Summary

“Taxation is the price which civilized communities pay for the opportunity of remaining civilized.”

Albert Bushnell Hart

Since 2002, S&P Dow Jones Indices (S&P DJI) has evaluated index versus active fund performance through the SPIVA Scorecards. In this report, we revisit the broad U.S. domestic equity categories with an additional layer of analysis, comparing the putative after-tax performance of active funds to indices.

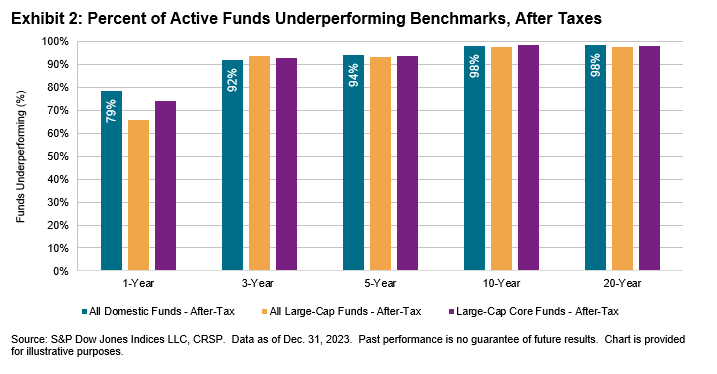

The average cumulative effects of taxes on investor returns are summarized in Exhibit 1 for the Large-Cap Core fund category. After tax, the median active fund trailed the S&P 500® over every time horizon, by up to 4.3% annually (see Exhibit 1).

Introduction

In last year’s inaugural SPIVA After-Tax Scorecard, we acknowledged the patience required for many investors to follow capitalization-weighted approaches to equities in the face of rising stock valuations and concentration. Under such conditions, active managers often tout their ability to sell off such positions; but at what cost? In the aggregate, more than 20 years of S&P Dow Jones Indices’ SPIVA Scorecards have illustrated the rarity that such sales lead to market-beating performance. Once the additional levy of taxes on gains and other distributions are factored in, underperformance only increases further.

But the challenges of successful market timing and stock picking are not the only factors in favor of the patience encoded in indices like the S&P 500. Additional support for an indexed approach may come from considering the potential tax implications associated with liquidating long-held profitable positions, while gains generated from short-term trading activity are normally diminished by a yet higher tax rate. Therefore, it might seem reasonable to suggest that outperforming broad, capitalization-weighted indices might prove even harder after accounting for the tax consequences of active trading.

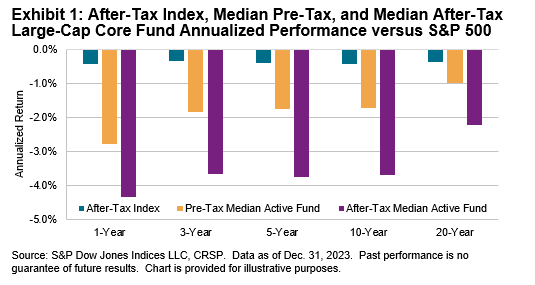

The existence of a common standard for reporting after-tax returns in U.S. mutual funds allows for measurement of tax impact on performance across selected categories from the traditional SPIVA Scorecards. Exhibit 2 highlights selected statistics from the detailed analysis that follows, confirming the relatively high long-term after-tax underperformance rates for actively managed U.S. domestic equity mutual funds.