Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsKey DMAs Are Driving Supply, Incentives, and Competition for In-Market Shoppers

For Optimal Car-Buying Analysis, Local Markets Matter

By Jason Jordhamo, Product Management Director, S&P Global Mobility

In this October edition of the Polk Auto Marketing Monitor, we dive into the industry's current inventory build-up at the DMA level and look at the markets and vehicle types that are outpacing the industry, leading to increased supply and competition for buyers in key regions around the US. Incentives are climbing to support moving this excess supply off of lots, so dealers in these regions will need to pay particular attention to their audience targeting strategies and the offers they're providing to attract buyers through year's end.

Top 50 DMAs added nearly 750,000 units versus last year

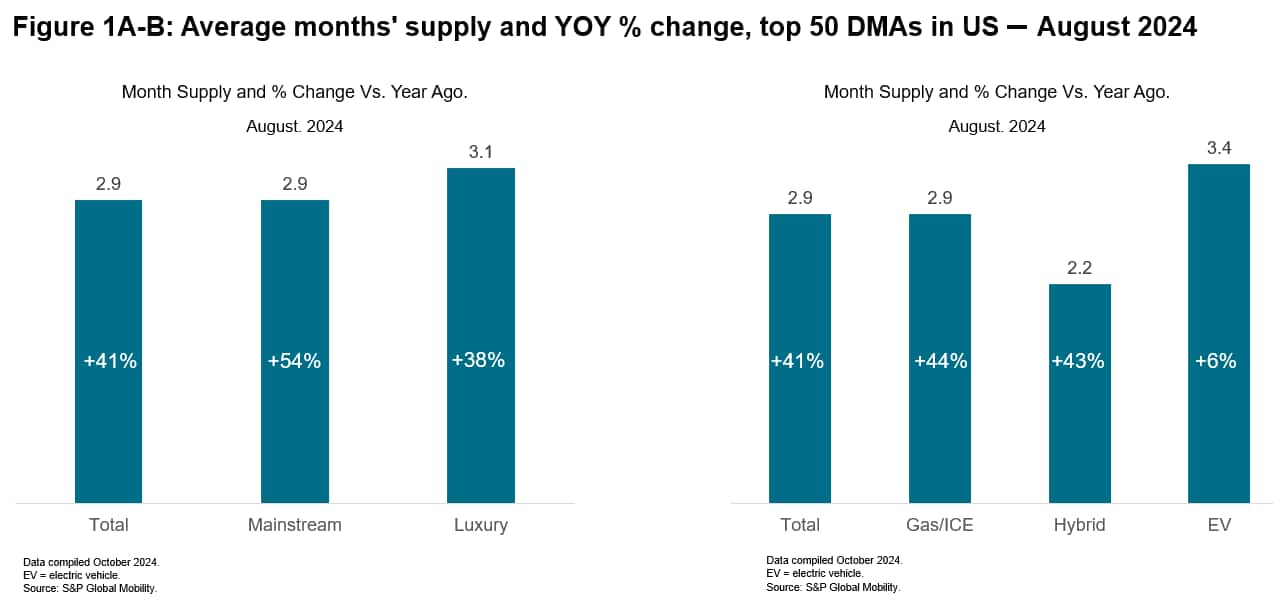

The top 50 designated market areas (DMAs), representing 72% of the US market, have seen a striking shift in new model retail advertised inventory, with year-over-year increases in these areas of over 50% in August 2024, raising the average available inventory to nearly three months.

This inventory surge continues to outpace demand across mainstream and luxury vehicles and across fuel types, with luxury and gas models accounting for the largest increases (Figure 1A-B). However, electric vehicles (EVs) continue to lead in total monthly inventory, although their growth rate from last year has been just 6%. Dealers have successfully used leasing and incentives to move their EVs off the lot.

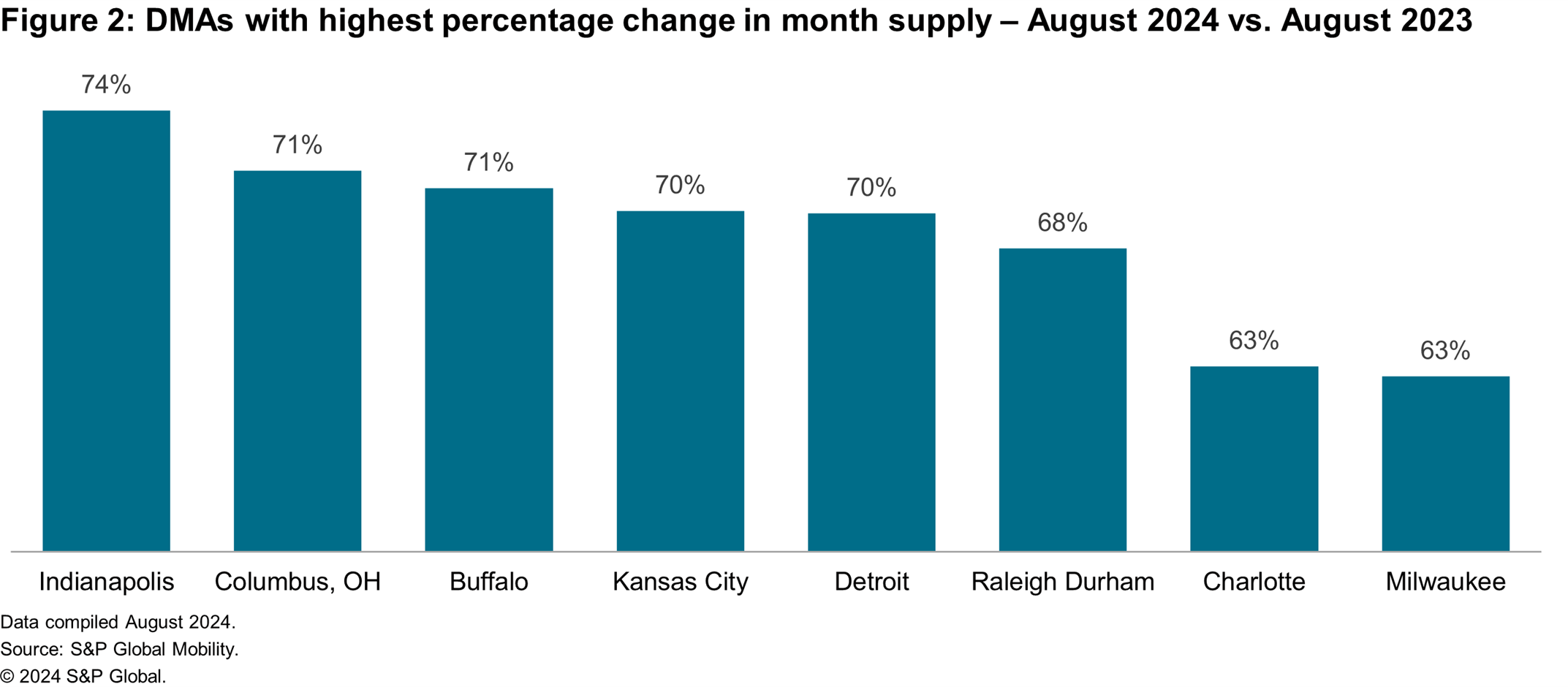

Midwest markets have some of the largest increases

Eight DMAs — representing 7.7% of the total US vehicle market — have experienced an average monthly inventory increase of more than 60% (Figure 2). Another 10 markets have seen their average monthly inventories rise 50-60%. Altogether, these 18 DMAs represent 21% of the US share, with supply increases exceeding 50% compared to a year ago. The Midwest region is home to 7 of these 18 markets, where dealer inventories have surged. There are also several major DMAs experiencing 50-60% increases.

Luxury inventory gains everywhere: From 18% to 122%

Even though inventory growth continues to outpace demand, new registrations have risen compared with last year, with the exception of the luxury segment which experienced a slight decrease of just one percent year-over- year for the month of August. Additionally, every DMA in the top 50 experienced a double-digit average monthly inventory increase for luxury vehicles; many saw an increase in the high double digits.

- Four DMAs saw luxury monthly supply growth hit triple digits: Raleigh-Durham (122%), Harlingen-Waco (111%), Milwaukee (104%) and Detroit (100%).

- Five additional DMAs had monthly increases over 70%: Dallas-Ft. Worth, Houston, Cleveland-Akron, Boston and Providence - New Bedford.

- Thirty DMAs had increases over 50%.

EV supply/demand challenge improving

As the industry knows well, EVs continue to accumulate on dealer lots, leading the industry with an average 3.4-month supply. This challenge persists in markets like Indianapolis (up 101%); Columbus, OH (up 67%); Detroit (up 65%) and Cleveland-Akron (up 54%). However, leasing and attractive incentives are boosting demand across much of the country, narrowing the gap between monthly supply (up 61%) and demand (new registrations up 51%).

- Fourteen DMAs have reduced EV monthly supply

- Denver EV supply is down 35% from 2023 and under 2 months.

- Declines in Seattle (30%), Harlingen-Waco (27%) and Miami (5%) brought these three markets to below 2.5-months' supply.

Impact to dealer marketing

For dealer groups, strategic, data-informed marketing is essential to reach in-market shoppers and drive sales. As inventory levels fluctuate across fuel type and segment, so too do pricing and demand dynamics. With increased inventory and competition, dealers must differentiate themselves through targeted audience strategies and offers to attract buyers. Highlighting leasing deals and incentives becomes crucial in driving sales, particularly for EVs and luxury vehicles. Understanding these trends will lead to better-informed marketing decisions.

Polk Auto Direct helps dealers and their marketing partners find and target the best households for in-market shoppers across EV, hybrid and gas fuel types.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.