Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 14 Jun, 2023

By Cesar Pastrana

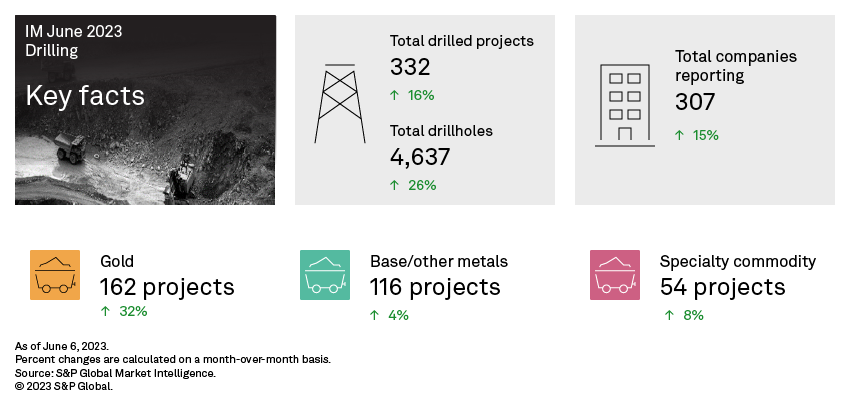

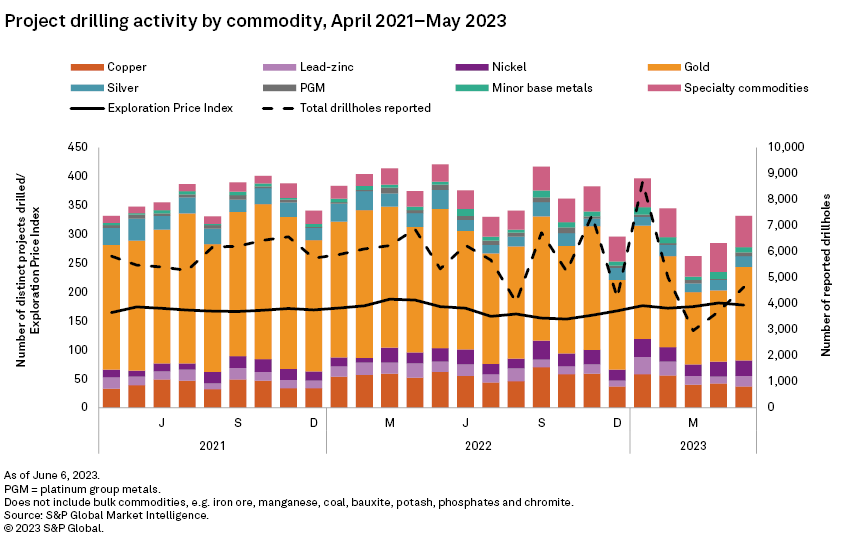

Drilling metrics continued to recover in May, recording another month-over-month increase with 332 total projects drilled. The total number of distinct drillholes reported increased 26% to 4,637 but was 13% less year over year. Gold led with an increase to 162 projects, from 123 projects in the previous month, while base/other metals and specialty commodities also posted increases, albeit lower at 4% and 8%, respectively. The number of projects drilled across all stages of development increased, with late-stage up 19% to 152, while early-stage and minesite were both up 15%, to 133 and 47, respectively.

Drilling at gold projects recovered after a 35-month low, with a 32% increase to 162 projects. Specialty commodities projects were up 8% to 54, led by the all-time high of 40 projects drilling for lithium, compensating for decreases in uranium, vanadium, graphite and tantalum. Base/other metals were up by a marginal 4% to 116 projects. An increase in zinc-lead and platinum group metals projects outweighed the decline in copper, cobalt, molybdenum and tin projects.

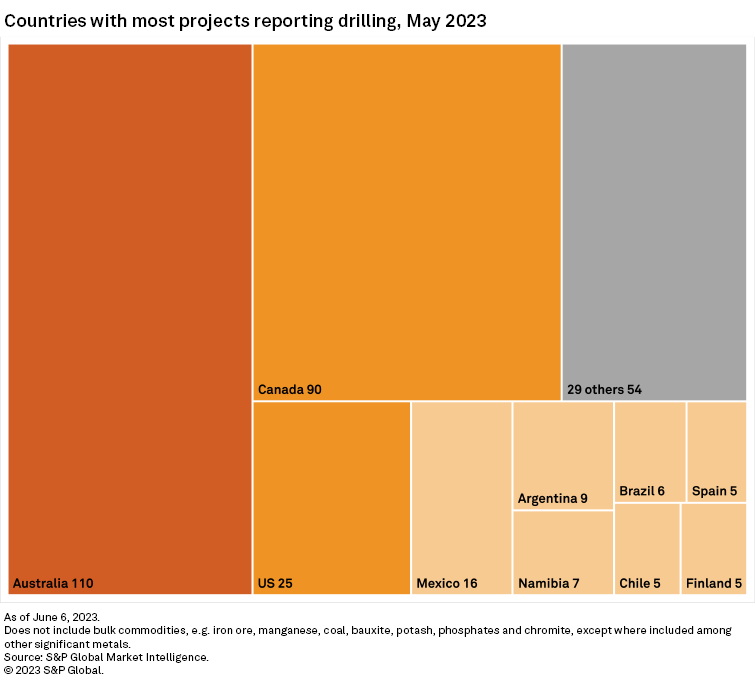

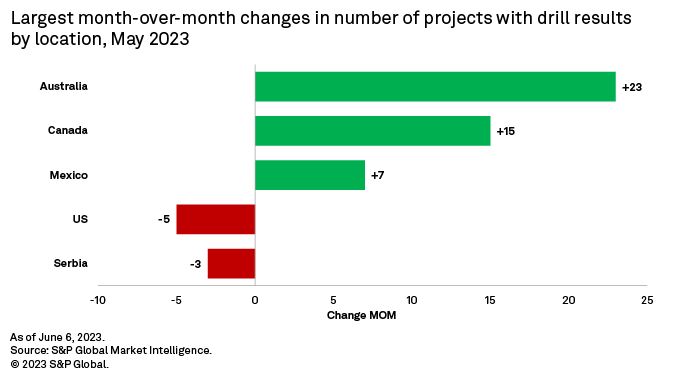

Australia held its top ranking, posting a year high of 110 total projects drilled, along with the largest month-over-month increase of 23 projects. Canada remained second with 90 projects drilled, bouncing back after a decline in the previous month. In contrast to April, the US recorded a decrease for all commodities except lithium, which increased to four projects compared with one in April. Australia accounted for 33% of the monthly total, with gold projects almost doubling, while there were decreases for copper, cobalt, silver and specialty commodities. Canada recorded the second-largest growth month over month, led by an increase in gold projects and the year high for lithium projects.

May's top result came from Australian Securities Exchange-listed Great Boulder Resources Ltd. advanced-stage Side Well gold project in Western Australia with an intersection of 36 meters grading 91.15 grams of gold per metric ton, 12.9 g/t silver and 0.19% copper. In May, the company announced the completion of a 35-hole, 6,134-meter phase two reverse circulation drill program and began a six-hole diamond drilling program at the Ironbark and Mulga Bill deposits.

The second-best result came from TSX-V-listed Patriot Battery Metals Inc. early-stage FCI-Corvette lithium project in Quebec with a 122.6-meter intersection grading 1.89% lithium. As of May, the company had completed an 89-hole, 32,367-meter drill program and planned to begin a summer-fall drill program in late May. However, the company recently said exploration activities were forced to a halt due to the high risk of forest fires over a large portion of the province where the project is located. The company also planned to release an initial resource estimate for Corvette in the June quarter.

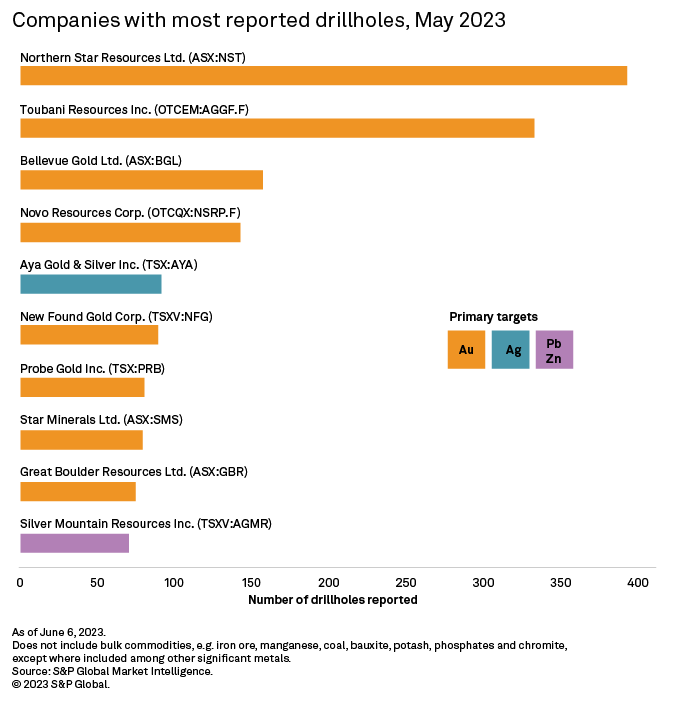

ASX-listed major producer Northern Star Resources Ltd. reported the most drillholes in May, with 353 completed among its six gold mines — five in Western Australia and one in Alaska. The company has maintained its A$125 million exploration budget for fiscal year 2022–23.

The second-highest drillhole total was from Toronto-based Toubani Resources Inc. with 299 completed at its Kobada gold project in Koulikoro, Mali. As of September 2021, the project contains 103.6 million metric tons grading 0.94 g/t Au, containing 3.1 Moz of gold. Following a 13,750-meter drill program, the company said it plans on a step-out and infill reverse circulation drill program to test for extensions to its new gold discovery at Kobada West.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.