Mid-Year 2024 Highlights

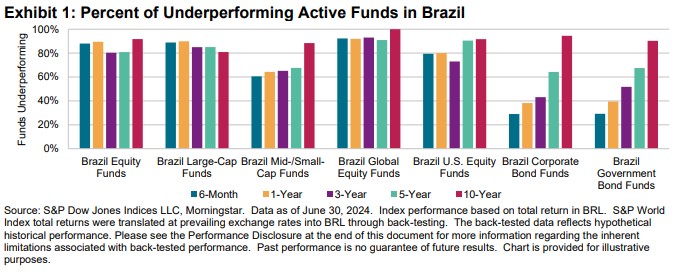

Our SPIVA Global Scorecard illustrated the challenging market conditions for active managers around the world in the first half of 2024, particularly in equities, and Brazil was no exception. Funds in the Brazil Equity category underperformed at a rate of 88.0% over the first six months of 2024, rising to 91.7% over a 10-year period (see Exhibit 1 and Report 2). Brazil Large-Cap funds fared similarly, with 88.9% underperforming in H1 and 80.9% failing to beat the benchmark over 10 years. Among Mid-/Small-Cap funds, results were slightly better, with 60.6% of funds underperforming in H1, but that rate rose to 88.4% over 10 years.

In addition to Brazil Equity categories, this report presents inaugural SPIVA analyses of two new categories of Brazil-domiciled funds: U.S. Equities and Global Equities. In the first six months of 2024, 79.4% of BRL-denominated U.S. Equity funds underperformed the S&P 500®, with the underperformance rate rising to 93.6% over 10 years. Global Equity funds had an even worse showing in the first half of 2024, with 92.3% underperforming and a full 100% falling behind the benchmark over a 10-year period.

Finally, Brazil Corporate Bond funds and Brazil Government Bond funds had better beginnings in H1 2024, with only 29.0% and 29.2% underperforming, respectively. However, few managers generated sustained outperformance, as 94.5% of Brazil Corporate Bond funds and 90.3% of Brazil Government Bond funds underperformed over the 10-year period.

Market Context: H1 2024 and Beyond

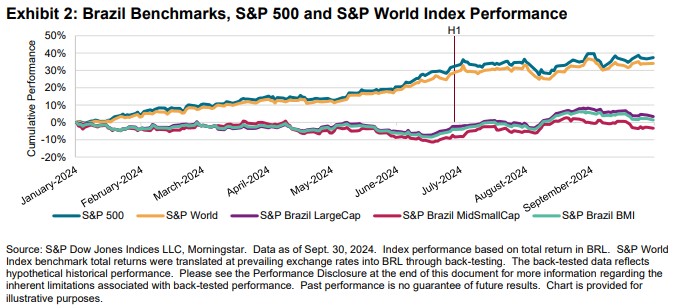

In Brazil, all our reported major equity indices finished the first half of 2024 in negative territory, standing in contrast to 2023 when benchmarks across capitalization ranges rose by double digits. The S&P Brazil BMI, S&P Brazil LargeCap and S&P Brazil MidSmallCap fell 4.1%, 2.3% and 8.5%, respectively. In contrast, the ANBIMA IDA (corporate bonds) and ANBIMA IMA (government bonds) benchmarks were positive during H1, rising 5.1% and 2.4%, respectively. Meanwhile, the S&P 500 rose 32.4% and the S&P World Index was up 28.8% in BRL during H1, outperforming local equities (see Exhibit 2).

Skewness of stock returns may have played a role in Brazilian active fund performance. The S&P Brazil LargeCap was led by a select few large contributors, as 65.6% of constituents underperformed the index. With so few stocks beating the benchmark, Brazil Large-Cap funds had one of the highest single-country underperformance rates reported for H1 in our SPIVA Global Scorecard, at 88.9%. In the Mid-/Small-Cap Equity category, managers did slightly better with 60.6% underperforming, perhaps dipping into slightly higher-performing large-cap stocks and picking from a somewhat less-skewed constituent universe, as 58.0% of stocks underperformed the S&P Brazil MidSmallCap index.

Looking beyond H1, Brazil equities rebounded in Q3, with the S&P Brazil LargeCap and S&P Brazil MidSmallCap rising 5.8% and 5.6%, respectively. The S&P 500 and S&P World Index remained positive in Q3, yet slowed slightly from their H1 pace, finishing Q3 up 37.4% and 34.0% YTD, respectively. Brazilian corporate and government bonds also continued a steady climb in Q3. Fast-rising markets can benefit index performance but can also create higher hurdles for active managers. As the months keep rolling past, only time will tell how well Brazil's active equity and bond managers navigate the challenges and opportunities remaining in 2024.