Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsUS auto sales December 2024: A solid finish to close out the year

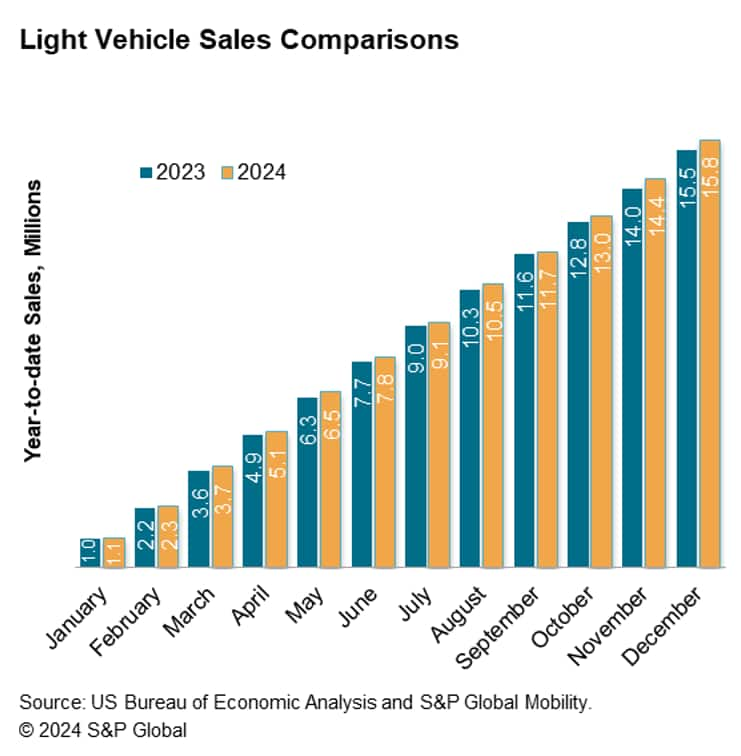

January - October2024 auto sales were moderate, but December auto sales are expected to build on the relatively strong November result.

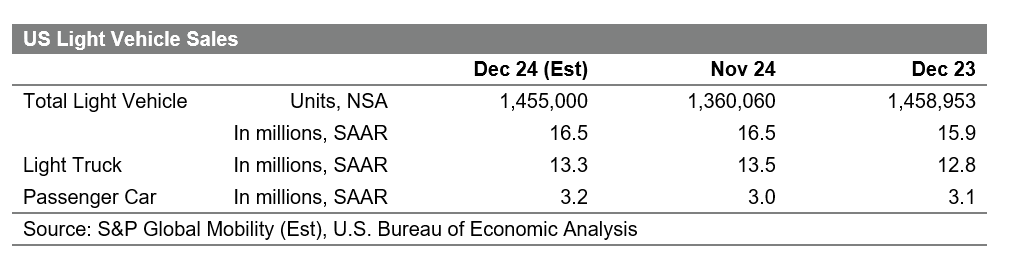

December auto sales in the US are estimated to hit 1.45 million units, translating to an estimated sales pace of 16.5 million units (seasonally adjusted annual rate: SAAR).

This would match the month prior reading and result in a fourth quarter selling rate average of 16.4 million units, a step up from the 15.6 million units averaged over the previous three quarters of the year, and the highest quarterly average for this metric since Q2 2021. But it also points to likely volatility ahead as we move into 2025.

Looking forward, we project US sales volumes to reach 16.18 million units in 2025, an estimated increase of 1.2% from the projected 2024 level of nearly 16.0 million units, as an uncertain environment remains for auto sales levels.

"2025 brings with it mixed opportunities and uncertainty for the

auto industry as a new administration and policy proposals take

hold," said

Chris Hopson, manager of North American light vehicle sales

forecasting for S&P Global Mobility.

"Unfortunately, the new vehicle affordability issues that coalesced

to constrain auto demand levels for much of 2024 will not be

resolved quickly in 2025. Vehicle pricing levels are expected to

decline but remain high; interest rates are expected to shift

further downwards, but inflation levels are anticipated to remain

sticky, and new vehicle inventory should also progress, but careful

management is expected too. Combined with an uneasy consumer, we

project this translates to mild growth prospects for US auto

sales."

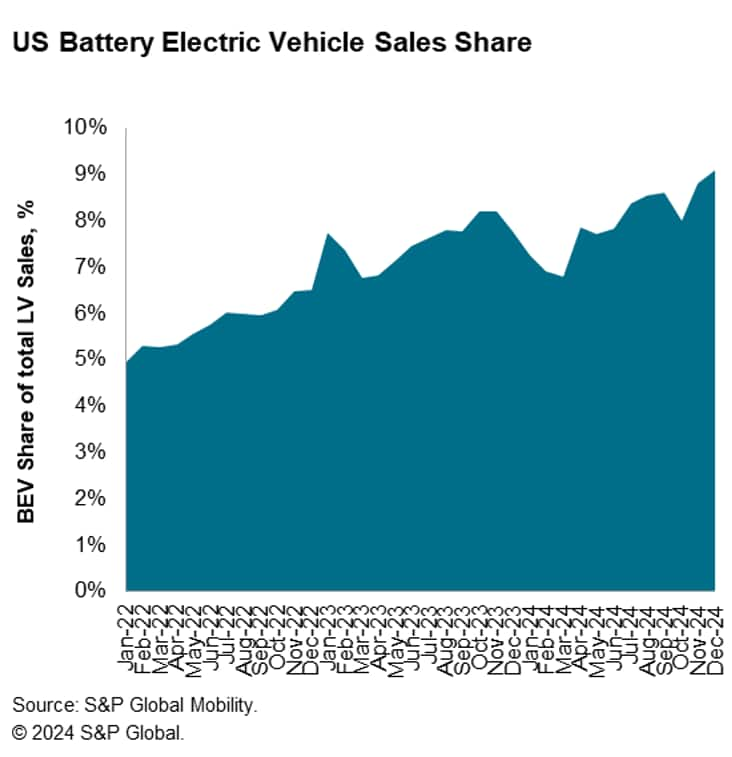

According to S&P Global Mobility new registration data, battery electric vehicle (BEV) share of sales has been above 8% every month since June, reflecting progress from levels earlier in the year. BEV share in September reached a level of 8.6%, with October estimated to have remained above 8% again.

Despite lower inventory levels for many EVs, November and December could realize BEV share advances in anticipation of Federal EV incentives being withdrawn in 2025. S&P Global Mobility projects December BEV share of more than 9.0%.

Get a preview of our Light Vehicle Sales Forecast.

Download the Forecast

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.