Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Sep, 2023

By Alexander Johnston

Generative AI has seen a wave of enthusiasm from investors and businesses. The role the technology will play as a way of interfacing with software, as well as in redrawing the automating potential of AI, is well acknowledged. As the storm of specialist startups entering the space has started to clear, the market is becoming easier to parse for acquisition targets. With Microsoft Corp. and Google absorbing much of the early mindshare around generative AI, acquisitions may be a route for large technology players to insert themselves into the narrative. This report provides an in-depth look at four — Meta Platforms Inc., Apple Inc., Amazon Web Services and IBM Corp. — with a deep dive into the sort of startups that may be of interest to them.

Databrick's acquisition of MosaicML is one of the first major acquisitions in the emerging generative AI market. It may be the first of a flurry later this year, and early into 2024, as the specialist market starts to settle and the best-placed startups become easier to identify. The high costs that many generative AI startups accrue around infrastructure, and the need for many of these offerings to be wrapped in enterprise-grade capabilities to scale up commercialization efforts — for example, security and governance — may lead to an accelerated M&A timeline. Large acquisitive technology companies that have received less attention than Google and Microsoft around their generative AI announcements are a segment to track, but the positioning of these companies around generative AI will differ. These distinct narratives will lead to divergent acquisition strategies.

The most high-profile generative AI acquisitions this year — MosaicML and Casetext — have been expensive acquisitions. MosaicML was acquired by Databricks in a $1.3 billion deal announced in June for a team of only 60, having only incorporated in December 2020. Thompson Reuters Corp.'s $650 million acquisition of Casetext, an AI legal assistant built on OpenAI's GPT-4, was announced the same month.

Smaller acquisitions in the last few weeks include Ramp Business' acquisition of Caldera Labs. Additionally, IT consulting firm Nitor Infotech was acquired by Ascendion explicitly for its generative AI expertise, and Tanla Platforms Ltd. acquired ValueFirst Digital Media, which provides a generative AI-driven employee productivity platform among other offerings.

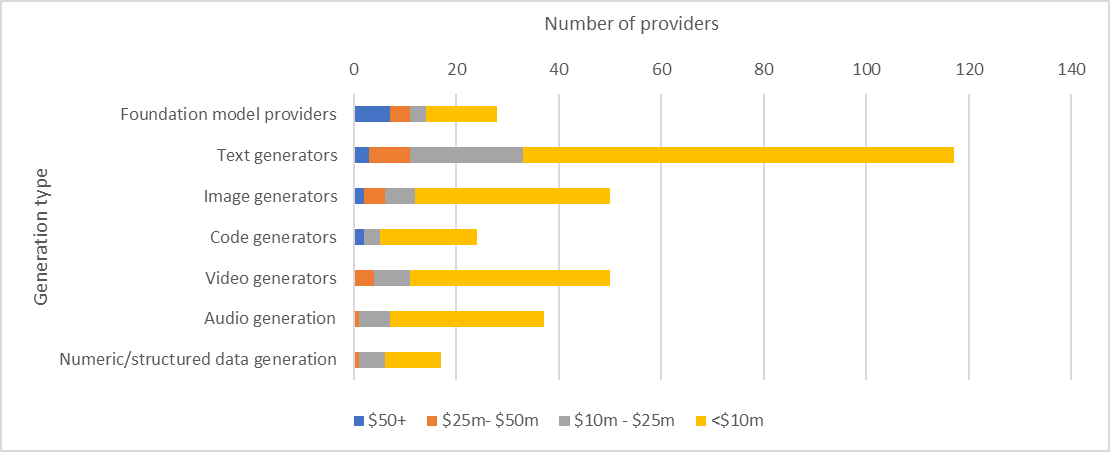

The generative AI software space is relatively nascent but growing quickly. As Figure 1 illustrates, a wide array of startups have emerged to address prospective demand, with the text-generator space appearing particularly saturated. A large number of specialist text generators are active, but with overlapping target users — often sales and marketing professionals — and limited differentiation. Better-established specialist text generators — a group that includes Jasper AI, CopyAI and Copysmith — may be a tempting pickup for large sales or marketing technology providers looking to bolster capabilities, and could also emerge as acquirers of smaller specialists. Copysmith acquired Frase and Rytr late in 2022.

Figure 1: Generative AI software providers by type and revenue generated

Source: 451 Research's Generative AI Market Monitor.

© 2023 S&P Global.

Acquiring consultancies with generative AI experience could offer a path for organizations looking to advise on, or implement, integrated solutions for clients. Just over half of respondents to 451 Research's Voice of the Enterprise: AI & Machine Learning, Infrastructure 2023 survey who had invested in AI, or planned to invest within the next 12 months, used systems integrators to build custom applications using machine learning. A further 29% expect to within the next 12 months. Reflecting this demand, large consultancies are building out explicit generative AI practices — Deloitte announced the launch of its practice in April, and IBM announced a Center of Excellence in May. With expertise at a premium, acquisitions may be key to scaling up these initiatives. Small AI specialist consultancies such as Brainpool AI, TECHVIFY Software, Deeper Insights AI and even Xenonstack, which plays more broadly but has explicit generative AI services, may prove shrewd targets.

Large technology companies are feeling pressure to bolster their capabilities. We will deep-dive into four possible acquirers currently bolstering their generative capabilities: Meta, Apple, AWS and IBM.

Meta has already released a number of notable generative AI capabilities — some integrated into its existing products — such as recently released sticker-generation capabilities within WhatsApp. Meta has developed a family of language models, with Llama 2 announced in July free for research and commercial use. Other generative AI initiatives have included Voicebox, a speech generative model, and AudioCraft, which can support generative music.

Meta made a number of M&A investments to bolster its metaverse strategy in late 2022. In March, Mark Zuckerberg suggested its single largest investment was now in AI, but the intersection between metaverse and generative AI may stimulate additional M&A interest. One target may be Theai, better known as Inworld AI; Meta contributed to its seed round. If part of the ambition is to populate the metaverse with AI avatars, cheaper alternatives include Scenario and Charisma Entertainment. Other relevant areas may be 3D object generation — 3DFY is a notable startup here, as are Sloyd and Luma AI.

Apple is a quiet but historically prolific acquirer of AI startups. It has remained tight lipped on its generative AI ambitions, but we believe Apple's intent is to support generative models that can run on mobile devices. An interest in compression may be suggested with the recent acquisition of WaveOne, announced in February 2023. Startups that may be of interest to Apple include Reka AI, a generative AI startup able to support model compression and on-premises deployment, and Writer. While Writer represents a fast-growing content-generation company with a headcount larger than Apple's typical acquisition, its Palmyra large language model is available as a smaller model size than alternatives and has an on-premises deployment option.

AWS has already made one acquisition of an AI startup this year to boost media production — Snackable AI — which it acquired for an undisclosed amount. The company has a number of investment and accelerator programs that may shed light on possible acquisition opportunities. Of the cohort of companies accepted into the AWS Generative AI accelerator, Stack AI, Wand and Griptake appear to align best with AWS' generative AI Bedrock platform. The Amazon Alexa fund portfolio also includes relevant model observability and management tools Comet and Fiddler, conversational intelligence platform Symbl.ai (Rammer Technologies), and Aspinity, which is designing machine-learning chips for edge processing use cases.

Similarly, an acquisition strategy that integrates generative AI into edge devices or machinery would align well with AWS' existing investments and portfolio. In the context of smart assistants, one area of investment could be audio-generation technology, which could create greater flexibility in assistant voices — able to change a voice or surrounding generative audio dynamically. Paired with language models that can be deployed on edge devices, this greater voice flexibility could be supported by offerings from companies like Eleven Labs, WellSaid Labs, Voicemod and LOVO, for example. Startups developing AI for edge devices targeting factory or logistics use cases include Neurala, ANYbotics and Fetch Robotics.

As our Voice of the Enterprise: AI & Machine Learning, Infrastructure 2023 illustrates, AI processing, training and inference venues are wide ranging, and organizations have an appetite for cloud-based development. With budget a major challenge and models proliferating across organizations, an acquisition like Apptio (announced in June) makes a lot of sense for IBM. Monitoring, resource optimization and cost management capabilities also align well with another major strategic pillar for IBM: hybrid cloud. AI governance tool watsonx.governance, part of AI brand watsonx announced at IBM's Think 2023 conference, could become a focal point for related acquisitions. IBM is keen to frame its competitive positioning around business-ready generative AI capabilities — with cybersecurity and IT automation models key to this narrative. With most of IBM's recent acquisitions skewing smaller, cost-effective governance acquisition options could include Monitaur, Konfer AI or Modzy.

Research

Research