SUMMARY

- S&P Dow Jones Indices has been the de facto scorekeeper of the ongoing active versus passive debate since the first publication of the SPIVA U.S. Scorecard in 2002. Over the years, we have built upon our experience by expanding scorecard coverage into Australia, Canada, Europe, India, South Africa, Latin America, the Middle East and North Africa, and Japan. While this report will not end the debate surrounding active versus passive investing in Japan, we hope to make a meaningful contribution by examining market segments in which one strategy performs better than the other.

- The SPIVA Japan Scorecard reports on the performance of actively managed Japanese mutual funds against their respective benchmark indices over 1-, 3-, 5-, and 10-year investment horizons. In this scorecard, we evaluated the returns of more than 774 Japanese large- and mid-/small-cap equity funds, more than 818 international equity funds investing in global, international, and emerging markets, as well as U.S. equities.

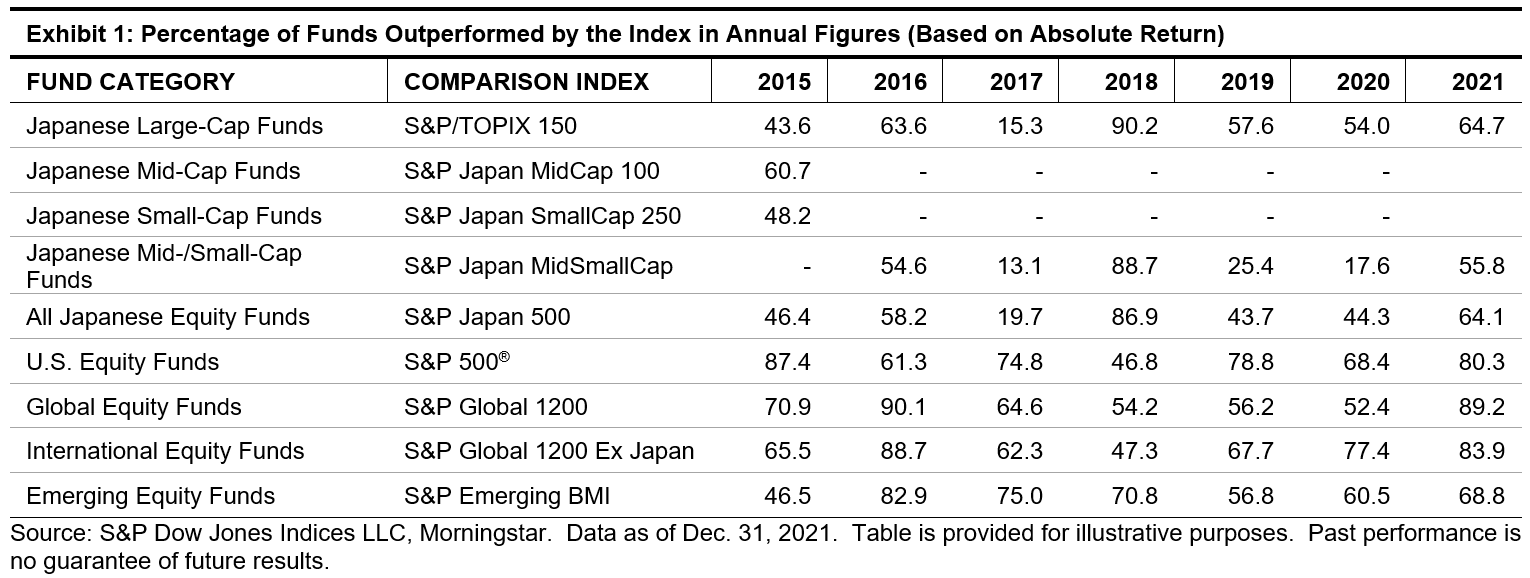

- Japanese Equity Funds: In 2021, the S&P/TOPIX 150 and the S&P Japan MidSmallCap gained 7% and 8.8%, respectively. Over the same period, 64.7% and 55.8% of large- and mid-/small-cap equity funds underperformed their respective benchmarks, with equal-weighted average returns of 13.0% and 7.8%, respectively. Active domestic equity fund performance relative to the benchmark in 2021 was worse than in 2020, with much higher percentages of funds underperforming the benchmark.

Over the 10-year horizon, 18.1% and 52.8% of large- and mid-/small-cap funds managed to outperform their benchmarks, while 38.3% and 33.5% were liquidated, respectively. The equal- and asset-weighted average returns of Japanese large-cap funds lagged the benchmark by 0.46% and 0.44%, respectively, while the mid-/small-cap funds reported annualized excess returns of 3.3% and 1.2% on equal- and asset-weighted bases, respectively. Japanese mid-/small-cap funds tended to deliver higher benchmark-relative excess return compared with Japanese large-cap funds across different periods.

- Foreign Equity Funds: In 2021, more active funds underperformed their benchmarks than in 2020 across all foreign equity fund categories. More than 80% of U.S., global, and international equity funds underperformed their respective benchmarks, and 68.8% of emerging equity funds lagged the S&P Emerging BMI. For 2021, all foreign equity fund categories recorded worse average return than their respective benchmark indices. In particular, the equal-weighted and asset-weighted average return of global equity funds lagged the S&P Global 1200® by 11.1% and 20.6% respectively.

Over the 10-year period, the vast majority of foreign equity funds did not outperform their respective benchmarks. Less than 10% of global, international, and emerging equity funds outperformed their respective benchmarks, while only 17.2% of U.S. equity funds beat the S&P 500®. However, U.S. equity funds underperformed most in their benchmark-relative returns, with annualized excess returns of -6.2% and -5.9% on equal- and asset-weighted bases, respectively. Foreign equity funds had a 10-year liquidation rate of 50.2%, which was much higher than that of domestic equity funds (36.5%).