Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 23, 2023

By Jingyi Pan

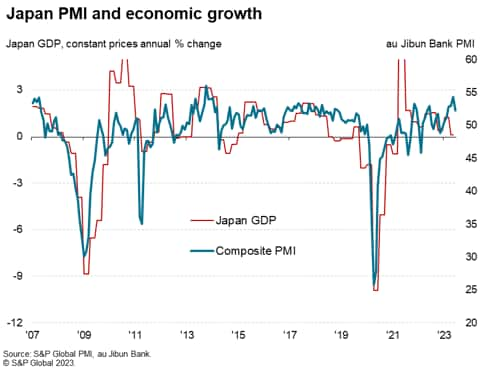

Despite a slowdown in growth momentum from May, as signalled by the latest June flash PMI data for Japan, a solid quarter of growth is expected for Q2 2023. This may well exceed the strong official GDP reading recorded in Q1, with a service sector expansion primarily supporting growth while manufacturing performance lagged.

Meanwhile price pressures remain elevated, but further receded in June. This is in line with Bank of Japan's expectations.

Overall business confidence amongst Japan's private sector firms fell further in June, which suggests that growth may have seen a recent peak, albeit staying strong by historical standards.

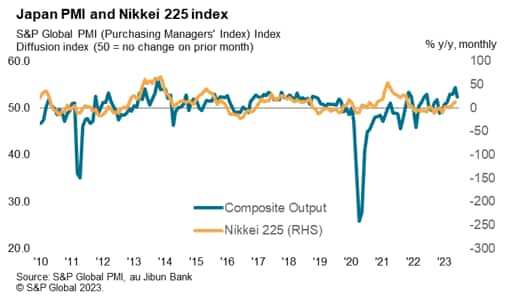

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, fell from 54.3 in May to 52.3 in June. Despite signalling a slowdown in growth momentum from the near decade high in May, the latest reading pointed to still solid expansion of Japan's private sector. Furthermore, June's PMI data marked a continuation of the growth streak that began since the start of 2023.

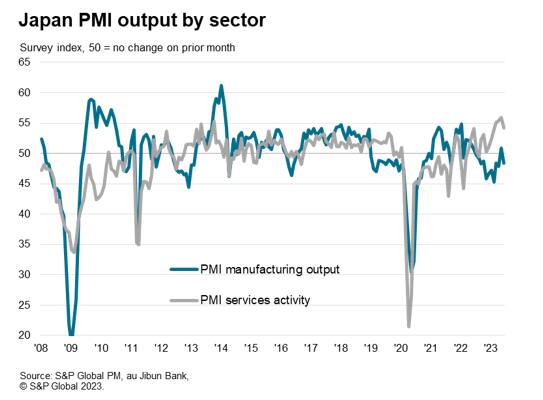

Growth was exclusively services driven in June, as manufacturing output returned to contraction, having now fallen in five of the first six months of 2023. The latest composite output reading is broadly consistent with GDP growing at an annual rate of just under 2%.

After recording the first expansion in manufacturing output in ten months during May, goods production shrank again in June to signal soft manufacturing sector operating conditions. New orders declined, albeit mildly, on the back of continued global destocking and amidst weak demand from key export destinations. This led to lower manufacturing output in June but goods producers also further pared back their input inventory holdings, preparing for further weakness ahead.

Meanwhile services activity remained in expansion but saw the pace of expansion decelerate from the survey record high (since September 2007) in May. The rate of growth nevertheless exceeded the latest 12-month average to indicate a still-solid service sector performance in June. As it is, service providers continue to bask in the upswing for services demand post the easing of COVID-19 restrictions in Japan. Some early signs of the growth momentum having peaked were reflected in the latest June survey, though it remains too early to tell if a further service sector slowdown may ensue.

Studying the gap between manufacturing and service performance at the midyear, one would find that it further widened after having narrowed in May. It may be some time before we see the gap narrow, especially with global factory destocking still underway and service demand remaining historically solid, according to the early PMI indications from June.

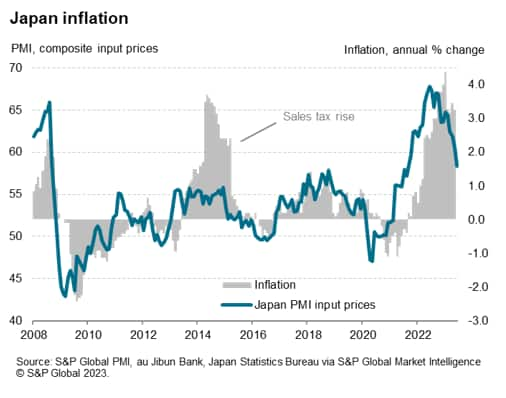

While the moderation in growth momentum coupled with the resumption of manufacturing contraction may garner concerns, the latest developments bode well for the easing of cost pressures for private sector firms in Japan.

Manufacturers faced the slowest increase in costs since February 2021, allowing them to raise selling prices at a slower pace in June. That said, anecdotal evidence suggested that this had only been enough to support Japanese in coping with their competition rather than drive improvements in sales.

Meanwhile service sector charges rose at a slower rate for a second straight month, helped by softer input price inflation. The latest output price inflation for services is at its lowest since January, indicating receding service sector inflationary pressures even as activity growth stayed resilient.

In turn, input cost inflation across both goods and services dipped to the softest in close to two years, preluding a further easing of official CPI numbers in the coming months.

The easing of price pressures is largely in line with Bank of Japan's expectations. Coupled with the latest indication of moderating growth, the flash PMI data further back the BOJ's inaction which may well maintain the yield differentials that we find for Japan with other major developed economies, thus forming the basis for persistent weak yen performance in the near-term.

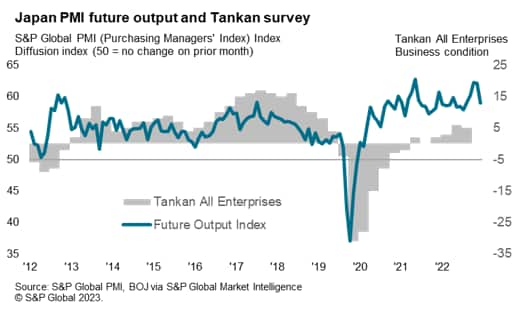

Finally, reduced optimism about the year ahead was observed via the latest flash PMI data for June. Despite continuing to run above the long-run average, business confidence among Japanese firms eased to the lowest in five months as seen via the Future Output Index. Greater caution about cost pressures and lingering global economic uncertainty was expressed in the latest survey by panel members.

Therefore, while the three-month average of the PMI Future Output Index indicate that we may still see better readings in the upcoming quarterly Tankan survey for Q2, the degree of optimism had been on the decline from April to signal caution setting in just before the second half of the year commences.

On equity market performances, the Nikkei 225 index, which has strong positive correlations with the Japan composite PMI, recently showed signs of stalling ahead of the 34,000 level. Although sustained private sector growth continues to provide support for equity prices, alongside the currency trend, further upsides could be limited in the near-term as a result.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.