Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsHybrids thrive as electric vehicle growth momentum slows

The US vehicle market is undergoing a significant shift, with hybrid vehicles gaining momentum as the popularity of electric vehicles (EVs) begins to slow.

Although electric vehicles are still gaining popularity in the US market, the electric vehicle growth rate has slowed significantly compared to previous years.

Slowdown in Electric Vehicle Growth

S&P Global Mobility new vehicle registration data indicates that year-over-year EV growth through the first nine months of 2024 has plummeted 80% compared to the same period in 2023.

EVs accounted for 9% of new retail registrations in January-September 2024, up just 0.6 percentage points from their 2023 market share. However, this increase is less than half the rise in any of the prior three years.

Incentives and EV Demand

To spur EV retail demand, original equipment manufacturers are significantly increasing incentives, with the average total spend per unit reaching $12,527 in September, three times the $4,188 spent two years ago.*

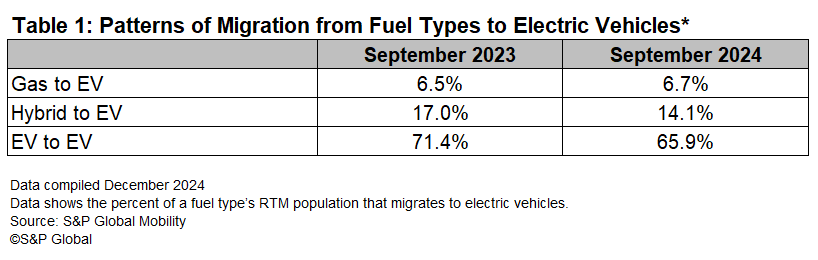

Furthermore, migration data at the fuel-type level (see Table #1) indicates that households with gasoline vehicles are now marginally more likely to purchase an EV than they were a year ago. However, the likelihood of households with hybrid or electric vehicles purchasing another EV has declined year over year.

The Financial Appeal of Hybrid Vehicles

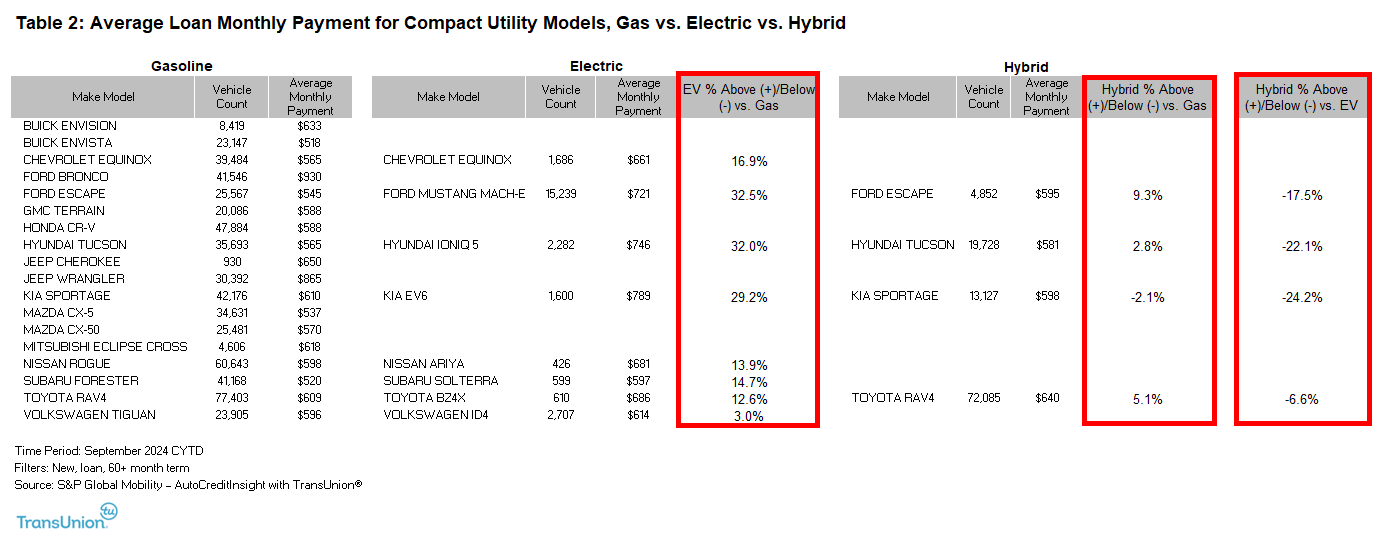

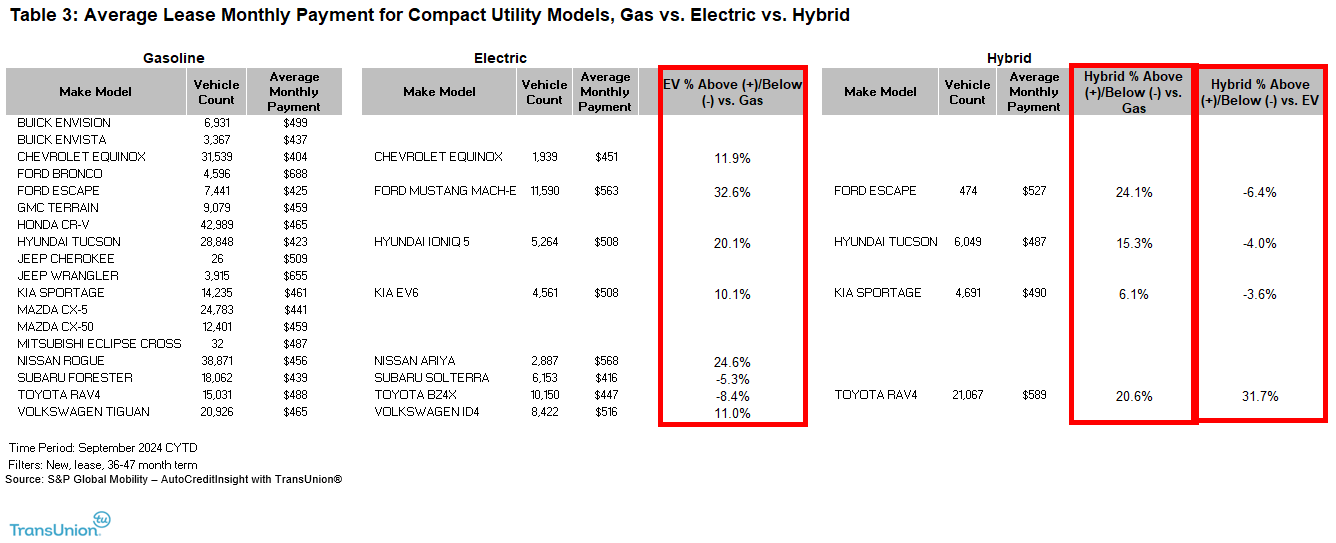

S&P Global Mobility new vehicle registration data, combined with financial transaction data from TransUnion, point to hybrids' value proposition relative to EVs as one influence on EV demand.

As Tables #2 and #3 demonstrate (one focuses on loan monthly payments and the other on leases), the average monthly payment for a hybrid is lower than the monthly payment for a similar EV in seven of the eight scenarios in the Compact Utility Segment, the largest segment in the industry.

The one exception is when a RAV4 hybrid is leased; here the hybrid payment is higher than the gasoline version and the EV payment is lower.

Hybrids' Success in the Market

The financial advantages of hybrids compared to their gasoline counterparts, as illustrated in the prior tables, are a key factor for their recent success in the US market. Hybrids' impressive market performance includes:

- Retail US market share reached a record 14% in September, up 3.0 percentage points in one year and almost 1.5 points in just August-September 2024.

- Almost half of market leader Toyota's retail registrations in September were hybrids, a far higher mix than for any other brand.

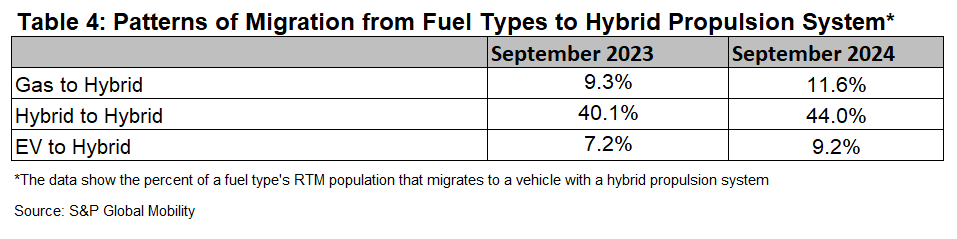

- September 2024 hybrid loyalty (of the return-to-market hybrid households in September that acquired a new vehicle, what percent acquired another hybrid) reached a near-record 44%, second only to February's 44.3% result.

- Migration from all three major fuel types to the hybrid propulsion system has increased from a year ago, as shown in Table #4.

The Evolving US Vehicle Industry

The US new vehicle industry is more complex than ever, with over 400 models, 50 active brands, 34 segments, 3 fuel types and numerous (sometimes conflicting) external influences including an upcoming change in the federal administration. This landscape makes it challenging to identify performance drivers, yet the data addressed above indicates financial factors, such as monthly payments, still play a role.

Demo Our Loyalty Analytics Tool

*Incentive data are from Autodata

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.