Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsJanuary auto sales 2025 begin year on positive note

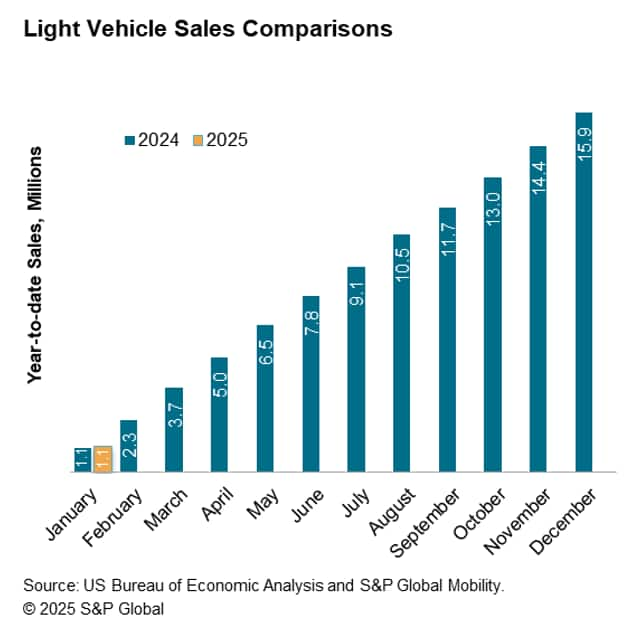

January auto sales in 2025 are expected to decelerate from the uptake realized in December, but still sustain some of 2024's fourth-quarter progress.

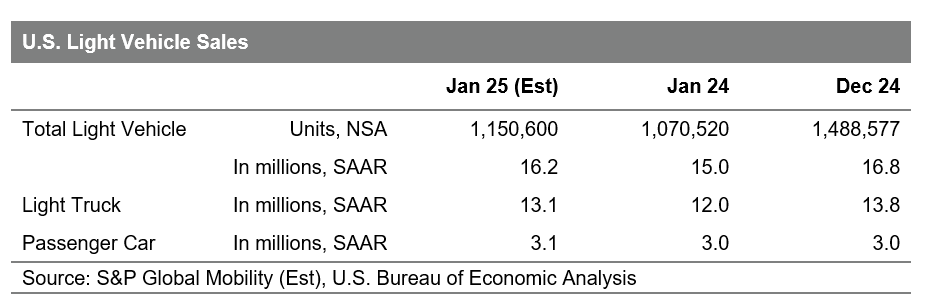

January US auto sales are estimated to hit 1.15 million units, translating to an estimated sales pace of 16.2 million units (seasonally adjusted annual rate: SAAR), according to S&P Global Mobility. The SAAR pace would be a mild step down from the relatively strong November and December 2024 readings but would be the fourth consecutive month this metric has been above the 16-million mark. Contributors to the chill of the January sales pace include an expected hangover from the solid closeout to sales in December 2024, combined with some inclement weather effects in various parts of the country.

"Auto sales are expected to post a decent volume level in January," said Chris Hopson, principal analyst at S&P Global Mobility. "An uncertain auto demand environment awaits in 2025, as the industry and consumers digest potential policy changes from the new administration, but together with the inventory draw down at the end of 2024, and weather impacts during the month, January sales should be viewed as a positive result."

Inventory levels are also lower entering 2025, following the strong sales close to 2024 and lower production levels that were scheduled in December.

According to S&P Global Mobility Retail Advertised Inventory data, at the end of December 2024, available retail advertised inventory in the US was 2.89 million vehicles, its lowest level since the first week of July 2024.

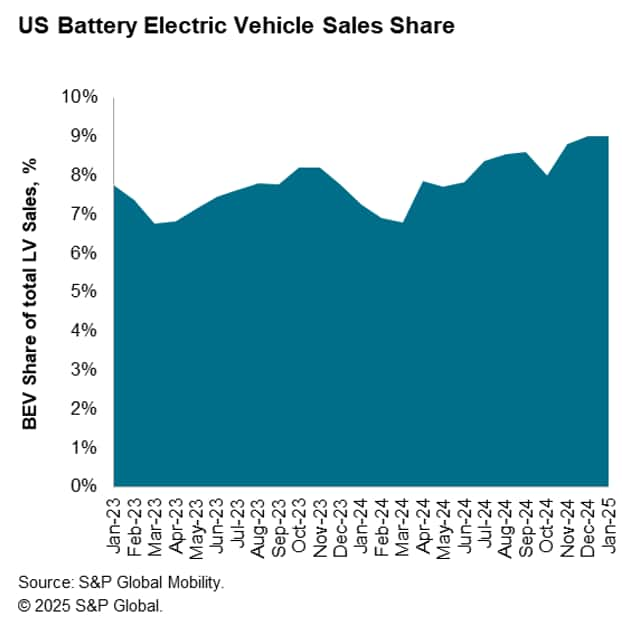

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. January BEV share is expected to reach 9.0%, similar to the month prior reading, as automakers, dealers and consumers consider the potential changes to BEV incentives to begin the new year.

Get a preview of our Light Vehicle Sales Forecast.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.