Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsSubstantial internal migration within the utility space

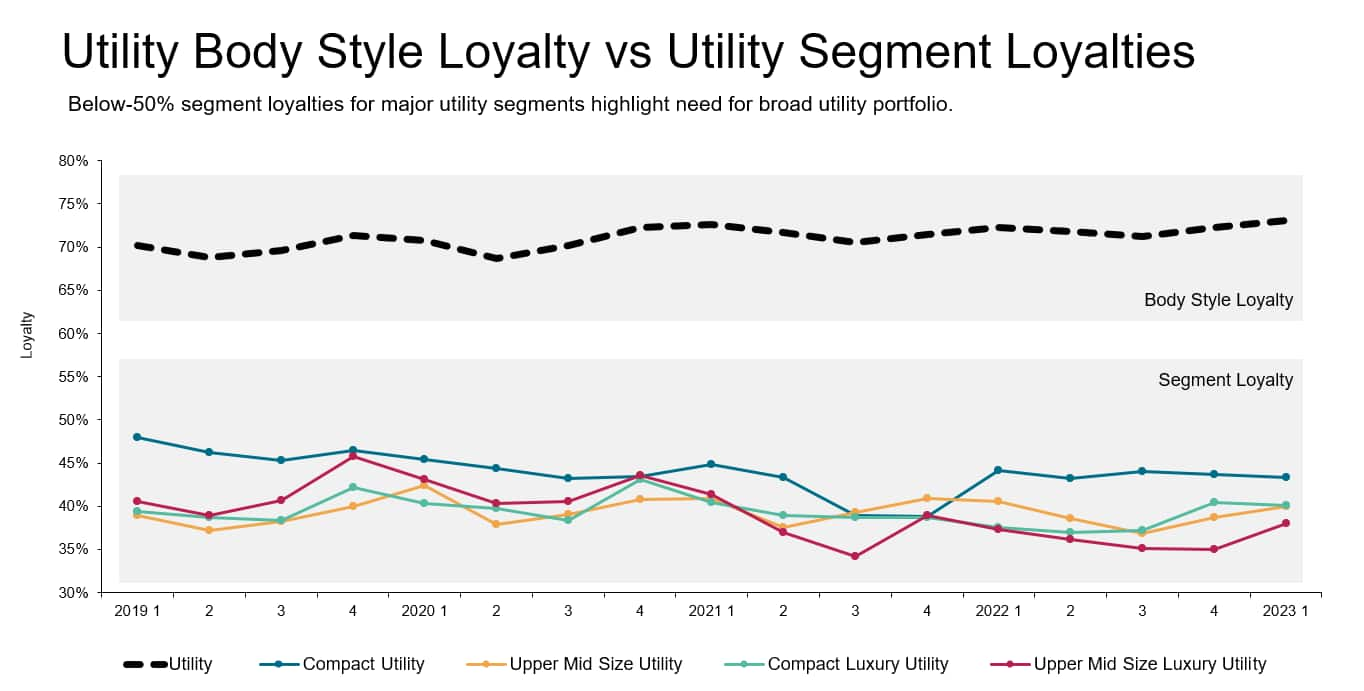

Nearly three-quarters of households with a sport-utility vehicle acquired another utility when they returned to market, according to S&P Global Mobility loyalty data from January 2023.

If January's 73% loyalty to the SUV body style holds in February and March, the Q1 2023 rate would be a record high for any quarter. It is also noteworthy that this metric now has exceeded 70% for 11 consecutive quarters (including Q1 2023).

Not only are utility owners very loyal, but they are also substantially more loyal to their body style than are sedan or pickup owners; the percentages of pickup and sedan owners who returned to market and acquired the same body style in January 2023 were just 48.8% and 35.6%, respectively.

The high loyalty to the utility body style is even more interesting when one looks at households' loyalty to the utility segments (sub-compact through full size in each of the mainstream and luxury categories); this metric measures a household's propensity to acquire another utility in the same segment as the garage vehicle.

As illustrated below, the segment loyalties for four of the largest utility segments never reach 50%, implying that less than half of utility households stay with the same size/price utility vehicle when they return to market.

The combination of high utility body style loyalty but lower segment loyalty implies that while the American public certainly has taken to the utility concept, there is substantial migration to new and untried utility segments.

As a result, automotive brands must offer a wide array of sport-utility vehicles, so that when a household with a utility in the garage migrates to a larger/smaller utility, the brand has an entry to satisfy the needs of that household.

------------------------------------------------------------------------------

Top 10 Industry Trends Report

This automotive insight is part of our monthly Top 10 Industry Trends Report. The report findings are taken from new and used registration and loyalty data.

The March report is now available, incorporating January 2022 CFI and LAT data. To download the report, please click below.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.