Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsVehicle Retailing – Old Dog, New Tricks

No-haggle pricing, direct-to-consumer, agency model - there are OEM announcements about new retail concepts almost every week, and often referenced in an EV context. But is selling EVs really all that different from selling ICE vehicles?

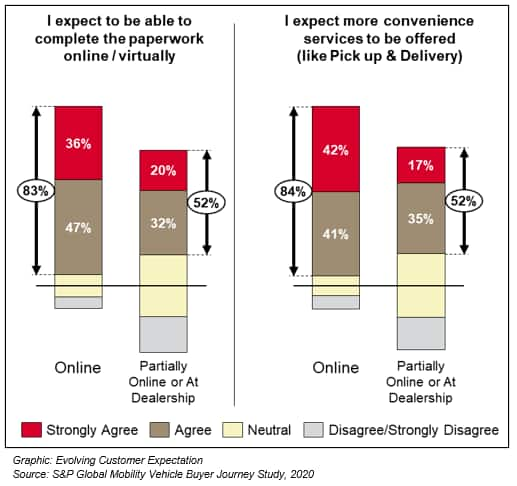

Evolving customer expectations - as opposed to electrification - is the impetus for change. Electrification is merely the lever to disrupt an industry that hasn't changed its retail model in over 80 years and still remains slow to adjust.

Even before the COVID pandemic, and before mainstream EV sales took off in most markets, consumers wanted a simplified and more digital purchase process, according to S&P Global Mobility surveys. But does that naturally lead to the elimination of the physical dealership?

Customer Convenience Newly Defined

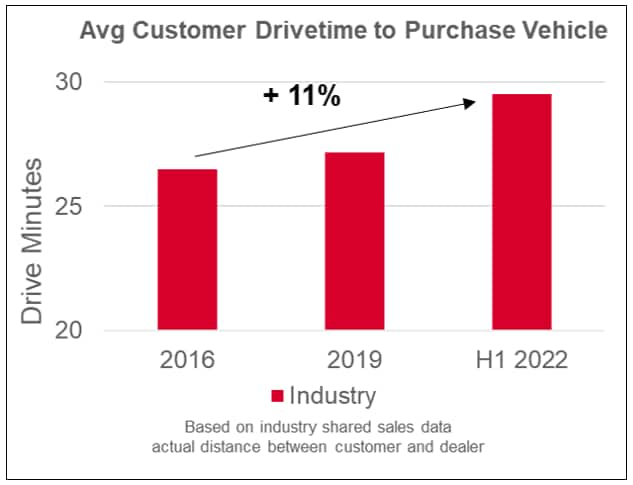

The impact of online engagement and omni-channel journey is already measurable in changing geographical consumer behavior data.

'Customer Convenience' traditionally is a metric focused on customer drive time to dealers and used by OEMs to measure network coverage. Consumers today travel 11% further on average than five years ago, reducing the need for very dense dealer networks.

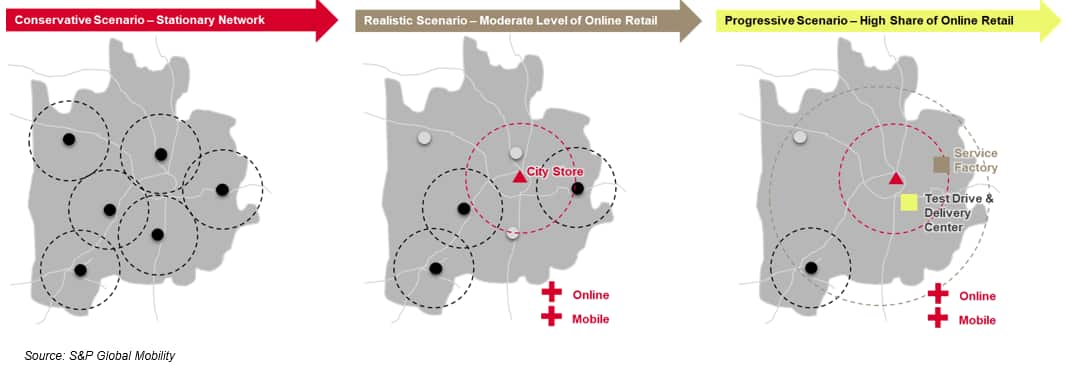

With shifting consumer behavior, many have questioned the future need for bricks and mortar showrooms. And certainly, some reduction of physical footprint will occur. That said…

Dealers are still relevant if there is a Business Case

For all the praise of the Amazon model, buying a car involves a different sensibility. Consumers want to touch, feel and experience the product. They also need the peace of mind to have a local go-to point for servicing, as remote-servicing models continue to face challenges. Physical representation will therefore remain crucial. Consolidation should first occur in facility optimization and investor consolidation, only then followed by responsible rooftop consolidation.

Facility recycling and right-sizing showroom space is not only important to reduce dealer operational costs, but also imperative to adjusting dealerships as the sales process becomes more casual and personal, rather than transactional. Removing desk space and printers in exchange for casual seating and coffee bars is only the tip of the iceberg to a new physical retail experience - which also provides an opportunity to improve on ESG in retail.

There is opportunity to generate a win-win outcome from this industry disruption, for OEMs, dealers, and consumers.

Is Agency Model the answer?

All innovative retail models eventually aim to provide superior customer experience, long-term profitability for dealers (beyond current favorable market conditions ending), and reduced cost of retail.

Agency Models (where contractually feasible) seem to be a suitable lever to harmonize and simplify the sales process, provide seamless experience along online and offline touchpoints, as well as reduce unnecessary intra-brand competition through better price transparency. If such model is adopted, OEMs and retailers should go all-in. However, hybrid models such as 'non-genuine agency' fall short of generating the expected efficiencies and expose legal risks.

To learn more about our Dealer Network Development solutions, click here

Authors:

Tanja Linken - Executive Director, Automotive Dealer Network

Development, S&P Global Mobility

Martin Garbutt - Associate Director, Automotive Consulting, S&P

Global Mobility

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.