Summary

Can investment results be attributed to skill or luck? Genuine skill is more likely to persist, while luck is random and fleeting. Thus, one measure of skill is the consistency of a fund’s relative performance. The Persistence Scorecard measures that consistency and shows that, regardless of asset class or style focus, active management outperformance is frequently short-lived.

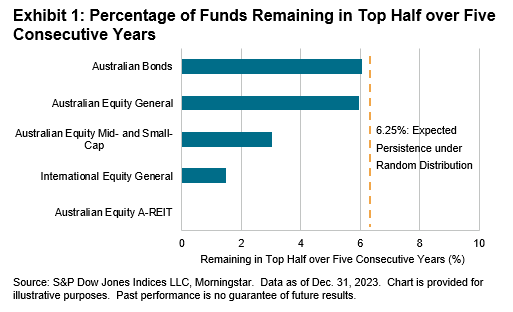

Almost no Australian funds, except for one Australian bond fund, remained in the top performance quartile within their category over five consecutive years ending December 2023. The results did not improve significantly by lowering the bar from the top quartile to the top half: the proportion of funds remaining in the top half over five consecutive years was smaller than would be expected if the performance were completely random (see Report 2 and Exhibit 1).

Report Highlights

2023 was a challenging environment for active equity managers in Australia and persistence of outperformance was hard to find, largely in line with the results of prior years. In comparison to equity managers, there was a higher degree of persistence in the outperformance of bond managers versus peers as well as benchmarks; however, more such results will need to be seen consistently over longer time periods to conclude the existence of genuine skill among bond managers.

- 20% of above-median funds in calendar year 2021 remained so in each of the two succeeding years. If outperformance were purely random, we would expect a 25% repeat rate (see Report 1a).

- Of 2021’s top quartile equity funds, only 2% remained in the top quartile for each of the next two years (versus a 6.25% expectation under random distribution). The result was much better for bond funds, with 44% of the top quartile remaining in the top quartile for the next two years (see Report 1a).

- Persistence of outperformance against benchmarks was rare: 196 out of a total 329 Australian Equity General funds outperformed the S&P/ASX 200 in calendar year 2021, and only 4 of those 196 winners—about 2%—managed to continue outperforming annually through December 2023 (see Report 1b).