Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 27 Jun, 2023

By Sarah Cottle

Today is Tuesday, June 27, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we put the spotlight on the eurozone as it grapples with a technical recession and high sovereign debt levels. Rising interest rates are likely to put further pressure on the economy at a time when borrowing costs are increasing, raising the question of debt sustainability and rekindling memories of the debt crisis in the region in the early 2010s. Six eurozone countries have swollen government debt-to-GDP levels of over 100% including France, Italy and Spain. Meanwhile, eurozone banks are set for a squeeze on profits and liquidity as they prepare to repay almost €500 billion of cheap funding borrowed from the European Central Bank during the height of the COVID-19 pandemic.

US banks are changing their deposit strategies after seeing the new reality about the stickiness of their deposit bases following the recent failures of three regional banks. Customers can now move their money more quickly and easily than ever thanks to digital banking, and social media can only fuel the fire, leading to much faster runs on deposits. In response, banks are adding new stress tests and risk disclosures and increasingly monitoring social media with a focus on association risk.

US retail sales recorded a surprising increase in May, inching up 0.3% month over month and upending economists' expectations that consumer spending would falter. Meanwhile, two companies filed for bankruptcy protection from mid-May through June 14, and the median default risk for retailers receded, according to S&P Global Market Intelligence data.

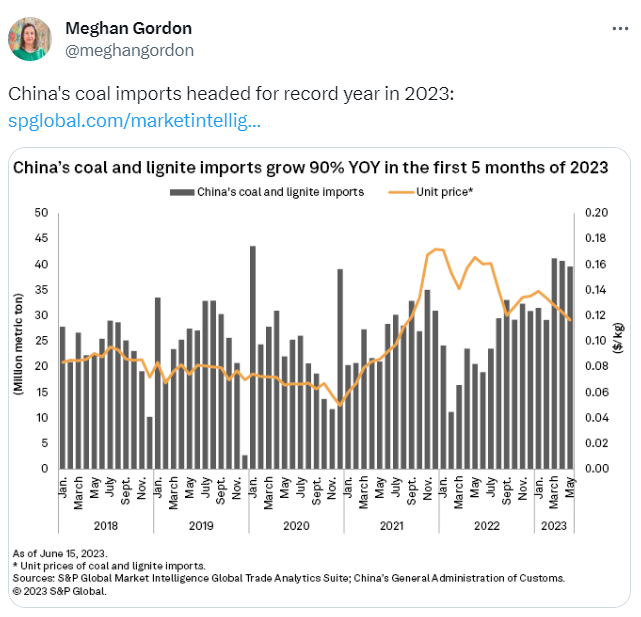

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @meghangordon on Twitter.

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Waqas Azeem

Theme