across the globe reduces consumers disposable income.

As a traditionally conservative market, regulators are keeping a close eye on the behavior of retail investors and the level of price volatility seen within the South Korean market. As a country that is heavily connected to many of the sectors that are currently in demand (electric vehicles, electric batteries, superconductors), when considering the current regional, and global economic and geopolitical themes, the South Korean stock market could be heading for a very interesting period.

For more information on how to access this data set, please contact the sales team at: Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.