Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsFuel for Thought: From aspiration to reality, building the trail to vehicle electrification

Listen to this Fuel for Thought podcast

As EV sales slow, OEMs must consider multiple factors to align their EV production with government regulations and consumer demand.

Insights in this Newsletter & Podcast:

The pathway to electrification: from the here-and-now reality to the long-term aspiration of decarbonization in the transportation sector.

The US government regulatory aspirations and their pressure on OEMs towards an accelerated response to electrification.

The consumer mindset and sentiment towards electrification: pricing, technology and the willingness of adoption.

OEM showroom response to align regulation and pricing via alternative vehicle electrification pathways.

The first quarter of 2024 brought significant attention to the tapering of electric vehicle (EV) momentum in the United States, with many clamoring "I told you so." There is no question that aligning the current administration's aspirations of a decarbonized transportation sector to the reality of how consumers transition towards electrified vehicles will remain very fluid. Much of this chapter of history will be written in the coming decade and is likely to feature surprises as the industry is shifting very quickly to a known emerging technology with an unknown consumer response. As a result, it is important to separate today's front-page news of early adopters from the mid-term ramp up and eventual long-term stabilization of EVs in the marketplace. It's also critical that all stakeholders are aware that failure to electrify is not an option.

Light vehicle sales in the US closed the first quarter at an estimated 15.4 million-unit SAAR, featuring growth of 5.4% year-over-year. The market is also transitioning from a build-to-order model back to a business-as-usual world of inventories and incentives for most segments. From a propulsion perspective, the market share for EVs is largely unchanged year-over-year. This is starkly different from the 50% expansion of 2023 and the first time in many years where EV growth has tapered to the single-digit level.

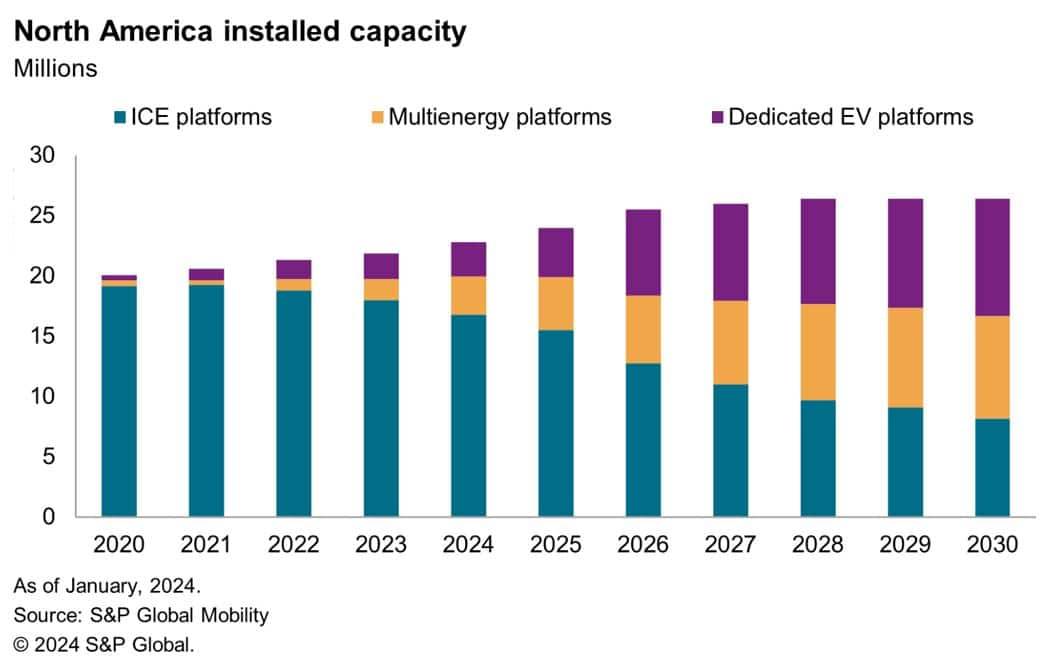

The stagnation of EV sales is making many within the industry uncomfortable (OEMs and suppliers alike) as the ongoing ramp-up of EV production capacity requires a continuous robust expansion of electrification. Capacity in North America is roaring from 20 million units today to 26 million within the next few years, as all OEMs want to proactively respond to regulatory requirements. Roughly 20 plants are expected to start or restart operations this decade (since 2020) geared towards ZEV assembly and dozens more are retooling their production from ICE to ZEV platforms.

This capacity expansion is pointing toward an industry migration—with more than 65% of North America-manufactured vehicles expected to be electric by 2030. However, the mood is cautionary for many OEMs with a manufacturing base in North America as they try to match government ambitions of a 50% Zero-Emission Vehicle (ZEV) market by 2030 (roughly a six-fold expansion in a six-year period) alongside weaker consumer demand. This alignment is only aggravated as it comes on the tails of a newly minted labor agreement that will boost wages by over 25% through 2027 for most plants in the US and Canada and is likely to erode profitability.

It is also important to mention that the Biden administration understood that matching a 50% ZEV regulatory target would need support. Simply put, this was going to be a carrot-and-stick approach, with the carrot being the Inflation Reduction Act (IRA). The IRA has multiple components supporting the path to decarbonization in the U.S.; the most critical to the automotive industry are the consumer and manufacturer credits for purchase and production of ZEV vehicles. Putting these two together could represent an average stimulus of $12,090 for ZEVs that meet all requirements, assuming a full $7,500 consumer credit and a $4,590 manufacturer credit ($45 per kW on the average US battery size of 102 kW for 2022).

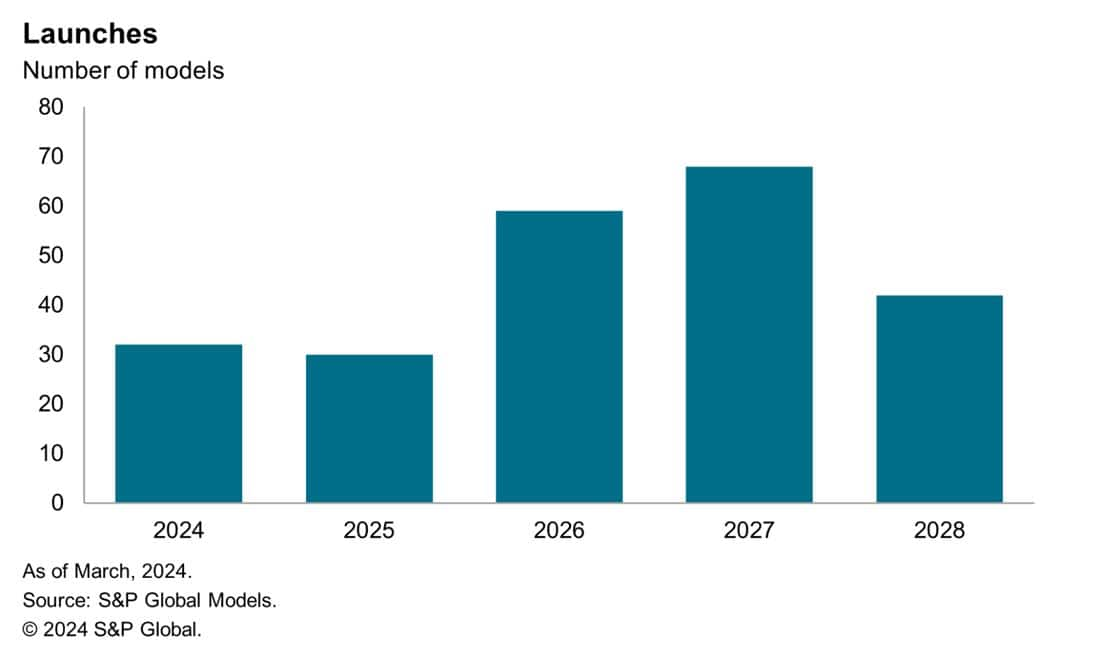

This approach triggered unparalleled investment for the expansion of ZEV capacity. OEMs assumed if they built them (EVs) they (consumers) would come. It was only natural to assume that the strong consumer demand for EVs seen in California and many other West Coast markets was going to expand across the country if IRA funds helped to close the gap in price between ZEVs and legacy Internal Combustion Engine (ICE) vehicles. OEMs have worked very hard to match the success Tesla is having in these markets, especially after the EV juggernaut's Model Y was the third top-selling light vehicle last year. The response from OEMs is a pipeline of over 30 different new EV models due in 2024 and more than 200 models due by 2028, according to current forecasts.

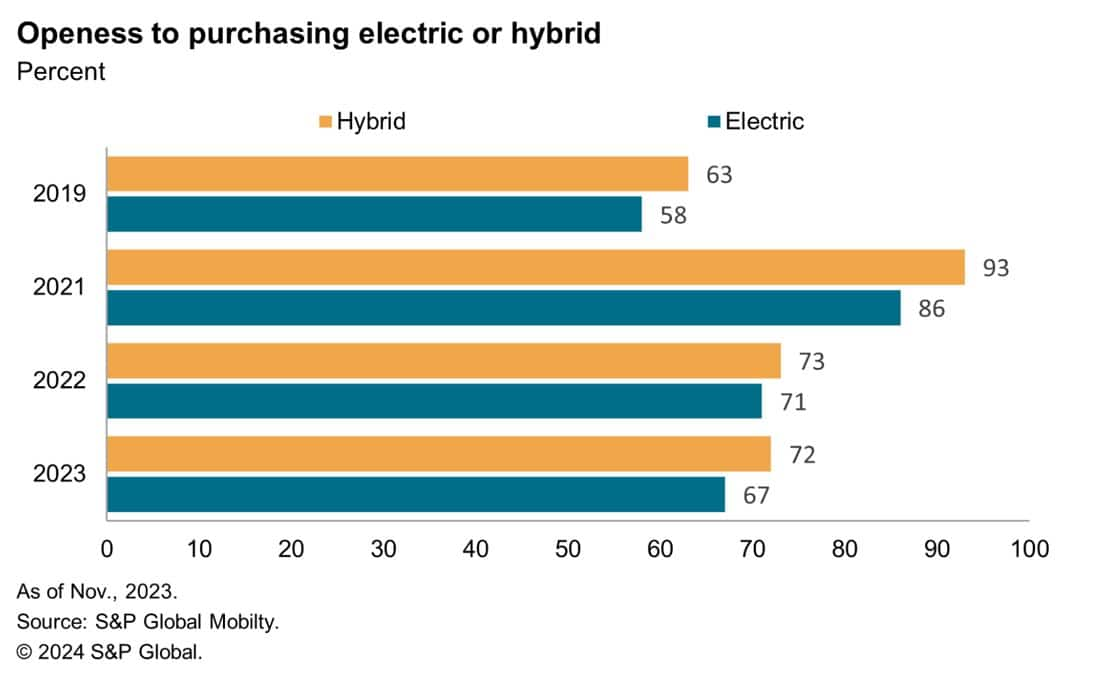

To understand consumer behavior and mindset, S&P Global Mobility runs proprietary surveys on a regular basis, one of which measures EV consumer sentiment. This research essentially recognizes the willingness of consumers to buy EVs. Our 2023 survey showed a 67-percent willingness to consider buying an EV vehicle, though a 19-percentage-point decline relative to the same survey in 2021 when EV excitement was cresting in the middle of the inventory/semiconductor crisis. Our 2023 survey indicates the primary concerns consumers had in mind were pricing, range and charging.

This same survey shows that consumers prefer a gentler transition towards electrification—more of an evolution than revolution. Here, hybrids are clearly top of mind to consumers where the need to change is not as drastic—essentially remaining on the same fueling system they are familiar with. It has only been in recent months that we have seen some OEMs assimilate this reality and reconsider their pathway to electrification.

The electrification roadmap will be primarily dependent on the triangulation of these three elements: pricing of EVs, meeting regulatory requirements from the government, and OEMs' creativity and flexibility to adjust their showroom portfolios to best match these two. Some OEMs are realigning strategies to create a bridge in the shape of Hybrid Electric Vehicles (HEV) and Plug-in Hybrid Electric Vehicles (PHEV) to address consumer concerns of pricing, range, and charging for EVs. This comes after traditional OEMs are now publicly stating that price parity for EVs won't be as easy as originally envisioned and have gone back to the drawing board to look for alternate roadmaps to appease consumer hesitation while remaining good corporate citizens.

Historically the law of the land has revolved around miles-per-gallon and meeting the regulatory requirement has been no small feat over the last two decades as it required an average 5% improvement in efficiency year-over-year. In response to lowering carbon emissions in the US, the Biden administration has added new dimensions to that equation by proposing a revised setting of e-MPG (equivalent MPG rating for EVs and PHEVs) and the requirement to also reduce emissions of other pollutants. From a numeric standpoint, if an EV used to get a 350 e-MPG rating the revision to the e-MPG calculation means that same vehicle will only be getting roughly 125 e-MPG rating in coming years.

To most, this is already a very tall order to meet, but again, times are very fluid. The roadmap of electrification becomes even more challenging as it may have to accommodate for a long list of what-ifs: US presidential elections, cost of raw materials, a revision of USMCA, or other factors. This accommodation and flexibility demand that OEMs respond quickly and, in the process, shift their entire value chain at similar speed, starting with suppliers, raw material providers, and logistics operators as well.

The writing of this thrilling chapter of the automotive history book as OEMs are asked to align pricing, regulation, and portfolios will not be black and white, but a true prism of colors. Lack of action is certainly not an option; the OEM ships have left the ports in search of a new carbon-free world and are navigating uncharted consumer waters and the perils that come along with such an altruistic endeavor.

Rest assured, we at S&P Global Mobility look forward to helping the industry best chart these waters to anticipate the rough seas and storms ahead.

-------------------------------------------------------------------

Dive deeper into these mobility insights:

Explore More Electric Vehicle Trends

2024 US Presidential Election and the Auto Industry - Read the article

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.