S&P Global Offerings

Featured Topics

Featured Products

Events

Our Services

Investment Themes

Explore new territories with greater confidence

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Education

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Governance

Methodologies

SPICE

Your Gateway to Index Data

Our Services

Professional Resources

Equity

Fixed Income

Commodities

Multi-Asset

Sustainability

Dividends & Factors

Thematics

Digital Assets

Indicators

Other Strategies

By Region

Our Exchange Relationships

S&P DJI combines global reach with local expertise, working with exchanges around the world to build indices for both the local and international investment communities.

Research & Insights

Education

Performance Reports

SPIVA®

For over 20 years, our renowned SPIVA research has measured actively managed funds against their index benchmarks worldwide.

Events & Webinars

Register to attend complimentary webinars and deepen your knowledge of current trends and issues impacting the index universe today.

Methodologies

SPICE

Your Gateway to Index Data

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

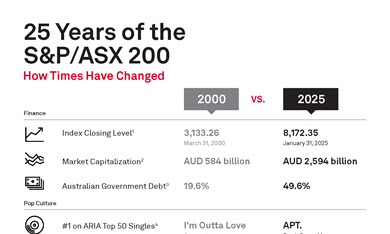

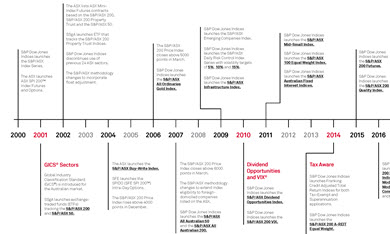

Since their launch in 2000, the S&P/ASX indices have become a cornerstone of Australia’s financial markets, providing investors with transparent, rules-based benchmarks that reflect the dynamic nature of the economy. Today, the S&P/ASX indices encompass not only equities but also fixed interest, and innovative factor-based and sustainability strategies. As we reflect on a quarter-century of growth and innovation, the S&P/ASX indices continue to set the standard.

Exploring the Expanding S&P/ASX Index Ecosystem

S&P/ASX Indices have played a vital role in Australia’s capital markets. From factors to fixed interest, explore how the index series has evolved.

What’s Driving the Continued Growth of Index Investing in Australia

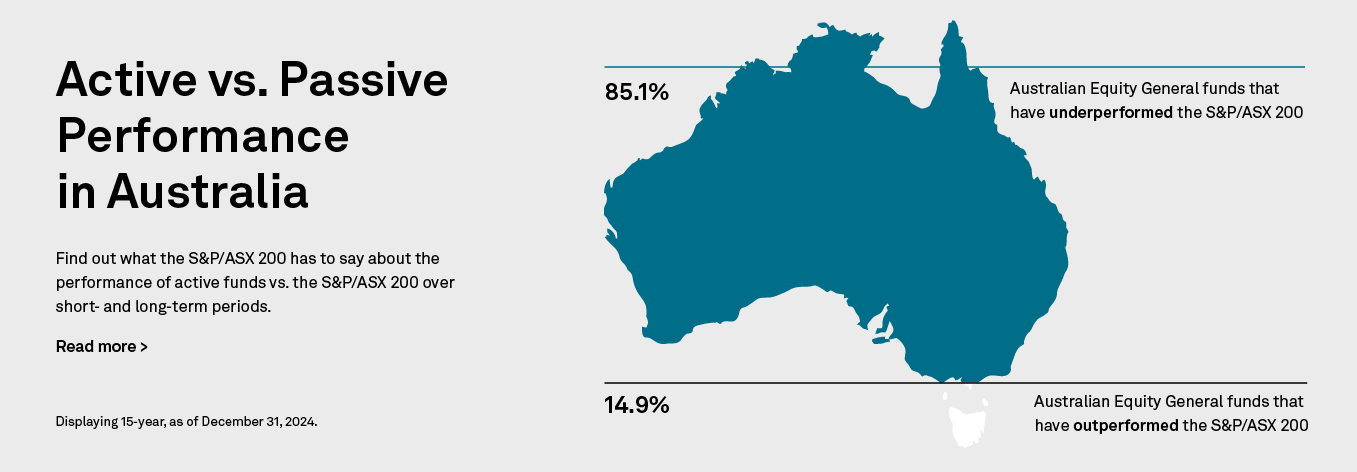

The shift to passive investing has been driven in part by the frequent inability of active managers to outperform their benchmark over the past two decades.

The S&P Indices Versus Active (SPIVA®) Scorecard measures the performance of actively managed funds against their relevant benchmark in equities, A-REITs, and bonds.

Our annual Persistence Scorecard provides additional evidence that it’s hard for top-performing active funds to stay at the top.

S&P/ASX Ecosystem

Over the years, the accumulation of assets and trading volumes across index-linked products such as futures, options and ETFs has led to a trading ecosystem associated with major market indices. Among the tradeable indices produced by S&P DJI, the S&P/ASX Index Series has the third-largest trading volume. Its aggregate traded economic value1 in 2023 exceeded USD 1.9 trillion, largely driven by the futures contracts of the S&P/ASX 200. Its total indexed assets were estimated at USD 102 billion at the end of 2023.2 Since its debut in 2000, the S&P/ASX Index Series has served as the barometer of the Australian stock market and become an integral part of Australia’s market infrastructure.

1 Traded economic value is measured by Index Equivalent Trading Volume, a notion developed by S&P Dow Jones Indices to reflect the economic exposure to the index that is being transacted at the time a trade occurs. It is determined by the instrument’s short-term responsiveness to movements in the underlying index (i.e., adjusted by the delta of the instrument). For details, please see Edwards, Tim, “A Window on Index Liquidity: Volumes Linked to S&P DJI Indices,” S&P Dow Jones Indices LLC, August 2019.

2 Indexed assets are assets in and/or notional value of institutional funds, ETFs, retail mutual funds, exchange-traded derivatives and other investable products that seek to replicate or capture the performance of the S&P/ASX Index Series. See Annual Survey of Assets as of December 31, 2023, S&P Dow Jones Indices LLC.

A Pillar of Australia’s Investment Infrastructure

Beyond the headline S&P/ASX 200, the S&P/ASX index series plays an integral role in Australia’s investment infrastructure. In fact, in the fund management industry, the S&P/ASX 200 and other S&P/ASX indices serve as the investable universe for actively managed strategies and as ways to benchmark active fund performance. Asset owners, such as superannuation funds, use the S&P/ASX indices to benchmark their domestic portfolios.

ESG Indexing in Australia Starts Now

The S&P/ASX 200 ESG Index represents S&P DJI’s first core ESG offering for the Australian market. It’s designed to exhibit risk/return characteristics similar to those of the S&P/ASX 200 while delivering an improved sustainability profile.

Indices

Equities

Sectors

Climate

Fixed Interest

Dividends & Factors and Multi-Asset

Volatility

Going Green in Australia

Market participants are recognizing the importance of sustainable investing and the need to realign their portfolios to meet global ESG targets. Starting with the launch of the Dow Jones Best-in-Class Australia Index, formerly known as the Dow Jones Sustainability Index. in 2006, S&P Dow Jones Indices has been at the forefront of Australia’s sustainable movement to identify local leaders in ESG based on long-term economic, environmental, and social criteria. As the importance of sustainability-focused investing has grown, our range of ESG indices has expanded to include the premier S&P/ASX 200 ESG Index in 2019 and the newly launched S&P/ASX 300 Net Zero 2050 Paris-Aligned ESG Index and S&P/ASX 300 Net Zero 2050 Climate Transition Index in November 2022.

About the Exchange Partnership

S&P DJI and the Australian Securities Exchange (ASX) together provide a complete range of Australian market benchmarks.

Operating at the heart of the deep and liquid Australian financial markets, ASX has a proud history as an early and successful adopter of new technology. The exchange continues to focus on embracing innovative solutions for ease of the customer, helping companies grow, creating value for shareholders, and supporting the Australian economy. ASX is an integrated exchange offering listings, trading, clearing, settlement, technical and information services, and other post-trade services.

Research and Insights

-

Read on

Read onAnalyzing High Dividend Yield Strategies in Australia

Examine the Australian dividend market in depth and analyze the historical performance of the Australian high dividend yield strategy.

-

Get the latest

Get the latestAustralia & New Zealand Dashboard

Get at-a-glance analysis of market performance in the region.

-

Read on

Read onBridging Value and Growth: Designing a GARP Strategy for Australia

Highlights potential applications of the growth at a reasonable price strategy for the Australian market and its unique position within the investment landscape.

-

Read on

Read onS&P/ASX Australian Fixed Interest Indices – A Look Back on the Past Decade

A closer look at the S&P/ASX Australian Fixed Interest Indices, designed to measure the performance of the Australian bond market.

-

Download now

Download nowASX-Listed ETFs

Explore the exchange-traded products available in the Australian market.

Indexology® Blog

SEE ALL-

- Blog

- May 7, 2025

Tariff Turmoil Shines Spotlight on S&P/ASX Geographic Revenue Exposure Indices

Tariff Turmoil Shines Spotlight on S&P/ASX Geographic Revenue Exposure Indices

-

- Blog

- Nov 18, 2024

S&P/ASX 200 High Dividend Index: Q3 2024 Performance Attribution

S&P/ASX 200 High Dividend Index: Q3 2024 Performance Attribution

-

- Blog

- Mar 17, 2024

Australian Mid Caps: A Sweet Spot for Diversification and Historical Outperformance

Australian Mid Caps: A Sweet Spot for Diversification and Historical Outperformance

-

- Blog

- Oct 25, 2023

The Importance of Profitability in Australian Small Caps

The Importance of Profitability in Australian Small Caps

-

- Blog

- Oct 4, 2023

Exploring Dividends Down Under

Exploring Dividends Down Under