Introduction

For more than a decade, pensions, endowments, foundations and sovereign wealth funds—collectively “asset owners”—have invested in exchange-traded funds (ETFs). Initially, they invested only minimal amounts. However, starting in 2017, plans began to slowly increase their ETF usage. Then, in Q4 2019, these plans suddenly increased their use of ETFs. The onset of COVID-19 and the resulting financial crisis resulted in asset owners greatly increasing their ETF usage.

In our initial analysis of U.S. and Canadian asset owners, we used 13F filings to analyze ETF holdings and trends in these investments. In 2023, asset owner ETF AUM increased 22%, to USD 56 billion. Over the past 10 years, ETF usage has increased 4x, with most of that growth coming in the past three years. During the same period, the number of asset owners using ETFs nearly doubled and the number of ETFs used increased more than 3.5x.

Holding Analysis

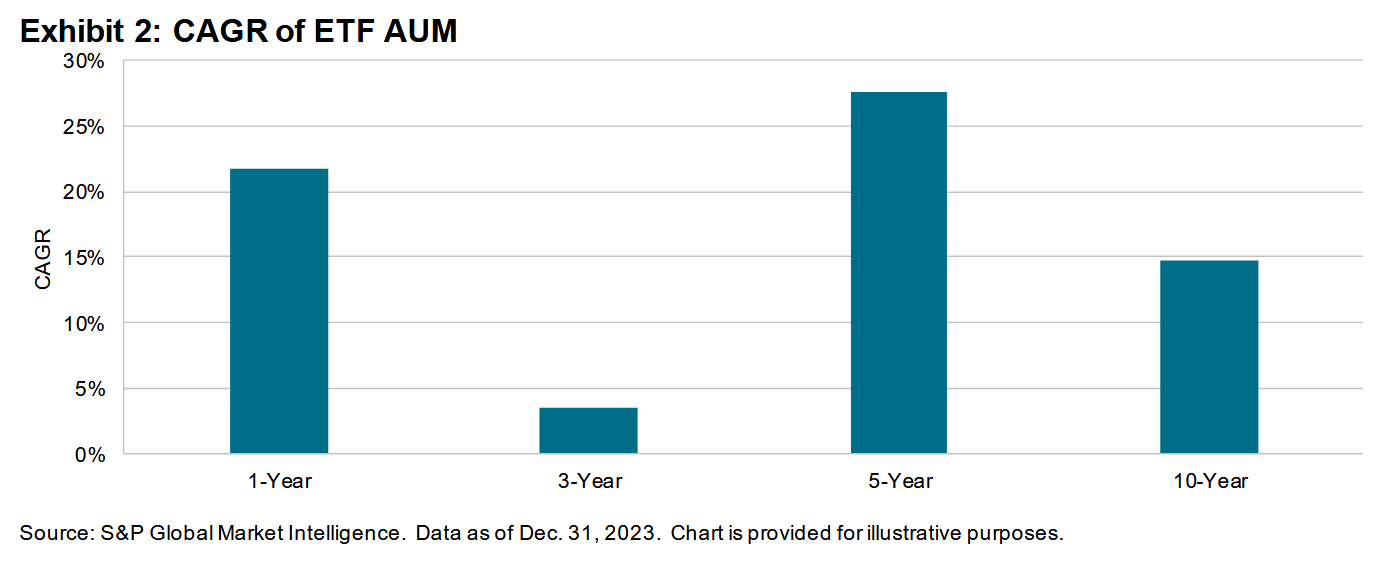

As of year-end 2023, asset owners had USD 56 billion invested in ETFs. Exhibit 1 shows the growth of ETFs over the past 10 years. ETF usage began increasing in December 2016. Then, between Q3 and Q4 2019, ETF AUM doubled.

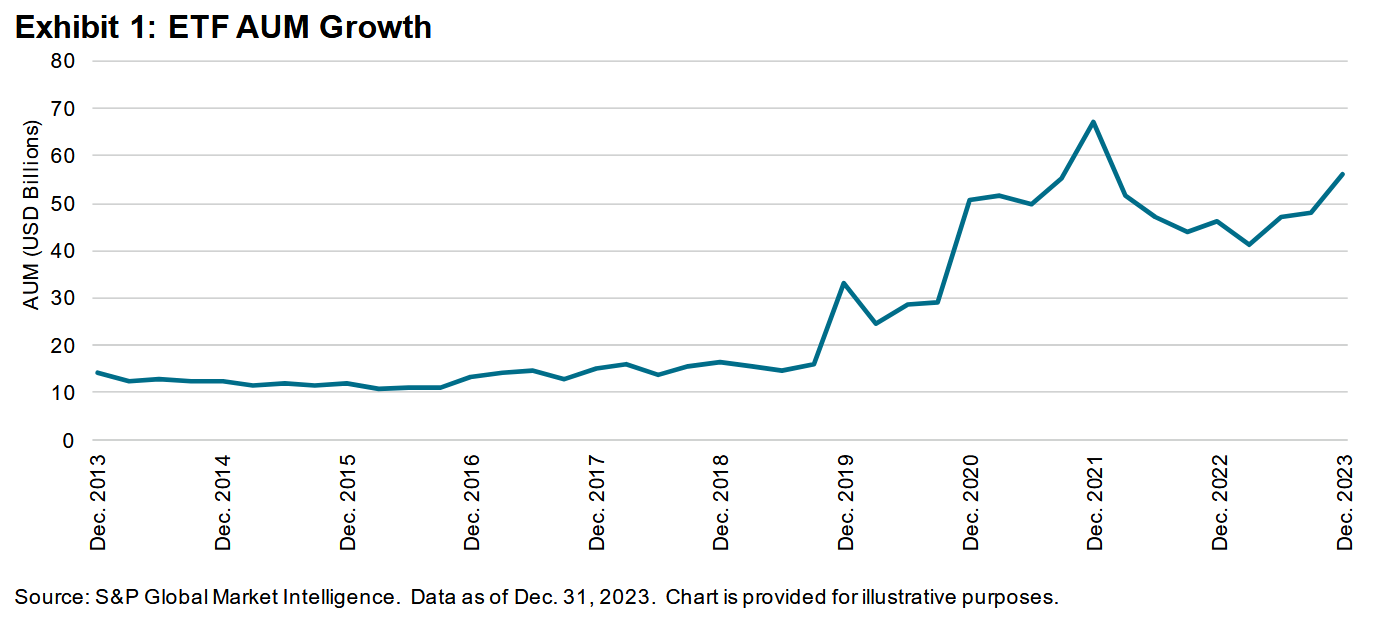

After peaking at the end of 2021, AUM dropped, mostly on valuation. However, in 2023, ETF usage again increased, and AUM grew by 22% (see Exhibit 2). Since 2018, when plans began to use ETFs in a material way, the compound annual growth rate (CAGR) has averaged 28%, implying a doubling of AUM every 2.85 years (see Exhibit 3).