Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsFuel for Thought - Automotive Marketing Signals: How inventory and loyalty impact investment

Automotive Monthly Newsletter & Podcast:

Automotive Marketing Signals: How inventory and loyalty impact investment

We are in year two of the great supply chain crisis. There are a handful of factors — from chip supply to impacts from climate and conflict — as to when "normal" production will return. Here is what we do know now: profit margins are near historic highs for OEMs while consumer loyalty scores are near historic lows. Here are the important data signals for automotive marketers:

Loyalty challenged

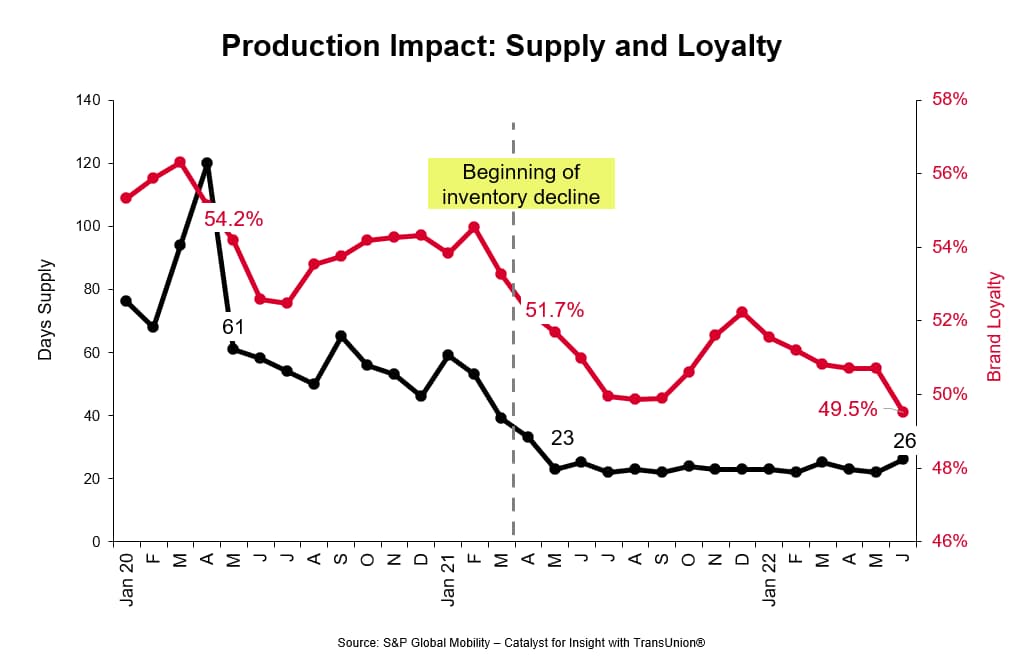

Industry supply has been at or below 26 days for an

unprecedented 14 consecutive months. As observed in this chart (fig

1), lack of days' supply drives a direct drop in brand loyalty

— now below 50%, an eight-year low. This is

not only costly for OEMs in the near term, but the lifetime value

lost from defecting customers over the long term is

significant.

Luxury leads the decline, despite the Tesla buoy

Luxury brand loyalty has outpaced the industry in loyalty decline, now at just 46%. When you remove Tesla models from luxury, it sheds another four points to 42%.

- More than 7 out of every 10 (73%) return-to-market Tesla owners buy another Tesla.

Another contributing factor is the sharp decline in leasing — generally higher with luxury segment — which has dropped 10 points since 2018 and accounts for just 20% of new registrations in 2022.

Segment over brand: Utility reigns supreme

Loyalty to the SUV body style is growing and is now at an all-time high of 74%. With nearly 150 SUV models, shoppers have an abundance of choice and will more easily leave brands that don't have the desired Utility vehicle available. For the first time, more car owners are buying a Utility (47%) instead of another car (42%).

- Utility-to-Utility migration for in-market shoppers has grown 48%, nearly one million units, in the past five years

- Going bigger is getting bigger. About half of those gains come

from up-sizers, households that moved into a bigger Utility have

grown 93% over the same time period (fig 2)

Recovery will fluctuate by region

Since the beginning of 2022, inventory levels have been trending up, but the lifts are relatively low, and recovery varies by market. The nation's top market, California, has inventory levels ~20% higher than the state's low in late 2021. Meanwhile, in number two state, Texas, inventory has increased at a slower pace, improving less than 10% from its 2021 low.

How marketers are responding:

Even with record profits, smart, healthy brands are

staying in front of customers

Data strategies and marketing dollars have responded to

marketplace conditions. There has been a shift from in-market and

incentive messaging to vehicle acquisition, EV and service

initiatives. At an investment and activation level, Polk Automotive

Solutions by S&P Global Mobility has seen monthly activity

across Trade-In, Service, EV and Future In-Market audiences

increase 2x since the beginning of the year.

At the retail level, dealerships have developed responsive messaging and targeting strategies that best match audience segments with inventory, adjusting monthly to align with available vehicles, both new and used.

From OEMs, we see brands increasing their efforts to search for Lost Souls or Orphan Owners— the second or third owners/sellers of a vehicle. Recruiting these owners into their CRM programs with specific offers can develop long-term customer value.

The great data race: Fortifying CRM programs for peak performance

Auto marketing's biggest competition is taking place in first-party data arenas. The increases in identity complexity are growing. The headwinds of data restrictions are stronger. Advantages will go to those that know the most about their customers and prospects and what motivates them through their first-party data. Best practices include:

- Go beyond the most recent purchase to develop complete garage, financial and household profiles

- Reduce waste by verifying ownership

- Append, enhance, and cleanse lists regularly

Conclusion

Conclusion

S&P Global Mobility expects the chip supply shortfall to improve further in 2023 with increases in chip fabrication being better aligned with demand in 2024. OEMs and dealers should be mindful of the growing wedge between profit margins and eroding consumer loyalty as the long-term implications could be substantial. As the EV transition approaches, the competition for customer attention — particularly in the Utility segment — will be fierce. Auto marketers that can leverage loyalty, inventory insights, and develop stronger customer connections, will be able to create and tell their own success stories.

---------------------------

Dive Deeper — Check out our automotive

insights

Join S&P Global Mobility at the 2022 Detroit Auto Show for insightful presentations

Download S&P Global Mobility's Top 10 Industry Trends Report

New Whitepaper Available: A Tale of Three Industries — Download Now

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.