Since the first publication of the S&P Indices Versus Active (SPIVA) U.S. Scorecard in 2002, S&P Dow Jones Indices has been the de facto scorekeeper of the ongoing active versus passive debate.

The SPIVA Japan Scorecard measures the performance of actively managed funds offered in Japan against their respective benchmarks over various time horizons, covering large-, mid- and small-cap segments, as well as international and global equity funds.

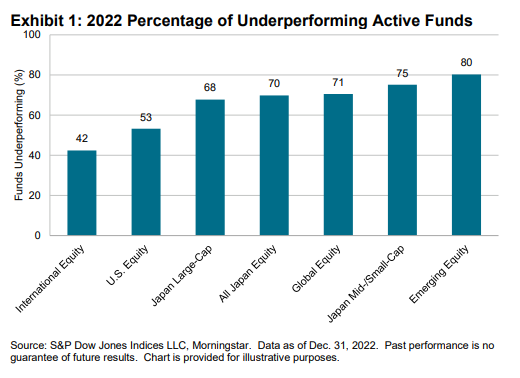

Year-End 2022 Highlights

More than two-thirds (70%) of All Japanese Equity funds underperformed the broad-based S&P Japan 500 over the full-year 2022 period. In all but one of the remaining categories, well over half of funds underperformed their benchmarks. International Equity funds were the sole exception with an underperformance rate of 42% in 2022.

- The S&P/TOPIX 150 posted -3.42% in 2022, and 68% of Japanese Large-Cap funds underperformed the index over the period. This was the worst underperformance rate reported for the large-cap category since December 2018.

- Results for active managers were better in the International Equity funds category, where 42% of actively managed funds underperformed the S&P Global 1200 Ex-Japan in 2022 (see Exhibits 6, 7 and 8).

- For Japanese Mid-/Small-Cap funds, 75% underperformed the S&P Japan MidSmallCap, which declined 0.21% in 2022. However, the long-term record of actively managed Japanese Mid-/Small-Cap funds is relatively better, with 50%, 47% and 52% underperforming over the 3-, 5- and 10-year periods, respectively (see Exhibit 5).

- All Japanese Equity funds generated a relatively range-bound underperformance rate over all our reported time horizons, with underperformance rates versus the S&P Japan 500 ranging between 70% and 82%. In 2022, the S&P Japan 500 ended the year down 2.93%, and 70% of actively managed funds underperformed (see Exhibit 4).

- After 80% of U.S. Equity funds underperformed over 2021, actively managed Japanese funds invested in U.S. equities reduced their underperformance rate in 2022, with a slight majority of 53% underperforming the S&P 500®’s loss of 6.17% in Japanese yen terms.

- The S&P Global 1200 posted -4.80% in 2022, and 71% of Global Equity funds failed to beat the benchmark, in many cases underperforming by wide margins. The average total return of the funds in this category was -12.68% on an equal-weighted basis and -22.17% on an asset-weighted basis.

- While the S&P Emerging BMI declined 5.76% in 2022, 80% of Emerging Equity funds underperformed. As time horizons extended, the percentage of underperforming funds increased to levels surpassing any other category, with 88%, 91% and 100% failing to beat the benchmark over 3-, 5- and 10-year periods, respectively.

- Taken all together, the data in this report suggest that among the active funds offered in Japan, International Equity managers were relatively more successful when it came to turning opportunities into positive outcomes, but that despite an abundance of opportunities, active funds in all the other fund categories struggled to take advantage.